Fears of Beijing metal-financing crackdown halt copper price rally |

- Fears of Beijing metal-financing crackdown halt copper price rally

- Canadian rare earth miner Ucore wins big with SB99 approval

- New York futures exchange mulls limits on gold, silver price moves

- Kincora Copper set to solve mining licenses dispute with Mongolia

- Kennady North Diamonds advances in Northwest Territories

- Wave of buying sends OceanaGold shares surging again

| Fears of Beijing metal-financing crackdown halt copper price rally Posted: 29 Apr 2014 04:09 PM PDT In late afternoon New York trade on Tuesday July copper changed hands nearly 2c lower at $3.073 a pound as weakening demand from China and the unraveling of copper-related financing deals worry the market. Tuesday's decline marks something of a reversal in sentiment after the metal hit a seven-week high on Monday following reports last week indicating that the Chinese State Reserves Bureau has bought up to 350,00 tonnes of copper in March and April to move into state warehouses. Beijing, which has picked up metal on the open market before, were making the most of copper near four-year lows in mid-March. Copper is down nearly 9% from opening levels for the year as the market adjusts to slower growth in China which consumes more than 40% of the world's copper. China's copper imports have not slowed down however, rising a whopping 31% to 420,000 tonnes in March over last last year and bringing the first quarter total to a record-breaking 1.3 million tonnes. But those numbers may be misleading and do not reflect a sharp fall-off in end demand. That's because much of that copper has been tied up in finance deals as collateral for trade credit and is not being put to industrial use. Other industrial metals are also used in short-term financing deals, notable iron ore where some 40% of the record 110 million tonnes of the steelmaking raw material stockpiled at China's ports, are believed to act as security for loans. The portion of copper inventories used for financing – part of China's vast shadow banking system – is believed to be much higher. Prompted in part by a weaker yuan – or more precisely a currency that's no longer appreciating steadily – these deals are now being unwound supplying even more copper to the market. Julian Jessop Head of Commodities Research at Capital Economics, an independent macro-economic adviser, in a new research note points out that "fresh signs that China is cracking down on the use of industrial metals as collateral have begun to unnerve markets": The immediate target of regulators is reportedly imports of iron ore by steel mills and traders. Hard data on the extent of this particular form of "shadow financing" is, by its very nature, sparse. But it seems likely that other commodities, notably copper, are used more widely for this purpose, not least because they are easier to transport and store. Indeed, reliable sources suggest that new regulations due to take effect after the Labour Day holiday (1st – 3rd May) will raise deposit requirements on letters of credit (LCs), which have used commodities widely as collateral. While price pain induced by the unwinding of these deals could be severe in the short and medium term, longer term weaker fundamentals are also clouding the outlook. Capital Economics predict a price as low as $2.65 a pound ($5,800 a kilogram) by the end of the third quarter, below even the bearish predictions of other market analysts. Thanks to the widespread use of the metal in construction, transport and manufacturing, copper is highly sensitive to an economic slowdown. Worries continue to mount about the outlook for the Chinese property sector after the value of new homes sold fell 7.7% and new home starts dropped more than 25% during the first quarter. China's property sector which has enjoyed years of red-hot growth, is a key component of its economy and also accounts for a large proportion of all copper demand. The supply side is also driving down price expectations, with a small surplus predicted this year. Global mine production rose by 8% to 17.8 million tonnes last year, its fastest pace in over a decade thanks to marked expansion top producer Chile and the Democratic Republic of Congo. Output is to top 22.2 million tonnes this year from just over 21 million tonnes in 2013 led by Codelco's new 160,000 tonnes-plus Ministro Hales mine, Glencore's Las Bambas project in Peru it sold to China's Minmetals recently, the first full year of production at Rio Tinto's Oyu Tolgoi mine in Mongolia and expansion at BHP Billiton's already giant Escondida mine. After an abnormally quiet 2013 with few supply disruption to existing operations, 2014 could yet turn out to be different. Freeport McMoRan and fellow Indonesian copper miner Newmont Mining are deferring exports from Indonesia due to onerous new duties were slapped on copper concentrate exports at the start of the year. Reuters reports last year's supply surge largely came from brownfield expansions, but "this year's will come from new mines with a higher risk of start-up problems, already foreshadowed with guidance downgrades and timeline delays at mines such as Oyu Tolgoi in Mongolia and Caserones in Chile ." Image courtesey of Codelco |

| Canadian rare earth miner Ucore wins big with SB99 approval Posted: 29 Apr 2014 02:04 PM PDT Canadian rare earth miner Ucore Rare Metals (CVE:UCU) is a step closer to see its flagship Bokan-Dotson Ridge project in Alaska become a reality as the State Legislature has unanimously passed the Senate Bill 99 (SB99), which authorizes the Alaska Industrial Development and Export Authority (AIDEA) to issue up to $145 million in bonds to finance Ucore's proposed mine. The SB99 bill, unanimously passed by the Senate, represents a major win for Halifax-based Ucore Rare Metals a development-phase mining company focusing on Bokan Mountain, its flagship property located 60 kilometres southwest of Ketchikan, Alaska and 140 kilometres northwest of Prince Rupert, B.C. According to Hallgarten & Company, Ucore's stock price soared by 100% on the news, and the company has now around US$10 million in cash in the bank, making it one of the most cashed-up rare element resources companies. "We're very pleased with the outstanding support that the Bokan Project has received from the Alaska State Legislature," said Jim McKenzie, president and CEO of Ucore said in a statement Monday. "Alaska legislators have recognized that the area has the potential to be America's leading heavy rare earth production hub, with an array of ancillary industries, such as REE separation and metal manufacture. " Bokan Moutain contains a significantly high ratio of heavy rare earths including dysprosium, terbium and yttrium, used in high-tech applications from smartphones to missile systems. All SB99 requires now is signing into law. Ucore hopes to begin commercial rare earth metal production in 2017. |

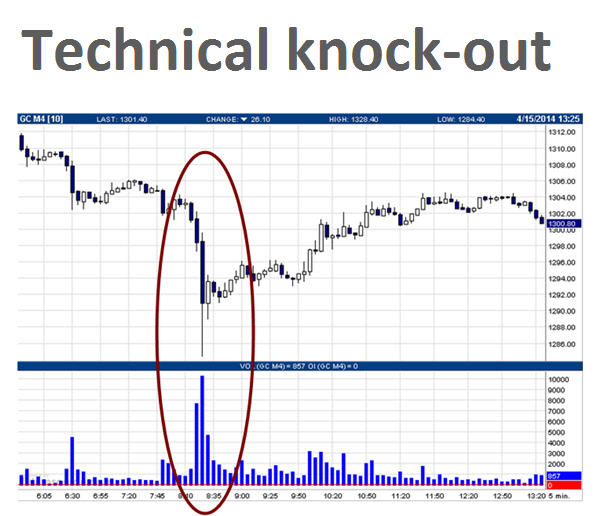

| New York futures exchange mulls limits on gold, silver price moves Posted: 29 Apr 2014 01:15 PM PDT On the Comex division of the New York Mercantile Exchange, gold futures for June were hovering below $1,300 an ounce in uneventful trade, while usually volatile silver contracts for July were down slightly to $19.54 an ounce late afternoon Tuesday. Tuesday's quiet trade – less than 100,000 contract of 100 troy ounces of gold had changed hands compared to almost twice that on a busy day – is the exception rather than the rule. Gold has become one of the most leveraged and high volume trades on the planet with daily transactions worth more than $240 billion across all exchanges and markets. That's more than the Dow Jones and S&P 500 combined. US derivatives exchange CME Group, which operates Comex, is considering introducing daily limits on price moves in gold and silver futures reports like it does on certain energy and agricultural products Reuters: "We don't have price limits in gold and silver. That's something that we are looking into," Miguel Vias, CME Group's director of metal products, told an audience at an event held by commodities consultant CPM Group in New York. Vias said unusually big moves and the fears of price "slippage" — the difference between the price at which a market player wants to execute an order and the price at which they are able to do so — have turned some gold and silver futures investors away. Last year on 15 April gold dropped $130 in a single session and more than $200 over just two days without warning. The crash took the price of the yellow metal from a high of $1,566 on the Friday to a low of $1,330 on Monday, a 15% smack down. A convincing argument has been put forward that the drop was the result of the "shock and awe" tactics of a short seller to break the backs of the gold bulls with a 400 tonne short sale. Two weeks ago – precisely one year after the big 2013 drop – another remarkable series of trades also prompted a quick fall in the price. Shortly after the New York market opened volumes spiked with some 2.28 million ounces (64 tonnes) dumped onto the market in three big chunks, in an apparent attempt to knock the wind out of buyers. |

| Kincora Copper set to solve mining licenses dispute with Mongolia Posted: 29 Apr 2014 12:03 PM PDT Mongolia-focused copper and gold miner Kincora Copper (CVE:KCC) said it is confident two of the licences revoked by the Mongolian government last year will be returned as a proposal to resolve the issue will be presented to the parliament during the ongoing session. The proposition includes security of tenure and a mechanism to compensate stakeholders for the time lost due to the original judicial process and returning the licences to compliant licence holders, the miner said this week. Kincora is one of 11 foreign investors whose mineral exploration licenses a Mongolian court declared void last year. The ruling came as it found the former head of the Mineral Resources Authority guilty of illegally approving them between 2008 and 2009. Toronto-listed Kincora said in a statement the proposed resolution was a "win-win" to end the dispute over its two cancelled licenses, on which the company had to take a Cdn$7 million write-off last year. "This case has had a major, negative impact on investor sentiment towards Mongolia. And the way in which the government responds to investor concerns about the revocation of licenses, we hope, will set a positive and visible precedent as to how future investors will be treated," Kincora Chief Executive Sam Spring said. The company's flagship Bronze Fox project was unaffected by the government's move. |

| Kennady North Diamonds advances in Northwest Territories Posted: 29 Apr 2014 11:36 AM PDT Toronto-based Kennady Diamonds is continuing to make progress in the Kennady North diamond project located in Canada's Northwest Territories. Patrick Evans, Kennady Diamonds' CEO, said in Tuesday's statement the company is making "encouraging progress with the larger diameter drilling underway at the Kelvin kimberlite and have to date recovered over 16 tonnes of the planned 25 tonne mini-bulk sample." Approximately 5,500 metres of drilling has been completed at the Kelvin kimberlite so far. According to Evans, there has been an unusual recovery at site of a high quality white, colourless and transparent diamond measuring approximately one millimetre in diameter. The project is adjacent to the Gahcho Kué project, located 280 kilometres northeast of Yellowknife. Kennady diamonds plans to move one of the drill rigs currently at Kelvin to Faraday kimberlite corridor, to the west of the Kelvin. Ground geophysics has recently been completed at these targets and are now drill-ready. The area has shown a significant diamond potential. Margaret Lake Diamonds Inc., Canada's newest diamond exploration company, commenced trading on the TSX-Venture Exchange last Thursday. The Margaret Lake property is operating immediately to the north of Kennady Diamonds. |

| Wave of buying sends OceanaGold shares surging again Posted: 29 Apr 2014 11:36 AM PDT OceanaGold Corporation (TSE:OGC, ASX:OGC) shot up more than 11% on Tuesday after releasing record production and revenue numbers from its copper-gold mines. In early afternoon dealings the Melbourne-based company was changing hands for $2.78, up 11.2% but slipping back from a day high of $2.83 hit in lunchtime trade on the Toronto Stock Exchange. Around 1.3 million shares in the $823 million counter were traded by 2:00EST versus usual daily volumes of around 700,000. OceanaGold, with mines in New Zealand and the Philippines, is up more than 67% since the start of the year. OceanaGold reported record first quarter revenue of $170.4 million, EBITDA of $101.0 million and net profit of $58.9 million. The stellar financials were achieved with a surge in gold production to 86,568 ounces. That included record quarterly gold production of 30,480 ounces from its Didipio Mine in northern Luzon, Philippines, which only went into operation a year ago. Company cash costs of $170 per ounce and All-In Sustaining Costs of $450 per ounce are some of the best in the industry and helped the company pay back $20 million of debts. Copper production increased to 6,479 tonnes with copper sales of 7,752 tonnes. OceanaGold operates New Zealand's largest gold complex at the Macraes goldfield in Otago and on the west coast of the South Island, the company operates the Reefton Open Pit mine. OceanaGold's commenced commercial production on 1 April 2013 and is expected to produce 100,000 ounces of gold and 14,000 tonnes of copper per year on average over the next 15 years. In 2014, the company expects to produce 275,000 to 305,000 ounces of gold from the combined New Zealand and Philippine operations and 21,000 to 24,000 tonnes of copper from the Philippine operations. |

| You are subscribed to email updates from MINING.com To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 20 West Kinzie, Chicago IL USA 60610 | |

0 Comment for "Fears of Beijing metal-financing crackdown halt copper price rally"