Iron ore, met coal prices slump as Australia ramps up exports |

- Iron ore, met coal prices slump as Australia ramps up exports

- Biggest US coal plant closures of 2013

- India won't ease gold import restrictions

- Rinehart's Roy Hill project gets $1bn funding injection

- Gold price swings wildly after Fed's surprise taper

- Survey: 72% of miners see the global economy improving

| Iron ore, met coal prices slump as Australia ramps up exports Posted: 18 Dec 2013 04:15 PM PST The price of iron ore slumped to a 7-week low and metallurgical coal traded at its lowest level since August on Wednesday. The benchmark CFR import price of 62% iron ore fines at China's Tianjin fell to $133.40 a tonne on a level last seen at the end of October, while FOB premium Australian coking coal declined to $136.30 a tonne, the lowest since August 2, according to data provided by SteelIndex. Pushing prices down were renewed worries whether economic growth in China, the world's number one importer of the steelmaking raw materials, would be sufficient to absorb a massive increase in supply. China buys roughly 65% of the world's 1.2 billion tonne seaborne iron ore trade and after an astonishing 30% jump in 2013 to an estimated 92 million tonnes absorbs almost a third of all coking coal exports. Chinese mills are still forging steel at a rate of more than 2 million tonnes per day – almost as much as the rest of the world combined – but the industry suffers from chronic overcapacity and low profitability. Cargoes from the world's largest exporters in Brazil, Australia and South Africa have been edging out generally low-quality domestic supply, with imports into China reaching a record high of 77.8 million tonnes in November, but the questions now becomes whether surging supply is about to overwhelm demand. New research by Australia's Bureau of Resources and Energy Economics (BREE), the country's official forecaster, show another sharp increase in exports of iron ore and coking coal, which may coincide with a slowdown in China as the country's red hot construction sector cools and the country moves from an investment to a consumer-led economy. BREE predicts that while Chinese iron ore imports will grow 7.4% next year, the world's top exporter Australia will increase cargoes a whopping 22.1% to 709 million tonnes as projects by Rio Tinto (LON:RIO), Fortescue Metals Group (ASX:FMG) and BHP Billiton (LON, ASX: BHP) come on stream. Brazil, led by world number one iron ore miner Vale (NYSE:VALE), is set to up exports 9.1% to 352 million tonnes. India, which has seen exports fall from 120 million tonnes to close to just 11 million tonnes this year, will also re-enter the market as a self-imposed ban on exports expire and stockpiles are sold on. With more limited supply growth and no new major projects coming on stream, the outlook for the coal price is better. Chinese imports will increase a still respectable 7.8% and met coal exports will show more modest growth with Australia, which at 168 million tonnes is expected to export three times more than second placed US, growing at just under 4%. US exports will decline for the the third year in a row, dropping 4.6% in 2014. Iron ore is second only to the seaborne crude oil trade and represents close to 25% of global dry bulk cargoes with coal a close second. More than 35% of mined iron ore is shipped and 12% of global coal production is carried by sea. Image of Port Hedland iron ore terminal courtesy BHP |

| Biggest US coal plant closures of 2013 Posted: 18 Dec 2013 03:53 PM PST It's no secret that the US is abandoning coal in a big way: Over the next decade, US power companies have formalized plans to permanently retire nearly 28,000 megawatts (MW) of coal-fired generating capacity. According to a report from SNL Financial, by 2015, US power plants will have to comply with the Environmental Protection Agency's (EPA) 'Mercury and Air Toxics Standards' which sets limits on plant emissions. Coal-fired power plants – the biggest source of US electricity generation – are hit particularly hard by these standards. As a result, companies have been gradually retiring non-EPA-compliant plants, with the biggest spike in closures expected between 2014 and 2016. Surprisingly, the pace of retirements has slowed in 2013 compared with 2012 when 8,800 MW of coal capacity was permanently shuttered. This year's, the US will forsake just under 6,000 MW of coal power – 34% less than the previous year.  Source: SNL Energy, Aug 2013 | Map credit: Whit Varner Here are the biggest US coal-fired power plant closures of 2013, grouped by company and based on data compiled by SNL Financial. 1 – FirstEnergy CorpFirstEnergy Corp retired the largest amount of coal power in 2013 in terms of megawatts. By closing its Hatfield's Ferry Power Station and Mitchell Power Station in Courtney Pennsylvania, the company took nearly 2,000MW of coal out of the US power mix. In total, about 380 employees were affected, according to a FirstEnergy news release. The company decided to shutter the plants because the cost of EPA-compliance was too high. 2 – Duke EnergyDuke Energy – the largest electric power holding company in the US – shut down three coal units in North Carolina this year, totalling 1,342MW. Among the closures was Duke's first large-scale power plant, the 256-megawatt Buck Steam Station in Rowan County which began operating in 1926. 3 – Southern CompanyThrough its subsidiary Georgia Power, Southern Company shuttered two units of its Harllee Branch power plant as Georgia Power shifts toward nuclear power, 21st-century coal technology, natural gas and renewable energy. Combined, the units produced about 500MW. |

| India won't ease gold import restrictions Posted: 18 Dec 2013 12:36 PM PST The Reserve Bank of India (RBI) will maintain its hard line against gold. The RBI announced on Wednesday that it will not reverse its policies on gold imports, the Times of India reports. Some were expecting at least a mild easing of import restrictions. "At this point, it will be premature to withdraw these restrictions for a variety of reasons," RBI governor Raghuram Rajan said, as reported by the Times. "Once we feel more comfortable with the current account deficit, once we have a sense that tapering, at least the threat of it, is behind us, we will certainly consider unwinding these distortionary actions." The RBI sees India's massive gold imports as a major contributor to the country's current account deficit (CAD) – the broadest measure of trade which indicates that India is importing more than it's exporting. India's CAD reached record highs in the past fiscal year, dragging down the value of the rupee and prompting the Bank to impose series of gold import restrictions and to raise duties on gold to 10%. But the attack on gold now appears to have reached its desired effect: India's CAD is shrinking. According to a Bloomberg report from earlier this month, the deficit has reached its lowest point since 2010, going from $21.8 billion in the second quarter of 2013 to $5.2 billion in the third. Meanwhile, although India's official bullion import levels have dropped, high levels of smuggling have placed a premium on the price of gold. Going forward, the RBI says it is in favour of removing the restrictions – especially since it would reduce incentives for smuggling. "I would be much happier if we had the kind of CAD we have without significant curbs on anything, including gold," Rajan said, as reported by the Times of India. India's jewellers were understandably disappointed by Wednesday's news. The Chairman of the All India Gems and Jewellery Trade Federation told The Hindu that the industry had lost between 30 and 35% of its business over the past six months. |

| Rinehart's Roy Hill project gets $1bn funding injection Posted: 18 Dec 2013 12:25 PM PST Aussie mining billionaire Gina Rinehart's massive Roy Hill iron ore project is closer than ever to get a financial injection after lining up $4 billion in debt funding allegedly coming from export credit agencies (ECAs) such as Korea Eximbank, the US Development Bank, Japan Bank for International Co-operation (JBIC), China Exim and US Ex-Im. According to Korea IT Times, Korea Exim Bank is offering US$550 million in loans and $450m in loan guarantees to the project. Commercial banks, which initially were said to be financing the other $3 billion needed to develop the mine, has decided not to take part in the financing of the massive project in the Pilbara region of Western Australia, the newspaper reported. Given the amount of contracts Roy Hill has been letting in the past year, the project – the biggest to emerge in Australia in decades – has been burning through equity, putting pressure on Rinehart and her partners to complete the debt financing, which was expected to be finalized last year. The $10 billion project, originally expected to begin production this year, is way behind schedule. While the company last pushed it out to September 2015, industry analysts believe it is more likely to see the light by 2016. This, of course, assuming it solves the financing issue. Gina Rinehart's Hancock Prospecting owns a 70% interest in the project, South Korea's Posco and STX Corp holds 15%, Japanese firm Marubeni has a 12.5% stake while Taiwan's China Steel Corp holds the remainder. Rinehart is the Australia's richest person with a fortune estimated at some $17 billion thanks to control of Hancock, which she inherited from her father who claimed swathes of the rich Pilbara iron ore deposits in the 1950s. |

| Gold price swings wildly after Fed's surprise taper Posted: 18 Dec 2013 11:05 AM PST The gold price fell on Wednesday, after a decision by the US Federal Reserve to start tapering asset purchases under its economic stimulus program. On the Comex division of the New York Mercantile Exchange, gold futures for February delivery were swinging wildly as investors digested the news. Just after the announcement gold dropped $20 an ounce to $1,220 before recovering to around $1,235, up slightly from yesterday close. But by late afternoon selling pressure returned to the market with the spot price of gold tumbling to a $1,216.90 an ounce, a two-week low. The Federal Open Market Committee surprised the market and announced a modest of $10 billion reduction of the $85 billion a month purchases under its quantitative easing program that has pumped $4 trillion of easy money into the US economy. While the cuts to the QE program is negative for the gold price the Fed took away with one hand and gave with the other: The Fed said in a statement at its last meeting for the year and under the chairmanship of Ben Bernanke that QE would be reduced in "further measured steps at future meetings," but will remain dependent on economic data. Interest rates will be kept near zero "well past the time that the unemployment rate declines below 6.5%," especially if inflation remains below the bank's targeted rate of 2%, i.e. near the end of 2015. Bernanke in the press conference after the announcement also reiterated that today's decision "should not be seen a tightening." The Fed has been reviewing QE for many months and was eager to start winding down the program on signs of a stronger recovery in the US, but most economists had expected that the money printing presses would only be slowed down in March when incoming chair Janet Yellen, a strong supporter of QE, has had time to make her mark. The US has not been alone in printing money and together with the Bank of Japan, the European Central Bank and the Bank of England, more than $10 trillion of easy money is now sloshing around in the system. Monetary expansion, particularly since the financial crisis, has been a massive boon for the gold price. Gold was trading around $830 an ounce before Chairman Ben Bernanke announced Q1 in November 2008. Gold and the US dollar usually moves in the opposite directions and gold's perceived status as a hedge against inflation is also burnished when central banks flood markets with money. The price of gold is down some 26% in 2013 – the worst annual performance since 1980 – in anticipation of an end to the ultra-loose monetary policy. The metal is set to break its 12-year bull run that took it from $271.10 on January 2, 2001 to today's trading level of $1,230 an ounce. Image courtesy of University of Michigan Ford School |

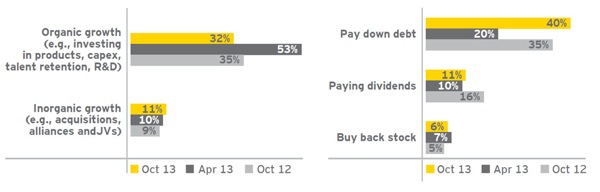

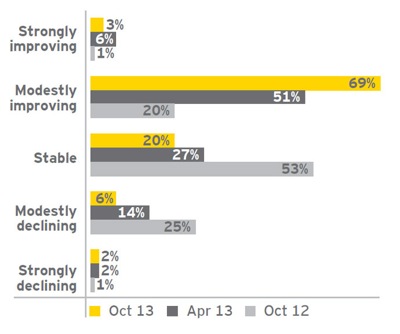

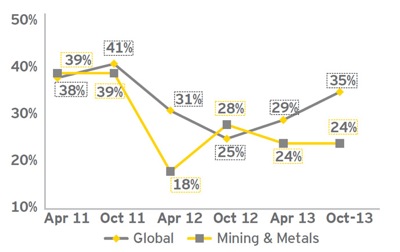

| Survey: 72% of miners see the global economy improving Posted: 18 Dec 2013 10:41 AM PST Improved credit availability is set to drive momentum in the mining and metals sector in the year ahead, according to EY's Capital Confidence Barometer: Mining & metals sector, published Wednesday. The report reveals that confidence levels in the sector have improved dramatically over the last 12 months, reaching a two-year high. This optimism, says EY's report, arises from increasingly stable global economics, particularly in mature markets, where GDP growth has largely returned. Currently 55% of mining companies are already focused on growth — compared to only 38% in 2012. "Transactions in the mining and metals industry have dropped considerably over the last year as companies struggled with capital allocation and access to capital challenges," says Bruce Sprague, EY's Canadian mining and metals leader. "Deal volume and value have fallen 36.9% and 58.1%, respectively, year over year in Canada alone." Now it looks as the tide is turning, with 47% of the companies surveyed believing credit availability is improving in the sector — and 72% believe the global economy is improving compared to 57% only six months ago. Investment decisions across the sector are currently focused on deploying low-risk capital for growth. EY expects miners to pursue mergers and acquisitions (M&A) that fit within their overall portfolio, rather than just to achieve scale. Equity markets still challenging While bank lending appears to be available to well-capitalized, investment-grade borrowers, equity markets remain challenging, with junior follow-on proceeds and IPO volumes at historic lows. This is creating new opportunities for alternative finance and private capital providers looking to invest.  If your company has excess cash to deploy, which of the following will be your focus over the next 12 months? "In the absence of traditional investor interest, we've seen a number of new buyers come on the scene, including state-owned enterprises, financial investors and commodity traders," says Sprague. "Together, increased access to capital, improving credit availability and growing investor confidence are setting the stage for M&A activity throughout 2014." In terms of deal volumes, nearly three quarters of mining and metals respondents say they expect a global increase. However, they remain tentative about pursuing an acquisition. During the nine months leading to September 2013, only 537 deals totalling US$96.9 billion closed. These numbers are down 24% and 22%, respectively, over the same period in 2012. Total deal value, excluding the merger between Glencore and Xstrata, was US$59.5 billion, which the analyst say it highlights an even larger drop-off when taking account of this unique deal. Image copyright: Everett Collection |

| You are subscribed to email updates from MINING.com To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 20 West Kinzie, Chicago IL USA 60610 | |

2 Comment for "Iron ore, met coal prices slump as Australia ramps up exports"

nice post sharing information related to Australian Electricity Prices

Thanks .