<b>Gold Price</b> Analysis- Nov. 19, 2013 - DailyForex.com |

- <b>Gold Price</b> Analysis- Nov. 19, 2013 - DailyForex.com

- <b>Gold</b>, Silver <b>Prices</b> and Mining Stocks About To Sell Off Again :: The <b>...</b>

- <b>Gold Price</b> Flat with Silver as Retail Investors Buy, <b>Chart</b> Analyst <b>...</b>

| <b>Gold Price</b> Analysis- Nov. 19, 2013 - DailyForex.com Posted: 18 Nov 2013 10:00 PM PST

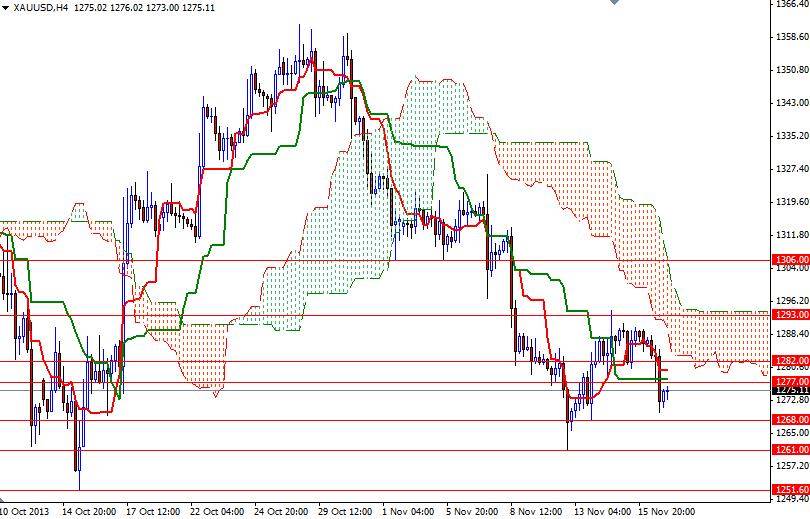

By: DailyForex.com The XAU/USD pair closed yesterday's session lower after three consecutive days of gains. Gold prices turned south after the bears increased selling pressure to defend the 1293 level. It is not only the Federal Open Market Committee meeting minutes that is coming up tomorrow, we also have U.S. retails sales and housing data. If these numbers beat forecasts, the market is going to start pricing in a faster tapering cycle again. It appears that Janet Yellen's confirmation to head the U.S. Federal Reserve is already priced into the market as well. Looking at the charts from a purely technical point of view, I can't find a reason to buy gold at the moment. The weekly, daily and 4-hour charts are still bearish as prices remain below the Ichimoku cloud. The Tenkan-sen line (nine-period moving average, red line) is moving below the Kijun-sen line (twenty six-day moving average, green line) on the daily time frame. If the bears continue to dominate the pair and drag prices below the 1268/6 level, I think the 1261 support will be the next stop. Breaking below this level increases the possibility of another attempt to revisit the October 15 low of 1251.60. However, if the bulls take over and push the pair above the 1282 level, we may see prices climbing towards the 1293 level, which happens to be the top of the Ichimoku cloud on the 4-hour chart. The bulls have to break and hold above the 1293 level in order to gain enough strength to challenge the bears in the 1303 - 1306 zone. Only a weekly close above this barrier could shift things to the bulls in the near term. | ||

| <b>Gold</b>, Silver <b>Prices</b> and Mining Stocks About To Sell Off Again :: The <b>...</b> Posted: 19 Nov 2013 06:24 AM PST Gold, Silver Prices and Mining Stocks About To Sell Off Again Commodities / Gold and Silver 2013 Nov 19, 2013 - 10:24 AM GMT By: Chris_Vermeulen

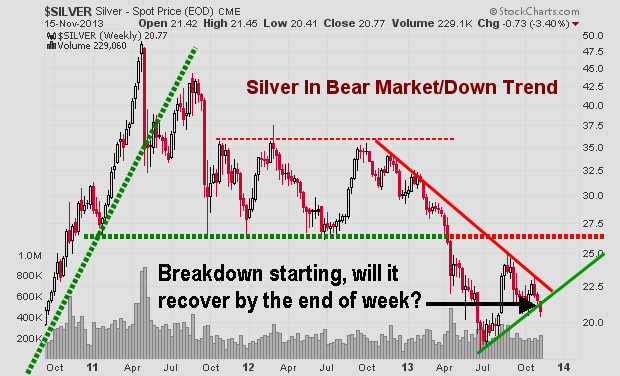

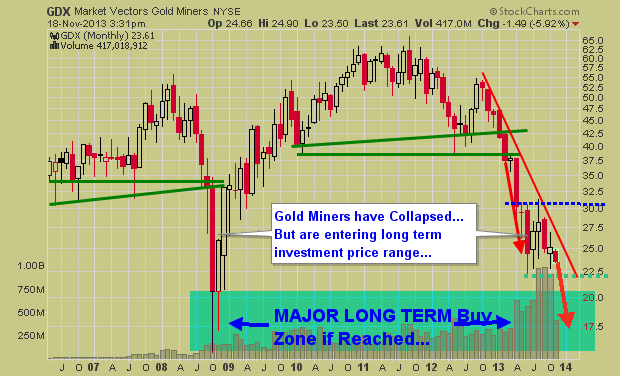

Let's take a quick look at what is going on. Gold Trading Chart: The chart of gold shows price being wedge into the apex of the down sloping resistance trend line and the rising support trendline. Gold was trading below this level but has since bounced. But if gold closes the week below this line in the sand the price could start to fall quickly and test the $1200 per ounce within a week or two. Silver Trading Chart: Silver is under performing gold and trading below its support level currently. If silver does not recover by Friday's closing bell then things could get ugly for a few weeks as investors start to exit their positions. That being said, I need to point out that silver is more of a wild card when using trend lines like this. Both gold and gold miners should be confirming this breakdown in silver if it is the real deal. Gold Mining Stocks ETF: The chart of gold miners I like the most. I like it because it's pointing to lower prices, roughly 25% lower if the breakdown takes place. Gold mining stocks could be a fantastic long term investment if we see the $17.50 level reached on this GDX etf. Last week I talked about ETF trading strategies and the big picture on gold, silver, miners and bonds. They look to be nearing a major bottom and once they do bottom it should be a great buying opportunity for specific stocks or the entire sector. The next few weeks are going to be crucial for precious metals and we will keep an eye on them as this bottom unfolds. Get more reports like this here: www.GoldAndOilGuy.com If you would like to keep up to date on market trends and trade ideas be sure to join my newsletter at http://www.thegoldandoilguy.com By Chris Vermeulen Chris Vermeulen is Founder of the popular trading site TheGoldAndOilGuy.com. There he shares his highly successful, low-risk trading method. For 7 years Chris has been a leader in teaching others to skillfully trade in gold, oil, and silver in both bull and bear markets. Subscribers to his service depend on Chris' uniquely consistent investment opportunities that carry exceptionally low risk and high return. This article is intended solely for information purposes. The opinions are those of the author only. Please conduct further research and consult your financial advisor before making any investment/trading decision. No responsibility can be accepted for losses that may result as a consequence of trading on the basis of this analysis. © 2005-2013 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication. | ||

| <b>Gold Price</b> Flat with Silver as Retail Investors Buy, <b>Chart</b> Analyst <b>...</b> Posted: 06 Nov 2013 06:35 AM PST GOLD PRICE losses of 0.8% for the week were erased Wednesday morning, taking the metal back to last Friday's finish of $1317 per ounce in what traders called "very dull" trade. By lunchtime in London, and just like the gold price, silver held unchanged for the week so far, trading back down to $21.90 after a brief spike above $22.00. World stock markets were meantime flat overall, while commodity prices reversed Tuesday's small drop. Ahead of tomorrow's monthly policy vote by the European Central Bank, the Euro currency crept back above $1.36 following stronger-than-forecast service sector data but a drop in retail sales. That nudged the gold price in Euros down €1 per ounce to €975. The Dollar gold price "has seen a lower high for the past daily 6 consecutive trading sessions," notes Scotiabank's latest technical analysis of the gold charts. "We believe the market is selling gold on any bounce while it remains below $1330." But last week's gold price dip to $1310 now means Bank of America Merrill Lynch strategist MacNeil Curry is "long gold", recommending clients buy the metal because "the medium-term trend has turned bullish." Citing "the impulsive gains from the $1251 low of Oct.15 low, and the break of the [two-month] downtrend," Curry is targeting a possible run up to $1500 per ounce - which he sees as "long-term resistance." "The jury is still out," counters the latest gold price analysis from Commerzbank's Axel Rudolph in Frankfurt, "as to which direction the medium-term trend will take. "But we still favour weakness." Silver prices meantime "remain longer term bearish while trading below the $23.12 resistance area," he adds. Australia's Perth Mint, which refines some 300 tonnes of gold bullion per year, said today that gold coin sales rose 13% in October from September. "We're desperately trying to keep up with production," the Wall Street Journal quotes Ron Currie, head of sales and marketing, who adds that the Perth Mint "sold out" of 1-ounce lunar silver coins "in just over a month." Although gold demand from Western retail investors grew in October, however, money-managers using the SPDR Gold Trust to gain exposure to gold prices cut their holdings by a further 3.6% last month. Holdings in the SPDR (ticker: GLD), the world's largest exchange-traded fund by value at its peak in 2011, ended Tuesday unchanged from Monday at 866 tonnes, a 57-month low. Looking at gold options contracts - which give traders the right to buy or sell at certain prices in the future - "We expect lower gold prices for the coming years," says a note from Dutch bank ABN Amro's analysts. "The bias [amongst options traders] turned negative in October 2012...[and while] the recovery of gold prices since June has resulted in a less negative bias, the market has not come close to being neutral." Meantime in India - the world's No.1 consumer gold market, but likely to be overtaken in 2013 by China - premiums above London's benchmark gold price held on Wednesday around $70 per ounce, says Reuters, after halving from last week's record levels as the traditionally strong Diwali festival ended. "Demand is tapering off," the newswire quotes Bachhraj Bamalwa of the All India Gems & Jewellery Trade Federation. "There won't be buying for another week" until the Hindu wedding season returns. Legal disclaimer and risk disclosure (c) BullionVault 2008 Please Note: This article is to inform your thinking, not lead it. Only you can decide the best place for your money, and any decision you make will put your money at risk. Information or data included here may have already been overtaken by events - and must be verified elsewhere - should you choose to act on it. |

| You are subscribed to email updates from gold price graph - Google Blog Search To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 20 West Kinzie, Chicago IL USA 60610 | |

0 Comment for "Gold Price Analysis- Nov. 19, 2013 - DailyForex.com"