Today's <b>Gold Prices</b> And Gold Investing News - Money Morning |

- Today's <b>Gold Prices</b> And Gold Investing News - Money Morning

- All Silver and <b>Gold Price</b> Indicators are Positive, Both Metals Look <b>...</b>

- The <b>Gold Price</b> Rose $42.90 this Week Closing at $1316.60

- This chart shows mini <b>gold price</b> rally could have legs | MINING.com

- <b>Gold Price</b> Finally Bombed Out :: The Market Oracle :: Financial <b>...</b>

- Silver and <b>Gold Prices</b>: The <b>Gold Price</b> Lost $3.20 to Close at <b>...</b>

| Today's <b>Gold Prices</b> And Gold Investing News - Money Morning Posted: 20 Jun 2014 10:39 PM PDT India drives gold prices, and a recent political shift there has brightened gold's outlook in coming months. Here's what's happening in India that will send gold prices zooming...Gold, silver, and the FOMC meeting today: Precious metal prices were fairly steady Wednesday morning awaiting the typically market-moving statement from the Federal Open Market Committee (FOMC) meeting today. The spot gold price was last trading down $0.90 at $1,271.50. July silver prices were last quoted up $0.003 at $19.735 an ounce. Over the last several years, investors have shown a keen interest in shiny assets as the U.S. Federal Reserve liberally printed money and distrust in dollars grew. But that interest has waned as the Fed slows its bond buying. Now an FOMC meeting can be a strong headwind for gold and silver...Gold shifted higher today (Monday) following recent record lows – our up-to-date gold price chart shows that in late May, gold tumbled to its lowest level in four months, to $1,243.00. Gold for August delivery was up 0.1% at $1,253.90 a troy ounce on the Comex division of the New York Mercantile Exchange. London gold was up 0.1% at $1,253.77 an ounce. Here's the top news affecting the yellow metal right now…Gold mutual funds are gaining attention as a safe-haven investment to hedge against the market volatility 2014 has brought so far. These types of investments are managed by professionals who analyze and monitor the movement of gold and invest accordingly in bullions and equities. Here we examine one method for how to invest in gold, using gold mutual funds. Plus we've highlighted a few to get you started today…Analysts look to the gold price history as a tool to make predictions about the yellow metal's direction. A good place to start when examining the gold price history is the 1970s. Up until the early '70s, gold prices hardly fluctuated by more than a dollar or two. But U.S. President Richard Nixon, who was in office from 1969-1974, decoupled the dollar from gold in 1971 due to various economic pressures. And this had a major effect on where gold went after that…Last week, the gold spot price tumbled to its lowest level in four months, to $1,243.00. Tuesday, the gold spot price hit another four-month low early on, but ended the day hovering around last week's low levels, at $1,245.80. August Comex gold was up $0.90 at $1,245.00 an ounce. Here's what's weighing on the yellow metal – and what to watch that could affect gold prices this week.A new gold ETF, Merk Gold Trust ETV (NYSE ARCA: OUNZ), was launched on May 16, 2014. It seeks to corner an often-neglected part of the investment market: goldbugs who like to hold onto tangible gold. Here's how this new gold ETF works...Today (Friday), gold price per ounce fell under $1,250 an ounce to a 16-week low. Prior to this five-day losing streak, gold price per ounce has been stuck in a tight trading range for weeks, struggling to consistently trade above the key $1,300 an ounce level. Gold futures for August delivery fell by 0.8% to $1,246.50 an ounce this morning on the Comex in New York. And earlier, the price touched on $1,244.50, the lowest for a most-active contract since Feb. 3, according to Bloomberg. Here's what's driving gold price per ounce, and how to play the yellow metal in 2014…Today's gold price was modestly lower Wednesday after Tuesday's rout left the yellow metal at its lowest level in 15 weeks. In morning trading, the most active contract, August Comex gold, slipped $8.40, or 0.67%, at $1257.10. Spot gold was lower by $6.90, or 0.55%, at $1,256.40. So why are gold prices going down today?Barclays Plc (NYSE ADR: BCS) was fined $43.8 million today (Friday) by a U.K. regulatory agency as part of a gold price fix episode back in 2012 . A trader abused Barclays' role as one of the big banks that participates in a twice-daily conference call to set gold prices. He manipulated the price of gold lower to avoid taking a big loss to a customer who had (correctly) bet gold prices would rise. But just because Barclays got caught doesn't mean they are the only member of the gold price fix group that's guilty…Amid a robust rally for U.S. equities, and a slightly hawkish tone in the minutes from the U.S. Federal Reserve's latest meeting, the gold price today (Wednesday) ended with modest losses. June gold have back $4.70 to $1,290 an ounce today. The spot gold price slipped $4.00 to $1,290.75 an ounce. Here are the details.With gold prices at roughly $1,300 an ounce, many investors are asking themselves if now is the time to invest in gold. I think that's the wrong question. What they should be asking themselves is if they can afford not to buy it right now. The case for gold investing has never been more clear - just take a look...If you own gold, or are thinking of buying some, here's something you need to consider... It's not all the same. Some, like fake gold-painted lead ingots, has no value whatsoever. Some gold said to be in storage or in the ground may not even be there at all. There are a number of aspects of gold's quality, whether it's real or even exists, that every investor needs to know... Full StoryGlobal central banks and geopolitical concerns guided gold prices this week - mostly lower. But the price of gold bucked the trend Friday and were modestly higher in morning trading. Read on for a closer look at what's moving gold prices today, and what's ahead in 2014.The gold price rose over the key $1,300 level Friday as tensions in Ukraine once again neared a boiling point. At Friday's close on the Comex, gold for June delivery settled at $1,302.90, up $19.50 for the day, its best close in a month. Spot gold, which traded as high as $1,306 in Friday's session, was last up or $16.70, or 1.3% to $1,302.60, putting the yellow metal on pace for its biggest gain since April 4. Here's what pushed the price higher after four losing sessions for the yellow metal. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| All Silver and <b>Gold Price</b> Indicators are Positive, Both Metals Look <b>...</b> Posted: 18 Jun 2014 05:39 PM PDT

What's interesting is that despite a dull day, here at the end both metals are tugging at their leashes. The GOLD PRICE stands at $1,275.90. The SILVER PRICE was 1984 cents when I plugged in my prices, but it's risen to 1993c now. Just looking at those charts, I'd be more comfortable buying on a pullback tomorrow, but if silver pushes through 2000c and gold through $1,285, there won't be any pullback. Both silver and gold prices have me chompin' at the bit. Indicators are all positive, and both look ready to sprint. The Federal Reserve's Federal Open Market Committee met again and announced another $10 billion monthly taper & mumbled about interest rates but placed the time at some far distant future not specified or even hinted at. Same old song and dance. A friend sent me a Bloomberg article you'll find at http://bloom.bg/1jtlVqC "Bonds' Liquidity Threat is Revealed in Derivatives Explosion." Stripping out the technical stuff, bond markets are becoming illiquid making it very difficult for traders to sell in case of a crisis, so traders are turning more to trading derivatives. It sounds as if central bank bond buying and interest rate suppression is painting the banks into the corner as their policies disrupt the markets they rely on to manipulate interest rates and money. Let me see if I can squeeze out a tear here. hmmmm. Nope. Dry's a bone. US dollar index waxed volatile under pressure of the FOMC statement. Didn't know whether to go up or down, but settled on dropping 18 basis points (0.23%) to 80.53. It managed a high at 80.97, challenging that 81 resistance, then wilted like an orchid in the Mojave Desert, & even closed below its 20 DMA (80.54). It has been trading above its 200 day moving average, but that's nearby at 80.42. 'Twill tumble if it steps over that line. Euro was encouraged by the Dollar's woes and rose 0.33% to $1.3548. Almost reached its $1.3602 two hundred day moving average. Must prove a rally by rising again tomorrow. Yen rose 0.26% also to 98.13, but remains below the downtrend line from its May high, and locked in the same old range. Just ponder for a moment. Suppose you had a friend in the Fed who 24 hours before, or even 2 hours before, the FOMC announcement could whisper to you what the FOMC would announce. Do you think you could make any money trading stocks? Fed's announcement that it would continue wrecking the US economy by suppressing interest rates sparked jubilation on Wall Street, where it seems nobody thinks much farther out than 20 minutes. Dow rose 98.13 (0.58%) to 16,906.62. S&P500 jumped 14.99 (0.77%) to a new all-time high close at 1956.98. Dow's close was not near a new high, but Nasdaq Composite is, and Nasdaq 100 already has made new highs. Russell 2000 isn't close, but the Wilshire 5000 made a new high. That looks a little like the cats & dogs flying toward the end of a move (lower grade stocks tend to outperform toward the end of a rally). Now it gets interesting. Today the Dow in Gold rose while the Dow in silver kept on falling, even through its 50 day moving average (853.75 oz or S$1,103.84 silver dollars). Dow in gold didn't rise much, 0.12%, and ended at 13.23 oz (G$273.49 gold dollars), barely below its 20 DMA. Dow in silver fell 0.15% to 849.79 oz (S$1,098.72). This catches my eye because, as y'all will remember, I have not been expecting the Dow in Silver to exceed 912 oz (S$1,179.15) at this top. The high at 892.99 oz (S$1,154.57) June 1 might have been THE top, and today's fall below the 50 DMA certainly supports that conclusion. Remember, when these two indicators top, it won't matter two hoots & a holler what stocks are doing, because even if they are rising silver & gold prices will be rising faster. - Franklin Sanders, The Moneychanger © 2014, The Moneychanger. May not be republished in any form, including electronically, without our express permission. To avoid confusion, please remember that the comments above have a very short time horizon. Always invest with the primary trend. Gold's primary trend is up, targeting at least $3,130.00; silver's primary is up targeting 16:1 gold/silver ratio or $195.66; stocks' primary trend is down, targeting Dow under 2,900 and worth only one ounce of gold or 18 ounces of silver. or 18 ounces of silver. US $ and US$-denominated assets, primary trend down; real estate bubble has burst, primary trend down. WARNING AND DISCLAIMER. Be advised and warned: Do NOT use these commentaries to trade futures contracts. I don't intend them for that or write them with that short term trading outlook. I write them for long-term investors in physical metals. Take them as entertainment, but not as a timing service for futures. NOR do I recommend investing in gold or silver Exchange Trade Funds (ETFs). Those are NOT physical metal and I fear one day one or another may go up in smoke. Unless you can breathe smoke, stay away. Call me paranoid, but the surviving rabbit is wary of traps. NOR do I recommend trading futures options or other leveraged paper gold and silver products. These are not for the inexperienced. NOR do I recommend buying gold and silver on margin or with debt. What DO I recommend? Physical gold and silver coins and bars in your own hands. One final warning: NEVER insert a 747 Jumbo Jet up your nose. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| The <b>Gold Price</b> Rose $42.90 this Week Closing at $1316.60 Posted: 20 Jun 2014 05:44 PM PDT

Y'all enjoy your weekend. Aurum et argentum comparenda sunt -- -- Gold and silver must be bought. - Franklin Sanders, The Moneychanger © 2014, The Moneychanger. May not be republished in any form, including electronically, without our express permission. To avoid confusion, please remember that the comments above have a very short time horizon. Always invest with the primary trend. Gold's primary trend is up, targeting at least $3,130.00; silver's primary is up targeting 16:1 gold/silver ratio or $195.66; stocks' primary trend is down, targeting Dow under 2,900 and worth only one ounce of gold or 18 ounces of silver. or 18 ounces of silver. US $ and US$-denominated assets, primary trend down; real estate bubble has burst, primary trend down. WARNING AND DISCLAIMER. Be advised and warned: Do NOT use these commentaries to trade futures contracts. I don't intend them for that or write them with that short term trading outlook. I write them for long-term investors in physical metals. Take them as entertainment, but not as a timing service for futures. NOR do I recommend investing in gold or silver Exchange Trade Funds (ETFs). Those are NOT physical metal and I fear one day one or another may go up in smoke. Unless you can breathe smoke, stay away. Call me paranoid, but the surviving rabbit is wary of traps. NOR do I recommend trading futures options or other leveraged paper gold and silver products. These are not for the inexperienced. NOR do I recommend buying gold and silver on margin or with debt. What DO I recommend? Physical gold and silver coins and bars in your own hands. One final warning: NEVER insert a 747 Jumbo Jet up your nose. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

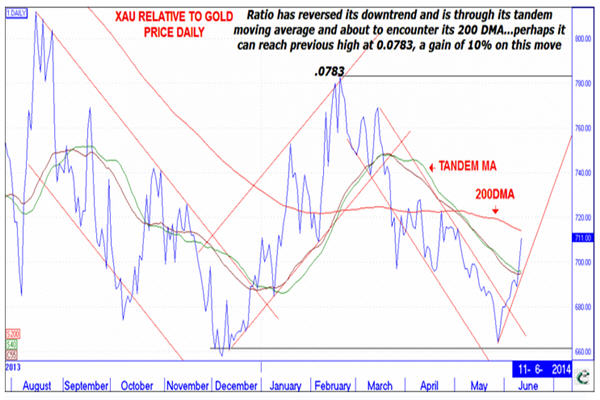

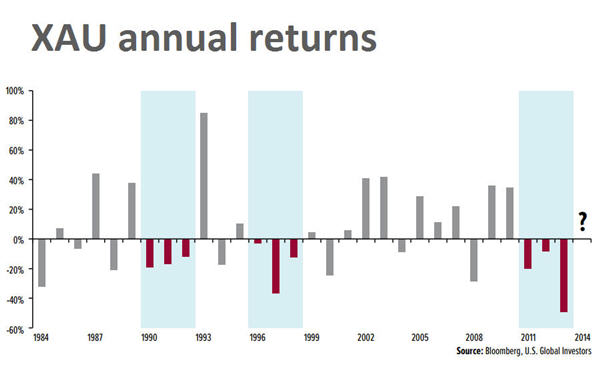

| This chart shows mini <b>gold price</b> rally could have legs | MINING.com Posted: 12 Jun 2014 02:39 PM PDT The gold price jumped to a near three week high on Thursday, buoyed by safe haven buying following outbreak of violence in Iraq and disappointing economic news out of the US. On the Comex division of the New York Mercantile Exchange, gold futures for August delivery in afternoon trade exchanged hands for $1,274.20 an ounce, up $13 or 1% from Wedensday's trading session and near its highs for the day. Technical research and investment blog InvesTRAC passed on this price graph to MINING.com showing how the Philadelphia Gold & Silver Index (INDEXNASDAQ:XAU) of top precious metal stocks can act as a leading indicator of the gold price: The XAU index rises faster than rising prices of gold and silver and falls faster than declining prices of gold and silver. And over the past week or so the metals and the XAU have been rising with the XAU rising faster. In fact InvesTRAC's OB/OS indicator (0-100 scale) is rising at 8.7 which suggests a good deal of upside potential before becoming overbought…InvesTRAC's forecaster is showing high June 16, low 27 and high July 8…let's look at the daily chart below which shows that the XAU/GOLD PRICE ratio has pushed up through its declining upper channel line and is through the tandem moving average…it is about to encounter its 200 day moving average with the potential to rise to the previous top at 0.0783 which is 10 per cent higher than the current level. What I like about the chart is that the ratio is bouncing off its previous low which implies further upside potential.  Source: InvesTRAC Back in February, firm US Global Investors also used the performance of the XAU index which thanks to its long existence has turned out to be a good predictor of trends. The boutique investment argued that shares in precious metals miners were approaching "the historical limits of multi-year declines" pointing out that over the last three decades there has never been a period where gold and silver stocks have declined four years in row. So far this rule of thumb is holding up: XAU is up 9% so far this year. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| <b>Gold Price</b> Finally Bombed Out :: The Market Oracle :: Financial <b>...</b> Posted: 14 Jun 2014 06:44 AM PDT Commodities / Gold and Silver 2014 Jun 14, 2014 - 12:44 PM GMT By: Aden_Forecast

Safe Haven?First, gold entered a seasonally slow period. This could last for another month or so but seasonality alone doesn't explain why the decline was so steep and sudden. More impressive, gold's safe haven appeal has diminished somewhat. Following the Ukraine elections, for instance, concerns eased. But with Iraq now heating up, gold could continue its current rebound rise. The Technical PictureMeanwhile, gold had strong support at $1280. This level had been tested several times but it clearly broke. This means gold will probably continue to hold above the $1200 area. It also suggests gold could continue forming a head and shoulders bottom (see LS, H, RS on Chart 1). Plus, there are growing signs indicating this could end up being the bottom for this decline, which has been in force since 2011- 12. Looking at gold's big picture since 1968, you'll see what we mean. Chart 2A shows that gold's decline of the last few years looks small in the big picture, within the mega uptrending channel since 1968. Note that gold has had two major bull markets, in the 1970s and in the 2000s. The major rise in the 70s didn't break its bull market red uptrend until 1984, several years after the peak in 1980. The bull market red uptrend since 2001, however, is still intact. On a big picture basis, it'll be important to see if this trend holds. That is, as long as gold stays above the lows of last year, at $1210, this trend will stay solid. And according to gold's leading long term indicator (B), it's saying that gold remains at an extreme low area... In fact, this is the lowest it's been since the 1980s. Since these low areas tend to coincide with bottoms in the gold price, this tells us that gold is totally bombed out and the lows of last year are unlikely to be broken. This doesn't mean gold will soar from here. Eventually yes, but for now we could see more backing and filling. All things considered, it looks more like 2015 could be the year of a strong change to the upside. Deflation Gaining MomentumOne important reason why is because deflationary pressures have been intensifying. Although there has been some improvement, global economies remain sluggish, despite massive stimulus efforts from the biggest central banks in the world. This suggests that stimulus measures will likely continue in order to boost the global economies. And even though these measures may eventually cause inflation, the current economic sluggishness is stubborn and it's feeding deflation. Our inflation-deflation barometer is an indicator that measures rising inflation against falling deflation by using a ratio between gold and bonds. Historically, gold has been used to measure inflation and bonds have measured deflation. Chart 3 shows the ratio of the two since 2003. Notice the steady rise in gold (inflation) against bonds (deflation) through 2011. Moreover, after the 2011 peak in gold, bonds began to strengthen against gold and they've continued to be stronger since then. In other words, we could still see bonds strengthen even more against gold in the months ahead. This would coincide with a sluggish economic outlook. But again, that may not be the case for long. Silver is CheapAt the same time, silver is super cheap. It's also cheap compared to most of the other markets. Demand for silver is also very good. A recent report said that physical demand rose to a record last year. This growing demand ties in well with the technical situation in silver. It too is bombed out and, like gold, it'll likely head higher in the upcoming months. By Mary Anne & Pamela Aden Mary Anne & Pamela Aden are well known analysts and editors of The Aden Forecast, a market newsletter providing specific forecasts and recommendations on gold, stocks, interest rates and the other major markets. For more information, go to www.adenforecast.com © 2005-2014 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Silver and <b>Gold Prices</b>: The <b>Gold Price</b> Lost $3.20 to Close at <b>...</b> Posted: 17 Jun 2014 05:48 PM PDT

Both the silver and GOLD PRICE daily charts are a bit ambiguous. Both might have finished a correction, but more likely is one more leg down. Looking past the Comex to trading the whole day, the gold price closed unchanged although during the day it dipped below its 20 Dma ($1,265.21). Low came at $1,258, high at $1,275.50, so it closed nearer the high. The gold price still must batter down the gate at $1,280 resistance, but more importantly, the 200 DMA at $1,290.60. These are the first baby steps. Beyond that the gold price must pull on those seven league boots and step out over $1,305, then $1,315 (May's High) and most important, $1,331.40 (April's high). All momentum indicators are positive with plenty of room to climb. The SILVER PRICE touched back to its 50 DMA (1942c) today, then closed near the 1977c high. Low came at 1943c. I'm nothing but a nacheral born durned fool, but this looks like a strong rally to me. Determined. I'll feel chipper as can be as long as silver stays above 1950c. Over 2050c, it will begin to run. Not coincidentally, the 200 DMA stands at 2052c. On the Burning Platform there's an especially good article, "Fourth Turn Accelerating." It's a little long, but the overview of our present condition economically, socially, and politically is quite thorough and insightful. It will make connections in your mind. Look at http://bit.ly/1qpqKJ3 Looks like the War Party (Republican/Democrat) is beginning to beat the drums for another war in Iraq, charging that somehow Iraqi rebels pose a threat to the US. With the lumbering US economy in trouble, war offers an easy political out. And it increases demand, for stuff that blows up and therefore has to be re-ordered over and over. Good for GDP, bad for people and other living things. Although it gained 17 basis points (0.2%) today and closed at 80.71, the US dollar index has only been dancing sideways for the last three days. Until it closes above 81, the dollar's intentions remain suspect. If it can clear 81, it will run at least to 81.50, maybe higher. Euro changed its mind again today and fell 0.2% to $1.3546. It ought to stage at least a little snap-back rally here, but if it falls through $1.3500 first, it's cooked -- clean through. Yen lost 0.32% to 97.88. Remains in the same rangebound track between 99 and 96, and until it beats one of those numbers will keep on snoozing. Ten year Treasury yield today hit and closed at its downtrend line from the year's opening. Closed at 2.655%. Any higher close tomorrow confirms a breakout, and a close above the 200 day moving average at 2.714% turns the yield -- and with it other interest rates -- up. Remember this comparison: Higher Interest Rates are to Janet Yellen as crucifixes are to Count Dracula. Today's little gains in stocks proved nothing. S&P500 and Dow are both hovering above their 20 DMAs. Dow rose 27.48 (0.16%) to 16,808.49 while the S&P500 augmented by 4.21 (0.22%) to 1,941.99. Dow in Gold rose a negligible 0.16% to 13.22 oz (G$273.28 gold dollars), with the 20 DMA at 13.23 oz (G$273.49). Excitement reigned in the Dow in Silver however, where a lethargic 0.29% drop to 851.06 oz (S$1,100.36 silver dollars) took the DiS down below the 50 DA (853.11 or S$1,103.01) It has already broken down through the 20 DMA, which on the advance from March had served as the safety net under it. Much more downside and I'll be forced to declare the Dow in Silver knocked out. - Franklin Sanders, The Moneychanger © 2014, The Moneychanger. May not be republished in any form, including electronically, without our express permission. To avoid confusion, please remember that the comments above have a very short time horizon. Always invest with the primary trend. Gold's primary trend is up, targeting at least $3,130.00; silver's primary is up targeting 16:1 gold/silver ratio or $195.66; stocks' primary trend is down, targeting Dow under 2,900 and worth only one ounce of gold or 18 ounces of silver. or 18 ounces of silver. US $ and US$-denominated assets, primary trend down; real estate bubble has burst, primary trend down. WARNING AND DISCLAIMER. Be advised and warned: Do NOT use these commentaries to trade futures contracts. I don't intend them for that or write them with that short term trading outlook. I write them for long-term investors in physical metals. Take them as entertainment, but not as a timing service for futures. NOR do I recommend investing in gold or silver Exchange Trade Funds (ETFs). Those are NOT physical metal and I fear one day one or another may go up in smoke. Unless you can breathe smoke, stay away. Call me paranoid, but the surviving rabbit is wary of traps. NOR do I recommend trading futures options or other leveraged paper gold and silver products. These are not for the inexperienced. NOR do I recommend buying gold and silver on margin or with debt. What DO I recommend? Physical gold and silver coins and bars in your own hands. One final warning: NEVER insert a 747 Jumbo Jet up your nose. |

| You are subscribed to email updates from gold price - Google Blog Search To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 20 West Kinzie, Chicago IL USA 60610 | |

1 Comment for "Today's Gold Prices And Gold Investing News - Money Morning"

Thanks for this article very helpful. thanks.

Goldkaufen Kassel