Newcrest to slash Telfer gold mine jobs |

- Newcrest to slash Telfer gold mine jobs

- Stonewall Resources to sell its Stonewall Mining interest to Shandong Qixing

- North American Palladium hit hard by sell-off

- 'We have reached the peak of the cycle' – German Engineering Federation

- A look at the mines funding warlords in the DRC

- Oil sands junior spreads the word on Warren Buffett's love for the crude

| Newcrest to slash Telfer gold mine jobs Posted: 21 Nov 2013 07:40 PM PST Aussie gold miner Newcrest will begin cutting jobs at its Telfer gold mine in the Pilbara, Western Australia. The plummeting gold price and higher operations costs have squeezed margins and led to the cost cutting measure, though the miner has not yet confirmed the exact number of terminations. Newcrest employs 1200 people at the Telfer site, and has a global workforce of roughly 16,000. For the 2013 financial year, Telfer produced 525,500 ounces of gold and 26,453 tonnes of copper. Newcrest is one of the world's largest gold mining companies and operates mines in four countries. |

| Stonewall Resources to sell its Stonewall Mining interest to Shandong Qixing Posted: 21 Nov 2013 05:19 PM PST Stonewall Resources Ltd (ASX: SWJ) has entered into a Share Sale Agreement (SSA) with Shandong Qixing Iron Tower Co., Ltd ("SQIT") that will transfer 100% of Stonewall Mining to the Chinese power transmission tower company in exchange for $124.39 million. Highlights of the agreement:

|

| North American Palladium hit hard by sell-off Posted: 21 Nov 2013 04:09 PM PST North American Palladium's share price fell nearly 30% to $0.48 on Tuesday after a CIBC downgrade to 'underperformer'. In response to the big sell-off, the company announced Thursday that it's "not aware of any undisclosed material changes that would account for the recent trading activity." The company urged investors to consider 2013 a transition period, with improved performance potentially on the way in 2014. "We still firmly believe that there is significant value to be unlocked at our Lac des Iles mine and remain optimistic about the mine's future cash generation potential," said Phil du Toit, President and Chief Executive Officer. "As we have always cautioned, 2013 is a critical transitional year and the financial challenges that we are encountering are no doubt related to this transitional phase." "Looking beyond to 2014, we have prospects for improved operating and financial performance, but this is contingent on a successful completion of a financing, which we are currently working hard to complete. We remain hopeful that once we enhance our balance sheet and successfully execute on the longer term strategy to increase production at reduced cash costs, that this achievement will be reflected in improved share price performance." North American's share price was at $0.50 on Thursday afternoon. |

| 'We have reached the peak of the cycle' – German Engineering Federation Posted: 21 Nov 2013 03:00 PM PST European mine suppliers are bracing for sales drops over the next year. As reported by Reuters, German mining equipment manufacturers have said they are expecting sales drops in the double-digit percentages in 2014. "We have reached the peak of the cycle," chief of the mining equipment arm of German engineering trade group VDMA told Reuters. The industry will likely see reduced working hours and job cuts, he warned. VDMA represents more than 3,000 mid-sized companies in Germany and elsewhere. Some big international players include Caterpillar and Komatsu. Just a few months ago VDMA was optimistic about future growth. Sales had been rising by an average 13% per year since 2007. According to International Mining, the organization reported a rise in sales for the first half of 2013 and said the mining equipment industry had "recorded an unprecedented series of successes." While encouraged by exports to China and the US – which rose by 40 and 20% respectively during the first half of the year – VDMA also noted an "atmosphere of uncertainty" at the time. |

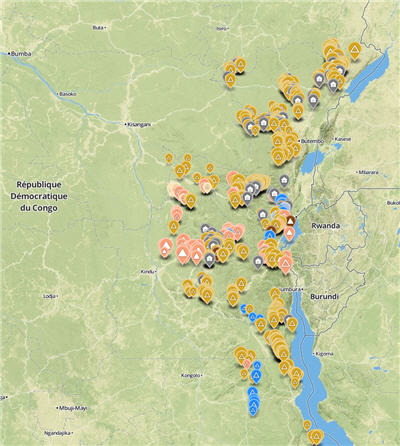

| A look at the mines funding warlords in the DRC Posted: 21 Nov 2013 02:12 PM PST The eastern part of the Democratic Republic of Congo (DRC) has long been recognized as a major source of conflict minerals. Although the DRC's natural wealth is an important source of income, it also presents a classic example of a resource curse. Militia groups control the country's mines, fuelling conflicts with profits derived from mineral sales. In an effort to expose and monitor these mining operations, a Belgian research group called the 'International Peace Information Service' (IPIS) has been creating the first maps of eastern DRC's artisanal mining areas.  Eastern Congo's major conflict mineral: Gold point on map represents gold mine | Image from IPIS' interactive map After releasing the first of such maps in 2009, the organization has now released a second version. By collaborating with the Congolese mining cadastre, IPIS has set up a permanent system to monitor artisanal mining activities and the involvement of armed groups in mineral exploitation and trade. IPIS' research has shown that gold is the currently the most important source of conflict minerals in the region. "Even though there have been previous indications about the great extent of artisanal gold mining in the region, the data collected suggest a scale that probably surpasses any estimate or expectation," the report reads. "The number of miners active in gold mining … is nearly four times higher than that for tin, tantalum and tungsten combined."

The report authors urge the country to formalize and control gold mining operations, as the DRC's "gold production is exported almost entirely unrecorded." In an interview with Voice of America, Judith Sargentini – a member of the European parliament who is campaigning for a European conflict minerals law – said that while US legislation to curb the influx of conflict minerals has had a big effect on tin, tungsten and tantalum, gold is still very profitable for armed groups. "You do not smuggle a pack of tin because it is just too heavy and it is only worth it if you have plenty of it, whereas gold is like diamonds – it is easier, Sargentini said. "So I think it is much more difficult to certify, which shows again that certification is not necessarily the way forward." See IPIS' full interactive map here. Image featured on homepage by: Julien Harneis |

| Oil sands junior spreads the word on Warren Buffett's love for the crude Posted: 21 Nov 2013 11:16 AM PST Billionaire investor-philanthropist Warren Buffett has once again put his money in the oil sands, and Alberta's crude producers are cheering him on. Buffet, also known as the 'Oracle of Omaha' because his investment moves are closely watched and mimicked by others, owns 40.1 million shares of Exxon Mobil, SEC filings revealed last week. According to CNBC, this stake would make Buffet's conglomerate Berkshire Hathaway the 6th-biggest shareholder of Exxon, but it still represents only 0.9% of the energy giant's shares. Exxon is a major player in Alberta's oil sands through its 70% owned stake in Imperial Oil – Canada's second-biggest integrated oil company. Perhaps looking to take advantage of the Oracle's loyal following, oil sands junior Strata Oil & Gas (OTCQB:SOIGF) released a statement on Thursday to spread the word about Buffett's investment. "Strata Oil views Buffett's increased stake in ExxonMobil as good news for Alberta's bitumen producers, and a real endorsement of the future potential of the resource," Strata Oil CEO Ron Daems said. "All these developments mean that momentum is building in Alberta's bitumen carbonate play, and Strata Oil has one of the largest and most attractive projects in the industry." Since 2006, Starta Oil has held a 100% interest in a 52,000-acre property in the Peace River region of Alberta's Carbonate Triangle. The Cadotte project and holds 887 million recoverable barrels and is valued at $1.3 billion. As revealed earlier this year, Buffett has also taken a half-billion dollar stake in Alberta's Suncor Energy – Canada's largest integrated energy company. A senior oil analyst at Oppenheimer & Co spoke with the Financial Post last week, and had this to say about the Exxon buy: "He likes buying big, established global brand names, and Exxon is a good flight-to-quality stock. The stock has also lagged the market in the last three and five years. That makes it a typical Warren Buffett holding." |

| You are subscribed to email updates from MINING.com To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 20 West Kinzie, Chicago IL USA 60610 | |

0 Comment for "Newcrest to slash Telfer gold mine jobs"