<b>Gold price</b> on insane surge after massive trade | MINING.com |

- <b>Gold price</b> on insane surge after massive trade | MINING.com

- <b>Gold price</b> breakout sparks massive move into mining stocks <b>...</b>

- <b>Gold Price</b> Stabilises Above 1,300 As Energy Shock Risk Remains <b>...</b>

- Few Believe <b>Gold Price</b> Can Shine :: The Market Oracle :: Financial <b>...</b>

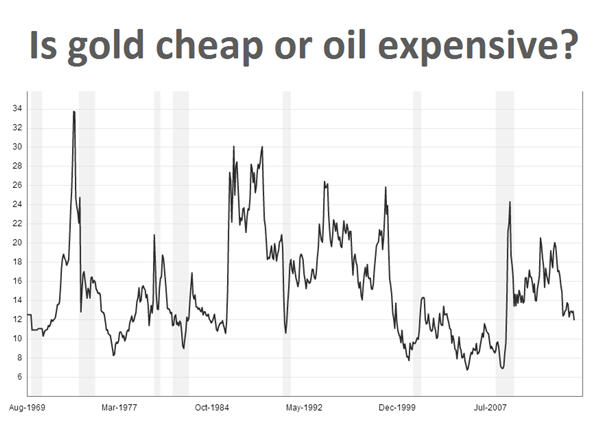

| <b>Gold price</b> on insane surge after massive trade | MINING.com Posted: 19 Jun 2014 10:39 AM PDT The gold price scaled $1,300 an ounce for the first time in more than a month, after comments by US Federal Reserve chair Janet Yellen yesterday and a huge buyer lit a fire under traders. On the Comex division of the New York Mercantile Exchange, gold futures for August delivery – the most active contract – jumped to a day high of $1,322.00 an ounce, up $49.30 or nearly 4% from yesterday's close. After months of subdued trade on gold futures markets volumes surged on Thursday leaping past 210,000 contracts – double recent daily averages – by mid-afternoon. As the chart shows, after a steady climb throughout the morning, during lunchtime volumes suddenly spiked with more than 2.9 million ounces (90 tonnes) changing hands in three big chunks in the space of 15 minutes. Gold built on its gains from there to settle at $1,320.40, the the best one day performance for the metal since September last year. The chart looks almost like the inverse of the trading pattern on April 15 this year when exactly year to the day of 2013's $200 shocker another strange gold price plunge occurred. Gold's positive move started yesterday after Yellen, speaking at the latest meeting of the Fed's interest rate committee, said she was comfortable interest rates could stay low for a considerable period, which sent the dollar tumbling against the euro and pound sterling. Gold and the US dollar usually moves in the opposite directions and gold's perceived status as a hedge against inflation is also burnished when central banks flood markets with money. Monetary expansion, particularly since the financial crisis, has been a massive boon for the gold price. Gold was trading around $830 an ounce when previous chairman Ben Bernanke announced the first program of quantitative easing in November 2008. The QE program together with other stimulus measures saw the balance sheet of the Fed cross the $4 trillion mark in January, up 400% in seven years. The US has not been alone in printing money and together with the Bank of Japan, the European Central Bank and the Bank of England, more than $15 trillion of easy money is now sloshing around in the system. Earlier this month the ECB took the unprecedented step of moving rates into negative territory. Gold was also pushed higher through safe haven buying as the deteriorating situation in Iraq sends oil prices rising. Benchmark West Texas Intermediate traded higher again on Thursday to reach $106.70 a barrel. Looking at the ratio between the gold price and the oil price which usually rise in tandem (rising oil prices pushes up inflation increasing demand for gold as a hedge), gold looks undervalued by comparison. Since 1970 the average ratio – how many barrels of oil can be bought with one ounce of gold – is 15 compared with 12 now, which suggests that gold is cheap compared to oil. The last time the ratio was at 12 was at the height of the global financial crisis in October-November 2008. The price of gold slid close to 28% in 2013 – the worst annual performance since 1980 – in anticipation of an end to the ultra-loose monetary policy, but has enjoyed double digit gains in 2013. |

| <b>Gold price</b> breakout sparks massive move into mining stocks <b>...</b> Posted: 19 Jun 2014 02:37 PM PDT Gold ended the day at its high of $1,320 an ounce on Thursday, fighting back from lows of $1.244 at the beginning of this month. The metal is up 10% in value this year. The silver price jumped nearly 5%, climbing back above $20 an ounce for the first time in two months. Gold's positive momentum sparked heavy buying of gold counters with the Market Vectors Gold Miners ETF (NYSEARCA:GDX), holding stock in the world's top gold miners, soaring 5.4% bringing its gains so far this year to 23.5%. The bellwether for the industry for decades The Philadelphia Gold & Silver Index (INDEXNASDAQ:XAU) gained 5% and is back to levels last seen in March when gold hit a 2014 high of $1,379 an ounce. By the close on Thursday, Barrick Gold Corp (NYSE:ABX, TSE:ABX) was up 3.2% with 4.3 million shares changing hands, more than double usual volumes for the world's number one producer of the metal. It was revealed earlier this week the company has been in talks about about possible partnerships with China's largest gold producer, China National Gold. The state-owned giant with nearly 50 operating gold mines in the country said it's actively looking at acquisition in gold, silver and copper companies around the world as it embarks on an expansion drive. Co-operation with Barrick would not include the the Toronto-based miner's Pascua Lama projecton the border between Chile and Argentina which is the subject of a number of class-action lawsuits. The class actions allege that Barrick Gold shareholders lost billions of dollars as a result of Barrick's "misrepresentations and failures" regarding the stalled project. The < href="http://redirect.viglink.com?key=11fe087258b6fc0532a5ccfc924805c0&u=http%3A%2F%2Fwww.mining.com%2Fbarrick-talking-to-new-chile-mines-minister-to-restart-pascua-lama-60443%2F">technically and politically challenging project high in the Andes launched in 2006 (initial capex costs were pegged at $1.5 billion but has now ballooned to $8.5 billion) suffered a number of defeats in Chilean courts about water use and the impact on glaciers in the area. Barrick which will produce roughly 7 million ounces of gold in 2014 is now worth $22.7 billion on the TSX, compared to its peers up a relatively modest 4% in 2014. Barrick shares struck 21-year lows in July last year after peaking at a $54 billion market value in 2011. Newmont Mining Corp (NYSE:NEM) with a market value of $12.3 billion also gained more than 3% with a whopping 12 million shares changing hands. Talks in April between Newmont and Barrick about a possible merger ended acrimoniously with both sides going public with unflattering comments about incompatible corporate cultures. The world's third largest gold producer behind Newmont, AngloGold Ashanti (NYSE:AU) jumped 4.8% in Thursday trade. The Johannesburg-based company's ADRs listed in New York is up a whopping 46% this year after first-quarter results showed a turnaround in operations with production of 1 million oz at a total cash cost of industry-beating $770/oz. Goldcorp (TSE:G) added $1 billion to its market value, surging 4.7% in heavy volumes of 4.4 million shares. The Vancouver-based company is widening the gap to its peers as the world's most valuable gold stock after a 28.7% gain in market capitalization to $24.1 billion this year. Goldcorp is expected to produce around 3 million ounces of gold this year and was praised by investors for walking away from a hostile takeover of fellow Canadian gold miner Osisko (TSE:OSK). Osisko found white knights in the form of Yamana Gold (TSE:YRI) and Agnico Eagle Mines (TSE:AEM) which will now jointly own 100% of the Montreal firm and take over operation of the company's only operating mine, the Canadian Malartic in Quebec. Yamana which is forecast to produce 1.4 million ounces this year, gained 5.6% on Thursday, while Agnico Eagle Mines (TSX:AEM) traded just under 5% for the better. The bidding for Osisko boosted the stock 83% this year for a market value of $3.8 billion ahead of its delisting on Monday. Malartic will produce nearly 600,000 ounces this year. Toronto-based Yamana is worth $7.1 billion and Agnico $7 billion making the acquirers the globe's seventh and eighth most valuable listed gold miners. Yamana shares are up 3% year to date, while Agnico has soared more than 40%. Toronto's Kinross Gold (TSX:K) increased 5.5% on the day but has only managed 3.2% upside in 2014 over worries about the impact on the company's operating mines in Russia amid the tensions over Ukraine. Kinross is worth a good $1.5 billion less than Yamana, despite being forecast to produce some 1.3 million ounces more than Yamana this year. Canada's Eldorado Gold Corp (TSX:ELD) was the best performer on the day with a 8.5% bounce. Eldorado is close to starting up a mine in Romania and also operates in China, Turkey and Greece with a target of 1.4 million ounces this year. South African miner Gold Fields (NYSE:GFI) continued its turnaround adding 5.2% in New York. The Johannesburg-based firm which is expected to mine 2 million ounces this year is up 20% in 2014 after a dismal performance last year when in a contrarian move its picked up some of Barrick's Australian operations. Randgold Resources ADR's trading on the Nasdaq (LON:RSS, NASDAQ:GOLD) jumped 4.2% and is up 31% this year as its massive new Kibali mine in the Democratic Republic of Congo (DRC) exceeds expectations. Africa-focused Randgold has become something of an investors' favourite with the company valued at some $7.7 billion in London, as it rapidly ramps up production in 2014 to around 1.2 million ounces and boosts it projects in the pipeline. Based on the sector's performance today many investors are choosing to ignore the advice of investment bank Citigroup which last month warned punter not to buy gold stocks no matter how tempting valuations had become. |

| <b>Gold Price</b> Stabilises Above 1,300 As Energy Shock Risk Remains <b>...</b> Posted: 23 Jun 2014 04:48 AM PDT by GoldCore Today's AM fix was USD 1,313.50, EUR 967.02 and GBP 771.51 per ounce. Gold fell $8.40 or 0.64% Friday to $1,311.30 per ounce and silver slipped $0.05 or 0.24% to 20.65 per ounce near 3pm EST. Gold and silver were up 3.33% and 6.58% for the week. Gold price stabilises above 1,300 as energy shock risk remains. The speed with which insurgents threatened Iraqi Oil production has stunned many analysts and underscored the fragile nature of energy exports from politically unstable regions. Oil prices are now trading at a the highest level since September trading in London at $115.66 a barrel. The move by insurgents has also made a mockery of the U.S. administration's policies in Iraq, which seems to be plagued by intransigence, nepotism and corruption. With large swathes of Iraqi people excluded from the political process on the basis of religious and tribal affiliation it is little wonder that a group such as ISIS found the necessary support to field an army and take such enormous territory and is now threatening the capital. It is also telling that the U.S. seemed wholly unprepared for such an event as it would seem that all stakeholders were caught flat footed. The fact that the "response" being considered is a joint effort with Iran (remember the axis of e-eeeevil"), rings of desperation.

Low Interest Rates are good for gold bullion, India mulls cutting tax on gold imports. Recent steps taken by the ECB, with the introduction of negative interest rates, and dovish comments from Yellen have underscored a low rate accommodative monetary policy for the foreseeable future. Professional gold investors may now look at gold as being attractive from a potential risk on trade perspective and be able to finance such purchases with low financing costs. The Hindustan Times reports today that India's battle to reduces its Current Account Deficit has been largely successful and the government is preparing to reduce the tax on imports and remove some of the restrictions that meant that 20% of what was imported must then be exported. India's imports of gold fell, circa 245 tonnes, in 2013 – 2014 from the year previous. If the report proves to be accurate extra demand for gold from India could drive gold prices far higher. 28 Total Views 28 Views Today |

| Few Believe <b>Gold Price</b> Can Shine :: The Market Oracle :: Financial <b>...</b> Posted: 23 Jun 2014 12:10 PM PDT Commodities / Gold and Silver 2014 Jun 23, 2014 - 09:10 PM GMT By: Submissions

This is just a small sampling of sentiment, but I think it's telling. We've had a 3 year bear market in Gold that has battered and beaten the bulls into complete submission. All speculative interest and fond memories of the past bull market have been completely erased. This lack of interest was evident in the recent 3rd test of the bear market low – the volume and volatility was much lower than during the first two retests. The bear market has achieved its goal – to clear sentiment on a longer timeframes and lay the foundation for a real change in trend. The view of Gold and its sentiment on longer timeframes is a picture perfect example of the ebb & flow of Cycles. The $40 "recognition day" last week was obviously more than enough confirmation to declare a new Daily Cycle (Daily Cycle is 24-28 trading days), but it was powerful enough for declaration of a new Investor Cycle (Investor Cycle is 22-26 Weeks) as well. This is the development we've patiently waited for. However, on shorter time frames, Gold has pushed the Daily Cycle into an extremely overbought state, so a $20 or more retracement is possible. This is only a problem for short term traders; a decision to take a new position now at such overbought levels could mean entering just as the market cools off. Nobody ever said that trading is easy, and determining when to enter a fast-moving asset is a frequent dilemma. Getting the trend right is only part of the challenge. Gold's 1st Daily Cycle typically rallies until day 18-20 before topping, so on day 13 here we're likely to see another push higher before Gold turns down into its 1st Cycle Low. There is no way of knowing how powerful the remainder of the Cycle will be, but the average 1st Daily Cycle adds 10%. If that happens this time, Gold will top at around $1,364. While the prescious metals Miners are looking good, Silver looks potentially explosive. Traders were caught flat footed and overly short, as is often the case at Investor Cycle Lows. The current 5% surge has come primarily on short covering, and Silver's massive short position will need to be reversed. The process of unwinding has only just begun, and it should provide enough fuel for Silver to move closer to the $23 level. Beyond short covering, speculators will determine where Silver eventually tops. If price continues to rise, speculators should begin to jump on the bandwagon and it will be interesting to see how far Silver gets pushed in the current Investor Cycle. From a historical standpoint, it's very common to see Silver rally at least 20% – and typically close to 30% – in any given Investor Cycle. In some cases, it did so while overbought for almost the entire move. A similar move now would put Silver near $26, a level that tests former support. I hope people keep their emotions contained while seeing these potential price projections. I'm not a believer in picking targets, especially ones 20%-30% above current levels, because doing so can serve to fuel a trader's bias while diverting focus from the price action at hand. It can also encourage a "can't lose" mentality and a tendency to over-trade or overleverage a move. This can lead to being whipsawed out of positions and to undue stress even as positions do well. Trading is more about execution that anything else, and proper timing (Cycles) of the markets is a key to success. From an Investor Cycle standpoint, we've yet to break the bear market trend-line. That's OK, because Gold is the slowest in this sector to react and it's only 14 days into what should be a 6 month Cycle. What a new Investor Cycle shows, however, is the potential ahead – a normal Investor Cycle can add up to 20% in gains before topping out. From a technical standpoint, the $1,500 area stands out as a potential top for Gold's coming move. At $1,500, Gold would test a key bear market resistance level and the point where bulls unsuccessfully mounted a defense. For the investors who trade on the Investor Cycle timeframe, we've finally got the turn and confirmation we've patiently waited for. All of that said, however, please remember that in investing, there are no guarantees. I will never stop repeating this phrase. But with a confirmed new Investor Cycle in play, the odds have dramatically shifted and the bulls should now be calling the action. The Financial Tap publishes two member reports per week, a weekly premium report and a midweek market update report. The reports cover the movements and trading opportunities of the Gold, S&P, Oil, $USD, and US Bond Cycles. Along with these reports, members enjoy access to two different portfolios and trade alerts. Both portfolios trade on varying timeframes (from days, weeks, to months), there is a portfolio to suit all member preferences. You're just 1 minute away from profitable trades! please visit http://thefinancialtap.com/landing/try# By Bob Loukas © Copyright Bob Loukas 2014 Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors. © 2005-2014 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication. |

| You are subscribed to email updates from gold price - Google Blog Search To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 20 West Kinzie, Chicago IL USA 60610 | |

0 Comment for "Gold price on insane surge after massive trade | MINING.com"