Gold price drops after Chinese imports crater 38% |

- Gold price drops after Chinese imports crater 38%

- Canada’s Ontario to invest up to $1bn in Ring of Fire

- Iron ore price plunges to 6-week low, producers hammered

- Platinum, palladium dive as strike turns violent

- Ukraine crisis fuels Europe demands for coal, prices jump

- Newmont's pointed to letter to Barrick: Merger is off

| Gold price drops after Chinese imports crater 38% Posted: 28 Apr 2014 03:15 PM PDT The price of gold weakened on Monday after data showed a crimping of demand from top importer China. On the Comex division of the New York Mercantile Exchange, gold futures for June delivery fell through the psychologically important $1,300 an ounce level to exchange hands for $1,296.10 an ounce in late trade. Earlier in the day the metal touched a low of $1,292.10, down nearly $10 from Friday's close. Trading was particularly lacklustre with fewer than 100,000 contracts dealt, almost half usual daily volumes. Mainland China's net imports totaled 80.6 tonnes in March, a 27% drop compared to the 111.4 tonnes imported in February. Compared to the same time last year the drop-off was even more stark – down 38% from the record 130 tonnes in March 2013. Another indication that there are fewer buyers in China is the disappearance of premiums paid on the Shanghai Gold Exchange. From premiums that topped out at $37 when gold was trading around $1,200 last year, during March traders on average offered gold at a small discount to the quoted London spot price. March was the first month since September 2012 that gold did not attract a premium. Driven in part by a weakening yuan, discounts on gold widened to as much as $9 an ounce below when the price were headed towards $1,400 in March. Bloomberg quotes Liu Xu, an analyst at Capital Futures Co. in Beijing as saying "banks changed their 'import at any time' mentality as the local gold price turned to a discount": "Chinese consumers no longer have an indiscriminate appetite for gold." Last week a report by the World Gold Council said Chinese firms could have locked up as much as 1,000 tonnes of gold – the equivalent of annual imports – in short-term financing deals, also a sign that end-user demand for jewelry, coins and bars may not be as strong as thought. Gold was also hurt on Monday by a lack of meaningful developments in Ukraine to boost safe haven buying and good news for the US economy. Further signs that the housing market in the world's largest economy was improving, boosted the dollar and sent gold, which usually moves in the opposite direction, lower. |

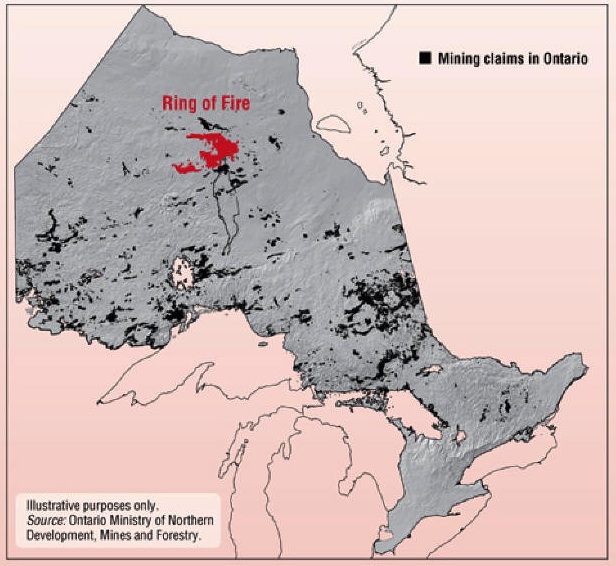

| Canada’s Ontario to invest up to $1bn in Ring of Fire Posted: 28 Apr 2014 12:33 PM PDT  Ontario Parliament Building, Toronto by Pete Spiro. The government of Ontario said Monday it is ready to allocate up to Cdn$1 billion to develop an all-season transportation corridor to the Ring of Fire and it is asking the Federal government to match the funds. The funds would help build the necessary infrastructure to develop the mineral-rich deposit, which authorities say will create jobs and boost northern Ontario's hard-hit economy. The 4,000 sq kilometres Ring of Fire, located 540 km northeast of Thunder Bay, is home to rich mineral deposits, and lawmakers say it could bring prosperity to northern Ontario much like the oil sands industry have to northern Alberta. But the region lacks highways, rail lines or reliable power.  The Ring of Fire has mineral potential known to be worth $60 billion and includes the largest deposit of chromite, a key steel-making ingredient, ever discovered in North America. US-based Cliffs Natural Resources (NYSE:CLF) had to suspend most work on its $3.3 billion Black Thor last summer, citing stalled talks with the province and other political and regulatory problems. The miner added it had struggled to win over aboriginal communities in the region. Noront Resources Ltd. (TSXV:NOT), which holds the Eagle's Nest and Blackbird mining projects, said the province's commitment is a "vital milestone" that will benefit remote First Nations communities. "Mining and the associated job creation can't happen without infrastructure, so we are pleased to see the province make a clear public commitment to funding a transportation corridor in the Ring of Fire," Noront president and CEO Alan Coutts said in a release. Noront's TSX Venture-listed shares went up by 9.1% to cents on Monday. Cliffs was down 3.7% at $17.33 on the New York Stock Exchange. The Ring of Fire has mineral potential known to be worth $60 billion and includes the largest deposit of chromite, a key steel-making ingredient, ever discovered in North America. The region also holds the potential for significant production of nickel, copper, gold and platinum. |

| Iron ore price plunges to 6-week low, producers hammered Posted: 28 Apr 2014 12:21 PM PDT Benchmark iron ore fell heavily again on Monday, bringing the decline in the price of the steelmaking raw material for April to almost 8%. According to data from the The Steel Index, the import price of 62% iron ore fines at China's Tianjin port was pegged at $108.60 per tonne on Monday, down more than 2.2% on the day as the market digested data showing stockpiles at the country's ports jumping to a new record. Inventories have surged 25% so far this year and now sit at just under 110 million tonnes. As much of 40% of this ore is estimated to be tied up as collateral in short-term financing deals which could mean more ore is dumped on the market once these loans are called in. China buys more than two-thirds of the world's seaborne ore and forges as much steel as the rest of the world combined and a slowdown in the world's second largest economy has the seen iron ore price decline 19% in 2014. The renewed weakness in the price after recovering from near 18-month lows suffered mid-March, comes as worries continue to mount about the outlook for the Chinese property sector after the value of new homes sold fell 7.7% and new home starts dropped more than 25% during the first quarter. China's property sector which has enjoyed years of red-hot growth, is a key component of its economy and also accounts for 47% of all steel demand, three times that of infrastructure. Shares in the big three producers, where profits from ore far exceed that derived from copper and other commodities, were marked down in New York trade on Monday as the price fell. American depository receipts of Anglo-Australian giants BHP Billiton (NYSE:BHP), Rio Tinto (NYSE:RIO) added to declines in London sliding more than 2%, while Brazil's Vale SA (NYSE:VALE) gave up 3.5%. Combined the big three have a market value of $355 billion. Earlier number four producer Fortescue Metals Group (ASX:FMG) dropped 4% in value on the Sydney Stock Exchange and shares in Anglo American (LON:AAL) trading in London also retreated. Apart from moderating demand from China, another factor pushing down the price of iron ore is the prospect of a huge ramp up in global output. BHP Billiton, Fortescue Metals Group and Rio Tinto are targeting an additional 170 million tonnes in Australia in 2014, while Vale wants to grow from just over 300 million tonnes per year in 2013 to over 400 million tonnes by 2018. Image by ttstam on Fotopedia |

| Platinum, palladium dive as strike turns violent Posted: 28 Apr 2014 11:00 AM PDT The price of platinum slid and sister metal palladium dropped back below the $800 an ounce level on Monday after a deal between the world's top producers and workers who have been on strike for 13 weeks drew nearer. On the Comex division of the New York Mercantile Exchange, platinum futures for July delivery – the most active contract – in afternoon trade exchanged hands for $1,419.80 an ounce, down nearly $5 compared to Friday's close, but well off the day's lows. On the day before more than 70,000 South African workers went on strike at Anglo American Platinum (LON:AAL), Imapala Platinumm (OTCMKTS:IMPUY) and Lonmin (LON:LMI) which together account for almost 50% of the world's production, platinum was trading at $1,450 an ounce. Palladium also eased back on Monday with June futures slipping back below $800 an ounce, touching a low for the day of $794.50 and trimming its strike-related gains to just over 10%. Production of the metal, often used as substitute for platinum in catalytic converters, is even more concentrated than platinum, with South Africa and Russia controlling more than 80% of global supply. Roughly 10,000 ounces of platinum production and 5,000 ounces of palladium are lost each day the strike drags on. Reuters reports after talks between the major union Amcu and management collapsed on Thursday, producers decided to take the latest offer directly to workers. Producers latest offer would push the basic salary of all underground workers to R12,500 ($1,100) a month by 2017. The union has been calling for an immediate doubling of the minimum wage to R12,500, guaranteed for three years. Business Day reports the union's leaders were reluctant to take the latest offer back to their members — "probably because they feared the rank and file would accept it after three months with no pay": "A typical South African mine-worker has eight dependants, and often two families, one in his home village and the other near the shafts. That means many of them are now near breaking point, especially as domestic inflation accelerates." The three mining companies have so far lost a combined R15.2 billion ($1.4 billion) in revenue, while lost employee earnings come to R6.7 billion ($630m). As an indication of how dire the situation for workers in the platinum belt has become, Eye Witness News reports "in a remarkable case of public disorder," around 4,000 people gathered near a shopping centre not far from Implats' number nine shaft in the town of Rustenburg at midnight Sunday shortly after a nearby community hall was set alight, and looted the entire complex. Image from Youtube file footage |

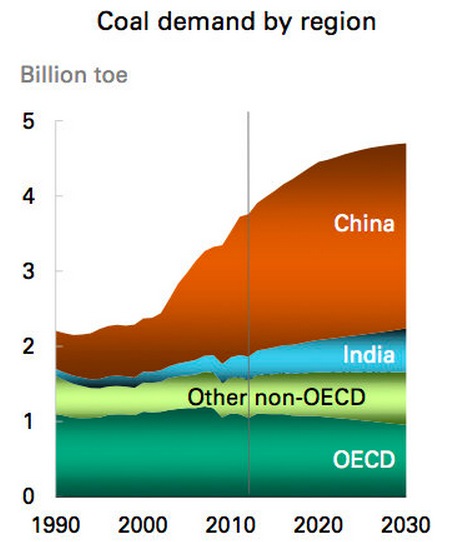

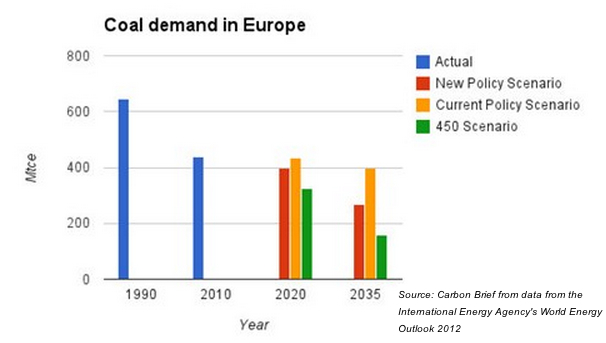

| Ukraine crisis fuels Europe demands for coal, prices jump Posted: 28 Apr 2014 10:50 AM PDT  Coal mine in Donetsk Ukraine by ver0nicka. Coal prices climbed to the highest level since January Monday amid speculation Russia's intervention in Ukraine will spur demand for the solid fuel to replace gas in power plants in Europe. According to Bloomberg the German contract, Europe's electricity benchmark, rose as much as 1.4%, while European coal for delivery in 2015 climber over 1%. Energy security has quickly become a strategic priority for the European governments, faced with the possibility of gas price rises. Tensions between Russia and Ukraine over gas supply are nothing new, as state-owned Russian energy firm Gazprom has repeatedly threatened to cut off gas supplies to Ukraine because of unpaid debt. On Monday Japan announced it will support Ukraine and other Eastern European nations in the construction of next-generation coal-fired power plants that can generate power with less fuel. The Japan News reports that Tokyo has offered stand behind the nations' efforts to use coal instead of natural gas, to help them reduce their dependency on Russian supplies. Ukraine imports 60% of its natural gas needs from Moscow while Eastern European countries import 60% to 100% of their natural gas.  Source: BP Energy Outlook 2030. The Japanese government is expected to announce the initiative next week, at the meeting of energy ministers from Japan and other Group of Seven industrialized nations to be held in Rome. As a result, experts expect an increase demand for coal in Europe in the coming months, especially as supply is becoming limited. Polish Kompania Weglowa, the largest coal producer in the 28-nation EU, today began a one-week halt at nine of its 15 mines, which was announced April 17 amid low sales. |

| Newmont's pointed to letter to Barrick: Merger is off Posted: 28 Apr 2014 10:44 AM PDT Fed up with Barrick Gold's aspersions, Newmont Mining (NYSE:NEM) says a merger is off. Newmont Mining's chairman Vincent Calarco wrote a letter on Friday to Barrick Gold's board criticizing the company's behaviour, singling out Peter Munk's comments in the press. The letter was released to the public today. "Our efforts to find consensus have been rejected out of hand repeatedly," wrote Newmont Mining. "And, as we contemplated further dialogue, we read in the continuing reporting of the transaction in the financial press a pointed characterization of our company as 'extremely bureaucratic and not shareholder-friendly.' Nothing could be further from the truth." [Emphasis added.] Rumoured merger speculation between Barrick, the world's number one gold producer, and Newmont surfaced in late April. Barrick released its own statement today confirming that the two companies had negotiated a term sheet for a proposed merger on April 8. Newmont Mining is down 6.12% to $24.83. Barrick Gold is down 3.13% to $17.33. Full letter below:

|

| You are subscribed to email updates from MINING.com To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 20 West Kinzie, Chicago IL USA 60610 | |

0 Comment for "Gold price drops after Chinese imports crater 38%"