<b>Gold Price</b> - Value Versus Momentum | Zero Hedge |

| <b>Gold Price</b> - Value Versus Momentum | Zero Hedge Posted: 16 Dec 2013 06:50 PM PST Submitted by Alasdair Macleod of GoldMoney.com, For many commentators there are two distinct camps in the gold market: investors in bullion and speculators in the paper market. With the two markets pulling in different directions some dealers think it is only a matter of time before derivatives fail completely and the price of gold will rocket on physical demand. That two ends of one market are in conflict and one will win over the other is a tempting conclusion, but this is unhelpful. The conflict is more about two different types of investor: there are those who buy or sell on grounds of value and momentum investors who deal on the trend. It is the market structure that tends to corral them into different camps. Value investors generally go for physical metal, while momentum investors go for derivatives. Their motivations are different. Value investors include buyers of physical gold from all over the world, commonly seeking value or security compared with holding fiat currency. Speculators in the futures markets rarely evaluate the price of gold, assuming the current price is the only valid reference point that matters. This bifurcation between value and momentum is a common feature from time to time in nearly all capital markets. We saw it in equities during the dot-com boom, when value investors were embarrassed before momentum investors were eventually crushed. However, both classes of investor always fish in the same pool. Futures are the principal channel for momentum-chasers in gold, with very few of them interested in questioning value; and with the rise of the hedge fund industry the amount of money and credit available to this class is substantial. It is hardly surprising that critics feel derivative markets are depressing the gold price, but they ignore the fact that the current price in any market is the point where supply and demand finds a balance. There are above-ground stocks of gold amounting to about 160,000 tonnes, and new mine supply increases this at about 1.7% per annum. Theoretically, all this gold is available for sale at some price; equally these quantities are an indication of the scale of underlying interest. If momentum investors think there is a case for lower gold prices they should make it after taking this into account. Trying to make this judgement in such an opaque market is never going to be simple, which is why they rarely try to do so. The answer is to identify so far as possible the location of all investment gold as a first step to understanding prospects for the market. We can only conclude there is very little of it in investment form in private hands in the West, the bulk of it having been bought up by Asian buyers. The amount of ETF liquidation has been wholly insufficient to satisfy this demand, so by deduction central banks must have been supplying the markets with large quantities, because there is no other source of supply. Therefore the key to future gold prices comes down to the point in time at which central banks stop supplying the market; not some sudden crisis between value investors in the East and momentum chasers in the West. That is to confuse cause with effect. (17 votes) |

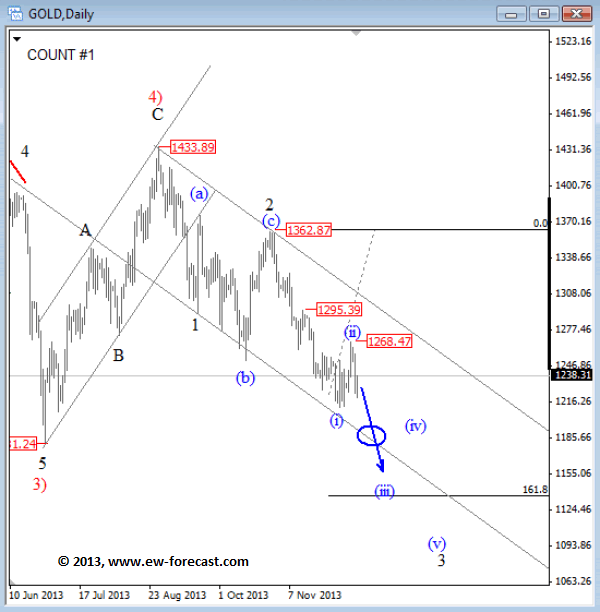

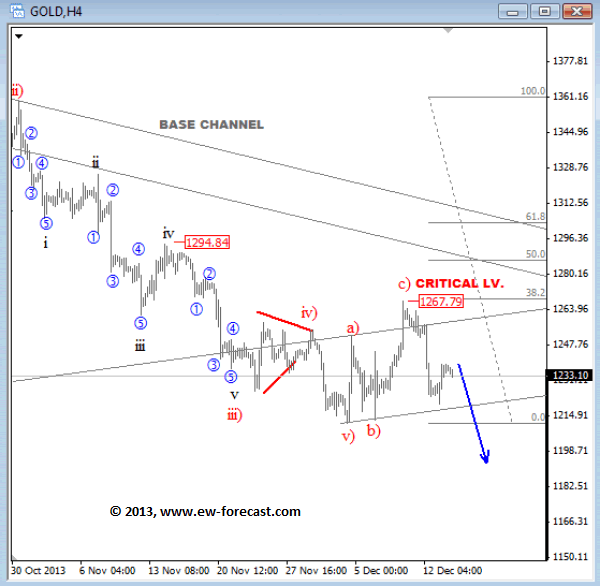

| Elliott Wave Suggests Bearish <b>Gold Price</b> Towards $1130 :: The <b>...</b> Posted: 16 Dec 2013 12:42 PM PST Elliott Wave Suggests Bearish Gold Price Towards $1130 Commodities / Gold and Silver 2013 Dec 16, 2013 - 05:42 PM GMT By: Gregor_Horvat Gold reversed sharply to the downside at the start of September, through the rising trend line of a corrective channel. As we know that's an important signal for a change in trend, which means that bearish price action is now back in play which is accelerating for the last couple of weeks from 1362 so we think that market is moving down in wave 3 that could reach 1130 region in the next few weeks. From a short-term perspective a break of 1210 opens door for 1180. On the other hand, if 1268 is broken then bearish reversal could be seen from second resistance placed at 1295.

Written by www.ew-forecast.com | Try our 7 Days Free Trial Here Ew-forecast.com is providing advanced technical analysis for the financial markets (Forex, Gold, Oil & S&P) with method called Elliott Wave Principle. We help traders who are interested in Elliott Wave theory to understand it correctly. We are doing our best to explain our view and bias as simple as possible with educational goal, because knowledge itself is power. Gregor is based in Slovenia and has been in Forex market since 2003. His approach to the markets is mainly technical. He uses a lot of different methods when analyzing the markets; from candlestick patterns, MA, technical indicators etc. His specialty however is Elliott Wave Theory which could be very helpful to traders. © 2013 Copyright Gregor Horvat - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors. © 2005-2013 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication. |

| You are subscribed to email updates from gold price - Google Blog Search To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 20 West Kinzie, Chicago IL USA 60610 | |

0 Comment for "Gold Price - Value Versus Momentum | Zero Hedge"