Myanmar one of the top countries to invest in 2014 |

- Myanmar one of the top countries to invest in 2014

- Canada wants 20% of global rare earth market by 2018

- As Bitcoin became more popular, these countries became more suspicious

- Codelco copper exports hit by Chile’s port strike

- South Africa charges mining firm that polluted river at national park

- The Philippines creates ‘mining accountability’ body

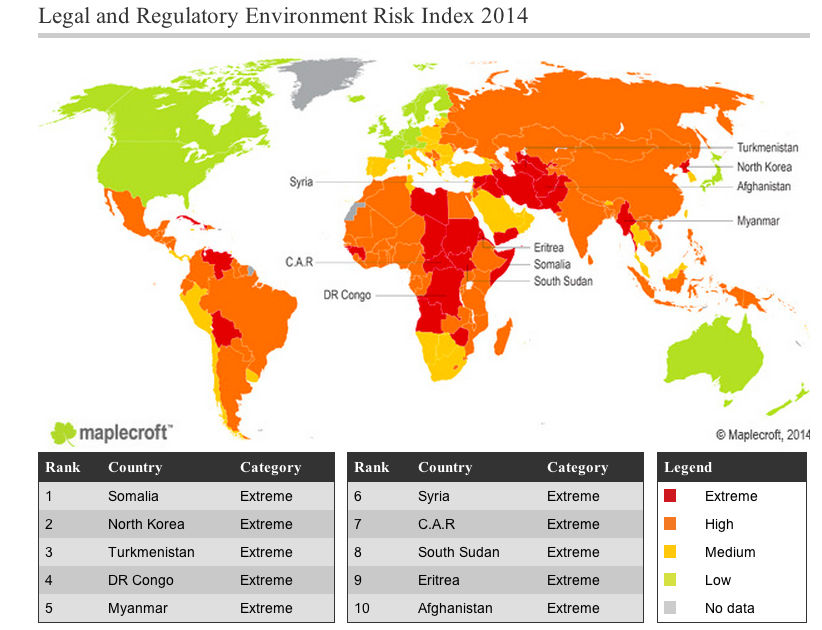

| Myanmar one of the top countries to invest in 2014 Posted: 07 Jan 2014 06:30 PM PST Investors, either focused on mining or not, will surely be surprised by the five countries global risk analysis firm Maplecroft has put at the top of its "good business environment" list, released Wednesday. In its annual Legal and Regulatory Environment Risk Atlas, the UK-based company says that Senegal, Guatemala, Mozambique and Rwanda are among the countries with best trade performance over the last five years. The big winner, by far, was Myanmar, according to Maplecroft. The country was singled out as the one where the business environment improved the most last year, thanks to key steps taken by the government. These included enhancing investor protection and implementing a new foreign investment law in March 2013, which provides much needed clarity around essential issues, such as foreign ownership limits and land leasing rules. Myanmar's continued commitment has resulted in a steady climb in the ranking from worst position at the bottom of the ranking in 2012, to 3rd in 2013 and 5th in 2014. Despite the modest shift in ranking, reforms have already resulted in significant improvements for business, and Maplecroft forecasts that if Myanmar sustains its current trajectory it may move out of the "extreme risk" category in less than three years. Now the bad news Resource rich countries, such as Congo (4th), Central African Republic (7th), South Sudan (8th), Venezuela (12th), Zimbabwe (14th), Iran (16th), Angola (19th), and Iraq (24th) made up over 50% of the "extreme risk" jurisdictions this year. Legal and regulatory risks impacting property rights are of particular concern in these nations. Despite softening commodity prices over the past year, societal unrest and poor economic conditions can act as risk multipliers when it comes to respecting private property rights. Company assets, especially those in the mining and oil and gas sectors, can become subject to nationalization and expropriation, as it happened recently in Venezuela (2012) and Argentina (2013). The report concludes the places to stay away from, at least for now, are Argentina, Bahrain, Bangladesh and Egypt, where the business environment has been curtailed by factors such as weak investor protection, increasing regulatory burdens and poor governance resulting from instability. (Click to enlarge) |

| Canada wants 20% of global rare earth market by 2018 Posted: 07 Jan 2014 05:14 PM PST Canadian exploration companies are targeting scores of rare earth projects around the world and with help from the federal government are making a go at loosening the grip China has had on the industry for the past decade or more. Canada.com reports Canada's parliament recently launched a new study of the country's REE industry while a new industry group called Canadian Rare Earth Elements Network, established in cooperation with Natural Resources Canada, is working to have government to set aside funding for research and development in the 2014 federal budget: "Canada is poised to capitalize on extracting rare earth elements, say briefing notes prepared for Natural Resources Minister Joe Oliver as part of last summer's cabinet shuffle. "Rare earth elements (REE) have been categorized by the government as being critical to Canada's economy," say the briefing notes, titled "Secret" and obtained by Postmedia News under access to information legislation." Canadian industry want to secure 20% of global supply by 2018. At the moment China produces some 90% of the world's rare earths – used in a variety of industries including green technology, defence systems and consumer electronics – and imposes export quotas. Frontrunners among Canadian juniors racing to build the country's first rare earth mine include Rare Element Resources (TSE:RES), Avalon Rare Metals (TSE:AVL) and Quest Rare Minerals (TSX:QRM) while Saskatoon-based Great Western Minerals (CVE:GWG) is recommissioning the Steenkampskraal mine in South Africa with Chinese backing. China did not always enjoy a virtual monopoly on REE production. The majority of the 17 rare earth elements were sourced from placer deposits in India and Brazil in the late 1940s. During the 1950s, South Africa mined the majority of the world's REEs from large veins of rare earth-bearing monazite. From the 1960s to 1980s, rare earths were supplied mainly from the US, mostly from the massive Mountain Pass mine in California, which was eventually mothballed in 2002. China then took over the industry completely, producing more than 95% of the world's REEs centred in Inner Mongolia and also becoming the top consumer ahead of Japan and South Korea. Worries about China's monopoly of production sent prices for all rare earths into the stratosphere from 2008 onwards with some REEs going up in price twenty-fold or more. That reignited interest in the sector with dozens of explorers active around the globe making major discoveries from Canada and Greenland to Madagascar and Malawi. Molycorp's (NYSE:MCP) Mountain Pass is almost back to full production, Lynas Corp's (ASX:LYC) Mount Weld mine in Australia and plant in Malaysia opened last year. Prices have now come back down to earth with most REEs dropping in price by 70% or more after peaking in 2011. For instance, the most abundant and cheapest of these, cerium oxide which is used to polish TV screens and lenses is now trading at $8.50 from all-time highs of $118 in the September 2011. The price for cerium oxide was $4.56 in 2008. The reversal in europium oxide – the priciest of the widely-used heavy REEs used in medical imaging and the nuclear and defence industries – has also been dramatic. The price of europium increased more than 10-fold from $403 in 2009 to an average of $4,900 in the third quarter of 2011. It is now worth $1,110 a kilogram in the export market, while Chinese domestic europium is another $500 cheaper at $630/kg. |

| As Bitcoin became more popular, these countries became more suspicious Posted: 07 Jan 2014 02:44 PM PST Bitcoin has come a long way in just a few months. In September 2013 one Bitcoin cost about $120. In December, the value shot up to $1,147 per BTC. Lately, one coin has been trading for around $900. The Bitcoin market is clearly volatile and one major force pulling it up and down is its level of acceptability. In November the price skyrocketed as more and more vendors began accepting Bitcoin and interest from China boosted demand. But things soured in December as China cracked down on trading, barring banks and payment institutions from dealing in the virtual currency. When this happened, the price of one BTC took a 50% plunge. Governments have taken note of Bitcoin's increasing popularity and many are proceeding with caution. Several countries and their central banks have officially warned people about the risks associated with Bitcoin trading. Some, like China, have gone a step further, introducing laws to control it. These are the countries that are most uneasy about Bitcoin. China - As noted above, China introduced a series of prohibitions on Bitcoin trading. The People's Republic believes that virtual currencies can pose "a risk to the public interest and the legal status of the Renminbi." A spokesperson for the People's Bank of China has said that Bitcoin is "not a currency in the real meaning of the word … It cannot and should not be used as a currency circulating in the market." Taiwan - Robocoin, the company behind Bitcoin ATMs, had plans to install Taiwan's first machines but was promptly blocked by the country's Financial Supervisory Commission (FSC). In an interview with the Central News Agency, FSC Chairman Tseng Ming-chung said the company would need his agency's approval to install the ATMs and that the commission "would not likely" give it. "If any Bitcoin ATM is illegally installed in Taiwan, the FSC will remove or demolish it," Tseng added. Thailand - Thailand is ahead of the game when it comes to tackling Bitcoin; the country's Central Bank banned the digital currency way back in July. But according to one report, the bank does not actually have the authority to make this ruling and the currency is still in a legal grey zone. India - In December India's central bank published an official warning to the public, cautioning users of virtual currencies about the "potential financial, operational, legal, customer protection and security related risks that they are exposing themselves to." Virtual currencies are also prone to losses due to hacking and malware attacks, the Reserve Bank of India said. The bank is currently looking at how India's laws may affect these currencies. According to the Financial Times, India has raided and closed down Bitcoin exchanges. Germany - Germany's central bank, the Bundesbank, has also warned the public that bitcoins are "highly speculative," CoinDesk reported. "There is not state guarantee for bitcoin and investors might lose all of their money. The Bundesbank is warning emphatically about these risks," Bundesbank board member Carl-Ludwig Thiele said. Germany has however recognized Bitcoin as 'private money.' Other European bodies that have issued warnings without any outright bans include the European Banking Authority which last month published a statement on the risks of Bitcoin trading. And although Norway's government has refused to recognize the cryptocurrency, it has taken measures to tax it as an asset. |

| Codelco copper exports hit by Chile’s port strike Posted: 07 Jan 2014 09:58 AM PST

Other three terminals have joined Angamos since 11 pm Monday. Workers at the seaports of Iquique, Antofagasta and San Antonio downed tools in support of the demands raised by their colleagues The company, owner of over 11% of the world's copper reserves, was hit by a one-day strike in July 2011 that cost it $40 million. Codelco is not the only one affected. The Chilean Fruit Exporters Association (Asoex) at the San Antonio port, in the Valparaíso Region, said they have already lost as much as $50 million in revenue. Asoex added that the work stoppage is costing the port $6 million a day. A meeting with the Chilean government is expected to take place Wednesday. |

| South Africa charges mining firm that polluted river at national park Posted: 07 Jan 2014 08:55 AM PST South Africa's Department of Water and Environmental Affairs (DWEA) has laid criminal charges against mining firm Bosveld Phosphate after one of its tailing dams overflowed in late December, causing major pollution of two rives that run through Kruger National Park. According to the government's news agency, highly acidic water flowed from a dam filled with waste rock into Selati River, resulting in "a massive fish kill" over a 15km stretch of water. The stream is an important tributary of the Olifants River, considered one the most environmentally stressed in South Africa and an important shared watercourse with Mozambique. DWEA director for compliance monitoring and enforcement, Nigel Adams, said that samples had revealed water quality in the dam was well below the levels stipulated by the National Water Act. Separately, SANParks added it had taken "immediate precautions" to ensure safe water supply to tourist camps in the park, home to about 147 species, including lions, rhinos, elephants, water buffaloes and leopards. Image: Shingwedzi river during the dry winter months, Kruger National Park, WikiMedia Commons. |

| The Philippines creates ‘mining accountability’ body Posted: 07 Jan 2014 07:35 AM PST The Philippine Department of Environment and Natural Resources (DENR) announced Tuesday it is creating a new body to guarantee the country's mining sector transparency and accountability. Environment Secretary Ramon Paje told The Inquirer, the ruling was among the reforms introduced by President Benigno Aquino III to ensure revenues coming from the sector are utilized "in the most efficient and effective manner." The creation of the Philippine Extractive Industries Transparency Initiative (PH-EITI) will make all companies engaged in the country's mineral sector report what they have paid to the government. Authorities, in turn, will have to report what they have received. A 2012 decree established a Mining Industry Coordinating Council to oversee the sector, which banned mining from some 78 areas considered sensitive ecosystems, crucial to farming or tourism or unsuitable for other reasons. After that ruling, foreign investment in the resources sector in the Philippines plummeted. Never that high to begin with, investment in the island nation now attracts less than $500 million worth of mining investment. The archipelago is rich in copper, gold, silver and chromium and at the moment produces about 10% of the world's nickel, but minerals make up only 8% of its exports. Image by qvist |

| You are subscribed to email updates from MINING.com To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 20 West Kinzie, Chicago IL USA 60610 | |

0 Comment for "Myanmar one of the top countries to invest in 2014"