The five most popular mining maps |

- The five most popular mining maps

- Filipe Martins: African miners that can generate cash flow and dividends

- Nickel price rally still has a long way to go

- Red Eagle takes centre stage in Colorado with 52% feasibility study IRR

- New hold-up for Rio’s subsidiary Turquoise Hill at Oyu Tolgoi

- India’s Supreme Court revises judgment on illegal coal blocks

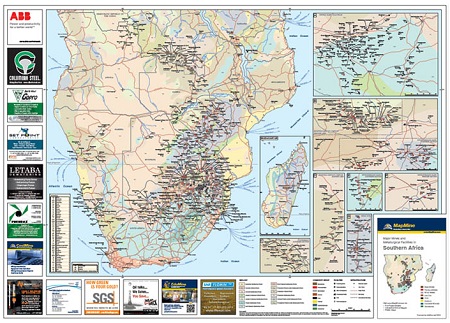

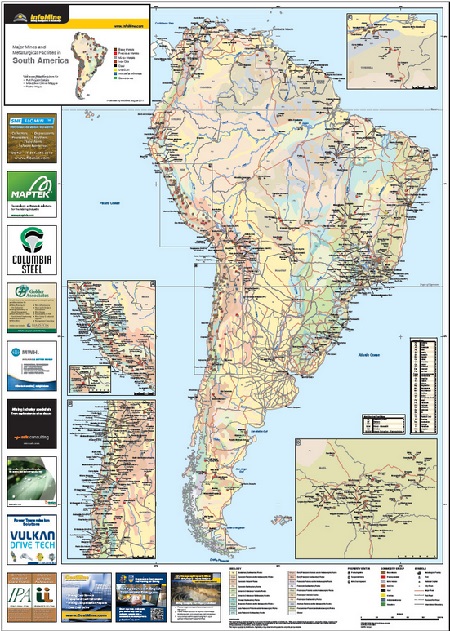

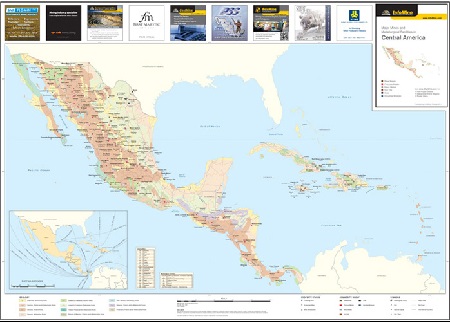

| The five most popular mining maps Posted: 09 Sep 2014 06:00 PM PDT Are you a map lover? A mining enthusiast? Since 1992 InfoMine has been analyzing and tracking mines and exploration projects around the world.Here are InfoMine's five most popular MapMine maps. 1. USA2. Canada3. Southern Africa4. South America5. Central America

Creative Commons image of people looking at a map is from the Library of Congress | ||

| Filipe Martins: African miners that can generate cash flow and dividends Posted: 09 Sep 2014 04:36 PM PDT Source: Kevin Michael Grace of The Mining Report (9/9/14) Low all-in gold cash costs are a good thing, says London-based GMP Securities Analyst Filipe Martins, but they don't tell the whole story. In this interview with The Mining Report, Martins argues that the best companies are those with strong free cash flow yields and a view to return cash to investors. Many of these companies have gold, copper, titanium and graphite projects in Africa, which boasts low-risk jurisdictions in addition to high-grade geology. The Mining Report: Some of the experts we have interviewed for the The Mining Report and The Gold Report is that a $1,250–1,350/ounce ($1,250–1,350/oz) gold price can be expected in the short term. Do you agree? Filipe Martins: At GMP, we forecast a $1,350/oz gold price from roughly 2015, but we think there is a real risk that the gold price could fall before it rises, given the threat of higher borrowing costs. Most recently, we haven't seen the increases in physical demand from China and India that normally follow gold price dips. This is a cause for concern. TMR: Assuming a gold price of $1,300/oz, will investors gravitate strongly to those companies with the lowest all-in cash costs? FM: All-in sustaining costs don't show the entire picture. We prefer to compare producers on a like-to-like, bottom-line cash basis, with focus on balance sheet strength and improvement in net debt. It's all about free cash flow yields going forward. In turn, cash needs to translate into strong dividend yields in order to pull investors away from other asset classes. The gold sector as a whole has responded well to the lower gold price. Companies have recut mine plans and have tightened their economic assumptions to focus on grade and profitability, rather than big net asset values (NAVs). A case in point is AngloGold Ashanti Ltd. (AU:NYSE; ANG:JSE; AGG:ASX; AGD:LSE), which has delivered close to five flawless quarters and reduced all-in sustaining costs by circa $500/oz (to around $1,000–1,050/oz) under new CEO Srinivasan Venkatakrishnan. TMR: Would you consider AngloGold Ashanti to be something of a model for the gold majors? FM: Yes, at an operational level. However, it has suspended its dividend and still has a long way to go before returning cash back to investors. The last big catalyst for the stock is converting problem-child asset, Obuasi in Ghana, from a $150–200 million ($150–200M) cash burn to a potential $2 billion ($2B) NAV asset. Finally, it needs to derisk its balance sheet to support disciplined growth and dividends. TMR: Which other operators have impressed you? FM: Within our coverage, Randgold Resources Ltd. (GOLD:NASDAQ; RRS:LSE) also stands out. The Kibali gold mine in the Democratic Republic of Congo (DRC) has been a success and is self-funding from here. The company has very little debt and world-class assets with a strong ability to build cash from here. With no further growth projects beyond Kibali, Randgold is committed to returning cash to shareholders. We believe that is what is backstopping the stock's premium valuation of 2.5x price/NAV, almost double its peers. There is huge scope for ounces to grow in the Congo, despite being a higher-risk geopolitical jurisdiction. It remains one of the best frontier jurisdictions for multimillion-ounce discoveries. We certainly think Randgold is fully valued at its current level, however. Among producers with smaller market caps, Centamin Plc (CEE:TSX; CNT:ASX, CEY:LSE) and SEMAFO Inc. (SMF:TSX; SMF:OMX) stand out. Both are debt free and operate high-quality assets, Sukari and Mana respectively, with long mine lives. We see them comfortably supporting 5% dividend yield streams from 2015, streams that could be sustained at spot gold prices over double-digit mine lives. Next best are Endeavour Mining Corp. (EDV:TSX; EVR:ASX) and Shanta Gold Ltd. (SHG:LSE). They're targeting $1,000–1,100/oz all-in sustaining cash costs or 15% all-in sustaining cash margins—a target, we think, all producers should be working to meet. They carry some balance-sheet risk but are inexpensive in price/NAV terms. That said, they are free cash flow-generative and able to improve their net debt positions. We'll have to wait a little longer for this to translate into bigger dividend yields. TMR: Besides net cash position and cash flows, which other qualities do you look for in gold producers? FM: Among the producers, ideally we look for the Holy Grail—companies that are cheap, growing and cash flow-generative. In developers, we look for high internal rate of return (IRR) projects, so high-grade deposits with low capital intensity, preferably in low-risk jurisdictions. TMR: What about management? FM: Disciplined management teams with track records of building and operating mines are key. Experience adds credibility to capex and opex numbers. Producers with first-class management teams include Centamin, SEMAFO, Endeavour and Shanta. SEMAFO also has a pretty good track record of discovering ounces, not least the recent discovery of Siou and Fofina, which has completely transformed Mana. TMR: What about near-term gold producers? FM: I prefer Roxgold Inc. (ROG:TSX.V) and its Yaramoko project in Burkina Faso. It's the highest-grade development asset on the continent outside of South Africa, with one of the highest IRRs. Its COO, Paul Criddle, is a solid mine builder. He's built 4+ million-tons-per-annum mines, including North Mara, Sabodala and Edikan. When you consider B2Gold Corp.'s (BTG:NYSE; BTO:TSX; B2G:NSX) acquisition of Papillon Resources Ltd., it proves our investment thesis that quality assets attract good valuation even through the bottom of the cycle. Yaramoko comfortably supports all-in sustaining costs of sub-$700/oz, which many investors gravitate toward. Having already attracted $75M in debt, it needs only a small amount of additional funding to reach production. TMR: What are your opinions of other West African near-term gold producers? FM: Asanko Gold Inc. (AKG:TSX; AKG:NYSE.MKT) just announced the commencement of phase 1 construction at its Asanko gold mine. The company acquired Obotan project through the PMI Gold acquisition. We like Obotan. It has pretty robust economics at US$1,300/oz gold, and on Aug. 26 Asanko eliminated a 2% net smelter royalty on the project. Obotan is in our top five best undeveloped gold assets in Africa. We also like Amara Mining Plc's (AMA:LSE) Yaoure gold development project in Côte d'Ivoire. The preliminary economic assessment outlines an 8 million ton (8 Mt), carbon-in-pulp plant processing 1.4 grams per ton (1.4 g/t) material at 95% recovery for 300,000–320,000 oz production over a 12-year mine life. It has a big mineral mining inventory at 4.2 million ounces with a reasonable 5:1 strip. Recent drilling, though, suggests that reserve quantum, grade and strip should all improve. Capex is $410M, and that includes close to $90M of mining fleet, which we think could be optimized. It has all-in sustaining costs of sub-$700/oz and excellent infrastructure on site with low-cost hydropower. It's the next best undeveloped project after Obotan and Papillon, which are funded to production. Yaoure is able to support a 20+% IRR post acquisition and build capex, which is quite rare. TMR: The companies you have mentioned are all in Africa. So it's safe to say you are bullish on that continent? FM: Africa remains one of the most mining-friendly continents. There is little to no precedent of nationalization, unlike Latin America. The only thing that holds back Africa is headline risk, which rarely impacts operations but can still drive significant share price volatility. Recent examples include political instability in Egypt and Mali, the threat of punitive mining code changes in Côte d'Ivoire and the DRC, and surprise levies in Kenya. We note that headline risk is typically higher in the run-up to general elections, but the election season is largely behind us now in West Africa. The next 12–24 months should reveal greater political stability and a better environment for investors. TMR: Which African country is most mining friendly? FM: Whether it is in the form of royalties, profit sharing, taxes, free carries or buy-ins, Côte d'Ivoire, Liberia and Mali rank as the three lowest-cost gold jurisdictions. Overall, though, we prefer Burkina Faso, Côte d'Ivoire and Senegal, given their combination of underexplored but prolific gold belts, stable politics and inexpensive fiscal code. Burkina Faso has permitted close to eight mines in almost as many years. We have recently seen the permitting of satellite operations at SEMAFO's Mana and Amara's Kalsaka operations in record time. Roxgold should soon follow, with first pour targeted for Q4/15. TMR: It's commonplace that increased mining company activity leads to demands for higher government revenues. Do we see this in West Africa currently? FM: With gold down to $1,250–1,300/oz, West African governments have come to realize that gold companies aren't making the big profits anymore. Reporting all-in sustaining costs has also helped. It's not surprising that Côte d'Ivoire has introduced a very competitive code, or that Ghana has scrapped its superprofits tax. Senegal is planning to change its code, but given that it only has one mine in operation,Teranga Gold Corp.'s (TGZ:TSX; TGZ:ASX) Sabodala, it's unlikely the new code will be overly punitive. TMR: What's your opinion of Teranga? FM: It has a quality asset, not least because it operates the only mill on Sabodala, which has a replacement value north of $500M. Senegal is very prospective in our view. There are multimillion-ounce deposits close to Sabodala's mill, such as Randgold's Massawa deposit and Mako, which is a high-grade open pit held by a private company, Toro Gold Ltd. That said, we were a bit disappointed with Teranga's takeover of Oromin Explorations. We believe the deal failed to materially improve the asset quality, given the price paid, and the current mine plan is lumpy in terms of stripping and grade, which hampers its ability to deliver a steady stream of cash flow. Another concern is the company's stream financing deal with Franco-Nevada Corp. (FNV:TSX; FNV:NYSE). While the cost of the stream is NAV neutral on reserve ounces, we believe it's punitive on future quality ounces discovered, and detracts potential buyers. TMR: On May 1, Teranga closed a $30M financing. What is its cash position? FM: It has $28.4M in cash, and this looks to be tight going into H1/15 under the current unoptimized mine plan, which is, of course, subject to change with future reserve drilling. TMR: Teranga shares reached about $1.20 earlier this year and then lost half their value. They're now at $0.85/share. In which direction will they move? FM: I have a $0.70/share price target. TMR: You praised SEMAFO's management. Would you talk about its decision to concentrate exclusively on Mana? FM: We believe it was the correct strategy. This decision followed its exploration success on its Siou deposit. The Siou and Fofina satellites have transformed Mana into a high-grade, high-margin operation. The Q2/14 results show what Mana is capable of: a 30% free cash flow margin and a 10% free cash-flow yield. We expect margins to improve with the changeover to grid powering expected in Q4/14. SEMAFO's management team is disciplined and conservative; they're not going to overpay for ounces and have a good exploration track record. The next catalyst for a share revaluation is the resumption of dividends and exploration success along the 15-kilometer anomaly at Pompoi Nord, which is within trucking distance to the mill. TMR: SEMAFO's stock was battered for years. As recently as last fall, it was under $2/share. Not long ago, it topped $5/share. Where do you see the stock going? FM: On a price:NAV basis, the share price looks a bit toppy, but if it can pay a 3% dividend yield—remember, this is a debt-free company—and if Pompoi Nord turns out as well as Siou, then this is $6–8/share stock. TMR: Earlier, you had nice things to say about Endeavour, which has mines in Mali, Ghana, Burkina Faso and Côte d'Ivoire. Tell us more about this company. FM: We really like Endeavour. It's cheap. It's growing. It's free cash flow-generative. It ticks all the boxes. The company does have debt to repay before it can return cash to shareholders or reinvest in accretive mergers and acquisitions deals. It has a strong track record in the latter, not least Tabakoto, where we see a lot of potential value upside from exploration. TMR: Endeavour doubled its share price this year. FM: It's still cheap at $0.93/share. We currently have a CA$1.55 price target. TMR: You also cover African companies with mineral sands, copper and titanium deposits. Which companies are most interesting in those sectors? FM: I'll start with mineral sands. Kenmare Resources Plc (KMR:LSE) announced its H1/14 financials Aug. 27. At first glance cash looks tight, and shares fell 6%. The key data point, though, is opex and capex continue to trend lower. This is a sector that's under a huge amount of pressure, not least because demand and prices for titanium feedstock have come down off 2011 highs. Ilmenite seems to be the feedstock that is most under pressure. If you look at ilmenite pricing against the Kenmare share price, you see that it gives you good exposure on the way up. We're very much of the view that the way to play the TiO2 space, at least right now, is to back the higher-grade titanium feedstock miners given stronger exposure to a recovering U.S. economy. One positive we do see is recent data from producers like Tronox Ltd. (TROXW:OTCMKTS), a vertically integrated feedstock pigment producer, which show that pigment-plant utilization rates are all on the rise, sales volumes are increasing and prices are stabilizing. But I don't think we'll see a price recovery until 2015. If you want to play the near-term U.S. recovery, you want to invest in the higher-grade TiO2 feedstocks—rutile and chloride. Rio Tinto Plc (RIO:NYSE; RIO:ASX; RIO:LSE; RTPPF:OTCPK) dominates, with ~80% of chloride feedstock market, but offers investors little pure-play exposure with only ~4% of EBITDA generated by its TiO2 business, hence our preference for mid-cap mineral sand producers. TMR: Which other mineral sands companies do you cover? FM: Mineral Deposits Ltd. (MDL:ASX) and Base Resources Ltd. (BSE:LSE). They have low-cost assets and good exposure to high-grade TiO2 feedstocks. We believe they're both very well funded to commission and ramp up their respective mines. So you are able to see through H2/14 and come out on the other side in 2015, when we're expecting the TiO2 recovery to gather pace. Kenmare is sitting on a world-class asset, but cash is looking tight. It doesn't have the balance-sheet strength that Base Resources and Mineral Deposits have, nor the near-term cash flow. TMR: You also cover Tiger Resources Ltd.'s (TGS:ASX) Kipoi copper project in the Congo. FM: This company has been cash flow-generative. It has raised well over $300M in debt and equity to acquire the Gécamines', the parastatal copper mining company, minority stake, and also to build the solvent-extraction and electro-winning (SXEW) facility, which it is commissioning now. Our biggest concern is that it still must spend $200M to finance further expansion, which brings with it capex, build and commissioning risks. The recently announced deal to acquire the 40% minority stake owned by Gécamines is mechanically accretive to our NAV. More important, it should make it significantly easier to sell Kipoi to a trade buyer. So right now, we are more positive on the name given the proposed equity and debt financing provides financial headroom going forward. TMR: Reservoir Minerals Inc. (RMC:TSX.V) has resources in Africa, but I wanted to ask about its Timok project in Serbia. What's your view of that? FM: It is one of my preferred copper-gold exploration stocks. It currently holds a 45% interest in Timok, which is in a joint venture (JV) with Freeport-McMoRan Copper & Gold Inc. (FCX:NYSE). The terms of the JV are very attractive in that Freeport fully funds all exploration and feasibility work, yet Reservoir will retain 25% of the project once it publishes a bankable feasibility study. Even more compelling is that Reservoir can publish its own resource estimates and undertake feasibility work without having to wait for Freeport. Reservoir's CEO, Simon Ingram, is a very competent geologist. Timok's maiden resource is 65 Mt at 2.6% copper and 1.5 g/t gold, one of the highest-grade recent discoveries anywhere. Our numbers show that it is worth roughly US$2B or $10/share attributable to Reservoir. Even better is that Timok's high-grade subset includes 4.5 Mt at 11% copper and 7.5 g/t gold or $900/ton of recoverable value. With long porphyry drill intervals beneath the high sulphidation cap, we believe Timok has an immediate head start over all the other low-grade, big capex porphyrys out there. TMR: On a different subject, you're bullish on graphite. What does projected demand tell us about the future of this sector? FM: In the graphite space, supply-and-demand fundamentals in the medium to long term are compelling. Graphite is used mostly in industrial applications like refractories, which will continue to grow in line with global GDP. But the big demand shift has been to high-end applications like lithium-ion batteries, which looks set to grow at a 10% compounded annual growth rate. This is what is driving the demand for the larger flake-size graphite. To satisfy demand growth, we estimate the world needs one new graphite mine every year, assuming an average mine size of 25–30 Ktpa. Looking at the long list of graphite developers that have emerged, it's about choosing the graphite project with the right size fraction, the best in situ rock value that produces a saleable produce. So you want to be in the large to jumbo flake size, but you also want easy processing, cheap mining costs and the graphite concentrate to be of the highest purity without requiring any acid treatment to upgrade it. TMR: What's your favorite project in that sector? FM: Energizer Resources Inc. (EGZ:TSX.V; ENZR:OTCQX) in Madagascar. This country has always produced a very high-quality graphite concentrate. TMR: A few years ago, Energizer touted its Madagascar vanadium deposit. Why the shift in focus to graphite? FM: Junior explorers must spend wisely, and vanadium is a much smaller market than graphite with more complex metallurgy to crack. The company has taken the right approach in shifting its attention to Molo. Energizer's share price ascribes zero for its vanadium project, which we view as an option investors get for free. TMR: When can we expect production at Molo? FM: Being conservative, I'm saying 2017. This gives Energizer the opportunity to deliver bulk samples to end-users to secure a definitive offtake. In my experience, memorandums of understanding (MOUs) rarely translate into anything binding. Ultimately, it will be the end-users who will decide which graphite development project sees production. We think Energizer stands the best chance of securing a definite offtake from end-users and can thus best attract the debt financing Molo will require. It's simple to mine and simple in terms of metallurgy. It has a low strip ratio and doesn't require acid treatment to improve its purity. It has a good flake size distribution and has already produced 13 tons of graphite concentrate. We expect a definite offtake by H1/15. TMR: Filipe, thank you for your time and your insights. Filipe Martins is a gold and precious metals analyst for GMP Securities in London. He was previously an engineer for Mota-Engil and AECOM. He holds a bachelor's degree in engineering from University College London, a master of science degree in soil mechanics from Imperial College London and is completing a master of business administration at Imperial College Business School. Want to read more Mining Report interviews like this? Sign up for our free e-newsletter, and you'll learn when new articles have been published. To see recent interviews with industry analysts and commentators, visit The Mining Report homepage. DISCLOSURE: Streetwise – The Mining Report is Copyright © 2014 by Streetwise Reports LLC. All rights are reserved. Streetwise Reports LLC hereby grants an unrestricted license to use or disseminate this copyrighted material (i) only in whole (and always including this disclaimer), but (ii) never in part. Streetwise Reports LLC does not guarantee the accuracy or thoroughness of the information reported. Streetwise Reports LLC receives a fee from companies that are listed on the home page in the In This Issue section. Their sponsor pages may be considered advertising for the purposes of 18 U.S.C. 1734. Participating companies provide the logos used in The Mining Report. These logos are trademarks and are the property of the individual companies. 101 Second St., Suite 110 Tel.: (707) 981-8999 | ||

| Nickel price rally still has a long way to go Posted: 09 Sep 2014 01:16 PM PDT Initially record warehouse inventories, massive stockpiling by Chinese pig iron producers and growing mine supply kept a lid on the price which was languishing at near five-year lows below $14,000 a tonne at the start of the year. But the Asian nation, against expectations, stuck to its guns and the ban, in combination with fears that tensions with Russia could affect supply from top miner Norilsk, sent the price of the steelmaking ingredient above $20,000 in May. The price subsequently pulled back from those levels, but last week saw nickel take another stab at $20,000 a tonne after the Philippines – the only other source in the region of high-grade laterite ore required by China and responsible for 9% of global mine supply – hinted that it may follow Indonesia's playbook. Nickel was last trading at $18,750 and is up 35% in 2014, but expectations are for the price to appreciate sharply this year and next. Even before suggestions of an ore export ban Philippine supply has been sketchy. Already Japanese refiners and steelmakers are struggling to buy ore and once China re-enters the market regional supply will be highly constrained. Capital Economics argues that the rise in LME stocks of refined nickel at more than 330,000 tonnes is less an indication that supply is ample, but that metal from China and Australia, previously held off market are being moved into visible locations. Another factor that should keep prices on the ball is the slow progress with the construction of smelters (some 16 have been proposed) in Indonesia, ostensibly the reason for the ban in the first place. Capital Economics forecasts nickel to reach $21,000 next year, but others are much more bullish. Citibank sees $24,000 next year and a peak of $30,000 while Scotiabank predicts $23,700 in 2015 and highs of $26,500 the year after that. It's not only 2014 that's been a nickel rollercoaster. The metal, named after a mischievous German mythological creature (and Old Nick in the Christian tradition), takes the prize for the most volatile of all commodities over the past decade: | ||

| Red Eagle takes centre stage in Colorado with 52% feasibility study IRR Posted: 09 Sep 2014 10:01 AM PDT The gold mining industry has a big week ahead of it—two of its most important conferences will be held in Colorado. From September 14 to 17, the main event is the Denver Gold Forum, which will host the world's largest precious metals miners, developers, and investors. The Precious Metals Summit, to be held in Vail from September 10 to 12, will focus on earlier stage gold miners. Red Eagle Mining (RD.v), a Vancouver based firm which owns the Santa Rosa gold project in Colombia, will be presenting at both conferences. They have much to discuss with investors in the audience. A small-ish company, worth about $21 million, Red Eagle has its sights set on cash flowing roughly $50 million in each of 2016 and 2017 (at $1,300/oz gold). Assuming the gold price holds or rises, Red Eagle could be a big winner for investors over the short- and medium-term. But it has a number of upcoming milestones it must first power through. A quick snapshot of Red Eagle's upcoming catalysts:

Introducing: Red Eagle CEO Ian SlaterIt's obvious CEO Ian Slater is working diligently to permit and finance Red Eagle's first mine. While his goal is to build the next mid-tier gold producer, he first needs the Colombian permitting authorities and the gold gods to sign off on it. Slater's a Chartered Accountant with an unusually high appetite for risk. At 24, he moved from Vancouver to Moscow to establish Arthur Andersen's Central Asian mining practice, just after the Soviet Union fell. He became Andersen's youngest partner at age 27. Six years later Slater returned to Vancouver to help build Ernst & Young's Canadian mining practice, then in 2007, he left the accounting world to join Lukas Lundin's Fortress Minerals back in Russia. Following the Lundin Group's exit from Russia a year later, Slater was introduced to future business partner Bob Bell, a mining engineer who had a long career of building and operating gold mines. Bell was a founding partner of Minproc Engineers' Mining Division, and more recently, general manager of Dundee's Chelopech Mine in Bulgaria. Slater and Bell hit it off and formed a pact to work together during their first meeting. After evaluating hundreds of mineral projects, the duo zeroed in on Colombia and hired a local team there. In 2011, Slater and Bell acquired the Santa Rosa property, a 2 hour drive from Medellin, named the venture Red Eagle Mining and listed it on the Toronto Venture Exchange. San Ramon will be the first modern gold mine in ColombiaRed Eagle has since invested a total of $55 million exploring Santa Rosa, a property littered with historical gold mines that previously hadn't seen modern exploration work. Due to poor financial conditions in the mining markets, management decided to focus on proving up one area of the property and priming it for production. The San Ramon deposit on the Santa Rosa property contains 405,000 ounces of gold in the Proven & Probable categories at 5.2 g/t Au using a 2.0 g/t cutoff within 200m of surface, and an additional 152,000 ounces of inferred material. Mineralization is open at depth and along strike, which in layman's terms means it could grow. The Feasibility Study shows a pre-tax NPV(5%) of US $135 million, IRR of 62% and 1.3 year payback using a $1,300 gold price. Cash costs were estimated to be $600 per ounce. That puts Red Eagle at the top end of IRR, NPV and cash costs for gold development projects globally, competitive with the likes of True Gold and Roxgold, two West African gold developers with similar economics, yet substantially higher market values. Red Eagle doesn't have quite the same size, but management is confident they will be able to grow their production profile. Red Eagle plans Q1 2016 production with a 1,000 tonnes per day (tpd) CIL Plant producing an average of 50,000 ounces per year over an 8 year mine life, and likely longer. It will be conventional shrinkage stoping mining with delayed backfill. The capex for this scenario is estimated at $74 million (including contingency) with an additional $33 million in sustaining capital required. And the plant's design will allow it to expand to 2,000 tpd should the company find more ore elsewhere at Santa Rosa; a scenario the company will look to develop in further studies. Red Eagle would like to spend $10 million on exploration next year, but management are realistic, and will only do so if exploration finance markets improve. Red Eagle's net cash position is $4.4 million as of June 30, 2014. Last week, Red Eagle announced that the Antioquia Secretary of Mines has formally approved its Mining Technical Work Plan, with only a final environmental permit looming. Since the company has decided to focus on an underground mining operation, which would be nearly invisible from the surface, the project should be more palatable to the permitting authorities. And if Red Eagle secures the permit, San Ramon will be the first permitted gold mine in Colombia in over 30 years. Obstacles Red Eagle will have to overcomeThe San Ramon mine hinges on the receipt of that final environmental permit. To Red Eagle's credit, there's been a profound effort by the company on the social license front. Red Eagle employs former government officials and has hosted at least 80 meetings with local communities over the past two years. And Slater is confident. "We're going to be the first modern gold mine in Colombia. It's not a question of if we will be permitted but when," he said. On top of permitting concerns, San Ramon's contract miners—experienced in road building and tunneling, but not this scale of underground mining, could present an operational difficulty. Bell told us that close oversight and training will be required, and that he himself will be accountable. Additionally, Bell said the company must stay ahead of its mine plan: "From my experience, and that's over 40 years, one of the biggest problems in all underground mines is keeping your development ahead of production," he told us.  Tim Neall, Project Geologist and Alan Baker, Project Director at Red Eagle's Santa Rosa property. Click for more images. CEO.ca photo Size is another issue. The San Ramon deposit is not big, and will produce 75k ounces per year initially decreasing to 30k ounces by year 7.. The company plans to increase to 100,000 ounces per year if further exploration on the property finds more ore. The price of gold is obviously an issue for potential investors as well. Any gold miner will have a tough climb in this low-price environment. Challenges will only be exacerbated if gold prices fall further. Looking to Red Eagle's futureSlater and Bell's ultimate vision is to build Red Eagle Mining into a multi-asset mid tier gold producer with a share price and market value substantially higher than it is currently. They pointed out that B2Gold started with a similar production profile just five years ago. The road ahead will not be without its challenges, but we like how Slater and Bell are approaching things. And if Red Eagle has permits in hand by the end of the year, the mining investors who come to Colorado to see them this week will likely have a rare win on their hands. Red Eagle Mining Ltd. Disclaimer: This letter/article is not intended to meet your specific individual investment needs and it is not tailored to your personal financial situation. Nothing contained herein constitutes, is intended, or deemed to be — either implied or otherwise — investment advice. I am biased with regards to Red Eagle Mining, having a business and personal relationship with management and insiders of the company. I own shares in the company and they are a sponsor of our web site. I may add to my position in the company and intend to sell the entire position at a profit and reserve the right to add to or reduce my position without notice. This letter/article reflects the personal views and opinions of Tommy Humphreys and that is all it purports to be. While the information herein is believed to be accurate and reliable it is not guaranteed or implied to be so. The information herein may not be complete or correct; it is provided in good faith but without any legal responsibility or obligation to provide future updates. Neither Tommy Humphreys, nor anyone else, accepts any responsibility, or assumes any liability, whatsoever, for any direct, indirect or consequential loss arising from the use of the information in this letter/article. The information contained herein is subject to change without notice, may become outdated and may not be updated. The opinions are both time and market sensitive. Tommy Humphreys, entities that he controls, family, friends, employees, associates, and others may have positions in securities mentioned, or discussed, in this letter/article. While every attempt is made to avoid conflicts of interest, such conflicts do arise from time to time. Whenever a conflict of interest arises, every attempt is made to resolve such conflict in the best possible interest of all parties, but you should not assume that your interest would be placed ahead of anyone else's interest in the event of a conflict of interest. No part of this letter/article may be reproduced, copied, emailed, faxed, or distributed (in any form) without the express written permission of Tommy Humphreys. Everything contained herein is subject to international copyright protection. | ||

| New hold-up for Rio’s subsidiary Turquoise Hill at Oyu Tolgoi Posted: 09 Sep 2014 09:22 AM PDT Shares in Turquoise Hill Resources (TSE, NYSE:TRQ) showed little reaction to the company's latest setback at its flagship Mongolian Oyu Tolgoi copper project, whose two tailings thickeners experienced rake failure last Friday. Vancouver-based Turquoise Hill, controlled by Anglo-Australian giant Rio Tinto (LON, ASX:RIO), said Tuesday an investigation was under way to determine the cause of the failure and that repairs at the mine had begun. The company is currently embroiled in a tax dispute with the Mongolian authorities over a $130 million bill delivered in June. The battle is the latest in a series of hurdles facing the Oyu Tolgoi project since Rio Tinto suspended work on the $5.1 billion underground expansion of the mine, where 80% of the resources are located, and fired about 300 workers.  At full tilt Oyu Tolgoi will account for 30% of the economy of Mongolia, a nation of just over 3 million people. In April, Turquoise Hill said potential lenders have extended a deadline to arrange financing for the project until the end of September. The miner said its concentrator at Oyu Tolgoi continued to operate at about a 60% production rate using the second thickener, adding it would update the market as additional information becomes available. For 2014, Oyu Tolgoi is still targeting production of 150,000 to 175,000 tonnes of copper in concentrates and 700,000 to 750,000 ounces of gold in concentrates. But after phase 2 the mine in the southern Gobi desert close to the Chinese border could produce more than 1.2 billion pounds of copper, 650,000 ounces of gold and 3 million ounces of silver each year. Oyu Tolgoi will account for 30% of the economy of the nation of just over 3 million people. | ||

| India’s Supreme Court revises judgment on illegal coal blocks Posted: 09 Sep 2014 08:04 AM PDT India's Supreme Court revised Tuesday its August decision to declare illegal all coal mining licences granted between 1993 and 2010, but said it wouldn't announce its verdict on the matter until an unspecified later date. The government, reports Economic Times, had requested the court to exempt nearly 40 coal blocks that have either started production or are near it. They are estimated to have a capacity of about 9% of the 566 million tonnes India produced last year. The award of more than 200 coal blocks to steel, cement and power companies has been at the centre of the so-called "Coalgate" scandal, estimated in a 2012 audit report to have cost as much as $33 billion. In the past twenty years India has granted coal blocks to a range of companies in sectors such as power and steelmaking, partly to overcome fuel shortages stemming from its inefficient and state-dominated mining sector. India is suffering from an acute shortage of coal, which fuels about three-fifths of its power needs. |

| You are subscribed to email updates from MINING.com To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 20 West Kinzie, Chicago IL USA 60610 | |

0 Comment for "The five most popular mining maps"