This <b>chart</b> shows mini <b>gold price</b> rally could have legs | MINING.com |

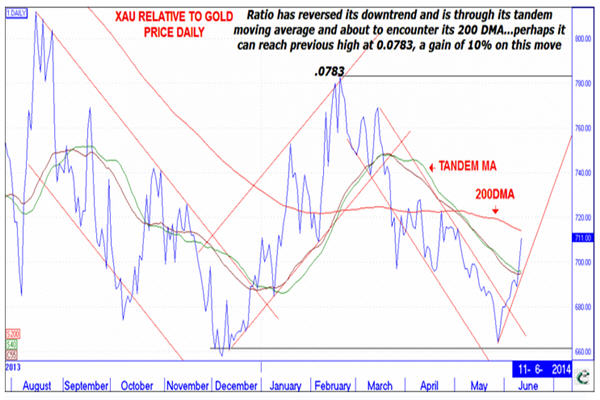

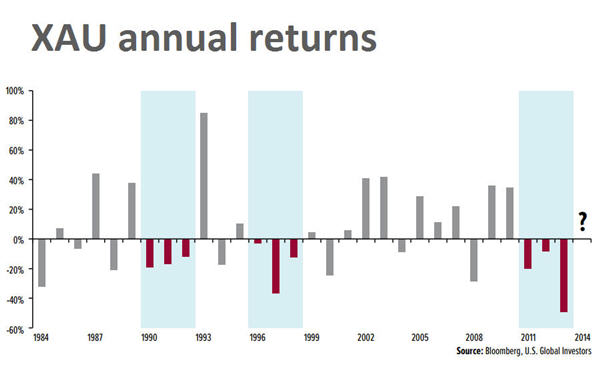

| This <b>chart</b> shows mini <b>gold price</b> rally could have legs | MINING.com Posted: 12 Jun 2014 02:39 PM PDT The gold price jumped to a near three week high on Thursday, buoyed by safe haven buying following outbreak of violence in Iraq and disappointing economic news out of the US. On the Comex division of the New York Mercantile Exchange, gold futures for August delivery in afternoon trade exchanged hands for $1,274.20 an ounce, up $13 or 1% from Wedensday's trading session and near its highs for the day. Technical research and investment blog InvesTRAC passed on this price graph to MINING.com showing how the Philadelphia Gold & Silver Index (INDEXNASDAQ:XAU) of top precious metal stocks can act as a leading indicator of the gold price: The XAU index rises faster than rising prices of gold and silver and falls faster than declining prices of gold and silver. And over the past week or so the metals and the XAU have been rising with the XAU rising faster. In fact InvesTRAC's OB/OS indicator (0-100 scale) is rising at 8.7 which suggests a good deal of upside potential before becoming overbought…InvesTRAC's forecaster is showing high June 16, low 27 and high July 8…let's look at the daily chart below which shows that the XAU/GOLD PRICE ratio has pushed up through its declining upper channel line and is through the tandem moving average…it is about to encounter its 200 day moving average with the potential to rise to the previous top at 0.0783 which is 10 per cent higher than the current level. What I like about the chart is that the ratio is bouncing off its previous low which implies further upside potential.  Source: InvesTRAC Back in February, firm US Global Investors also used the performance of the XAU index which thanks to its long existence has turned out to be a good predictor of trends. The boutique investment argued that shares in precious metals miners were approaching "the historical limits of multi-year declines" pointing out that over the last three decades there has never been a period where gold and silver stocks have declined four years in row. So far this rule of thumb is holding up: XAU is up 9% so far this year. |

| You are subscribed to email updates from gold price graph - Google Blog Search To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 20 West Kinzie, Chicago IL USA 60610 | |

0 Comment for "This chart shows mini gold price rally could have legs | MINING.com"