Shares of gold mine waste retreatment firm surges 28% |

- Shares of gold mine waste retreatment firm surges 28%

- Kinder Morgan applies to nearly triple capacity for western Canadian pipeline

- India gold import curbs could be eased by year-end

- Using natural gas to mine for oil sands – a strategy by Shell and Caterpillar

- Rio Tinto says Chinese now make 'much higher quality' mining equipment

- Oyu Tolgoi financing commitments extended

| Shares of gold mine waste retreatment firm surges 28% Posted: 16 Dec 2013 04:35 PM PST

ADRs of DRDGold (NYSE:DRD) which retreats surface gold tailings rocketed 28% in New York on Monday without any fresh news about Johannesburg-based company surfacing. By the close DRD Gold, which extracted 33,600 ounces of gold from old mine dumps in its most recent quarter, was trading up 27.8% at $4.23 in New York, after earlier spiking as high as $4.65 per American Depositary Receipt. Almost 1 million units changed hands compared to usual volumes of less than 80,000. The company, worth $160.4 million on the NYSE, is still showing annual losses – it is down 47% in 2013. The company announced a small loss in its September quarter due to delays of a new flotation and fine-grind milling circuit at its Ergo plant near Springs outside Johannesburg, South Africa. The plant treats some 2 million tonnes of recovered mine waste every month and the flotation technology could up recoveries of gold to 75% from the 45% achieved at the existing carbon in leach facility. |

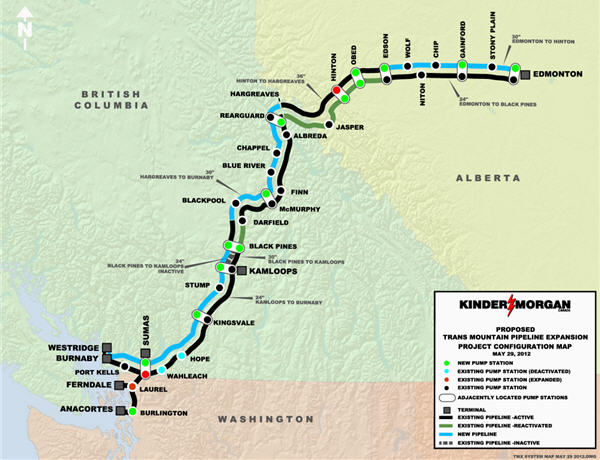

| Kinder Morgan applies to nearly triple capacity for western Canadian pipeline Posted: 16 Dec 2013 02:35 PM PST Midstream company Kinder Morgan Canada has applied to nearly triple the capacity of its Trans Mountain pipeline which flows from Edmonton, Alberta to Burnaby, British Columbia. The filing, which the company submitted to the National Energy Board (NEB) on Monday, will trigger a public regulatory review process. If the proposal is approved, the expansion should be operational by late 2017. According to the Globe and Mail, Kinder's filing with the NEB contains 15,000 pages in 37 binders that stack up to more than two meters high. "For the past 18 months we have engaged extensively with landowners, Aboriginal groups, communities and stakeholders along the entire proposed expansion route, and marine communities, and have carefully considered the input received during this period of study and dialogue," President of Kinder Morgan Canada Ian Anderson said in a statement. "Our engagement efforts will continue beyond this filing leading up to the NEB hearing as we consider further input that is critical to our planning on this project."  Kinder Morgan, Trans Mountain expansion plan | Map from Kinder Morgan website Kinder Morgan has been operating the 1,150km-long Trans Mountain pipeline since 2005. The nearly 60-year-old line carries oil from Edmonton to Vancouver at a rate of 300,000 barrels per day. The line provides the interior and southern coasts of British Columbia with 90% of its gas and is the only west coast pipeline for Canadian oil products. The expansion project would allow Canada to sell more crude to American and Asian markets. Motivated by strong support from its customers, in 2012 Kinder Morgan put forward plans to increase the capacity to 890,000 barrels per day. In January the firm signed 13 new long-term contracts with customers, according to Kinder Morgan's website. The $5.4 billion plan is to twin nearly the entire existing pipeline, adding 981km of new line. The project would also include the expansion of the Westridge Marine Terminal where five oil tankers sail to each month. This figure would increase to 34, according to the Globe and Mail. |

| India gold import curbs could be eased by year-end Posted: 16 Dec 2013 01:19 PM PST India's finance ministry, fighting a crippling current account deficit and a weakening currency, implemented various measures stop citizens from importing gold over the last year and more. Gold import duties have been pushed up tenfold – from 1% at the start of 2012 to 10% today. Excise duties now stand at 9% while new rules such as strictly cash only for imports, a rule that calls for the re-export of 20% of all imports, transaction taxes and even bans on gold-backed exchange traded fund investments have stymied India's gold industry. But the government import restrictions have led to a scarcity of physical gold inside the country which increased smuggling activity and sent premiums paid over the London price to rocket to as much as $130 an ounce. The gold trade employ three million Indians and with activity so low, even during the recent festivals, some gold shops have been forced to quit the market or idle their businesses. The Economic Times reports Monday, quoting an official from the ministry, that the economic situation has improved to such an extent – including a 10% appreciation in the rupee from record low in August – that some curbs may be lifted and others eased by the end of the year. "There have been several representations," said the official cited above, adding that a call will have to be taken based on several factors, including the degree of the threat to CAD, the impact on duty collections as gold imports shift to unofficial channels and the effect on employment. Gold traders and jewellery exporters have lobbied hard with the government for the easing of the import compression measures, arguing that they had fuelled the grey market and hurt trade badly. No doubt there is a political angle to easing the restrictions too after India's ruling Congress Party were roiled in state elections last week – losing the three large states of Rajasthan, Madhya Pradesh and Chhattisgarh – ahead of general elections set for 2014. According to some estimates about 400 tonnes of recycled gold to enter the market this fiscal year to March 2014, compared with normal rates of about 130 tonnes, according to Thomson Reuters GFMS data. India's 330 million households are hoarding 18,000 – 20,000 metric tonnes of gold worth some $900 billion at today's prices, representing almost 50% of the country's GDP. |

| Using natural gas to mine for oil sands – a strategy by Shell and Caterpillar Posted: 16 Dec 2013 01:03 PM PST Shell Canada and Caterpillar are joining forces to save money and reduce emissions from oil sands mining in Alberta. The companies have signed an agreement to test a new truck engine which would run mainly on liquefied natural gas (LNG) rather than diesel. By using LNG, the pair expects to reduce emissions and costs. LNG will displace most of the diesel power resulting in a duel fuel truck. Through the agreement, Caterpilar will test the design at Shell's oil sands operations located near Fort McMurray. "To succeed commercially in the future, we believe we have to be able to compete both economically and environmentally. We believe that is what Canadians want," Shell's VP of oil sands, John Rhind, said in a statement. Shell will also retrofit its existing trucks with the new engine for the trial. Caterpillar says most of its customers are asking for LNG-powered equipment in order to reduce costs and environmental effects. Field testing of the new trucks will last up to one year and will begin in 2016. Mine trucks are a substantial source of CO2 emissions, as Shell noted in its 2011 performance report. The new trucks should help reduce oil sands operations' contributions to emissions, which are currently 4-18% higher than from the average barrel of crude oil consumed in the US. Shell Canada's oil sands operations include the Muskeg River and Jackpine mines and the Scotford Upgrader, which it runs on behalf of the Atahabasca Oil Sands Project – a joint venture between Shell, Chevron and Marathon Oil. |

| Rio Tinto says Chinese now make 'much higher quality' mining equipment Posted: 16 Dec 2013 12:13 PM PST The CEO of world number two miner Rio Tinto last week told an investor conference the quality of Chinese mining equipment is catching up to that of the major US manufacturers. The Wall Street Journal quotes Rio Tinto (LON:RIO) CEO Sam Walsh as saying that the Anglo-Australian giant has been increasing purchases of heavy equipment and other items from India and China, and has found the quality impressive. Among RIO's purchases were heavy-duty trucks, equipment for loading ships and rail cars that carry ore. Without naming any names, Walsh said "funnily enough" on the rail cars "the quality actually was much higher" compared to the miner's traditional supplier: "Instead of spot welds, for example, on the sheet metal they were actually continuous welds." A JP Morgan analyst said that quality at Chinese equipment makers can vary widely, but "it's incredible the speed at which they are coming up the quality curve." It's a development that spells tougher competition down the line for a host of mining equipment suppliers, including the likes of Caterpillar (NYSE:CAT), Joy Global (NYSE:JOY), Komatsu and Liebherr. Leaders CAT and Joy Global are having a tough year. In October, world number one supplier Caterpillar lowered guidance and reported revenue numbers below analysts expectations, while Joy Global last week reported a 26% slump in sales as the slowdown in mining capital expenditure continues. Other manufacturers like Belarusian mining equipment manufacturer Belaz are also muscling in on the traditional leaders turf. Belaz is testing a truck which will be the world's largest capable of carrying a 450 tonnes payload. Image of US$300,000 BZK D45 dump truck courtesy of Beijing Zhonghuan Kinetics Heavy Vehicles. |

| Oyu Tolgoi financing commitments extended Posted: 16 Dec 2013 12:11 PM PST Turquoise Hill (NYSE:TRQ) has a few more months to wrangle with the Mongolian government. The company announced on Monday that its parent, Rio Tinto, has received extended commitments from the 15 commercial banks that have agreed to finance the expansion of the Oyu Tolgoi mine in Mongolia. The commitments were set to expire on December 12. Rio Tinto now has until the end of March to resolve its issues with the Mongolian government over financing the expansion. These discussions have been dragging on for about a year now. The Mongolian government, which owns 34% of Oyu Tolgoi, has been reluctant to cough up the cash, saying the price tag is $2 billion more than expected. The mine could cost as much as $14 billion if the underground expansion goes ahead. A government source told Reuters last month that legislators envisioned a deal by early 2014. "All parties are committed to resolving the shareholder issues and advancing the necessary steps to restart the underground mine; including resolution of the shareholder issues, completion of the feasibility study, project financing, permitting and approvals," Vancouver-based Turquoise Hill said in a statement on Monday. "The feasibility study remains on track for completion in the first half of 2014." Mongolia has a strong interest in making this a reality – the mine is expected to contribute as much as a third of the country's economy. Meanwhile, Dutch commodity trader Trafigura revealed on Monday that it had agreed to provide financing for the Oyu Tolgoi mine in exchange for long-term supplies. The company did not provide any further information on this deal. Oyu Tolgoi is set to produce 150,000 to 175,000 tonnes of copper in concentrates and 700,000 to 750,000 ounces of gold in concentrates in 2014. |

| You are subscribed to email updates from MINING.com To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 20 West Kinzie, Chicago IL USA 60610 | |

0 Comment for "Shares of gold mine waste retreatment firm surges 28%"