New Trend Guarantees Higher <b>Gold Prices</b> 2014 - The Market Oracle |

- New Trend Guarantees Higher <b>Gold Prices</b> 2014 - The Market Oracle

- TIMELINE: <b>Gold price</b> from QE1 to the taper to chair Yellen | MINING <b>...</b>

- <b>Gold Price</b> and Time Preference :: The Market Oracle :: Financial <b>...</b>

- <b>Gold Price</b> Has Bottomed.. A Good Possibility... :: The Market Oracle <b>...</b>

- Royal <b>Gold</b>, Inc USA) (RGLD): Royal <b>Gold</b> Offers Deep Value And <b>...</b>

| New Trend Guarantees Higher <b>Gold Prices</b> 2014 - The Market Oracle Posted: 02 Jan 2014 01:58 PM PST Commodities / Gold and Silver 2014 Jan 02, 2014 - 08:58 PM GMT By: Jeff_Clark

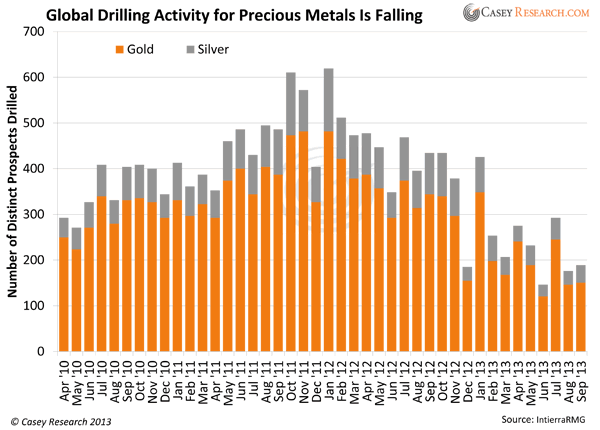

These are valid, core reasons to hold gold in a portfolio at this point in time. But a new trend is under way, and someday soon it will be just as much a driving force for gold prices as anything else: a good old-fashioned supply crunch. A few metals analysts have mentioned it, but it escapes many and certainly is off the radar of the mainstream financial media. But unless several critical factors reverse course, a supply shortage is on the way with clear implications for the price of gold. The following four factors are combining to diminish gold supply. While we've touched on some of them before, put together they're creating a perfect storm that will, sooner or later, impact the gold market in several powerful ways. As these forces gather steam, you'll want to make sure you've already built a substantial position in physical bullion. Factor #1: Production Pullbacks, Development Delays, Exploration CancelationsGold producers don't operate in a vacuum. If the price of their product falls by 30% over a two-year period, they've got to make some adjustments. And those adjustments, more often than not, result in lower production, delayed mine development plans, and cuts in exploration budgets. The response is industrywide, and even low-cost producers are not immune. The drop in metals prices means some mines can't operate profitably, and if the losses exceed the cost of closure (and possibly, restart in the future), these mines will be shut down. As operations come offline, global output falls. While lower metals prices are not what any of us want, they're long-term bullish because, as they say, the cure for low prices is low prices. If prices drop further, a greater number of projects will be unable to maintain production levels. For example, we know of several operating mines that, in spite of large reserves, will be forced offline if the gold price falls to the $1,100 level. The impact on development and exploration projects is even greater—it's easy to postpone construction on tomorrow's new mine when you're worried about cash flow today. As a result, many companies have cut drilling projects and laid off geologists. The chart below shows the precipitous decline in the number of drilling projects around the world.

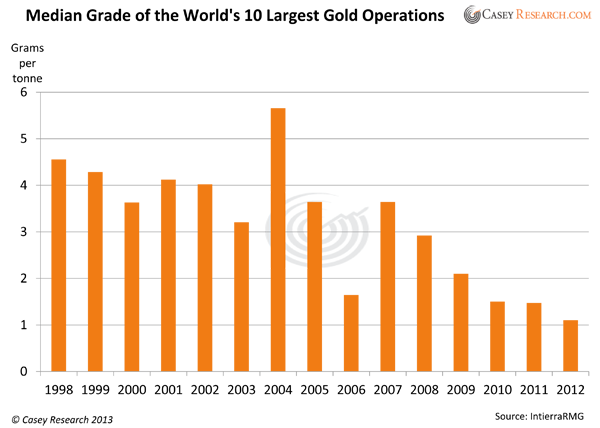

Through the first nine months of 2013, 52% fewer drills have been turning compared to the same period last year. And it's not just fewer holes being poked in the ground—ore grades are declining too.

As of last year, ore grades of the ten largest gold operations are less than a third of what they were just five years ago, and less than a quarter of what they were 14 years ago. Here's the troubling aspect: This trend cannot be easily reversed. It takes about a decade to bring new projects on line, and even shuttered, recently producing mines held on "care and maintenance" take time and money to get going again. In other words, even when gold prices start rising again, new mine supply will take years to rebuild. Many companies will find themselves with a lack of readily available ore, and the market with fewer ounces. Lower metals prices obviously have an impact on how much metal gets dug up. This alone is bad enough for supply, but unfortunately it's not the only factor… Factor #2: Now You See 'Em, Now You Don'tMany mining projects have both low-grade and high-grade zones. When prices fall, a company can mine the richer ore and still make money. It may sound shortsighted, but it can be the right thing to do to stay profitable and be able to survive in a temporarily weak price environment. But high-grading, as it's called, can make low-grade ore part of a disappearing act. Here's how: When metals prices are low and companies focus on high-grade ore, the low-grade material is temporarily bypassed. It's still physically there, so one might assume the company will come back at a later time to mine it. But not only is it not economic at lower metals prices, it may never get mined at all. That's because some low-grade ore only "works" when it's mixed with high-grade ore. Even when gold moves back up, it doesn't matter, because the high-grade ore is gone. So it's not just gone legally, as per regulatory definitions of mining reserves—it may be economically gone for good. Miners could return to some of these zones in a very high gold price environment (something well north of $2,000), but that's a concern for another day. The point for now is that many of today's low-grade zones would be written off if the high-grade they need to work is gone. Critical point: You may read reports early next year that global production is rising. However, to the degree that's due to high-grading, it virtually guarantees lower production is around the corner. Factor #3: Greed Is Good—Says the PoliticianIt's become increasingly difficult for mining companies to navigate the political minefield. Many governments have become so rapacious that supply is already suffering. We've mentioned this issue before, but take a look at how governments and NGOs (nongovernment organizations) put an effective halt to some of the biggest precious metals discoveries seen this cycle… Pebble Project in Alaska. Anglo American (AAUKY) spent $540 million on one of the biggest copper/gold discoveries ever, but recently announced that it will walk away from it. The company said it wants to focus on lower-risk projects and is undoubtedly tired of putting up with ongoing environmental scares and regulatory delays. Fruta del Norte in Ecuador. Kinross Gold (KGC) bought Aurelian shortly after what many called the discovery of the decade, but the politicos demanded such a big slice of the pie that Kinross stopped developing the project. New Prosperity Mine in British Columbia. Taseko Mines (TGB) has been relentlessly challenged by environmental activists at the world's tenth-largest undeveloped gold/copper deposit and pushed politicians to continually delay permitting. Pascua-Lama in Argentina & Chile. This giant deposit has been postponed for several years, largely due to environmental issues and unmet regulatory requirements. Some analysts think it may never enter production. Navidad in Argentina. Pan American Silver (PAAS) was forced to admit that the Navidad silver deposit—one of the world's biggest silver-primary deposits—was "uneconomic at any reasonable estimate of long-term silver prices" when the local governor announced he wanted "greater state ownership" and increased royalties from 3% to 8%. Minas Conga in Peru. Newmont's (NEM) multibillion-dollar project was put on the back burner last year when the government gave the company two years to develop a way to guarantee water supplies for residents of the Cajamarca region. Certainly bigger projects attract greater attention and scrutiny, but as it stands now, none of the above projects are in operation. This list is by no means exhaustive; large numbers of smaller projects all around the world face similar challenges. The bottom line is that finding economic gold deposits in pro-mining jurisdictions is getting increasingly difficult. The result? The metal stays in the ground. Factor #4: Implosion ExplosionAs you've likely read, the gold mining industry in South Africa is imploding.

The breakdown in South Africa is important because as recently as 2006, it was the world's top producing country; it's now #5. Unfortunately, there's every reason to expect this trend to continue, in many countries around the world. The result is—you guessed it—fewer ounces come to market.

The net result of this perfect storm is that we should expect gold supply to decline until prices are much higher. Even when prices do rise, management teams will be reluctant to expand operations, reopen mines, or buy new projects until they feel the new price level is sustainable. As a result, this trend will almost certainly last several years. Based on the research we've done, it is my opinion that after a bump in output early in 2014, the shortfall will become increasingly evident by the end of the year and reach fractious levels by 2015. If demand remains at current levels, or even if it falls by less than the decrease in supply, gold and silver prices will be forced up. And in an environment of currency depreciation, we should see more demand, not less. We have the makings of a classic supply squeeze. Higher metals prices are not the only ramification, however: Investors will be required to pay higher premiums on bullion. Further, we can expect a lack of available product, most likely resulting in delivery delays or even rationing. That's why it's so important to buy bullion now, before the storm. Even if you need to sell a little to maintain your standard of living, the effects on you will be all positive. The product you sell will…

All it takes to capitalize on this opportunity is to recognize the supply shortage that's on the way and act accordingly. Critical point: Buy the physical gold and silver you think you'll need for the future NOW. One of the best places I know has among the lowest premiums available in the industry, and also offers several international storage locations in case things get bad in your home country. This breakthrough program is as liquid as GLD and offers greater safety than storing bullion at home. Click here to find out more. © 2013 Copyright Casey Research - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors. © 2005-2013 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication. |

| TIMELINE: <b>Gold price</b> from QE1 to the taper to chair Yellen | MINING <b>...</b> Posted: 01 Jan 2014 02:34 PM PST When US Federal Reserve Chairman Ben Bernanke testified in front of the US Congress in July last year he famously said said he "doesn't pretend to understand gold prices" and "nobody does". During incoming chair Janet Yellen's confirmation hearings in November she echoed Bernanke's befuddlement about the gold price adding that she doesn't "think anybody has a very good model of what makes gold prices go up or down." Yellen, a noted monetary policy dove and considered an architect of the Fed's QE program, did have some insight into gold safe haven status: "It is an asset that people want to hold when they're very fearful about potential financial market catastrophe or economic troubles and tail risks. And when there is financial market turbulence, often we see gold prices rise as people flee into them." While Yellen pleaded ignorance about where the gold price is headed, she is more confident about the state of the stock market saying traditional valuation methods do not suggest equities are behaving "bubble like". Yellen supported the modest start to tapering off asset purchases despite her beliefs that the US economy is falling "far short". But 2014 could bring a few surprises, not least of which a stock market correction as this 50-year chart shows. CLICK BELOW FOR A SLIDESHOW OF THE ROCKY RELATIONSHIP BETWEEN THE US FEDERAL RESERVE AND THE PRICE OF GOLD: |

| <b>Gold Price</b> and Time Preference :: The Market Oracle :: Financial <b>...</b> Posted: 03 Jan 2014 09:55 AM PST Commodities / Gold and Silver 2014 Jan 03, 2014 - 06:55 PM GMT By: Alasdair_Macleod The future price of gold cannot be discussed without considering its implied discount rate expressed through time-preference. This is the relative desire to own goods at an earlier date rather than later. There are several reasons gold is almost certainly more valuable sooner rather than later, including the fact that when someone wants something he naturally wants it now, and there is always the risk that a promise for future delivery will not be kept. Bear in mind that time-preference for one good is not necessarily the same for another, reflecting factors peculiar to any good such as supply and demand. The other side of the coin, a lower preference for money, is compensated for by payment of interest on currency that reflects a balance between current and future demand for all goods generally. This is the starting-point for understanding the true relationship between paper currency and gold, now that gold is no longer circulating as money. Currency pays interest and gold we are often reminded does not. If this were the end of the matter time-preference for gold would coincide more or less with the norm for all other goods. However, individuals have widely differing ideas of gold's time-preference. If you think there is systemic and currency risk your time-preference for gold will be high, or put another way it will take a significant discount to tempt you to buy it for forward settlement compared with paying for immediate delivery. If you think that the banking system is completely safe and there is no risk in holding currency, you will accept a far lower discount for forward settlement of gold, reflecting approximately current currency interest rates. Near-zero interest rates for the four major currencies and time-preference rates for gold as indicated by lease rates suggest either there is minimal systemic and currency risk or gold's forward discount rate is badly mispriced. Given the rapid expansion of central bank balance sheets, logically the latter must be the case. Back in 1980 interest rates were raised to choke off price inflation: this is the same as saying time-preferences for goods were discouraged from rising further and began to fall. Gold also became less desired as an inflation hedge, so its time-preference reduced as well. Later that decade the London bullion market began to lease central bank gold in large quantities and gold's time-preference continued to fall, suppressed well below the return available on dollars in the interbank market. In other words the London bullion market developed by treating gold as an asset whose lease rate was to be permanently below LIBOR. Therefore gold's time-preference discount is radically different from what it would otherwise be in an unfettered market. Instead, gold's time-preference should reflect that of other goods, adjusted by gold's own specific characteristics, including its soundness relative to fiat currencies. And therefore the gold forward rate (GOFO) in a free market should normally be negative, given that expansionary monetary policies for currencies are the norm, because GOFO is defined as LIBOR less the gold lease rate. Instead it has been nearly always positive. Sooner or later a more realistic time-preference for gold is bound to return as leasing by central banks dries up. This explains why GOFO tried to go negative on several occasions in 2013. All that's happening is time-preference is beginning to be rightfully re-instated. Head of research, GoldMoney Alasdair.Macleod@GoldMoney.com Alasdair Macleod runs FinanceAndEconomics.org, a website dedicated to sound money and demystifying finance and economics. Alasdair has a background as a stockbroker, banker and economist. He is also a contributor to GoldMoney - The best way to buy gold online. © 2013 Copyright Alasdair Macleod - All Rights Reserved © 2005-2013 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication. |

| <b>Gold Price</b> Has Bottomed.. A Good Possibility... :: The Market Oracle <b>...</b> Posted: 02 Jan 2014 06:03 AM PST Commodities / Gold and Silver 2014 Jan 02, 2014 - 11:03 AM GMT By: Thomas_Clayton

MACD line have surpassed ZERO which denotes Uptrend, Stoch RSI & Slow Stoch are Consolidating and the On Balance Volume is more than Positive

Pg. 15, DOW JONES PRECIOUS METAL, $DJGSP, 1 HOUR. CONFIRMED BUY ON DEC 22nd

Pg 21, GDX, Gold Miners ETF 1 hour Volume Candles, Notice the huge Red Candles, Capitulation, huge Sellers means there is huge Buyer on the other side of the trade. Again follow Green Arrows for trigger points After MACD lines cross upwards, the Line Cross Above Zero and usually a Surge in Price. Anticipate this for your Entry Point GDX is the tail which Expresses NUGT x3 on Up moves and DUST x3 on Down moves. Next chart down.

Page 15 NUGT, 1 hour , Again observe the Green Arrows denoting Buy Signal on the respective Indicators.

Page 19 DUST, Bear GDX Gold Miners x 3. Observe the Red Arrows for Sell Triggers. If GDX expresses a Sell, then of course you want to be Long DUST .. and GDX Buy, be long NUGT.. these are the most Volatile ETFs in Existence. Caveat, a Double Edged Sword. Be in the correct ETF in the right Direction- USE STOPS.

MACD LINES ARE ABOVE ZERO WHICH DENOTES IN UPTREND SINCE 8a.m. Dec 31. I am a retired pharmacist, but went through the Dean Witter training Program, as depicted in the movie "Seeking Happyness" with Will Smith, and worked as a Representative with stocks and commodities for D. Witter, which was later absorbed into Morgan Stanley.. I do this as an avocation now. It would have been nice to have had access to this Technical Analysis as offered at stockcharts.com back in the early 1970s. You may see my work at stockcharts.com, public chart list, Easy $$, Clayton Tom. Thank you for your interest. By Thomas Clayton © 2013 Copyright Thomas Clayton - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors. © 2005-2013 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication. |

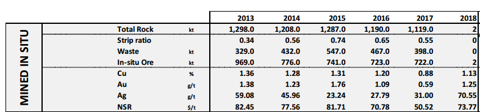

| Royal <b>Gold</b>, Inc USA) (RGLD): Royal <b>Gold</b> Offers Deep Value And <b>...</b> Posted: 01 Jan 2014 04:52 AM PST My thesis here is that Royal Gold (RGLD) is a compelling stock to own for those investors who want exposure to the price of gold and to the potential leverage offered by mining companies without several of the risks inherent in mining companies. Executive Summary Royal Gold makes its money by buying royalties from mining companies that entitle it to a portion of the gold or other metal produced on a specified property. Such agreements take various forms, but they are typically net smelter royalties, or "NSRs," meaning that Royal Gold gets a portion of the revenues from the gold sold minus what the mining company pays the smelter--a virtually negligible amount in the broader scheme of things. So let's say for instance that Royal Gold buys a 1% NSR on the gold produced at mine X. If mine X produces 100,000 ounces of gold, then Royal Gold will get the revenues from the sale of 1,000 ounces of gold minus what the company pays the smelter. Royal Gold has royalty agreements on over 100 properties, although most of its value is in its ownership of royalty agreements on the following properties:

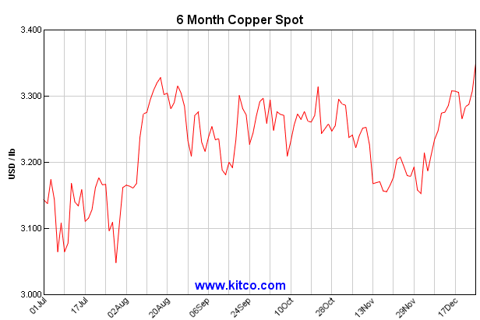

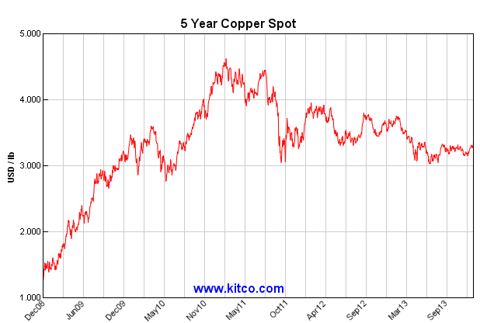

Royal Gold trades at a relatively high multiple to earnings--48-times trailing--however, investors should keep in mind that going forward the company's earnings should grow given that production at Mt. Milligan will reach full capacity in 2014. The stock price also takes into consideration the values of non-producing assets of value such as the Pascua Lama and El Morro royalties. Finally the company has a solid history of rapid earnings growth, dividend growth, strong profit margins, and a clean balance sheet. Given these points, a relatively high P/E multiple is justified. Why Invest in Royalty Companies? There are two features of royalty companies that make them so compelling. The first is their fixed cost structure. Royalty companies generally pay an agreed upon price for their gold, which means that they are not directly exposed to volatile production costs. The exception to this is that the mining company may be forced to close the mine if costs get out of hand, or if the prices of other metals mined fall. So for instance, Royal Gold's Mt. Milligan royalty entitles the company to about half of the gold mined there at $435/ounce. But Thompson Creek also mines copper there, and supposing that the price of copper plummets, Royal Gold shareholders could be adversely affected if Thompson Creek decides to close the mine as a result. The second is that unless otherwise stipulated, royalty companies get free exposure to any expansionary discoveries at a mine on which it has a royalty/streaming agreement. Thus, if Thompson Creek finds more gold at Mt. Milligan and mines it, then Royal Gold is still entitled to its share at the agreed upon price while Thompson Creek has to pay for the exploration effort and for the expansion of the mine. Thus, it is as if Royal Gold owns several out of the money call options. Why Royal Gold? There are three gold royalty companies: Sandstorm Gold is a much smaller company, and it is not as developed as the first two--e.g. it is not profitable and it doesn't pay a dividend. Thus the only competition to Royal Gold is Franco Nevada--the largest gold royalty company. Investors favor Franco Nevada as it has no debt and its Chairman (Pierre Lasonde) and its CEO (David Harquail) have stellar reputations in the industry. Furthermore Franco Nevada is more diversified. This has led to a relative opportunity in Royal Gold. Franco Nevada has a $6 billion valuation and an estimated 235,000 gold equivalent ounces of annual production (high end of guidance), while Royal Gold has a $3 billion valuation and 180,000 gold equivalent ounces of production. Once Mt. Milligan begins producing at full capacity next year, Royal Gold's annual production will exceed 250,000 ounces. Furthermore, regardless of the general consensus that Franco Nevada is superior based on these three points of comparison--balance sheet, management, and diversification--I would argue that Royal Gold has a very strong balance sheet and a capable management team. Royal Gold has $700 million in working capital and just $300 million in debt. This isn't "perfect," but it shouldn't give investors any reason to worry. Royal Gold also has a very capable management team, which is evidenced by the nearly 20-fold increase in Royal Gold's share price since the beginning of the gold bull market. I should also point out that last year, when the stock traded at $100/share, management recognized that its shares were overvalued and it issued 5 million shares--a brilliant move considering the $46 share price today. The point that Royal Gold critics get right is the company's relative lack of diversification. Its Mt. Milligan royalty comprises more than a quarter of its current valuation as I calculate it below. Mt. Milligan is so important to the company that I devoted an entire article to it in October. Fellow author Stephen Simpson has expressed concern that Mt. Milligan can pose problems for Royal Gold given Thompson Creek's questionable financial position. He argues that this concern will hold Royal Gold shares down despite the fact that they trade at a very low relative valuation based on a history of its price/NAV ratio. Pascua Lama also comprises a large portion of Royal Gold's portfolio, and it has seen setbacks. Ultimately Royal Gold's relative lack of diversification is reason enough to pay less for it than one would for Franco Nevada, however, the current valuation disparity isn't justified. With this being the case, Royal Gold stands out in my mind as the superior investment. This sentiment is corroborated by an in depth look at its individual royalty agreements, the value of which portends significant upside in the company's shares even if the price of gold remains flat. Valuing Royalties I value royalties based on their discounted cash flow. Given the fact that royalty companies have fixed, and therefore predictable costs, I believe that a low discount rate is justified. In what follows, I use a 3% discount rate as opposed to an 8% discount rate which I have used to value mines. Royal Gold's Cornerstone Properties As I previously stated Royal Gold has royalties on over 100 properties, but five in particular account for a great deal of the company's value. A: Mt. Milligan The Mt. Milligan stream is by far Royal Gold's most important asset. It entitles the company to 52.25% of the gold produced at Thompson Creek's Mt. Milligan property, which should be roughly 130,000 attributable ounces in the first 6 years and roughly 80,000 ounces in the following 16 years. Unlike most of Royal Gold's deals it is a streaming agreement, whereby the company has to pay $435/ounce for its gold, which leaves it with $765/ounce assuming a $1,200/ounce gold price. Assuming a 3% discount rate at current gold prices, the pre-tax NPV of the Mt. Milligan stream is $1,218 million. However, as I have suggested above, we need to address the possibility that Mt. Milligan will see production issues due either to low copper prices or to Thompson Creeks' financial issues. I have addressed Mt. Milligan's economic feasibility in a separate article, in which I argue that the project will be far more expensive to operate than initially predicted. However the mine should be profitable at current prices and it should not pose any problems. Furthermore, the mine's value--from Thompson Creek's perspective--is predominantly leveraged to the price of copper, which seems to be breaking out on a short-intermediate term basis. Furthermore, a five-year chart of copper reveals that there is extremely strong support around the $3/lb. level. Given that there is substantial monetary easing from the Fed and given that China--the largest global driver of copper demand--has economic growth in excess of 7%, I am fairly confident that $3/lb. copper will hold, and I believe that copper prices will continue to move higher, albeit through a long, drawn out consolidation process. The issue of Thompson Creek's viability is a different matter, especially given that its other two producing projects are molybdenum mines that are not profitable at current prices. Furthermore, while molybdenum should see strong demand longer term increased supply coming from China in the near term will likely keep prices subdued. Fortunately for Royal Gold shareholders, should weak molybdenum continue to adversely impact Thompson Creek, it has the option of selling Mt. Milligan to remain afloat, or it can shut its molybdenum mines down. If things get worse and Thompson Creek is forced into bankruptcy (and this is a possibility that has been put forth) this in no way entails that Mt. Milligan's production will be altered--the mine will revert to bond-holders or it will be sold to another company. Thus I am fairly confident that Mt. Milligan will not cause problems for Royal Gold, although my explanation should only allay, and not not eliminate this concern. B: Andacollo Andacollo is a large copper mine with some gold in Chile operated by Teck Resources. Royal Gold owns an NSR on 75% of the gold produced up to 910,000 ounces, and 50% of the remainder. Thus far about 200,000 ounces of gold have been produced, and the mine produces about 60,000 ounces per year, and so Royal Gold will receive about 45,000 ounces of gold annually for the next 12 years. At the current gold price this comes to $54 million annually. Using a 3% discount rate, the value of the royalty for the next 12 years is $554 million. After the 910,000 ounce level is reached, the company will still receive a lot of gold for quite some time. Not only does the mine have a million additional ounces of reserves, but it has half a million ounces of resources, although the latter are especially low grade. The mine is expected to operate 8 years after the 75% era has ended, although it can easily go longer. Given the uncertainty of mining so far into the future, I will assume 50,000 ounces of production (25,000 attributable) for 8 years. This increases the value of the royalty to $706 million. C: Pascua Lama The Pascua Lama royalty is one of the company's most valuable on paper, but I remain skeptical. I expressed this skepticism when Barrick suspended development of a project that was supposed to be producing by now. This suspension came after the company revealed that development and permitting costs would far exceed initial estimates. That being said, should Pascua Lama go into production, it will add a lot of value to Royal Gold. This is a 5.23% NSR royalty assuming the gold price remains about $800/ounce. The property will be one of Barrick's largest producers in some years, although production fluctuates wildly from some years to others from just over 100,000 ounces to nearly 700,000 ounces. Using a 3% discount rate the NPV is $339 million. D: Pensaquito Royal Gold owns a 2% NSR royalty on Goldcorp's Pensaquito mine. Pensaquito is a polymetallic mine that produces gold, silver, lead and zinc. Production is expected to continue through 2032 with gold production exceeding:

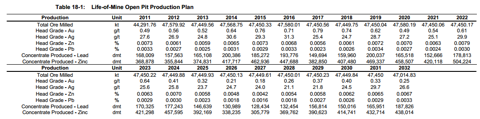

These figures will be higher, especially for gold, in the near term, but they will taper off towards the end of the mine's life as ore grades decline. However assuming constant metal prices the company should generate roughly:

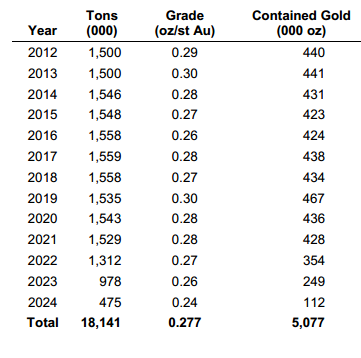

Thus, for the next several years, the royalty will generate over $25.6 million annually. Since ore grades begin to taper off after 10 years, let us assume $25.6 million/year for 2014 - 2023 and about 2/3 of that--$16.5 million--for the remaining 9 years (2024 - 2032), keeping in mind that these figures are very conservative when applied to the next 3-5 years or so as gold production peaks. Using a 3% discount rate, this gives us a valuation estimate of $323 million. E: Voisey's Bay Voisey's Bay is a large nickel mine with some copper and cobalt production in Labrador, Canada operated by Vale . Royal Gold owns a 2.7% NSR royalty on the property. Its life should exceed 20 years, although I will calculate the royalty's value based on exactly 20 years using 85 million pounds of copper production (2.3 million pounds attributable), 140 million pounds of nickel (3.8 million attributable) and 3.3 million pounds of cobalt (89,000 attributable). All of these figures are below those from last-year. The NPV using a 3% discount rate is $506 million. Summary of the Main Properties If we total the values of the five major properties, their collective value is $3,102 million. Royal Gold anticipates paying 30% - 34% in taxes, and so using a 35% tax rate, the collective NPV of these five royalties is $2,016 million. Secondary Properties Royal Gold has a lot of royalties that are smaller, but which still add substantial value to the company. I have broken up my discussion of them into two sections--those worth more than $20 million and those worth less than $20 million--for simplicity's sake. A: Delores Delores is a gold/silver mine in Chihuahua, Mexico operated by Pan American Silver (PAAS). Royal Gold has an NSR royalty on 3.25% of the gold produced and 2% of the silver produced throughout the life of the mine--estimated to be 16 years. While Pan American doesn't give a year by year breakdown of the amount of gold/silver it expects to mine, current-day figures of about 60,000 ounces of gold conservatively (2,000 attributable) and 3.25 million ounces of silver (65,000 attributable) are conservative estimates compared with the mine's total estimated reserves (1.6 million ounces of gold and 76 million ounces of silver). At current metal prices, Royal Gold will realize $2.4 million from gold and $1.3 million from silver for a total of $3.7 million annually for 16 years. At a 3% discount rate this comes to an NPV of $48 million. B: Mulatos The Mulatos Mine in Sonora Mexico is operated by Alamos Gold (AGI). While it is a sliding scale royalty, it is a 5% NSR royalty assuming the gold price remains above $400/ounce. Unlike most of Royal Gold's royalties, it is capped at 2 million ounces of production. Thus far the mine has produced about 1.2 million ounces. Thus with 800,000 ounces to go before the royalty expires, Royal Gold is entitled to 40,000 ounces, the value of which depends on how long it will take the company to mine it. The mine is estimated to produce 180,000 ounces this year at the low-end, and it produced 200,000 ounces last year. So conservatively, if the mine produces 180,000 ounces/year the royalty has 4.5 years remaining, with Royal Gold receiving 9,000 ounces annually. Thus, at current gold prices at a 3% discount rate, the NPV of the royalty is $45.8 million. C: Cortez Cortez is another Barrick mine in Nevada. It is a large mining complex, and Royal Gold has four separate royalty agreements covering different parts of the complex. The first two are both effectively 5% GSR royalties, although they only cover a small part of the mining complex that produces between 60,000 and 100,000 ounces annually (the entire complex produces about 1 million ounces). Erring on the side of caution, I will estimate that these areas produce 70,000 ounces annually, giving Royal Gold 3,500 ounces. The third royalty is a 0.71% GSR on a part of the mine that produces in line with the first two parts combined, and so this will add about 500 ounces of annual production. Finally there is a 0.39% NVR (a net value royalty entitles the royalty company to an agreed upon portion of the net revenues from a mine) which should add another 300 ounces annually. Thus in all, the Cortez royalty should provide Royal Gold with 4,300 ounces of annual production for 13 years. The NPV at a 3% discount rate is therefore $57 million. D: Las Cruces Las Cruces is a copper mine in Spain operated by First Quantum Minerals (OTCPK:FQVLF). Royal Gold owns a 1.5% stake in NSR royalty on the copper produced here, which should be 150 million pounds (2.25 million pounds attributable) through 2021 conservatively (the company estimates through 2022). Thus at the current copper price, the royalty should generate $7.3 million annually for the next 8 years. Thus at a 3% discount rate the royalty is worth $53 million. E: Robinson The Robinson copper gold mine in Nevada is operated by KGHM. Royal Gold has a 3% NSR royalty on the copper and gold produced here. The property has been a long term copper producer, but based on current resources, it should be able to produce 120 million pounds of copper (3.6 million attributable pounds) and 30,000 ounces of gold (900 attributable ounces conservatively for the next 8 years or so.) At current copper and gold prices, this amounts to $13.1 million in annual revenues. Using a 3% discount rate the NPV is $95 million. F: Canadian Malartic Canadian Malartic is a huge project located in Quebec and operated by Osisko Mining (OTCPK:OSKFF). Royal Gold effectively owns a 1.5% NSR royalty on the gold produced at Canadian Malartic. Despite the fact that the project has over 9 million ounces of reserves, Osisko has a modest projection of a 15 year mine life at 500,000 - 600,000 ounces of annual production once full capacity is reached. Assuming the low-end of this range, Royal Gold will receive 7,500 ounces annually, or $9 million in annual sales. This means that the royalty is worth $112 million at 3%. G: El Morro The El Morro mine is a joint venture gold/copper project in Chile owned by Goldcorp and New Gold (NGD). Royal Gold owns a 1.4% NSR on El Morro. The project is slated to begin production in 2017 and reach full production in 2018, at conservatively 400,000 ounces annually (5,600 attributable) for 16 years, although I will use 15 years, because the mine doesn't have the reserves necessary to mine at this pace without assuming that resources, which are not necessarily economically feasible, will be mined. Since mining doesn't begin until 2018, this will lower the discounted value of the royalty. At a 3% discount rate, the value of the El Morro royalty is $73 million. H: Back River The Back River project is currently being developed by Sabina Gold and Silver (OTCPK:SGSVF). Royal Gold owns a 1.95% royalty on the gold produced at Goose Lake above 400,000 ounces, and a 2.35% royalty on the gold produced at George Lake about 800,000 ounces. I remain skeptical that production will begin on time (2016 given Sabina's capital needs and the fact that the company has not yet decided how to raise the money it needs.) In all it should produce about 300,000 ounces/year for 12 years. Assuming production starts in 2017, the royalty is worth $53 million at 3%. I: Goldstrike The Goldstrike mine is located in Nevada and operated by Barrick Gold . Royal Gold owns a 0.9% NSR royalty on Goldstrike. Barrick has produced estimates as to how much gold it will produce each year, although 2013 was a major disappointment, with the company's technical report predicting 440,000 ounces (4,000 attributable) but producing less than 400,000 (3,600 attributable). Thus while we have the following production schedule, I am going to err on the conservative side and assume 3,600 attributable ounces for 8 years (through 2021) and simply ignore the rapidly declining production through 2024.

Thus using a 3% discount rate the royalty is worth $31 million. J: The Leeville Mining Complex The Leeville Mining Complex is located in Nevada and is operated by Newmont Mining (NEM). Royal Gold owns a 1.8% NSR on the gold produced here. Reserves are estimated to be 1.6 million ounces while production is at 220,000 ounces (4,000 attributable), which means that the property can easily produce another 7 years at the current pace. The NPV at 3% is $31 million. K: Gwalia Deeps/King of the Hills The Gwalia Deeps project in Western Australia is operated by Santa Barbara Ltd (OTCPK:STBMY). Royal Gold owns a 1.5% NSR royalty on the Gwalia Deeps project, which is projected to produce 190,000 ounces of gold next year (2,850 attributable) and which has two million ounces of reserves. Assuming conservatively that the property can produce 175,000 ounces/year for the next 8 years the royalty will generate $3.15 million annually at the current gold price. It is therefore worth $23 million using a 3% discount rate. King of the Hills is near the Gwalia Deeps project, and Royal Gold owns a 1.5% NSR on the project. While it has potential and a history of production, as of the most recent reserve estimate the figure was just 68,000 ounces, or just slightly more than a year's worth of production at 55,000 ounces (825 ounces attributable). Therefore I am valuing it at $1 million at current gold prices. L: Marigold The Marigold project in Nevada is a joint venture between Barrick and Goldcorp. Royal Gold owns a 2% NSR on the gold produced at Marigold. It currently produces about 100,000 ounces annually and it is expected to operate for another 16 years. Assuming conservatively 80,000 ounces (1,600 attributable ounces) over 14 years the royalty is worth $22 million using a 3% discount rate. M: Soledad Mountain Soledad Mountain is a gold/silver mine located in California and is currently being developed by a small mining company--Golden Queen Mining (OTCQX:GQMNF). Royal Gold owns a 3% NSR on Soledad Mountain. Production is slated to begin in 2015 and average conservatively at 80,000 ounces of gold equivalents (2,400 attributable). Given these figures the NPV of Royal Gold's royalty at 3% is $33 million. N: Ruby Hill Ruby Hill is another Nevada gold mine operated by Barrick. Royal Gold owns a 3% NSR on the gold produced there. In 2013, the mine should generate about 70,000 ounces of production (2,100 attributable). While gold reserves are limited to just a few years of production, the property's indicated resources exceed 3 million ounces, which suggests that the mine can generate more production for a long time-frame. This opinion is corroborated by Barrick's own estimate of 90,000 ounces for 2013 production, although the company fell short of this. Still, I believe that the company can produce 90,000 ounces (2,700 attributable) for 7 years and easily much more than this. At this rate the royalty is worth $21 million at 3%. O: Kutcho Creek The Kutco Creek is primarily a copper and zinc project being developed by Capstone Mining (OTCPK:CSFFF). Royal Gold owns a 1.6% royalty. It should produce an average of 30 million pounds of copper (480,000 attributable) and 50 million pounds of zinc (800,000 attributable) per year for 12 years starting in 2016. It will also produce small amounts of silver and gold. The NPV at 3% is $26 million. P: Wolverine The Wolverine project is operated by Yukon Zinc, which is privately owned. Royal Gold owns a 9.445% royalty on the gold and silver mined there. The project has nearly 200,000 ounces of gold and nearly 40 million ounces of silver. It produces 5,600 ounces of gold (550 attributable) and 1.9 million ounces of gold (180,000 attributable), and it has the resources to maintain this production easily for 10 years, and probably longer. At 3% the NPV is $36 million. Q: Pinson The Pinson project is located in Nevada and operated by Atna Resources (OTCQB:ATNAF). Royal Gold owns a 3% NSR on virtually all of the property's resources. Production began production last year and expanded it earlier this year, but it was forced to shut down in response to lower gold prices. That being the case, the royalty only has optionality value at $1,200/ounce gold. However, the resource base exceeds 1.6 million ounces and the mine is capable of producing in excess of 120,000 ounces/year (3,600 attributable). That being the case, it is certainly worth attributing value to the royalty. It is worth $24 million at 3%. Summary These 17 properties add an additional $785 in pre-tax value, or $510 million after taxes. Smaller Producing/Development Properties A: Inata Inata is a small mine in Burkina Faso operated by Avocet Mining (OTC:AVVGF). Royal Gold owns a 2.5% GSR on all of the gold produced there. Production should continue for the next 6 years at roughly 100,000 ounces (2,500 attributable) in 2014 and 80,000 (2,000 attributable) in the following 5 years. This gives the royalty a value of $14 million with a 3% discount rate. B: Don Mario The Don Mario copper/gold/silver mine is located in Bolivia and operated by a small mining company called Orvana Minerals (OTCPK:ORVMF). Royal Gold owns a 3% NSR. Right now the mine has a short life span through 2017, although the company is making effort to expand the resource base. The following table shows the production schedule. Based on current metal prices the NPV of the royalty at 3% is $13.4 million. C: Limon Limon is a long-life mine in Nicaragua operated by B2Gold (BTG). Royal Gold owns a 3% NSR on the gold produced here. While it is low on reserves at just under 250,000 ounces of gold, there are significant inferred resources. Furthermore, the mine has a 70 year history of producing, and there is a strong likelihood that this will continue. The company estimates 60,000 ounces (1,800 attributable) of annual production through 2018, and in order to keep my estimate conservative, I will not assume any subsequent production. Using a 3% discount rate the royalty is worth $10.2 million. D: The Allan Project The Allan project produces potash in Saskatchewan, and is operated by Potash Corp. (POT). Royal Gold is entitled to $1.44/ton for 40% of the production out of the first 600,000 tonnes produced. It gets $0.72/ton for 40% produced from 600,000-800,000 tonnes, and the figure drops to $0.36/ton above 800,000 tons. This doesn't seem like a lot--on the 1.1 million tonnes produced last year this comes to $446,000 per year. However the project has 312 million tons in reserve, meaning the project could theoretically produce at this rate for hundreds of years. Assuming production of 1 million tons per year ($432,000 annually to Royal Gold) for 100 years the royalty is worth $14 million at a 3% discount rate. E: Troy The Troy mine, operated by Revett Minerals (RVM) is in Montana, and Royal Gold owns a 3% GSR royalty on the silver and copper produced there. The mine ceased production a year ago because of unsafe working conditions, and so Royal Gold has lost its royalty income. While Revett Minerals remains hopeful that production can start again soon from Royal Gold's perspective, healthy skepticism is in order. In 2012, Troy produced a million ounces of silver (30,000 attributable ounces) and 7.4 million pounds of copper (222,000 attributable pounds), and currently the property has over 11 million ounces of silver reserves and over 85 million pounds of copper reserves. If we include resources, which may not be economical to mine, then these figures skyrocket, adding 82 million ounces of silver and over 750 million pounds of copper. For the sake of being conservative, I will assume that production starts in a year (hence I will discount the royalty's value by a year) and that Revett will mine 900,000 ounces of silver (27,000 attributable) and 7 million pounds of copper (210,000 attributable) for 10 years. This gives the royalty a NPV of $10.2 million at 3%. F: Williams The Williams mine in Ontario is a small mine operated by Barrick on which Royal gold owns a 0.97% NSR. It has less than a million ounces of reserves and produces just over 80,000 ounces annually (800 attributable). Since it is such a small mine in the context of Barrick's > 7 million ounces of annual production, Williams is not a priority for the company, and it doesn't give annual production guidance, although if it produces at the current pace, it should generate $1 million annually for Royal Gold for 8 years or so. This gives it an NPV of $7.2 million at 3%. G: Mara Rosa The Mara Rosa project in Brazil is being developed by Amarillo Gold (OTC:AGCBF). Royal Gold owns a 1% NSR royalty on the project. It is expected to generate at least 110,000 ounces of gold for seven years once it goes into production. While the project's pre-feasibility study suggests that production will begin next year the market seems to think otherwise with the stock having fallen to just $0.10/share, or a market capitalization of just over $7 million. Assuming that the project goes into production in 2 years, the royalty has an NPV of $8.5 million at 3%. H: El Toqui The El Toqui zinc mine in Chile is operated by Nyrstar (OTCPK:NYRSY). Royal Gold owns a 3% NSR royalty on El Toque. Given past production, it should be able to produce about 30,000 ounces of gold (900 attributable) and 50 million pounds of zinc (1.5 million pounds attributable) for 7 years. Thus the NPV at 3% is $15.6 million. I: Gold Hill The Gold Hill mine is a small operation in Nevada run by Kinross Gold (KGC) and Barrick. It is right next to these companies' JV project--Round Mountain. Royal Gold owns a 2% NSR royalty on the gold and silver produced there. Current reserve estimates are fairly low at just 370,000 ounces of gold and 5 million ounces of silver, and production is estimated to be 30,000 ounces of gold (600 attributable) and 50,000 ounces of silver (1,000 attributable). These figures are low but given the proximity of the Gold Hill to Round Mountain--a large mine--there is a distinct possibility of expansion. Assuming these levels of production for 8 years the NPV of the royalty at 3% is $6.6 million. J: Skyline Skyline is a thermal coal project operated by Arch Coal (ACI). Royal Gold owns a 1.41% GV (gross value) royalty on the property. It currently generates just over 2 million tons annually (28,200 attributable), and it has over 18 million tons of reserves. Assuming the mine can operate for 7 years at 2 million tons annually, its NPV at 3% is $10.1 million. K: South Laverton The South Laverton project is in Western Australia and is operated by Saracen Mineral Holdings (OTC:SCEXF). Royal Gold owns a 1.5% NSR on the gold produced there. The project has roughly 750,000 ounces of gold reserves and produces over 100,000 ounces (1,500 attributable) on an annual basis. Thus the mine's life is limited to 7 years, but if it is able to mine resources, it could be extended far beyond this. At 3% the NPV of this royalty is $11.6 million. L: Taparko The Taparko Mine is in Burkina Faso and is operated by Nord Gold. Royal Gold owns a 0.75% royalty on the property. It produces about 125,000 ounces annually (938 attributable) and it has enough reserves to maintain this for 6 years. The NPV at 3% is $6.2 million. M: Wharf The Wharf project in South Dakota is a small gold mine operated by Goldcorp. Royal Gold owns a 2% NSR on Wharf. It has roughly 500,000 ounces of reserves and produces about 50,000 ounces annually (1,000 attributable). Given the mine's additional resources, it can easily operate like this for 8 years. At 3% the project has an $8.7 million NPV. N: Don Nicolas The Don Nicolas mine in Argentina is owned by Minera IRL. Royal Gold owns a 2% NSR ona the property. Currently the mine is slated to begin production in about a year at 50,000 ounces of gold (1,000 attributable). It will only produce for four years based on current reserve estimates but the company is confident in its exploration potential. The NPV at 3% is $4.6 million. O: Kundip The Kundip project is a part of Silver Lake's (OTC:SVLKF) Great Southern project in Western Australia. Royal Gold owns a 1% NSR royalty on the first 250,000 ounces mined and a 1.5% royalty on subsequent production. Based on current estimates, the mine should generate 50,000 ounces (500 attributable) from 2017 through 2020. However the mine has far more reserves and resources than this (about 1.1 million ounces in all), which suggests that the value of this royalty can end up being substantially higher. Without this additional production, however, the NPV is just $2.1 million at 3%. Summary The total value of these 15 royalties is $143 million before taxes, or $93 million after taxes. Conclusion Thus, the sum total of the value of the royalties is $2.62 billion. If we add in the rest of the company's net equity the NAV of Royal Gold comes to $2.83 billion, which is slightly less than its $2.94 market capitalization. Of course we have to keep in mind two things. First, Royal Gold has historically traded at a significant premium to its NAV. If the shares were to revert back to the mean, they could easily double. Even if we want to play it safe and not count Pascua Lama or half of Mt. Milligan in our calculation, then we can apply the 2.3 multiple to the above total minus $1 billion and still get a $4.18 billion valuation, or about 35% upside. Second, the company owns royalties on dozens of exploration properties, and each of the mines in production or development can potentially be expanded. While we cannot quantify this, if these properties could generate just 150,000 ounces of gold/equivalents in the next 10 years, then this would more than make up for the small difference between the company's market capitalization and its NAV. Thus even with the gold price as weak as it has been, Royal Gold shares offer a compelling investment opportunity, especially for somewhat risk-averse investors who want to generate income from gold portfolio without playing in highly leveraged miners or in the options/futures markets. Disclosure: I am long GG, NGD, POT. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article. I am long Sandstorm Gold warrants, and I may initiate a long position in Royal Gold in the near future. |

| You are subscribed to email updates from gold price - Google Blog Search To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 20 West Kinzie, Chicago IL USA 60610 | |

These four factors are already affecting gold supply. Gold production in the US was already 8% lower in the first half of 2013 vs. the first half of 2012. Through June of each year, output dropped from 655,875 ounces last year to 623,724 in 2013.

These four factors are already affecting gold supply. Gold production in the US was already 8% lower in the first half of 2013 vs. the first half of 2012. Through June of each year, output dropped from 655,875 ounces last year to 623,724 in 2013.

0 Comment for "New Trend Guarantees Higher Gold Prices 2014 - The Market Oracle"