<b>Gold price</b> on insane surge after massive trade | MINING.com |

- <b>Gold price</b> on insane surge after massive trade | MINING.com

- Silver and <b>Gold Prices</b>: The <b>Gold Price</b> Closed Higher at $1,320.90

- <b>Gold Price</b> Relative To Monetary Base At All-Time Low :: The Market <b>...</b>

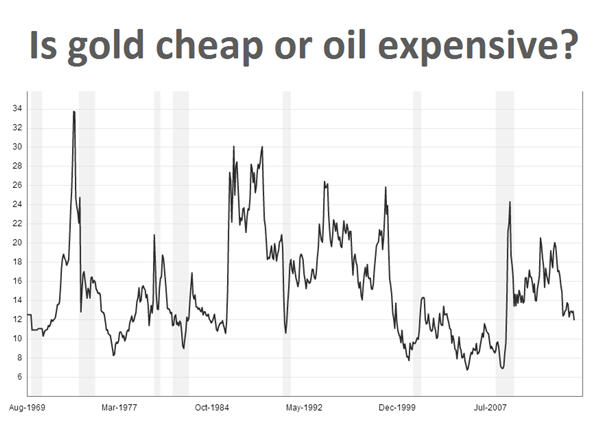

| <b>Gold price</b> on insane surge after massive trade | MINING.com Posted: 19 Jun 2014 10:39 AM PDT The gold price scaled $1,300 an ounce for the first time in more than a month, after comments by US Federal Reserve chair Janet Yellen yesterday and a huge buyer lit a fire under traders. On the Comex division of the New York Mercantile Exchange, gold futures for August delivery – the most active contract – jumped to a day high of $1,322.00 an ounce, up $49.30 or nearly 4% from yesterday's close. After months of subdued trade on gold futures markets volumes surged on Thursday leaping past 210,000 contracts – double recent daily averages – by mid-afternoon. As the chart shows, after a steady climb throughout the morning, during lunchtime volumes suddenly spiked with more than 2.9 million ounces (90 tonnes) changing hands in three big chunks in the space of 15 minutes. Gold built on its gains from there to settle at $1,320.40, the the best one day performance for the metal since September last year. The chart looks almost like the inverse of the trading pattern on April 15 this year when exactly year to the day of 2013's $200 shocker another strange gold price plunge occurred. Gold's positive move started yesterday after Yellen, speaking at the latest meeting of the Fed's interest rate committee, said she was comfortable interest rates could stay low for a considerable period, which sent the dollar tumbling against the euro and pound sterling. Gold and the US dollar usually moves in the opposite directions and gold's perceived status as a hedge against inflation is also burnished when central banks flood markets with money. Monetary expansion, particularly since the financial crisis, has been a massive boon for the gold price. Gold was trading around $830 an ounce when previous chairman Ben Bernanke announced the first program of quantitative easing in November 2008. The QE program together with other stimulus measures saw the balance sheet of the Fed cross the $4 trillion mark in January, up 400% in seven years. The US has not been alone in printing money and together with the Bank of Japan, the European Central Bank and the Bank of England, more than $15 trillion of easy money is now sloshing around in the system. Earlier this month the ECB took the unprecedented step of moving rates into negative territory. Gold was also pushed higher through safe haven buying as the deteriorating situation in Iraq sends oil prices rising. Benchmark West Texas Intermediate traded higher again on Thursday to reach $106.70 a barrel. Looking at the ratio between the gold price and the oil price which usually rise in tandem (rising oil prices pushes up inflation increasing demand for gold as a hedge), gold looks undervalued by comparison. Since 1970 the average ratio – how many barrels of oil can be bought with one ounce of gold – is 15 compared with 12 now, which suggests that gold is cheap compared to oil. The last time the ratio was at 12 was at the height of the global financial crisis in October-November 2008. The price of gold slid close to 28% in 2013 – the worst annual performance since 1980 – in anticipation of an end to the ultra-loose monetary policy, but has enjoyed double digit gains in 2013. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Silver and <b>Gold Prices</b>: The <b>Gold Price</b> Closed Higher at $1,320.90 Posted: 24 Jun 2014 04:21 PM PDT

On five day charts both silver and gold have passed through resistance and begun what appears to be the next leg up. The GOLD PRICE hit a new high for the move at $1,326.60, but remember that April high at $1,331.40 is the hurdle to beat. The SILVER PRICE really has no fierce barrier until it reaches the February high at 2218c. Many's the observer who is holding back, watching to see whether silver can leap that hurdle. When she does, all those skeptics will turn into fans. Stepping back from silver's chart for a longer view, it has made what resembles but technically is not an upside-down head and shoulders, with lows at end-June 2013, end-December 2013, and 30 May, but no fireworks will be lit until silver passes above 2218c. That will likely mark the limit of this move, i.e., the first leg of this rally. Friends, I have checked a lot of other charts, and all of them indicate a certifiable break-out rally. Gold stocks are manic, Gold vs Bank stocks is thriving. Dollar index and stocks are struggling. It all points to the end of the 2011-2014 precious metals correction and beginning of the next rally. I'm not even going to breath or whisper my upside targets for this phase of the bull market, cause if I did y'all would just call me a nacheral born durned fool from Tennesseeand spit. This morning I remembered that in Memphis, Tennessee when I was a college freshman in 1965, laundering a dress shirt cost 25 cents each, but the cleaner would wash, starch, and hang five shirts for a dollar. Today it costs $2.50 or more a shirt. Cheer up, though. I read an article today in the Jamaica Observer that noted in 1989, J$100 could feed a family of five for a week. Today, a pound of chicken costs J$200. I reckon that socialism puts a big load on a central bank, not to mention the poor -- but somebody has to pay. Oh, my -- something's happening in markets, and not too many folks are noticing. The tide is turning. Stocks fell across the board today. Dow Industrials Dover 119.13 (0.7%) while the S&P500 belly-flopped 12.63 (0.64%) to 1,949.98. The Dow stopped dead on its 200 DMA (16,818.79). Closing below 16,700 punctures the 4 month uptrend line. A close below 16,450 pierces the uptrend line from the March 2009 bottom. S&P500 is holding up a little better than the Dow. It's 1,949.98 close stopped well short of its 1,940.21 20 DMA. The uptrend from 2009 crosses today about 1,790. Stock momentum turned down today. Oh, my -- how about the Dow in Metals! "Collapsed" is the word that pops into my mind, but that may be a bit extreme. Dow in Gold today stopped at 12.73 oz (G$263.15 dollars), below both its 20 and 50 day moving averages, and only about 2% above its 200 DMA at 12.50 oz (G$258.40). The real test comes about 12.20 oz (G$252.20) where the DiG will meet its uptrend line reigning since August 2013. And my, Oh, my, that Dow in Silver! Since the 892.99 oz (S$1,154.57 silver dollars) high on 1 June, it has imitated those Mexican cliff divers at Acapulco. You can see a chart here, http://bit.ly/TgEJSV Right now it's more oversold on the RSI than it has been since August 2013, so you'd expect a correction. Dow in silver has smashed all its shorter term moving averages and is closing in on the 200 DMA at 790.02 oz (S$1,021.44). More, it has fallen down out of the bearish rising wedge in place since last year. At the risk of repeatedly repeating myself, I remind y'all that the Dow in Gold and Dow in Silver have proven my most reliable indicators. Now they are shouting that the stocks' three year climb against silver and gold has ended. Time to swap stocks for metals. Like Wile E. Coyote hurtling over the brink in a cartoon, the US dollar index windmilled its legs at 80.20 and managed to climb back up on the rocks to an 80.39 close today, up 6 basis points. Range for the last 5 days has been 80.50 to 80.15. A close below 80.30 puts the dollar index at peril of a much longer fall. Today's save, however, inspired little. Closed at 80.39 when the 200 DMA is at 80.38. Triflin'. Euro rose a nothing 0.2% to $1.3606. Yes, it might be curling up for a rally, but not very likely. It's below its 200 DMA and spent all of may losing from $1.3993 to $1.3503. About the best to expect is a dead cat bounce. Yen is knocking its head on the downtrend line, but only managing to hurt its head. Lost 0.2% to 98.10 cents/Y100 today. It's building an even-sided triangle, so not hinting which way it will move. Susan and I had a good time at that wedding in Georgia, but on Sunday we stepped off the asphalt just for a second into some thin grass, and that was enough. We are now serving as bloodbanks for thirsty Georgia red bugs. - Franklin Sanders, The Moneychanger © 2014, The Moneychanger. May not be republished in any form, including electronically, without our express permission. To avoid confusion, please remember that the comments above have a very short time horizon. Always invest with the primary trend. Gold's primary trend is up, targeting at least $3,130.00; silver's primary is up targeting 16:1 gold/silver ratio or $195.66; stocks' primary trend is down, targeting Dow under 2,900 and worth only one ounce of gold or 18 ounces of silver. or 18 ounces of silver. US $ and US$-denominated assets, primary trend down; real estate bubble has burst, primary trend down. WARNING AND DISCLAIMER. Be advised and warned: Do NOT use these commentaries to trade futures contracts. I don't intend them for that or write them with that short term trading outlook. I write them for long-term investors in physical metals. Take them as entertainment, but not as a timing service for futures. NOR do I recommend investing in gold or silver Exchange Trade Funds (ETFs). Those are NOT physical metal and I fear one day one or another may go up in smoke. Unless you can breathe smoke, stay away. Call me paranoid, but the surviving rabbit is wary of traps. NOR do I recommend trading futures options or other leveraged paper gold and silver products. These are not for the inexperienced. NOR do I recommend buying gold and silver on margin or with debt. What DO I recommend? Physical gold and silver coins and bars in your own hands. One final warning: NEVER insert a 747 Jumbo Jet up your nose. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| <b>Gold Price</b> Relative To Monetary Base At All-Time Low :: The Market <b>...</b> Posted: 24 Jun 2014 05:15 AM PDT Commodities / Gold and Silver 2014 Jun 24, 2014 - 10:15 AM GMT By: GoldSilverWorlds

The report discusses in great detail the state of the monetary system. Probably the most important of the ongoing trends is the frightening observation that we arrrived in terra incognita when it comes to our monetary world. This is the result of continuing monetary interventions by central banks around the world. Monetary policy doesn't work like a scalpel, but like a sledgehammer. Superficially, extreme monetary policy stimulus has calmed financial markets overall. The results, in terms of the real economy by contrast, continue to lag behind expectations. The significant bubble in paper assets relative to hard assets is illustrated in the next chart. In spite of substantial volatility, global financial wealth has doubled since 2000 alone. The growth stems primarily from the bond markets. Between 2000 and 2013, the value of outstanding debt securities has almost tripled (from USD 33 trillion to USD 100 trillion). Over the same period, the total capitalization of stock markets has increased by a mere 35% (from USD 49 trillion to USD 66 trillion). The share of gold can also be seen. While it has grown considerably since 2000, it nevertheless remains at an extremely low level. The following chart shows the divergence between money supply growth and the trend in the gold price that has been underway since 2011. It shows the combined balance sheet totals of Federal Reserve, ECB, Bank of England, People's Bank of China and Bank of Japan. Whenever the money supply grows at a faster pace than the supply of physical gold, the gold price should rise and vice versa. The chart shows us that either the gold price has corrected too much, or that central bank balance sheets will stagnate, resp. decline, in the future. Anyone familiar with economic history knows how few precedents of sustained reductions in central bank balance sheets exist. What is already clearly recognizable is that these massive market interventions marked a regime change: while before 2008, a balance between economic growth and moderate price inflation were the focus of central bank efforts, central bankers have in the meantime mutated into slaves of the financial markets. The continual artifices of banking and currency policy appear to have now become a necessity, so as to prolong the continued existence of the fiat debt money system. Japan's Abenomics program is in Ronald Stoeferle's view emblematic for the "Keynesian endgame" currently underway. It is a final desperate attempt to keep a debt dynamic going that must sooner or later collapse. We also see Japan as a harbinger of what the West will soon face as well. A painless way out of this situation is by now unthinkable.

From an economic point of view, the current "lowflation" environment that still prevails, which is characterized by low price inflation and growth figures that largely remain below expectations, has turned out to be a Land of Cockaigne for stock market investors. As long as stimulus does not show up in inflation data, market participants don't fear a drying up of the monetary aphrodisiac. Among investors, the prevailing sentiment is "the crisis was yesterday", and the "Yellen Put" is considered an integral feature of asset allocation decisions in many portfolios. The longer the low interest rate environment continues, the more investors will be pushed toward excessive risk tolerance. The monetary experiments currently underway resemble a walk on a knife's edge. A low rate of inflation can be driven up by brute force through decisive central bank action. Whether the flood of liquidity that is currently put at the banking system's disposal can really be removed in time is more than questionable. In a worst-case scenario, a loss of confidence in the currency may occur that can no longer be reversed. It was said in the 1920s that central bankers were like ships captains who not only refused to learn the basic rules of navigation, but even asserted that they were superfluous. At the moment the impression is that central bankers are attempting to cross the Pacific using a map of the Atlantic. Stoeferle writes it cannot be stated a priori whether inflationary forces will prevail in this power struggle. However, due to existing socio- economic incentive structures, when in doubt, higher price inflation will definitely be preferred over a deflationary adjustment. However, disinflationary forces should not be underestimated. The southern European banking system has not yet been sufficiently recapitalized in the wake of the credit bust and is very reluctant to extend new loans. The preceding credit boom has left a palpable deflationary echo behind. In order to get an idea of the potential inflation in the system, the following illustration shows how large the potential for inflation is which has been "stored up" due to the generous supply of central bank liquidity. To this end we employ the above described logic of the monetarist perspective and assume that the money multiplier and the velocity of circulation normalize. It cannot be ruled out that deflationary effects will intermittently prevail, e.g. due to another banking crisis or a government bankruptcy. A temporary deflationary episode similar to that of 2008, on the road to greater inflation, could well be a realistic scenario. More about the inflation vs deflation war was discussed in great detail in the monetary tectonics chartbook released earlier this year. Since the autumn of 2011, when inflation rates in the US stood at an annual rate of change of more than 4%, we have seen a strong disinflation trend. Since the inflation rate has in the meantime fallen significantly below the official 2-2.5% target, and the trend continues to point down, the Federal Reserve and the ECB have leeway to take countermeasures against the disinflation trend. Should the trend of price inflation reverse, excellent opportunities in inflation-proof investments would present themselves. The gold/silver ratio appears to be useful measure to monitor the disinflation in the system, as evidenced by the following chart. As far as gold is concerned, the report concludes with an analogy of central bankers' behavior to that of a pharmaceutical company that forces the market to take a medication that has never before been clinically tested. Investors should not only focus on the near-term successes of the treatment, but also consider the long-term side effects. The current state of the monetary system and expected continuation of monetary policies by central planners around the world make up for the fundamental case of a gold investment. The In Gold We Trust 2013 report was published on 27 June 2013, just as the anxiety over the metal's declining price trend reached its peak. In hindsight, this date turned out to coincide with a multi-year low. Last year, Ronald Stoeferle came to the conclusion that massive technical damage had been inflicted and that it would take some time to repair the technical picture. That forecast has turned out to be correct, even though the counter-trend move turned out to be significantly weaker than expected. Recent months show clearly that many speculators have given up on the sector. A majority of bulls appear to have thrown in the towel. Volatility and market participant interest have decreased significantly in the last year. From a technical perspective our assumption is that the gold price is near the end of its long consolidation period. The clearly positive CoT data, negative sentiment and not least the recently evident relative strength in gold mining shares all suggest as much. The ongoing consolidation since the all-time high in the late summer of 2011 is important for the bull market's health. The nominal gold price may well appear to be still high, but relative to the monetary base it is actually at an all- time low. In our opinion this is a temporary anomaly which we regard as an excellent entry opportunity. The report shows that gold remains attractively priced relative to stocks and bonds, but also relative to a number of hard assets. Hence, the gold bubble argument often forwarded by pessimists is refuted as well, making the gold investment case even more compelling. In terms of valuation of the gold price based on the monetary valuation model, the degree of gold's monetization relative to the monetary base currently stands at 8%, which represents an all-time low. Confidence in US monetary policy is therefore very high. Very few market participants regard price inflation as an imminent danger. Similarly, valuation of the gold price relative to other asset classes paints a very positive picture. Both in relation to monetary aggregates, as well as to traditional asset classes (stocks and bonds), gold is below the long-term averages. Compared to a selection of "real assets" a number of ratios are above the mean, but remain far from extreme values. Stoeferle is convinced that gold stocks' risk-reward profile is highly asymmetric, i.e., the downside seems limited relative to the potential upside. Creative destruction in the sector is normal and healthy for the long-term. In the course of the market adjustment, mining companies are resetting their priorities: profitability, capital discipline and shareholder value have replaced maximization of production. Moreover, there is currently no other sector that meets with more skepticism from investors. In terms of gold price expectations, it appears that the repair of technical picture is now behind us and that a stable bottom has formed. The next 12 month price target is the USD 1,500 level. Longer term, the author expects a parabolic trend acceleration, with a long-term target of USD 2,300 by the end of the cycle. Furthermore, the report does an outstanding job in covering the following topics

Incrementum Liechtenstein AG | Email: contact@incrementum.li Source - http://goldsilverworlds.com/economy/the-coming-crash-of-the-financial-and-monetary-system/ © 2014 Copyright goldsilverworlds - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors. © 2005-2014 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication. |

| You are subscribed to email updates from gold price - Google Blog Search To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 20 West Kinzie, Chicago IL USA 60610 | |

0 Comment for "Gold price on insane surge after massive trade | MINING.com"