Silver prices | Expect Gold And <b>Silver Prices</b> To Retain Their Gains In Q3 | Gold <b>...</b> |

- Expect Gold And <b>Silver Prices</b> To Retain Their Gains In Q3 | Gold <b>...</b>

- <b>Silver price</b> steady as the London price fix ends today « ArabianMoney

- Update: <b>Silver</b> Wheaton's Earnings Decline On Lower Production <b>...</b>

- <b>Silver Prices</b>: Is 14% Enough for 1 Month? | Gold News - BullionVault

- <b>Silver Price</b> Breaks $22 But Analysts See "Substantial" Risks | Gold <b>...</b>

| Expect Gold And <b>Silver Prices</b> To Retain Their Gains In Q3 | Gold <b>...</b> Posted: 13 Aug 2014 02:54 PM PDT This article is based on an interview with Chris Thompson of Raymond James, courtesy of The Gold Report. Thompson's main argument is that the relative stability now characterizing the market permits investors to make informed decisions about which companies can build value and demonstrate cash flows at today's prices. Will we see higher or lower gold and silver prices this year?

How comes the deteriorating geopolitical situation combined with weak U.S. economic performance has not pushed precious metals prices higher?

After gold fell significantly under $1,200/oz, some argued that gold had been overvalued and overbought for a long time. Has this negative atmosphere been dissipated?

What to think of the fact that precious metals equities have done poorly in the last three years compared to the broader indices?

Are the broader indices are in bubble territory?

Can mining companies make money at $1,300/oz gold and $20/oz silver?

|

| <b>Silver price</b> steady as the London price fix ends today « ArabianMoney Posted: 14 Aug 2014 03:11 AM PDT Posted on 14 August 2014 with no comments from readers The London market for silver enters a new era tomorrow with the ending of the London silver price fix after 117 years. From tomorrow it is replaced by a new benchmark administered jointly by Thomson Reuters and the CME Group offering a superior level of transparency and reckoned to be immune to illegal price fixing that has been widely alleged to be a feature of silver prices up until now. The LBMA will accredit price participants and own the intellectual property rights. Market fix? Indeed if you see some of the market data presented by the experts like Ted Butler this is self-evident. It's the market authorities who have always chosen to look the other way. What happens to any market that is fixed after a while? Well it is obvious really. The participants get sick of being screwed and leave it alone. Once bitten twice shy! So a new system ought to gradually start winning people back. London Silver Price, or LSP as the new benchmark will be known, will publish the volumes of silver bars traded daily and tested-prices while keeping the buyers and sellers anonymous. Thomson Reuters will handle LSP governance and administration. CME Group is providing the electronic price platform and software. Instead a bullion bank chairman determining the opening silver price, this will now be undertaken by an electronic process. The opportunity to trade on this information before it becomes public – however unlikely it is that a bullion bank might do this – is eliminated at a stroke, although market participants this week have reported some confusion over the mechanism by which their information can be used. That leaves something of a hiatus hanging over the switch on tomorrow. Will the LSP actually work as planned? Long-term deal We will see. Most likely it will be just fine. But the longer term implications of an end to the silver price fix are what the market should really be focusing on. Its a way to get confidence back into silver trading. Why should this precious metal still be trading below its 1980-high unlike any other commodity? Will investors now reconsider silver as a play on higher precious metal prices and monetary inflation? Revolutionary this price fix change is probably not. But it could be the butterfly flapping its wings on the other side of the ocean that causes a tsunami thousands of miles away. Posted on 14 August 2014 Categories: Gold & Silver |

| Update: <b>Silver</b> Wheaton's Earnings Decline On Lower Production <b>...</b> Posted: 13 Aug 2014 10:03 PM PDT

Silver Wheaton (NYSE:SLW) just announced its second quarter earnings figures, and admittedly they were somewhat disappointing. The company reported revenues of $148.6 million, earnings of $63.5 million ($0.18/share) and cash-flow of $102.5 million ($0.29/share). These figures were down from the second quarter last year as the price of silver was weaker and silver equivalent production fell by approximately 4% to 8.4 million ounces. The company also reported a $0.06/share dividend. Silver Wheaton's figures show a lack of growth, and this reflects the fact that the company hasn't been making new streaming deals. While it bought a small royalty recently on Chesapeake Gold's (OTCPK:CHPGF) Metates Project - a topic I discuss here - this royalty will not generate any cash-flow for many years and even then it will be relatively small compared to the size of the company. But while the company hasn't been buying streams recently it does have some growth as its gold stream on Vale's (NYSE:VALE) Solobo Project should show growth as that company expands the project. Furthermore Primero Mining (NYSE:PPP) has been expanding production on its San Dimas Project on which Silver Wheaton owns a silver stream. It also has some other projects coming online over the next few years, continuing a history of growth which is illustrated on the following chart. (Source: Silver Wheaton's July Presentation) With this in mind, and given the recent weakness we have seen in the silver market I would be hesitant to buy Silver Wheaton as it trades above $27/share, especially since I recommended it just 6 1/2 months ago at $21.40/share. As a streaming company it has been performing very well as investors prefer this business model to miners given its relatively fixed, low costs. But this preference means that the shares trade at a high valuation. Hopefully the lack of immediate growth we saw in this most recent quarter will scare off some investors and provide long-term investors with a chance to add to their positions before silver begins its next move higher. Disclosure: The author is long SLW. The author wrote this article themselves, and it expresses their own opinions. The author is not receiving compensation for it (other than from Seeking Alpha). The author has no business relationship with any company whose stock is mentioned in this article. Seeking Alpha PRO helps fund managers:

Thank you for your interest in Seeking Alpha PRO Our PRO subscription service was created for fund managers, and the cost of the product is prohibitive for most individual investors. At this time, we do not yet have a subscription product for individual investors. If you'd like us to contact you when it's ready, please click here. If you are an investment professional with over $1M AUM and received this message in error, click here and you will be contacted shortly. Thank you for your interest in Seeking Alpha PRO |

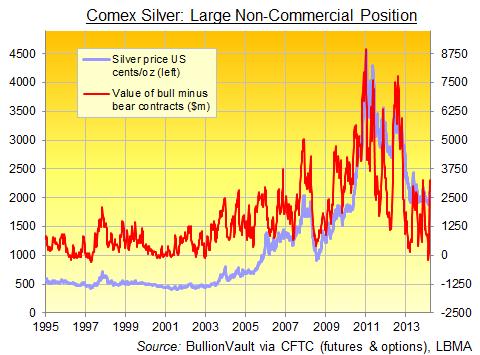

| <b>Silver Prices</b>: Is 14% Enough for 1 Month? | Gold News - BullionVault Posted: 02 Jul 2014 11:30 AM PDT Spec shorts hit a record start-June, then covered faster than ever helping prices jump... SILVER PRICES hit new 15-week highs Wednesday, writes Adrian Ash at BullionVault, adding 14.1% from end-May's drop near 4-year lows. Any more gas in the tank for extra gains short term? Summer is typically boring for gold, and by extension silver prices. (The median move during June-August is the smallest 3-month change over the last 45 years, stats fans.) But 2014 has seen both gold and silver prices buck the seasonal lull so far. June saw gold add 6% against the Dollar. Silver doubled that move. The immediate cause, certainly for silver prices, was plainly short covering. Bullionvault wasn't alone in spying the all-time record number of bearish bets against silver held at the start of last month by hedge funds and other speculators. We weren't alone either in guessing that could end badly for silver's short sellers if prices rose. But we can't find many other commentators noting that, derivatives trading aside, June was actually quiet for silver investment demand. Indeed, after May's stellar addition to BullionVault user holdings – the largest 1-month rise since end-2012 – holdings were flat overall last month as more users opted to take profit than buy more following the sharp leap through $19...$20...and then $21 per ounce. The rise in gold and silver prices meantime hit those hot-money traders betting against them so badly, they all ran to the other side...and at a record pace. The question now is whether there's any cash left to join the bullish betting short term.

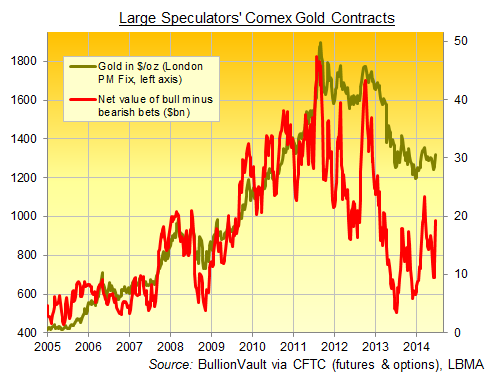

Every Friday, after the futures market closes in New York, US regulators print data showing how traders were positioned the previous Tuesday. Tracking the changes lets you see what the big money is thinking. If it's thinking at all. On one side are the "commercials"...the producers and merchants who make a living selling the stuff. On the other are the "speculators"...the hot-money funds who try to make a living betting which way prices will move. Now, at the start of last month, the specs were holding more bets against silver prices than ever before. Looked at as a group overall, they were "net short" silver (bullish minus bearish bets) for the first time in 11 years. This made sense from a technical view. Silver prices, like gold, were marking a tight range which only got tighter. Higher lows and lower highs created a triangle shape. Technical analysts studying chart patterns could see the final corner drawing near. Hitting that apex as time rolled by, silver would either shoot higher or, they guessed, sink hard. But then Janet Yellen spoke...coughing about how maybe the Fed won't actually ever, y'know, raise interest rates from zero...and the precious metals shot right where the silver shorts hoped they wouldn't. Having started with a record large speculative short bet against silver, June saw the fastest swing in bullish betting on silver, net of bearish contracts, on record. The so-called spec net long rose 150%...swelling over $2bn by value...and growing faster than any week since at least 1986 as prices jumped. Speculative gold betting was similarly dramatic in the week-ending last Tuesday. Faster than January 2012, the jump in net bullish betting totaled some $7.3bn. That jump is beaten only by mid-July 2011, when the US debt downgrade and Eurozone debt crisis sparked that summer's record peak in gold prices.

All told then, June 2014 saw $13bn-worth of speculative bets jump onto the long side of gold and silver contracts at the US Comex exchange. So like we suggested to Bloomberg's Alix Steel last week, the hot money has run to the other side very fast. This has proven a welcome dose of good luck for physical investors in silver bars wanting to pocket a tidy gain for the summer. But further ahead?

With silver up 12% in 4 weeks, why not? Bottom line, silver is volatile enough without needing to borrow money...and multiply your risk of ugly losses as well as profit...to play the futures or options market. Let the hedge funds set themselves up for a fall if they wish. As for choosing silver over gold, that's a tough call. But when silver moves in the same direction as gold (some 75% of all trading days since 1968) the cash price moves very much faster. Three to four times as fast in fact. That cuts both ways remember. Up and down. |

| <b>Silver Price</b> Breaks $22 But Analysts See "Substantial" Risks | Gold <b>...</b> Posted: 24 Feb 2014 02:34 PM PST UBS bucks trend, SocGen says Indian silver imports "will fall" if gold rules eased... SILVER PRICE gains of 6% last week and 12% so far in February have yet to convince precious metals analysts that the trend will prove more than a blip. According to French bank Natixis, the silver price rally is likely to be short-lived. "We would expect US economic data to improve," they further add in their latest note, "as we move beyond the current bout of extreme weather which has dampened economic activity since December." Looking ahead, Natixis' analysis says "This should help to raise US interest rates and strengthen the Dollar, both of which would be negative for gold and silver prices." Turning to silver ETFs, which bucked the trend in gold investment trust funds and continued to grow by weight last year even as the silver price dropped 28%, "If these guys start selling like they did with gold," says Walter De Wet of Standard Bank, "we could see substantial downside pressure on silver." Again pointing to forecasts of a rising US Dollar and higher US bond yields, "Over the past couple of years," de Wet concludes, "we have seen that the silver price does ultimately tend to follow the same path as gold so we do think that is a substantial risk." French investment and London market-making bullion bank Societe Generale conversely points to India, where 2013 imports rose sharply. That's because strict gold import regulations "diverted some traditional gold demand to silver," says precious metals specialist Robin Bhar. Additionally, the sharply lower silver price last year encouraged opportunistic purchases by Indian households. Now however "there have been signs in mid-February that the silver price recovery has caused demand to drop back," Bhar believes. Overall, silver investment "is set to dissipate," he says, "particularly if the Indian government loosens restrictions on gold imports." SocGen now expects the silver price to average $19 in 2014, well below last year's $23.79 per ounce and almost a dollar below the London market's average analyst forecast. Only Swiss investment and bullion bank UBS breaks consensus, raising its analysts 2014 average silver price forecast from $20.50 per ounce to $22.30. "The improvement in gold sentiment should have a considerable positive spillover effect on silver," write strategist Edel Tully and analyst Joni Teves. Moreover, "Silver should benefit from a global economic recovery more than gold." |

| You are subscribed to email updates from Silver prices - Google Blog Search To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 20 West Kinzie, Chicago IL USA 60610 | |

0 Comment for "Silver prices | Expect Gold And Silver Prices To Retain Their Gains In Q3 | Gold ..."