INFOGRAPHIC: How to short penny stocks |

- INFOGRAPHIC: How to short penny stocks

- Rick Rule: Three reasons to start buying resource juniors

- Rick Rule on the OK jobs report, gold

- Apache Corporation pulling out of proposed Kitimat LNG project

- AngloGold expects more assets on the block before year-end

- Codelco’s new CEO to lead the copper miner’s $25 billion revamp

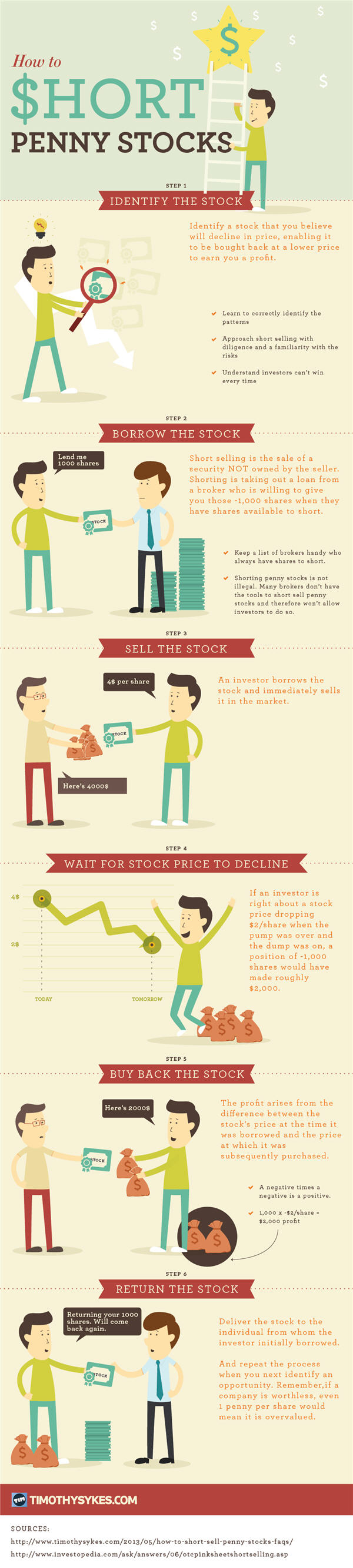

| INFOGRAPHIC: How to short penny stocks Posted: 02 Aug 2014 01:33 PM PDT You may have heard of shorting penny stocks, but in case you don't know how the background process works, we have you covered. As described in the infographic, short selling is not an incredibly complex process. Rather, the art of mastering short selling lies in identifying stocks that will decline in price (even though hunting for declining stock feels counterintuitive). Remember that it can be considerably more difficult to borrow microcap shares because of their illiquidity. However, it is very possible, especially in the US. Also, when shorting, remember that your risk is higher. You are using borrowed money and the stocks are more thinly traded. Lastly, because a stock price can continue to increase, your potential losses could be much higher if you are wrong. A quick step-by-step recap:

|

| Rick Rule: Three reasons to start buying resource juniors Posted: 02 Aug 2014 01:27 PM PDT Gold has declined slightly, from around $1,320 to $1,300, in the last few weeks. Rick commented that this was normal for a recovery in resource stocks. You expect gradual rises and subsequent consolidations. Today, he lays out his three big drivers for a recovery in the 'junior' resource stocks. Rick, are we still on our way towards a recovery? What catalysts might take the market higher? "The market for junior resource stocks, as you can see from the performance of the TSX.V, the ASX, and the LSE AIM, marked a bottom around a year ago. They're in a gradual recovery now, and I believe the uptrend will continue, albeit marked by the same volatility that we've seen in the market so far. We've experienced three advances and subsequent declines this calendar year – and that's normal for the early stages of a resource recovery. These advances need to consolidate, which they have already done nicely. "There are three key drivers to this advancement. First, there's the incredible amount of capital that the junior market raised five or six years ago and the fact that sooner or later, investors will realize that they're playing with '25-cent dollars,' as many juniors are trading well below the value of their cash and other assets. Second, there are the extraordinarily low valuations attributed to some of the best companies in the sector. Third, there is the increasing pace of mergers and acquisitions. This is a good thing, as horizontal mergers decrease G&A expenses, while in 'top-down' mergers, larger mining companies buy up select juniors to add to their exploration and development pipeline. "Besides these three points, there is also the fact that we are in a nascent boom in the discovery cycle. There has been an increasing pace of new discoveries, and the market certainly appreciates genuine discoveries. "In my experience, Henry, bull markets begin when the market as a whole exceeds expectations. Since expectations are currently exceedingly low, it won't take much to beat them. Moves up from lower bases, discoveries, mergers and acquisitions, and particularly the generally low valuations today relative to market norms for the best companies in the sector, all point to a continued uptrend among resource stocks. "I would urge you, if you are interested in the sector, to increase the pace of you investments now. Do it selectively because the sector will continue to be volatile and the recovery will continue to be gradual, though perhaps not tepid. I do believe that the risk is to the upside, not the downside." You mention that we need to be selective, but don't "rising tides raise all ships?" How important is analyzing resource stocks ahead of a recovery? "Important point, Henry. The sector is already so risky that you should try to minimize those risks, not increase them. Bad management teams make the risks of the sector even worse. My friend Doug Casey often says that 'when the wind is blowing even turkeys can fly.' The problem though is that the turkeys need to stay fed long enough that they can last until the wind picks up. "If you took all the juniors together, merging them into a single entity – they would probably lose around $2 to $5 billion a year. Therefore buying the sector as a whole is an excuse to go broke. Meanwhile, the 5 or 10 percent of the best companies in the sector can create such spectacular increase in shareholder value that they add visibility – and sometimes luster – to the overall sector. Confining your portfolio to the best people, the best projects, and the sturdiest balance sheets is not that constraining, but it is critical to maximizing your returns through both upswings and declines in the resource sector." P.S.: Our inaugural Sprott Vancouver Natural Resource Symposium took place last week – some of the best speakers in the mining industry converged for our three-day conference. Recordings offered for a fee through Agora Financial. Rick Rule is the Chairman and Founder of Sprott Global Resource Investments Ltd., a full-service brokerage firm located in Carlsbad, CA. Sprott Global is an affiliate of Sprott Inc., a public company based in Toronto, Canada. Mr. Rule leads a team of earth science and finance professionals who form an intellectual pool for resource investment management. He and his team have experience in many resource sectors including mining, oil and gas, water, agriculture, forestry, and alternative energy. Image of driver from Library of Congress |

| Rick Rule on the OK jobs report, gold Posted: 01 Aug 2014 04:22 PM PDT Spot gold gained $10 to $1,294 per ounce after muted July job numbers were released. Total non-farm payroll employment increased by 209,000 last month, and the unemployment rate was little changed at 6.2 percent, the U.S. Bureau of Labor Statistics reported today. Analysts had been expecting about 230,000 jobs. Spot silver was mostly unchanged at $20.27 per ounce. "I think it was a better jobs report. I think there is probably a disconnect between the jobs report and day-to -day economic data and the gold price," said Rick Rule in an interview with MINING.com today. "It would appear in today's markets with so much access to information—but maybe so little patience for knowledge—that people seize on things like the jobs report or like the Ukraine to explain day-to-day or hour-to-hour moves in precious metals prices, and I would suggest the moves are not neatly correlated as people might otherwise think. "With specific reference to the US economy. I think there is a couple of things that have to be noted. First of all labour force participation is problematic." The labour-force participation rate—a measure of the number of people available for work—ticked up by about 300,000 in July. It was a small gain, one-tenth of a percentage point. The rate is still at a multi-decade low. "The second thing we need to understand is unfortunately the number of lower wage service jobs relative to manufacturing jobs. I think the silver lining in this is that the United States does seem to be experiencing a nascent recovery in manufacturing. I don't think this has shown up in these job numbers yet."  Chart from the Federal Reserve Bank of St. Louis showing the declining labour-force participation rate |

| Apache Corporation pulling out of proposed Kitimat LNG project Posted: 01 Aug 2014 11:44 AM PDT Apache Corporation has announced hat it intends to completely sell its stake in the proposed multibillion-dollar Kitimat LNG project. The company also announced in its second quarter report that it plans to completely exit the Wheatstone LNG project in Australia. Apache had said in the past said that it was looking to "right size" its participation in the Chevron Corporation-operated Kitimat LNG project by selling some of its 50% stake. In addition, Apache is evaluating its international assets and exploring multiple opportunities, including the potential separation of some or all of these assets through the capital markets. Apache had been under pressure from activist investor JANA Partners LLC, which wanted Apache to free up cash flow by exiting the two major LNG projects in Canada and Australia that aim to export natural gas. The planned project in Canada has until now struggled to secure a long-term offtake agreement with an Asian buyer.

"LNG is for IOC and NOCs with very long time horizons. Perhaps someone will take them out. [Encana Corporation] and [EOG Resources, Inc.] exited earlier when it was obvious they could not attract contracts or pony up for the costs. Despite being large, they were not large enough." Under a deal that closed in early 2013, Chevron Canada Corporation and Apache Canada Ltd. each became a 50% owner of the Kitimat LNG plant, the Pacific Trail Pipelines and 644,000 gross undeveloped acres in the Horn River and Liard basins. It's unclear what will happen to the upstream partnership, now that Apache has decided to exit the Kitimat LNG project. A spokesperson for Apache wasn't immediately available. "Chevron cannot comment on Apache's plans to manage their joint venture interest in the Kitimat and Wheatstone LNG projects," Chevron spokesperson Gillian Robinson-Riddell said when asked about the future of the upstream portion of the partnership. Chevron bought into the project by taking out Encana's and EOG's positions in Kitimat. EOG had entered the project by agreeing to acquire the shares of Galveston LNG Inc., a private Calgary-based company whose subsidiary Kitimat LNG Inc.was helping to develop the export facility. At the time, Kitimat LNG owned 49% and Apache earlier in the year had acquired 51% of the planned project. Encana entered the project in early 2011. Image via WikiMedia Commons. |

| AngloGold expects more assets on the block before year-end Posted: 01 Aug 2014 10:15 AM PDT World's No.3 gold miner AngloGold Ashanti (NYSE:AU) (JSE:ANG) said Friday it expects largest producers to put more assets up for sale soon, as they seek to sustain margins in light of a forecast slump in gold prices. Speaking to Bloomberg News, the company's VP Graham Ehm said as the precious metal is seen more likely to decline than to advance beyond $1,400 an ounce, "portfolio rationalization" will continue to happen. A recent PwC study showed the gold sector lost US$110 billion off its market capitalization last year. It was also the hardest hit by plunging commodity prices, as gold suffered the largest annual drop since 1981, forcing miners to writedown $27 billion of assets. To reduce risk, many companies have cut costs in several ways. Some have decreased capital spending, while others have sold off assets and placed exploration on standby. With operations across 10 countries, Bloomberg said the South Africa-based miner might consider selling a few assets, including Obuasi in Ghana, Sadiola in Mali or Colombia's La Colosa. |

| Codelco’s new CEO to lead the copper miner’s $25 billion revamp Posted: 01 Aug 2014 08:01 AM PDT As anticipated by MINING.com in May, Chile-owned copper giant Codelco has appointed former manager Nelson Pizarro, who has over 50 years experience in the industry, as its new leader, effective Sept. 1. Pizarro (73) has a daunting mission ahead, as he is expected to lead a $25 billion revamp of the world's largest copper producer, which is dealing with ageing mines and dwindling ore grades. The mining engineer, whose most recent achievement was the development of the $4.2 billion Caserones copper mine in the Atacama Desert for Japan's Pan Pacific Copper Co., received unanimous support from Codelco's board. The copper giant said in a statement (in Spanish) it sought a candidate with mine management expertise to oversee development of two of the world's largest underground mine projects, as the company needs now to dig deeper to access profitable ore. Pizarro, who also once worked for London-listed copper firm Antofagasta Plc (LON:ANTO), ran Codelco's Andina and Chuquicamata mines, both more than a century old, between 1990 and 1997. The new CEO is set to carry out the biggest investment plan in Codelco's history, according to the company. As a state-owned company, Codelco has often been in a tug-of-war with the government over its investment budget. Of about $100bn in profits that Codelco has transferred to the state since it was nationalized in 1971, only $4bn has been returned back to the miner. The mining company is undergoing a massive transformation, trying to maintain profits from the world's largest open-pit copper mine, Chuquicamata, by extending operations underground. At the same time, plans call for turning the world's largest underground mine, El Teniente, into an open pit operation. Copper accounts for 60% of Chile's exports and 15% of gross domestic product. Images from archives. |

| You are subscribed to email updates from MINING.com To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 20 West Kinzie, Chicago IL USA 60610 | |

0 Comment for "INFOGRAPHIC: How to short penny stocks"