US manufacturing data sends gold price higher |

- US manufacturing data sends gold price higher

- CHART: Gold was actually least volatile metal during past decade

- Will your gold juniors make it to summer?

- South Africa Grindrod to build copper railway in Zambia

- More than mining: Anglo sets up trading arm

- Water filtration company targeting estimated $1 trillion worth of precious metals sitting in old mining sites

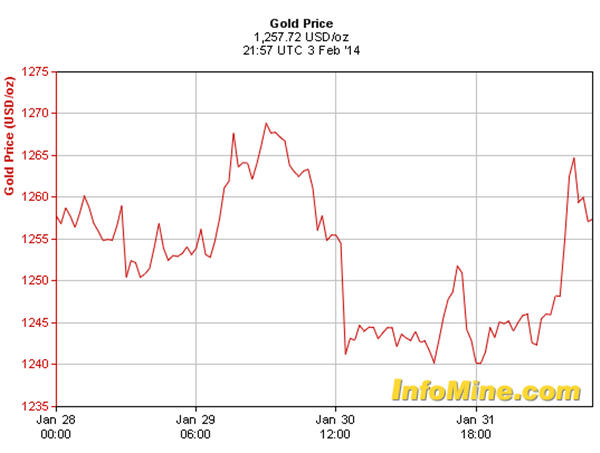

| US manufacturing data sends gold price higher Posted: 03 Feb 2014 02:15 PM PST The gold price had another good Monday after gaining more than $20 for a spot price of $1,264 by noon. The morning boost simmered to $1,257 by closing. Last Monday the precious metal's spot price had a similar rally, though it reached nearly $1,270 that day. Futures trading also rose sharply: Gold for April delivery - the most active contract - gained $18 to $1,257 on the NYMEX, nearly making up for last week's drop. Gold bugs have the US economy to thank for the gains after the Institute for Supply Management (ISM) reported a Purchasing Managers Index (PMI) of 51.3% – down 5.3% from December's seasonally adjusted reading of 56.5%. This level is still above the magic 50% mark which distinguishes economic expansion from contraction. The PMI – which is based on a survey of manufacturing supply managers – is considered an important indicator of the health of the US economy. The ISM's report also noted that the manufacturing sector expanded for the eighth consecutive month in January. George Gero, a vice president and metals strategist with RBC Capital Markets told the Wall Street Journal that some of the buying was from automatic buy orders triggered by gold's rise above $1.250 per ounce. |

| CHART: Gold was actually least volatile metal during past decade Posted: 03 Feb 2014 01:53 PM PST Investment firm US Global Investors has put together a neat new interactive chart of the price of different commodities over the last decade. It shows just what a fickle market commodities can be with wild price swings from year to year. While natural gas was not surprisingly the worst performer over the last decade, and top honours go to palladium's showing since January 2004, some of the price movements in metals are unexpected when displayed in this way. In 2013 investors in gold suffered their worst year since 1980 as the price plunged more than 28% and gold was also twice the best performing commodity over the last decade. Yet year-to-year price swing in gold made it the least volatile of all commodities, although its relationship with silver is pretty stormy: Those hoping for a pick-up in the price thanks to top producer Indonesia's intervention in the market would probably already know that the prize for the most volatile of all commodities this past decade goes to nickel: Copper, long thought of as the bellwether for the the metals sector, has had its ups and downs as well over the years as well, going from a 56% loss in 2008 to a stomach churning 153% gain the following year: Click here for the US Global Investors Commodity Periodic Table |

| Will your gold juniors make it to summer? Posted: 03 Feb 2014 12:26 PM PST "These are sobering times," Michael Kosowan told a Cambridge House audience in Vancouver on January 20th. Michael has worked for Rick Rule at Sprott Global Resource Investments Ltd. for 13 years and is now located in Sprott's Toronto office. Like Rick, he has made a fortune for himself betting on contrarian ideas in bear markets… But Michael has a warning about 2014 in his speech below… There has been a collective exhale as the mining sector began 2014, marching into the New Year with a strong up move in gold and high hopes of a recovery. Although there have been a few bright spots as gold reached $1,275 by January 26, the 'bonfire of the juniors' has yet to occur. Endangered companies fight tooth and nail merely to survive. There are just too many companies out there with too little cash. According to John Kaiser, a mining analyst who has been following the sector for over 25 years, 1,025 companies out of a possible 1,770 trade below 10 cents a share while 817 of these companies have less than $200,000 left in capital.1 So What's Coming? The big crisis point could come in April and May of this year when the audited financials must be filed with SEDAR. Credit that was extended in 2013 is unlikely to be extended in 2014, forcing management to dig into their own pockets which could precipitate a flurry of de-listings. The current economic reality has fashioned a quality-control system, albeit somewhat crude and often brutal. The inherently weak or flawed juniors will likely be removed, leaving a leaner and fitter sector that will be easier to navigate. The very first to go will be the ones that never should have made it to the party in the first place – those built on dreams of a get rich quick scheme, usually by ambitious but misguided geologists without enough experience. They will not be easily saved through mergers and acquisitions either. Most seniors have frozen their M&A activity following an abysmal year of heart-wrenching write-downs and impairments. The seniors remain timid and many will be licking their wounds for a while, even though the damage to their balance sheets is self-inflicted. Overall, they are not taking advantage of the lower prices to buy juniors; they are cautious and unaggressive this time around and are being decidedly more discerning when it comes to acquisitions. The New Reality for Exploration New finds are going to become ever more critical for the industry's future, but exploration is becoming both more complex and costly. A combination of decreased funding and more difficult exploration targets makes it unlikely that we will see many new legitimate discoveries this year. Should one occur, the resulting localized success will surely serve to baffle and confuse investors, who might interpret one exploration win as a signal that all juniors are moving up. In fact, some companies can be headed higher while most of the remaining companies continue their descent. Get 'Something for Nothing' Nonetheless, some miners have taken advantage of this situation by extracting favorable terms from junior companies at extremely competitive prices. We are seeing acquisitions made 'at cost' and not accounting for the expenses, headaches or risks that the company has overcome. For example, B2Gold Corp. signed an agreement in October of 2013 to acquire Volta Resources Inc.2 The deal valued Volta at $63 million, which is approximately what the company spent on its drilling program that led to the discovery of a significant resource. B2Gold received the value of Volta's success 'at cost' of drilling, not taking into account the risk taken on by Volta's shareholders prior to the drilling program and the intellectual capital that went into the success. Because investment in exploration was relatively low over the past two decades, there are few high-grade projects out there to be 'scooped up' by a major. As a result, there are buying opportunities in companies that are not glaringly obvious in terms of grade, size, and ease of extraction. This also puts a higher premium on the ability to scrutinize and assess these projects. Even the better-looking projects, for that matter, need to be held to stringent scrutiny as to whether they make financial sense! 2014 will be the year of sobriety and bifurcation. The weak will simply not survive; many companies will disappear. These are very sobering times. The sector is still being culled and a rise in the price of gold will not necessarily save them; do not bet on a high tide floating all ships this time around. Selectivity is key, which means having the best information and keeping a close eye on developments in the sector. We should expect a lot fewer companies in the space after 2014, and even by the summer, so the months ahead could prove to be a highly determinant period for investors in the sector. Michael Kosowan has recently moved to Toronto Ontario, where he has joined the Sprott Private Wealth team. Having worked alongside Rick Rule since 2000, he will now lead the investment advisory initiative for resource equities in the Toronto office. Michael holds a Master's Degree in Mining Engineering and is a licensed professional engineer. He is also a registered representative in both Canada and the United States. With his extensive experience in resource investing, Michael is able to provide insights and knowledge critical in helping clients select and understand their investments. You will find Michael as a speaker at several natural resource conferences, on webcasts and radio interviews discussing the resource sector. To contact Michael e-mail him at MKosowan@sprottwealth.com or call 1.866.299.9906. 1http://resourceworld.uberflip.com/i/229125/31 2http://www.cbc.ca/news/business/b2gold-to-acquire-volta-resources-in-all-stock-deal-1.2254366 |

| South Africa Grindrod to build copper railway in Zambia Posted: 03 Feb 2014 11:09 AM PST Landlocked Zambia received some good news Monday as South African transportation firm Grindrod has committed to build a new 590 km-rail line, which will connect the country's vast copper mines to the Atlantic coast. The close to $990 million project, reports Railwaygazette.com, will link the African nation's largest copper mine by output, Kansanshi Copper Mines, as well as Lumwana Copper Mines, to the railway network of neighbouring Angola. This way, Canada's Barrick Gold Corp. (TSX:ABX) and First Quantum Minerals (TSX:FM), which own the benefitted mines, will have a direct railway connection to the port of Lobito, on the Atlantic side. Currently, most of Zambia's copper is moved by truck to ports at Dar es Salaam and Durban in South Africa. Grindrod believes that taking the metal by rail will probably be cheaper as trains use less energy. The rail line to the Angolan border will also allow Zambia, Africa's top copper producer, to import oil from Angola. |

| More than mining: Anglo sets up trading arm Posted: 03 Feb 2014 10:34 AM PST

Diversified mining group Anglo American (LON:AAL) surprised markets and ended 2013 on an exceptional note, as the turnaround plan under new CEO Mark Cutifani gathers pace. The London-listed giant reported robust increases in iron ore, copper, coal and platinum production and long-suffering investors – the company's shares remain 28% cheaper than this time last year – duly rewarded it. Apart from cost-cutting, rationalization and a renewed profit over growth focus, Cutifani who took the reins of the company last year, also signalled a new approach to the business of mining to differentiate Anglo from its peers, which have become increasingly dependent on iron ore for profits. Cutifani, the third CEO to run the company in 10 short years, told South African magazine Financial Mail in October of his intentions to take a leaf out of the books of Swiss rival Glencore and the world's oil majors to become more vertically integrated: "In the big five, you've got a Brazilian iron ore company; an Australian iron ore company; a large-scale, partly diversified company in BHP Billiton; and a broadly diversified company in Glencore Xstrata, which has a trading platform. In Anglo American there is a broadly diversified mining company with a strong focus on operating performance and a big opportunity to improve on that. We and Glencore Xstrata are the only two truly diversified resource companies. "We want to do more with our commercial side on the lines of what Ivan [Glasenberg — CEO of Glencore Xstrata] is doing, and our big value-add is getting our assets to their full potential." Cutifani has started to make good on his word, completely overhauling Anglo's sales operations and consolidating nine export and marketing offices into two regional hubs. The Financial Times (sub) reports the result has been the creation of a new commercial unit, which is "promising to add $400m to the company's profits by 2016:" "It plans to do this by selling Anglo's output – which includes coal, platinum and iron ore – in a more intelligent way and adopting some of the sophisticated strategies used by the big commodity trading houses. "With the exception of Glencore Xstrata, big mining companies have traditionally shied away from trading. Many subconsciously link physical trading to the business of outright price speculation even though the reality is more subtle. (Traders often run flat books and take advantage of superior market intelligence and logistics to make money. They do this through by exploiting different prices for products in different parts of the world)." While the success of the new strategy remains to be seen Anglo's deep knowledge of the global coal trade acquired during the previous century from its Johannesburg base (where Glasenberg and Xstrata's Mick Davis also cut their teeth), the vertically integrated model has its adherents. After being pushed out in the Glencore takeover, former Xstrata chief Mick Davis has been working hard to raise money for his new venture. Davis hopes his X2 Resources will soon have a war chest of $3 billion to snap up mining assets around the world, which at the moment can be had at bargain prices. And the first investor Davis lined up? Glencore rival Noble Group, a Hong Kong based commodities trader and logistics company with revenues set to top $100 billion this year, ponied up the initial $500 million. Image by ecstaticist |

| Posted: 03 Feb 2014 10:24 AM PST A small nanotech company based in Mississauga, Ontario claims to have developed a technology that can recover metals from mine tailings using "nature's very own sponges" – crustacean shells. "Scientists have known for years that this is a very effective answer in nature for water filtration," NanoStruck CEO Bundeep Singh Rangar told Mississauga.com, giving the example of shrimp in a dirty harbour. "The question is how do you take that shell and repurpose that for human purposes and industrial purposes?" Testing from mining operations in Africa showed that the technology could "retrieve more than 80 per cent of some of the precious metals they contain," Mississauga.com wrote. Coming at it as a water treatment company gives NanoStruck an advantage because they have the technology to extract tiny particles of precious metals from water, Rangar told 680 News. "We can pull out precious metals from tailings … left behind from the primary mining activities … gold, silver, platinum, palladium. Things that would not be easy to pull out for a mining company." NanoStruck estimates that there is about $1 trillion worth of precious metals already extracted from the ground, sitting in old mining sites. The company is in the process of setting up recovery plants in South Africa and Mexico. The value of precious metals recovered would be shared with the tailing site owners. According to NanoStruck, using these "molecular sponges" can boost the value of existing mining assets and "reduce the need for new, costly and potentially environmentally harmful exploration and mining." As for water purification, the technology is already being applied to runoff from a landfill in Mexico. |

| You are subscribed to email updates from MINING.com To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 20 West Kinzie, Chicago IL USA 60610 | |

0 Comment for "US manufacturing data sends gold price higher"