Lack of interest sees gold price back below $1,300 |

- Lack of interest sees gold price back below $1,300

- PICTURE OF THE DAY: Mining coal that is on fire

- Platinum, palladium prices tank

- Matchmaking miners and China's $7 trillion in savings

- 'All investment comes through Toronto': Colombia mining minister

- Rio Tinto walks away from massive Pebble copper-gold project

| Lack of interest sees gold price back below $1,300 Posted: 07 Apr 2014 03:21 PM PDT The price of gold fell back below the 1,300 an ounce level after traders booked profits on Friday's brief post US jobs-numbers rally. On the Comex division of the New York Mercantile Exchange, gold futures for June delivery in late afternoon trade exchanged hands for $1,296.90 an ounce, down close to $7 compared to Friday's close. Volume was noticeably thin with 70,000 contracts traded, compared to average daily volumes on the exchange of around 200,000. Reuters quotes Jonathan Jossen, a COMEX gold options floor trader, as saying "investors are not taking any interest in the precious metals right now, and gold and silver are definitely in tight trading ranges." Shanghai's gold exchange was also closed on Monday for the Qingming public holiday. On Friday data showed the US economy created fewer jobs than predicted – the Fed's key measure in deciding interest rates – meaning that the Fed's economic stimulus program could stay in place longer than anticipated. Monetary expansion across developed economies, particularly since the financial crisis, has been a massive boon for the gold price, burnishing the metal's reputation as an inflation hedge and storer of wealth. Gold was trading around $830 an ounce when previous chairman Ben Bernanke announced QE1 in November 2008. Ross Norman, CEO of bullion brokers Sharps Pixley, one of the original members of the London Gold Fix, on the sidelines of the Dubai gold conference predicted a rise in the gold price on the basis of the ratio between crude oil and the yellow metal. |

| PICTURE OF THE DAY: Mining coal that is on fire Posted: 07 Apr 2014 02:40 PM PDT Mining Mayhem posted photos of Blair Athol, a coal mine located in Queensland, that is combusting while it gets excavated. Photos are not dated. In October Rio Tinto announced plans to sell the mine. |

| Platinum, palladium prices tank Posted: 07 Apr 2014 12:23 PM PDT The price of platinum lost more than $20 an ounce and sister metal palladium dropped 3% on Monday despite an ongoing strike at three top producers and strong investor interest. On the Comex division of the New York Mercantile Exchange, platinum futures for July delivery – the most active contract – in early afternoon trade exchanged hands for $1,428.70 an ounce, down $23.10 compared to Friday's close and near the day's lows. On the day before more than 70,000 South African workers went on strike at Anglo American Platinum (LON:AAL), Imapala Platinumm (OTCMKTS:IMPUY) and Lonmin (LON:LMI) which together account for almost 50% of the world's production, platinum was trading at $1,450 an ounce. Roughly 10,000 ounces of production are lost each day the strike drags on and even after a resolution to the bitter dispute can be found it would take months for the affected mines to return to capacity. Year to date platinum is up 3.7%, but remains $125 or 8% below where it was this time last year. Palladium also fell on Monday with June futures last trading at $768.75, down 2.8% on the day and recovering slightly from a day low of $761.25. Palladium which has been outperforming platinum, helped in part by tensions with Russia which together with South Africa control more than 70% of global supply. The metal touched its highest level since September 2011 in March and is up 6.8% since the start of the year. News that Sibayne Gold (NYSE:SBGL), turnaround specialists, may be interested in picking up the platinum assets of the strike-affected companies may account for some of the weakness on Monday although no formal talks have taken place. A proposal by South Africa's state pension fund manager that producers should form a cartel to control the price has also been met with skepticism and called unfeasible. The weakness in the PGM metals come despite a number of factors over and above the supply squeeze from South Africa and Russia and renewed demand from top consumer of PGMs, the European auto industry, that should combine to push the price much higher than it is today. Futures and options speculators have been building net long positions in particularly platinum and there has been a surge in investor interest in physical platinum and palladium-backed exchange traded funds. Johannesburg's NewPlat ETF topped one million ounces for the first time last week in the less than one-year old fund, while two newly-launched palladium ETFs ar said to have attracted more than 250,000 ounces. Barrons.com quotes from a research note by investment bank HSBC which also argues for a higher platinum and palladium price: Platinum: We continue to have a bullish bias towards platinum prices and expect the average price to reach USD1,595/oz in 2014. The strikes are further aggravating already tight production from South Africa and contributing to the market's production/consumption deficit. Second, we expect good demand from the European auto sector where the more popular diesel-powered engines require heavier platinum loadings, than gasoline engines. Third, we anticipate further strength in jewelry demand from China as its growing middle class continues to seek out luxury goods. Taken together, these factors will further widen the expected demand/supply deficit for platinum and push prices higher. Palladium: We are also bullish on palladium prices, where global supply is also constrained. Rising automotive demand from China and North America is particularly relevant to palladium due to the need for this metal in the gasoline-fired engines favored in these regions. We expect average prices to reach USD825/oz in 2014. |

| Matchmaking miners and China's $7 trillion in savings Posted: 07 Apr 2014 11:20 AM PDT

The Australian reports that Asian investors have no shortage of cash. China's populace has built up US$7 trillion in savings that could start making its way to mines and other hard assets.

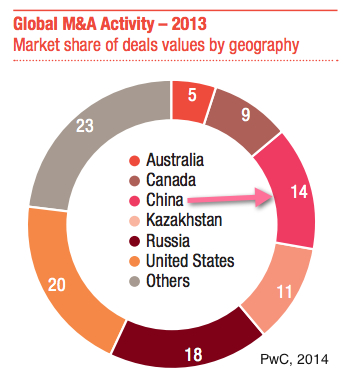

But while Chinese have traditionally targeted energy and mining firms, experts such as HSBC claim they are beginning to see evidence of a shift away from these sectors towards renewable energy, social infrastructure, sustainable business and biotechnology. Despite the novel trend, industry data shows China accounted for nearly 14% of all mining merger and acquisition activity by value last year. The number of transactions, however, fell to 21 from 34 with a total value drop of $1 billion, from $6 billion in 2012 According to PwC's latest global mining deals outlook, Beijing's share of global mining deals is set to grow this year, as in 2013 —the worst for global mining mergers and acquisitions in nearly a decade— China still managed to outpace nations such as Canada, Australia and the United States. However Ken Su, the China mining and metals leader at PwC, warns the average deal size of investments in overseas mines would be smaller, as more private Chinese companies, which lack the financial muscle of state-owned enterprises, continue to venture abroad. |

| 'All investment comes through Toronto': Colombia mining minister Posted: 07 Apr 2014 09:33 AM PDT MINING.com sat down with Amylkar Acosta, Colombia's mining minister, who discussed investment opportunities and risks. Acosta was attending the PDAC International Convention, Trade Show & Investors Exchange in Toronto last month. Asked why he came to the show to tout Colombia, he says "all investment comes through Toronto." "Colombia is the Latin American country with the most promising future," says Acosta. While Colombia is well known for its coal and oil resources, Acosta added that it's also a leader in energy and power generation. Quoting a recent report from the World Economic Forum, the minister explains that Colombia is considered one of the top 10 countries best prepared for the future of energy. While recent incidents such as rebel attacks to the country's main coal miner and the kidnapping of a Canadian mining executive raise safety concerns in Colombia, Acosta says the country is still one of the world's top mining destinations. Investment has climbed 17% since 2012 outpacing Latin America as a whole. (Interview is in Spanish aided by a translator. Audio quality is poor due to excessive background noise. Interview was conducted by Michael McCrae.) |

| Rio Tinto walks away from massive Pebble copper-gold project Posted: 07 Apr 2014 09:00 AM PDT  Opponents to the project had long argued it could jeopardize the pristine environment of U.S. biggest salmon fishery. Global miner Rio Tinto (LON, ASX:RIO) said on Monday it is pulling out of the polemic Pebble Mine copper and gold project in the Bristol Bay region of Alaska, by giving away its 19.1% percent stake in Northern Dynasty Minerals (TSX:NDM), the owner of the huge deposit. The company said the project does not fit its strategy, so it will donate its shares to two Alaskan charities. This way Rio becomes the second large diversified miner to back out of the project in less than seven months. Anglo American (LON:AAL) left the project last September, handing its 50% stake in the project back to Northern Dynasty and taking a $300 million write down in the process. Rio itself took a $130 million write down on the asset in its 2013 results. Environmentalists across the world praised Rio's decision. Washington, DC-based watchdog Earthworks also applauded the giant miner for respecting locals' wishes. "Rio Tinto's divestment from Pebble may not be the final nail in the coffin, but it's surely one of the last," the group said in a statement. "With Rio Tinto's departure…there is now no mining company behind Pebble that has actually mined anything," it added. The project has faced increased scrutiny from environmental campaign groups and the U.S. Environmental Protection Agency (EPA) regarding its potential risk to salmon fisheries. Northern Dynasty and Anglo previously said that the project could be built without harming Alaska's salmon fishing industry. In February, EPA initiated a rarely used process under the Clean Water Act that would block development of the copper-gold deposit, one of the largest in the world, citing the potential of "irreversible harm" to the state's salmon fishery. Half of Rio's shares will go to the Alaska Community Foundation and the other half will go to the Bristol Bay Native Corporation Education Foundation, the company said.

Pebble mine would have become the largest open pit copper and gold mine in the world, but its opponents claimed it would have generated tons of potentially dangerous waste material. The Pebble deposit holds an estimated 55 billion pounds of copper and 67 million ounces of gold. Shares in Northern Dynasty crashed on the news. The stock was 3.85% in Toronto this morning at 11:20 am ET. |

| You are subscribed to email updates from MINING.com To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 20 West Kinzie, Chicago IL USA 60610 | |

1 Comment for "Lack of interest sees gold price back below $1,300"

The dollar rose along with equities, weighing on bullion after U.S. data pointed to a light build in inflation.