Mackenzie Gas Project delay continues as costs increase 40% |

- Mackenzie Gas Project delay continues as costs increase 40%

- Paul Krugman bashes Bitcoin, Barrick, gold

- Gold mining in Brazil's amazon: Artisanal miners vs. mining companies

- Gold headed for year-end above $1,200 but worst performance in three decades

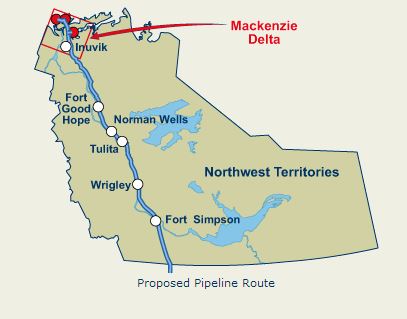

| Mackenzie Gas Project delay continues as costs increase 40% Posted: 26 Dec 2013 03:11 PM PST Imperial Oil's Mackenzie Gas Project in Canada's Northwest Territories will be 40% more expensive than expected, putting the total price tag at $18.82 billion, Reuters reports. The increased cost estimate is due to rising labour and material prices. But it's not yet clear if the project will go forward. "The Mackenzie Gas Project proponents have not yet made a decision to construct the project because of the current natural gas market conditions," Imperial said in a filing to Canada's National Energy Board (NEB), as reported by Reuters. The Mackenzie Gas Project is a proposal to develop three natural gas fields and to transport the natural gas to southern markets via a 1,196-kilometre pipeline system. The much-delayed project is a joint venture between Imperial, ConocoPhillips, Shell, ExxonMobil and the Aboriginal Pipeline Group.  Map from Mackenzie Gas Project website In October Imperial announced that it was looking to revamp the Mackenzie plans after cutting spending on the project in 2012. According to the CBC, the venture has until 2015 to start construction on the pipeline and gas fields, otherwise it will have to go through another NEB review. The CBC also reports that Imperial Oil will not go ahead with the project right now, "as the market conditions are just not good." |

| Paul Krugman bashes Bitcoin, Barrick, gold Posted: 26 Dec 2013 01:45 PM PST It's no secret that famed economist Paul Krugman hates Bitcoin (as a monetary system). He's been talking about it since back in 2011 when the cryptocurrency was on very few peoples' radars. "What we want from a monetary system isn't to make people holding money rich; we want it to facilitate transactions and make the economy as a whole rich. And that's not at all what is happening in Bitcoin," the economics professor wrote two years ago. In his most recent column, "Bits and Barbarism," Krugman has even harsher words for the cryptocurrency whose valued has soared over the past few months, reaching an all-time high of $1,240 per BTC in November. In Krugman's piece – a "tale of monetary regress" as he puts it – the economist identifies three "money pits" – Bitcoin being the second on his list. Bitcoin only has value because people are willing to buy it because they think other people are willing to buy it, Krugman explains. "It is, by design, a kind of virtual gold. And like gold, it can be mined: you can create new bitcoins, but only by solving very complex mathematical problems that require both a lot of computing power and a lot of electricity to run the computers," Krugman writes. "A lot of real resources are being used to create virtual objects with no clear use," he concludes. Interestingly, the first "money pit" on Krugman's list is Barrick Gold's Porgera open-pit gold mine in Papua New Guinea. The economist criticizes the mine for its reputation of human rights abuses and environmental damage. Interested in Krugman's third "money pit"? You should probably read it in his words. |

| Gold mining in Brazil's amazon: Artisanal miners vs. mining companies Posted: 26 Dec 2013 12:34 PM PST As MINING.com reported last week, illegal mining has become the "new cocaine" of Latin America. Illicit gold extraction in Peru already generates 15% more profits than the country's total estimated drug trafficking. In Brazil these operations have been ongoing for half a century and the government has been pushing hard to evict the 'garimpeiros' (prospectors) – a reflection of the competing interests between mining companies and artisanal miners. The BBC recently took a closer look at the life of these small-scale miners in Brazil's amazon. According to the BBC's report, most of these men are not rich but have been able to scrape a better living with gold than in other industries such as fishing or agriculture.

Big mining companies are the garimpeiros biggest rivals. Miners claim that while they have been trying to legalize their activities for years – "taking their request as far as the federal capital, Brasilia," the BBC writes – mining companies have a much easier time getting their activities regularized with authorities. In 2010, federal police evicted miners from the hamlet of Sao Jose on the Pacu river. As the BBC reports, a subsidiary of Canadian mining group Albrook Gold Corporation has mining rights over the subsoil in this area. But in June 2013 the miners came back, escalating the conflict with the company. "If they go on mining, they will make the whole project unviable for us by the damage they do," a shareholder of the Brazilian company told the BBC. But the miners say they would be "ruined" if they can't produce gold. Many of them have been there for decades. Artisanal mining operations are often criticized for their effects on the environment. It's estimated that illegal activities have destroyed about 40,000 hectares of rainforest in Peru alone. Illegal mining operations are also often extremely violent. As the Guardian has reported, when miners strike a big gold deposit, their lives are in danger. "If you find a lot of gold in the garimpos you keep quiet – very quiet. A single shout of triumph can amount to suicide," the Guardian writes. See the full BBC story and video here. |

| Gold headed for year-end above $1,200 but worst performance in three decades Posted: 26 Dec 2013 10:38 AM PST Gold inched slightly higher on Thursday, trading at $1,215 per ounce – the highest it's been since plunging past the $1,200 mark last week. But Thursday's gains don't make up for the fact that the precious metal is about to complete its worst year in three decades: Gold is down nearly 30% for the year, ending a 12-year rally that saw the gold price at $1,900 per ounce when US and global markets were at their worst. US jobless data came out on Thursday, showing that the number of people filing for benefits declined by more than expected. Jobless data usually influences the gold price since it's seen as a good indication of the health of the US economy. Meanwhile, China – the world's number one gold consumer – has forecasted 2013 economic growth of 7.6%, 0.1% higher than its target, the Wall Street Journal reports. Next year's target is the same as this year's, the lowest in over a decade. |

| You are subscribed to email updates from MINING.com To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 20 West Kinzie, Chicago IL USA 60610 | |

0 Comment for "Mackenzie Gas Project delay continues as costs increase 40%"