Currency mayhem |

- Currency mayhem

- Learn how to optimize your mine operations

- Turquoise Hill up 22% after Oyu Tolgoi tax bill slashed

- Heavy precious metal shorting is bullish

- Tailings dam failure kills three workers

- Jeff Killeen: Cash and catalysts rule the day

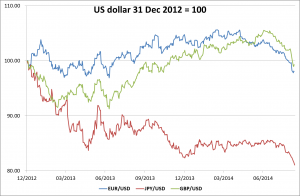

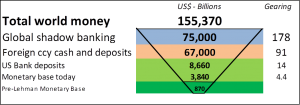

| Posted: 12 Sep 2014 03:30 PM PDT An article by Alasdair Macleod, Head of Research, GoldMoney You'd think that the US dollar has suddenly become strong, and the chart below of the other three major currencies confirms it. The US dollar is the risk-free currency for international accounting, because it is the currency on which all the others are based. And it is clear that three months ago dollar exchange rates against the three currencies shown began to strengthen notably. However, each of the currencies in the chart has its own specific problems driving it weaker. The yen is the embodiment of financial kamikaze, with the Abe government destroying it through debasement as a cover-up for a budget deficit that is beyond its control. The pound is being poleaxed by a campaign to keep Scotland in the union which has backfired, plus a deferral of interest rate expectations. And the euro sports negative deposit rates in the belief they will cure the Eurozone's gathering slump, which if it develops unchecked will threaten the stability of Europe's banks. So far this has been mainly a race to the bottom, with the dollar on the side-lines. The US economy, which is officially due to recover (as it has been expected to every year from 2008) looks like it's still going nowhere. Indeed, if you apply a more realistic deflator than the one that is officially calculated, there is a strong argument that the US has never recovered since the Lehman crisis. This is the context in which we must judge what currencies are doing. And there is an interpretation which is very worrying: we may be seeing the beginnings of a major flight out of other currencies into the dollar. This is a risk because the global currency complex is based on a floating dollar standard and has been since President Nixon ended the Bretton Woods agreement in 1971. It has led to a growing accumulation of currency and credit everywhere that ultimately could become unstable. The relationship between the dollar and other currencies is captured vividly in the illustration below. The gearing of total world money and credit on today's monetary base is forty times, but this is after a rapid expansion of the Fed's balance sheet in recent years. Compared with the Fed's monetary base before the Lehman crisis, world money is now nearly 180 times geared, which leaves very little room for continuing stability. It may be too early to say this inverse pyramid is toppling over, because it is not yet fully confirmed by money flows between bond markets. However in the last few days Eurozone government bond yields have started rising. So far it can be argued that they have been over-valued and a correction is overdue. But if this new trend is fuelled by international banks liquidating non-US bond positions we will certainly have a problem. We can be sure that central bankers are following the situation closely. Nearly all economic and monetary theorists since the 1930s have been preoccupied with preventing self-feeding monetary contractions, which in current times will be signalled by a flight into the dollar. The cure when this happens is obvious to them: just issue more dollars. This can be easily done by extending currency swaps between central banks and by coordinating currency intervention, rather than new rounds of plain old QE. So far market traders appear to have been assuming the dollar is strong for less defined reasons, marking down key commodities and gold as a result. However, the relationship between the dollar, currencies and bond yields needs watching as they may be beginning to signal something more serious is afoot. About GoldMoney GoldMoney is one of the world's leading providers of physical gold, silver, platinum and palladium for retail and corporate customers. Customers can trade and store precious metal online easily and securely, 24 hours a day. GoldMoney has offices in Jersey and Hong Kong. It offers its customers storage facilities in Canada, Hong Kong, Singapore, Switzerland and the UK provided by the leading non-bank vault operators Brink's, Via Mat, Malca-Amit, G4S and Rhenus Logistics. Historically gold has been an excellent way to preserve purchasing power over long periods of time. For example, today it takes almost the same amount of gold to buy a barrel of crude oil as it did 60 years ago which is in stark contrast to the price of oil in terms of national currencies such as the US dollar. GoldMoney is regulated by the Jersey Financial Services Commission and complies with Jersey's anti-money laundering laws and regulations. GoldMoney has established industry-leading governance policies and procedures to protect customers' assets with independent audit reporting every 3 months by two leading audit firms. Visit www.goldmoney.com. | ||||||||||||||||||||

| Learn how to optimize your mine operations Posted: 12 Sep 2014 02:45 PM PDT Radically increasing efficiency by cost effectively managing assets and creating an integrated mining operation through automation and optimization Mining Magazine's Optimizing Mine Operations Conference offers the ideal opportunity for mining professionals to understand the choices they face and decisions they make to enhance efficiency at their operations. Ensuring exposure to the thoughts of some of the most innovative minds within the industry attendance guarantees you stay abreast with the most cutting-edge developments. Radically increasing efficiency by cost effectively managing assets and creating an integrated mining operation through automation and optimization Featuring confirmed industry leading speakers throughout the four day event, attendance at the Optimizing Mine Operations Conference is a must for all those striving towards greater operational efficiency. 2014 speakers include:

| ||||||||||||||||||||

| Turquoise Hill up 22% after Oyu Tolgoi tax bill slashed Posted: 12 Sep 2014 10:18 AM PDT Shares in Turquoise Hill Resources (TSE:TRQ) gained sharply for a second day in a row after unconfirmed reports that Mongolian authorities have slashed the amount of tax claimed in a dispute over the Rio Tinto-subsidiary's Oyu Tolgoi mine. Bloomberg reports the National Tax Dispute Settlement Council has reduced the tax claim on the $6 billion project to about $30 million from around $130 million. The cuts haven't been made public and Mongolia is waiting for a formal response from Rio Tinto (LON:RIO), according to sources. Turquoise Hill suspended work on the $5.1 billion underground expansion of Oyu Tolgoi where 80% of the resources are located in November and in June work on a feasibility study for the underground phase were suspended after Mongolia's Tax Authority accused the Vancouver-based company of evading taxes and penalty payments related to Oyu Tolgoi.

The massive copper-gold-silver mine is 66% owned by Turquoise Hill with the government of the Asian nation holding the rest. Shareholders who have marked down the share price nearly 20% over the past year jumped back in this week, sending the counter 22% higher since Monday. By early afternoon on Friday Turquoise Hill was trading up 4.3% at $4.37, affording the company a $8.8 billion market value on the TSX. The underground expansion faces another crucial deadline at the end of this month. Financing arrangements with the Mongolian government including a World Bank-led $4.5 billion debt package – the largest in the history of mining – have been placed on ice. Funding commitments needed to build the underground mine are set to expire Sept. 30. For 2014, Oyu Tolgoi is targeting production of 150,000 to 175,000 tonnes of copper in concentrates and 700,000 to 750,000 ounces of gold in concentrates. But after phase 2 the mine in the southern Gobi desert could produce more than 1.2 billion pounds of copper, 650,000 ounces of gold and 3 million ounces of silver each year. Oyu Tolgoi would then account for 30% of the economy of the nation of just over 3 million people. | ||||||||||||||||||||

| Heavy precious metal shorting is bullish Posted: 12 Sep 2014 09:43 AM PDT Gold and silver have been pounded lower over the past month, contrary to their bullish seasonals. This selling pressure has come from the usual suspects, American futures speculators. They've been busy aggressively dumping gold and silver futures, particularly on the short side. But each time they pressed this bet in the past 15 months, gold soon surged higher. Shorts are bullish since they must soon be covered. Gold suffered its worst quarter in 93 years in 2013's second quarter, a nauseating 22.8% loss. This was triggered by the Fed's stock-market levitation, which sucked vast amounts of capital out of alternative investments. Gold plunged early in that catastrophic quarter when major support failed, and again later on Ben Bernanke's initial QE3-taper scare. This naturally left gold sentiment overwhelmingly bearish. American futures speculators responded by betting heavily against gold and silver during that Q2'13 timeframe. And given gold's once-in-a-century plunge, they obviously enjoyed great initial success. But even after gold decisively bottomed in late June 2013, this elite group of traders remained extremely bearish on the precious metals and kept selling their futures. This has continued for the 15 months since. The ironic thing is that fantastic Q2'13 gold-downside bet hasn't worked very well since then. Of the 303 trading days since gold plummeted to $1199 in late June 2013, it has only closed lower briefly on 3 trading days in late December. The universal gold bearishness of the past 15 months hasn't paid off, it was a bad bet. Gold has weathered the heavy selling to grind sideways in a massive bottoming consolidation. Yet American futures speculators still remain exceedingly bearish on precious metals, which is truly seriously irrational given their sideways price action. The reason is likely twofold. Until the Fed-driven stock-market levitation decisively rolls over, demand for alternative investments will remain weak. And given the extreme leverage inherent in gold futures, speculators must maintain an ultra-short-term focus. At $1250 gold, a single 100-ounce gold-futures contract controls $125,000 worth. Yet the maintenance margin on US gold futures is now just $4600. Thus traders running at maximum margin have leverage to gold of 27.2x! That is astoundingly risky, as a mere 3.7% gold move against these guys would wipe out literally all of the capital they bet. For comparison, stock trading is legally limited to 2.0x leverage. Big gold moves aren't uncommon. Since 2009, fully 1/13th of all trading days have seen gold close 2%+ higher or lower. So highly-leveraged futures speculators can be wiped out in a matter of days if they make the wrong bet on gold! Thus their myopia is as extreme as their leverage, with their whole world existing between a week in the past and a week in the future. Any minor gold slide rekindles their bearishness. If the stock markets edge up to new nominal records, American futures speculators are quick to dump gold. If the US dollar is stronger, they are quick to dump gold. If the Fed hints at interest-rate hikes, they are quick to dump gold. If some elite investment bank makes its umpteenth weathervane bearish call on gold, they are quick to dump gold. If some geopolitical hot spot appears to cool, they are quick to dump gold. Already having a heavily-bearish bias and forced by leverage to be short-sighted, American speculators jump on every opportunity to sell gold futures. And that is exactly what happened to gold and therefore silver over the past month or so. Gold would droop for a couple days, futures traders would rationalize that as confirmation of their bearish theses, so they would sell more gold futures and amplify its decline. This creates a vicious cycle. And in the absence of normal levels of gold investment demand thanks to the Fed's artificial stock-market levitation, there isn't enough offsetting physical buying. So futures selling dominates the gold price, and it slumps towards lows. The funny thing is these extreme bets against gold by such sophisticated traders always prove wrong, as gold rallies right at their peak bearishness! This first chart looks at American speculators' total long and short positions in gold futures, which are reported each week in the CFTC's famous Commitments of Traders reports. On top of these collective bets the gold price is overlaid, as seen through the lens of the flagship SPDR Gold Shares ETF (GLD) that stock traders prefer. The worst time to be bearish on gold is when futures speculators force it near lows. And that's exactly what's going on today. Around $1250 gold isn't far above its June 2013 low of $1199, its December 2013 low of $1190, and its June 2014 low of $1244. Seeing gold and therefore GLD shares heading towards the bottom of their 15-month consolidation trading range makes investors and speculators very nervous and bearish about gold's prospects. It feels like gold is ready to fall off a cliff. At times like this, nearly everyone is bearish except the hardcore contrarians. We humans have a natural tendency to extrapolate our present conditions out into infinity. We want to assume that trends in force today are going to persist indefinitely. This dangerous assumption is why the vast majority of traders lose money in the markets. They succumb to the herd groupthink and popular emotion near extremes. That fails because the markets are forever cyclical. Once everyone is bearish, the selling has already happened and a reversal is imminent because only buyers remain. So it is foolish to sell low in the midst of extreme popular bearishness. Yet since nearly everyone wants to feel accepted by their peers, to believe markets move in the same direction forever, bearish calls abound right as prices are actually bottoming. The elite and highly-respected Goldman Sachs is a prime example of this, reiterating its 15-month-old (and wrong) forecast that gold will fall to $1050 by the end of this year. Each time gold nears the lower support of its bottoming consolidation trading range, this high-profile bearish call gets much attention. But Goldman Sachs, along with all of Wall Street, is merely a weathervane extrapolating current trends. Back in August 2011 when gold was skyrocketing and a few contrarians like me were warning that it was way overbought and due for a serious correction, Goldman Sachs was wildly bullish on gold. It came out with report after report upping its gold price targets over all time horizons. It declared that a year later, gold would be around $1860. But a year after that euphoria, gold had slid down near $1600! Goldman Sachs is bullish on gold or stocks or anything when they are high and topping, the exact wrong time to be. And it is bearish on gold when it is low and bottoming, the smart time to be bullish. As a herd, American futures speculators are the same way. They are weathervanes that reflect prevailing sentiment, with no desire to fight the crowd to buy low and sell high. This is crystal-clear in this chart. Note that the blue GLD-share price has a strong and nearly perfect inverse correlation with the total level of American futures speculators' gold shorts. Just as this elite group of traders is the most bearish on gold as evidenced by their real-money bets, gold is bottoming and on the verge of a sharp rally. This happened in mid-2013, late 2013, mid-2014, and is almost certainly going to happen again soon here today. After Q2'13's epic once-in-a-century gold plunge, American futures speculators were so convinced that gold would spiral lower indefinitely that their bets against it surged to an at-least 14.5-year high. It may have even been an all-time record. But defying these guys, gold soon rallied sharply. Extreme gold-futures shorting is inherently self-limiting, as it sets the stage for massive and frantic short covering. When everyone thinks gold is doomed to spiral lower forever, everyone who wants to sell gold futures has already done so. Traders with long-side bets who succumbed to the bearish groupthink are already out, and traders with the cojones or hubris to make hyper-leveraged short bets have already laid them in. And with essentially no futures sellers left, that leaves only buyers. So a minor gold rally can quickly explode. At relatively-conservative-for-futures-traders 20x leverage, a 5% gold move against their bets will erase 100% of their capital risked. And it doesn't take much at all to spark 1% to 2% up days in gold that will trigger nearly instant 20% to 40% losses for these speculators. A material stock-market down day, a worse-than-expected economic report, some geopolitical flare-up, many things can ignite a sharp gold rally. And when leveraged futures speculators see 20%, 40%, 60% of their capital risked annihilated in a day or two, they have no choice but to cover. In the futures realm, shorts are covered by buying offsetting longs. So in terms of positive price impact, there is zero difference between adding a new long and buying one to offset and close a short. As speculators buy to cover, the gold-price gains naturally start accelerating. The faster gold rises, the more other speculators are forced to cover too. This process forms a virtuous-circle self-reinforcing upleg for gold prices. The more traders buy it, the faster it rises. The faster it rises, the more traders want to buy it by adding new long-side positions and the more traders trapped on the short side have to rush to cover. Thus gold is due for an imminent sharp rally when futures shorts hit extremes. And such extremes certainly aren't hard to define. Between 2009 and 2012 in the last normal years before 2013's crazy Fed-driven gold anomaly, American speculators held the short side of 65.4k gold-futures contracts on average in any given week. That's the opposite of extreme, the baseline. And early July 2013's at-least-14.5-year record high of speculators holding 178.9k gold short contracts is peak extremeness. While this latest week's read of speculators holding 108.5k short gold-futures contracts was nowhere close to that, it is still extreme by a couple key measures. First, over the past 15 months as gold failed to plunge into oblivion despite the extreme bearishness, futures traders are gradually learning not to listen to the sentiment weathervanes. With each subsequent gold low, their zeal for shorting this metal wanes. So a strong downward-sloping resistance line on extreme gold-futures shorting tops has formed. And the levels of speculator shorts we are seeing today are almost there. Odds are it will hold again, that a sharp short-covering gold rally is imminent. If gold couldn't be hammered to decisive new lows over the past 15 months despite the most extreme bearish headwinds seen in well over a decade, it probably can't be now either. The second clue we've reached extremes is the speed of the surge in speculators' gold-futures shorts over the past three weeks. These super-leveraged downside bets on gold have rocketed 50.1% higher in that short span! An explosion of shorting is the bearish equivalent of a speculative mania to the upside, an unsustainable surge to a climax of pessimism. Once that peak hits, all the sellers have already sold. American speculators' gold-futures shorting surged similarly near gold's major bottoms in late 2013 and mid-2014. These short bets can't soar at such spectacular rates for long. So it really looks like gold is carving a major bottom in today's extreme bearishness, on the verge of a serious rally initially sparked by frantic short covering that will catapult it higher. One final clue buttresses this bullish outlook on gold. Despite their recent propensity for emotional and theatric shorting, futures traders are a big and diverse group. More of them are betting on gold's upside through long contracts than the other way. The green line above shows their total long-side bets. They've been gradually rising all year in a nice uptrend despite the extreme bearishness plaguing gold. These traders understand the great wisdom in buying low. With speculator longs rising all year even when gold happened to be wilting, it is very unlikely the short-side traders will get much help from long-side liquidations. And without heavy long-side selling like we saw in that catastrophic second quarter of 2013, there is just no way gold prices are going to plummet to the deep new lows that Wall Street is calling for. This increases the odds gold is carving a bottom today. Interestingly most of this analysis holds true in silver futures too. Silver has always been slaved to gold, amplifying its gains and losses. When gold is strong traders rush into highly-volatile silver to catapult it higher, and when gold is weak traders abandon it. Silver has also seen a huge spike in speculator shorting, raising the odds it too is on the verge of its own parallel short-covering rally when gold's starts. Here silver is represented by the prices of the flagship iShares Silver Trust (SLV) shares. It too has a strong inverse correlation with futures speculators' short positions. Silver tends to be bottoming right when they are peaking, futures traders as a herd are the most bearish at exactly the wrong times. Silver-futures shorts actually hit their staggering at-least-15.4-year-if-not-all-time high just recently in June 2014. That 65.2k contracts is truly extreme, and in this latest Commitments of Traders week speculators' shorts surged back up to 54.4k contracts! Such excessive selling is self-limiting, as soon everyone who is willing to sell silver low has already done so and only buyers remain. All it will take is a decent gold up day to ignite some gold-futures short-covering, and silver-futures traders will scramble to cover as well. Silver acts as a sentiment gauge for gold, maybe its premier one. So the terribly-weak silver prices over the past 15 months reflect the exceedingly-bearish gold sentiment. Yet despite this, silver hasn't fallen below its original mid-2013 lows! This is partially due to a strong uptrend of speculator buying of long-side silver-futures contracts. Like in gold, these bullish bets indicate fewer traders willing to short silver. As usual, the entire precious-metals complex hinges on gold. With gold-futures shorts so extreme and gold sentiment so overwhelmingly bearish, an oversold rally is inevitable very soon here. And that will ignite short covering that will feed on itself and accelerate gold's mean reversion higher. I still believe the most-likely catalyst will be the Fed-spawned levitating US stock markets decisively rolling over. They have done nothing but power higher since early 2013 because the Fed's QE3 bond-monetization campaign was seen by traders as a backstop. But QE3 is scheduled to end in a matter of weeks, in late October. This has ominous implications for the lofty stock markets, which plunged sharply in major corrections after both QE1 and QE2 ended. When QE3 is over, the Fed can no longer short-circuit stock selloffs. Once investors and speculators are jolted out of the Fed's fantasyland back into the real world where stock markets go up and down, alternative investments led by gold will regain their attractiveness as a prudent portfolio hedge. Gold and silver will surge as capital returns, but that will be dwarfed by the gains in the radically-undervalued stocks of their miners. Contrarians buying them low will earn fortunes. Contrarian trading is so simple in theory, yet so hard in practice. In order to buy low and sell high, you have to buy when everyone hates a particular sector and sell when everyone loves it. That means you have to fight the crowd and your own dangerous emotions. You have to force yourself to be bullish when everyone else is bearish, like in gold today. And bearish when everyone else is bullish, like in general stocks. And contrarians are what we are at Zeal, not Wall Street weathervanes foolishly selling low and buying high. We've spent decades intensely studying and trading the markets, and know from long experience the contrarian approach works. By buying low when few others had the courage, all 686 stock trades recommended in our newsletters have averaged stellar annualized realized gains of +22.6% since 2001! Our renowned contrarian expertise will help you overcome the Wall Street tendency to succumb to herd groupthink. We've long published acclaimed weekly and monthly newsletters for speculators and investors. They draw on our decades of hard-won experience, knowledge, wisdom, and ongoing research to explain what's going on in the markets, why, and how to trade them with specific stocks. Subscribe today and start thriving as a contrarian! The bottom line is gold and silver were hammered by heavy shorting by American futures speculators over the past month. These elite traders have been extremely bearish on gold since its major lows in mid-2013, quick to ramp up their downside bets. But they are actually a strong contrarian indicator. Every time their shorts soar up near extremes, gold is bottoming and ready to surge on short covering. Futures trading is an exceedingly-risky hyper-leveraged game, so these speculators can't afford to be wrong on gold for long. Once it inevitably starts rallying, the losses on the short side explode so those traders are forced to rapidly cover. This initial buying entices in more long-side buyers, which can ignite major new uplegs. With speculator shorts back at extremes today, gold and silver once again look very bullish. Adam Hamilton, CPA September 12, 2014 So how can you profit from this information? We publish an acclaimed monthly newsletter, Zeal Intelligence, that details exactly what we are doing in terms of actual stock and options trading based on all the lessons we have learned in our market research. Please consider joining us each month for tactical trading details and more in our premium Zeal Intelligence service at … www.zealllc.com/subscribe.htm Questions for Adam? I would be more than happy to address them through my private consulting business. Please visit www.zealllc.com/adam.htm for more information. Thoughts, comments, or flames? Fire away at zelotes@zealllc.com. Due to my staggering and perpetually increasing e-mail load, I regret that I am not able to respond to comments personally. I will read all messages though and really appreciate your feedback! | ||||||||||||||||||||

| Tailings dam failure kills three workers Posted: 11 Sep 2014 05:51 PM PDT At least three mine workers are dead after a tailings collapse in Brazil. According to a report by EM Digital (written in Portuguese), rescue personnel were called to the accident early on Wednesday in Itabirite, the central region of Minas Gerais The military were called to the accident around 7:50 a.m. and worked for four hours to rescue buried miners. The Municipal Secretary of Environment, Antonio Marcos Generoso, confirmed that three are dead in the slide. Another was transported to João XXIII Hospital in Belo Horizonte. Officials did maintenance at this dam early in the morning when the accident happened. A large amount of waste was released on top of vehicles and workers. A truck driver, a bulldozer with operator and a Fiat Uno with the driver were all buried. Firefighters worked by hand to try to find them. Workers on the site are being accounted for and the dam is being monitored. | ||||||||||||||||||||

| Jeff Killeen: Cash and catalysts rule the day Posted: 11 Sep 2014 04:02 PM PDT Source: Brian Sylvester of The Gold Report (9/10/14) Jeff Killeen, mining analyst with CIBC World Markets, has spent much of 2014 on the road vetting junior mining projects. He says that the cash-and-catalyst mindset should remain prevalent for investors looking at explorer and developer equities, while improving operations has been the biggest motivator for producer share prices in 2014. In this interview with The Gold Report, Killeen offers his insight and hands-on perspective on several developers and producers with near-term catalysts. The Gold Report: Two years ago CIBC World Markets recommended taking a short position on a selection of gold stocks. What's CIBC's view on gold stocks today? Jeff Killeen: We had put out a basket of names recommending some short positions, but at that time gold was trading at about $1,600/ounce ($1,600/oz) and there was little support for the price at that level. That dynamic doesn't seem to be at play in today's environment. We are maintaining our current recommendation: Investors should be at market weight with respect to their gold equity allocations. Many mining stocks have performed well in 2014 and the move has largely been motivated by several factors. First, gold bullion itself has found a footing. The gold price has traded in a range of $1,250–1,350/oz, which is fairly narrow compared to how gold prices have moved in the past three to five years. Investors are becoming comfortable with the idea that gold will remain range bound for the coming 12 months or more, and concerns that gold could drop significantly over a short period seems to be waning with gold seeing support around $1,250/oz. While some profit taking on strong first half share performance is certainly justifiable, I continue to recommend buying gold stocks with a focus on companies that are currently generating healthy margins and could enjoy higher trading multiples as they gravitate up toward longer-term averages. I also like gold stocks that have underperformed relative to their peers in 2014 that are projecting improving operations or have meaningful catalysts in the near term. TGR: What do you expect the trading range for gold to be through the end of 2015? JK: Our gold price estimate for 2015 is $1,300/oz. Next year is likely to look a lot like 2014 with typical seasonal moves and maintaining that price range of roughly $1,250–1,350/oz for the year. TGR: Do you think the Market Vectors Junior Gold Miners ETF (GDXJ:NYSEArca) will be up another 30% through the first eight months of 2015? JK: That would be difficult. There could be stocks that realize some strong performance in the back half of this year and into next year, but I don't think it will be as broad based as we saw early in 2014. TGR: In the near term do you expect gold buying to gain steam or have seasonal gold buying trends become something of the past? JK: We've spent a lot of time tracking gold's seasonal price patterns over 5-, 10- and 15-year trends. Plotting the relative performance of gold prices over those periods shows a fairly consistent seasonal pattern. A move in the gold price in early June on the back of geopolitical tensions was unexpected and may have taken some of the steam out of a fall rally, but we need to realize that the typical fall rally is largely spurred by physical demand from the East. I don't see a reason why typical physical demand wouldn't materialize in 2014 and we expect the gold price to do well over the next few months. TGR: One division of CIBC World Markets uses quantitative models to identify predictive relationships and broad market trends. What are these models telling investors about small-cap gold stocks and the gold space? JK: Our quantitative analyst, Jeff Evans, has been promoting the idea that gold stocks, especially the more volatile small- to mid-cap gold stocks, have high beta outperformance relative to the S&P 500 and the Toronto Stock Exchange given the current environment for stable or marginally upward moving interest rates over the long term. That's from a technical standpoint. With that in mind, we have to be cognizant of the fact that we've seen better downside support and some strong moves in the gold price in 2014 that weren't necessarily expected and I'm sure that has helped move some gold stocks upward. But interest rates are having an effect on how people look at gold and gold equities, and using that as a trigger to buy or sell gold stocks makes sense to me. TGR: In June 2013 positive news had largely stopped moving equity prices. You told us then that it would be temporary. What news is moving producer and developer equities in this market? JK: On the producer side, improving operations has been the biggest motivator for share prices. Although I expect a lot of the cost improvements in the gold mining space have already been incorporated into operations, the market is thinking about how sustainable those cost improvements might be. Companies that maintain lower costs through 2014, relative to where they may have been in previous years, are likely to get attention as investors think about 2015 performance and if they should consider increasing their estimates for company earnings and cash flow. Such a scenario could generate further share support for good operators. Of course, companies that realize further cost improvements in the second half of 2014 are also likely to get investors' attention. TGR: What about developers? JK: On the developer side, we're starting to see share prices get rewarded for good drill results, resource growth and even new discoveries. When we spoke back in mid-2013 I recommended that investors stick to the cash-and-catalyst mentality because an exploration stock needs to have a strong balance sheet and material near-term catalysts. That approach was the right one and I'd stick with that concept today. In 2013, Premier Gold Mines Ltd. (PG:TSX) was one stock I highlighted as being a company with lots of cash and that would have meaningful developments over the following 12 months. In 2014 the company produced a preliminary economic assessment (PEA) and increased the total resource for its Hardrock project in northern Ontario. That has improved Premier's estimated return on paper. Meanwhile, Premier has increased the mineralized footprint and consolidated its Cove project with the neighboring McCoy mine in Nevada. Its strong balance sheet and the ability to unlock value in its assets are a big part of Premier's share price performance—it's up almost 80% year-to-date. That cash-and-catalyst requirement should still be prevalent in investors' minds. TGR: Would you make any modifications to the cash-and-catalyst thesis given what has transpired between then and now? JK: Cash and catalysts are not the only components that a company must have. The main project has to have gold grades that are amenable to the type of process it is proposing, and the economics have to work at current gold prices to have a realistic chance of seeing a takeover offer. A company definitely has to have a solid management team to navigate today's tricky financing waters or wisely allocate capital. TGR: Which types of companies are seeing interest from institutional investors? JK: My producer coverage is in the small to intermediate market cap in the gold space. The intermediate producers tend to have a higher beta to the bullion price so that segment of my coverage seems to have sustained greater institutional interest in 2014. Despite some merger and acquisition (M&A) activity in 2014, the general feeling among investors is that although M&A is likely to continue, it's expected to come in the form of smaller consolidations or the sale of noncore assets by majors. In that context, exploration companies are struggling to attract attention from the institutional market. Investors are apprehensive to build meaningful takeout premiums into a company's share price. But the gold exploration stocks that are still on the radar for institutional investors are companies like Premier,Continental Gold Ltd. (CNL:TSX; CGOOF:OTCQX), Pretium Resources Inc. (PVG:TSX; PVG:NYSE), Pilot Gold Inc. (PLG:TSX) and Asanko Gold Inc. (AKG:TSX; AKG:NYSE.MKT). Those are developers under coverage that are getting the most attention from institutional buyers. TGR: What are your top picks in the junior and midtier producer space? JK: My top pick would still be B2Gold Corp. (BTG:NYSE; BTO:TSX; B2G:NSX). The company is spread out geographically, but it is continuing to incrementally improve the performance at the operations in production. B2Gold is going to bring on another leg of meaningful growth with the Otjikoto mine in Namibia later this year. Although the pace of acquisitions has been high over the last few years, B2Gold has been able to build a solid pipeline of projects—the next likely being the Fekola project in Mali. B2Gold will see fairly significant production growth over the next couple of years and that growth should come with improving costs. That's the kind of dynamic that investors are looking for given the concept that gold may stay range bound here in the near term. TGR: You visit a substantial number of mining projects each year. Please share some of your takeaways from recent visits. JK: In late August I visited Pretium Resources' Brucejack project in northern British Columbia. This was my third time there and my focus was to have a closer look at the underground bulk sample area of the Valley of the Kings deposit and see how both the geology and the mineralization compare with some of the interpretations and estimates Pretium has laid out. I looked at the stockwork veining that hosts much of the gold and silver mineralization and witnessed how the company has assessed its resource. I returned from the trip with an improved comfort level around the company's interpretations. Questions from the broader market about the realized mine grade will persist until it goes into operation, but nonetheless the site should perform well. TGR: Boston-based Liberty Metals & Mining Holdings recently took a position in Pretium. Does the market see that as a vote of confidence in Brucejack? JK: That type of investment often gives investors the idea that there is further financial support available for an asset like Brucejack. That builds some confidence from the market's perspective that Pretium will be able to find financing to move the project forward. But no single investor investing in an asset could build full confidence in any one project. It's a positive step, yet many other pieces would have to fall into place to get a complete stamp of approval from the market. TGR: Is Pretium fairly valued? JK: We rate it a Sector Outperformer so we think it's certainly a stock with upside. At CIBC we have taken a more conservative approach to modeling Brucejack and the Valley of the Kings deposit relative to how the company designed its feasibility study. Even so, our net asset value (NAV) for Brucejack alone is north of $11 based on Pretium's current share count. I would note, though, that a takeout premium is priced into our $11.50 target because most stocks in the junior space are trading in the 0.4-0.6x NAV range. In order to build and sustain a significant takeout premium, Pretium will have to undertake a few more derisking steps over the next 12 months. TGR: Please tell us about some other recent visits. JK: I recently visited its Premier's Hardrock project in northern Ontario. Similar to my trip to Pretium, I was looking at how the geology and mineralization on surface compares to the company's estimates. Premier has exposed some of the geology on surface and interpretations of that geology based on computer models are being validated through surface sampling. Also in focus were some steps it is taking toward producing a feasibility study early next year. Premier has done a lot of geotechnical drilling over the last year and found that it has good rock stability, so it's likely that we'll see slightly steeper pit walls in the feasibility study relative to the PEA of January 2013; this could improve the overall strip ratio and improve costs. The bottom line is that Hardrock is certainly the company's focus. The work the company will do over the next 6 to 12 months should at least marginally improve Hardrock's economics, which could bring people's eyes back to that project. TGR: What's Premier's likely course with Hardrock once the feasibility is published in 2015? JK: Once it gets Hardrock past the feasibility stage, Premier must seriously consider how it would finance a mine. Financing this mine will be one of the bigger challenges Premier faces. Hardrock is a "modest capital expenditure" project in the range of $500 million and it could be attractive to a midtier or senior producer because the cost is not in the billions. TGR: Does Premier Gold Mines President and CEO Ewan Downie still see himself as an asset developer or is he thinking about becoming a miner? JK: With senior management additions like Chairman Ebe Scherkus and a number of other engineering and resource-modeling professionals, we can see that this company is transforming. Ebe and the team that Premier has brought in are focused on properly designing Hardrock and are moving that project through the development phase. But this is still a junior exploration company. If its project looks attractive from an M&A standpoint, I expect that Premier would be willing negotiators provided that the numbers make sense. TGR: Perhaps maybe one or two more recent site visits. JK: Sure. Every year we have a mine tour that goes across the Abitibi in northern Ontario and Québec. I visited a number of sites including Primero Mining Corp.'s (PPP:NYSE; P:TSX) recently acquired Black Fox gold mine. That's certainly a big part of Primero's story in 2014. It went from owning a single asset—the San Dimas mine in Mexico—to being a multi-asset company with Black Fox. Primero has some work to do at Black Fox in getting development meters completed and underground production back to mid-2013 levels. The larger part of the story—and what the market is really paying attention to—is the current drill program. The mine life at Black Fox is just over five years. Primero is drilling down dip from the main ore body at Black Fox with the goal of adding to the overall resource. Drill results released since Primero acquired the asset in 2014 suggest that the resource will grow, but the company will need to finish the current drilling campaign to get a better understanding of the resource growth potential at Black Fox. TGR: That's the near-term focus. Do you see Primero continuing to consolidate that camp given Black Fox's proximity to other assets? JK: At this point Primero is focused on Black Fox. Down the road there could be some opportunities for consolidation. St Andrew Goldfields Ltd. (SAS:TSX), for instance, is one of Primero's neighbors. St Andrew has been working toward getting the Taylor mine up and running. Once that mine is in operation, St Andrew's mill would be east of Black Fox and Primero's Stock mill whereas Taylor is west. St Andrew would effectively be passing right by Primero's mill to travel to its mill. Do I think that there could be further consolidation in the district? It's possible but I don't think that is as likely. Developing working agreements between companies to improve efficiency is a more likely outcome in my mind. TGR: What are some other stories under coverage? JK: Argonaut Gold Inc. (AR:TSX) recently released an initial resource for its San Agustin project in Mexico. Why it's interesting is that San Agustin is the neighboring project to the company's flagship mine, El Castillo, about 10 kilometers away. Argonaut performed well in 2013, yet its shares have underperformed in 2014. I think part of that underperformance has stemmed from some concern about Argonaut's next leg of growth—but the initial San Agustin resource could be that next leg of growth. With an average gold grade of about 0.32 grams per ton (0.32 g/t) in its resource statement, I wouldn't call the grades flashy but the neighboring El Castillo mine has a reserve grade of 0.36 g/t. A PEA for San Agustin before the end of 2014 could be another meaningful catalyst for Argonaut. TGR: Maybe one more? JK: One junior that continues to get attention is Pilot Gold, largely on the back of its good work in Turkey and Nevada. We've seen some great results from its Kinsley project in Nevada—some of the better grades I've seen in Nevada in recent memory. How big is the Kinsley deposit? The overall footprint is still fairly small so there is more work to be done to conceptualize the size of the deposit and get investors fully engaged. Nonetheless, the grades are robust and have garnered some market attention. In Turkey, Pilot identified several new zones at the TV Tower project, a joint venture with Teck Resources Ltd. (TCK:TSX; TCK:NYSE). Again, oxidized mineralization in some cases and showing consistent mineralization patterns. Bottom line: There seems to be a fairly clear path to adding ounces at both projects. Those are the kinds of things that get the market's attention. TGR: One recent drill result at TV Tower was 130.9 meters grading 1.5 g/t Au and 0.48% Cu starting at surface. You model results like these all the time. What does that look like to you? JK: No project is a single drill hole, but to have a single hole with those kinds of numbers is an excellent start. If you put several intercepts like that together you can quickly build pounds and ounces. Being able to validate a surface geological interpretation is big and a great starting point for any drill program. TGR: What's your sense of where we are in the recovery of precious metals equities? JK: I get the feeling that we have hit the bottom and taken the first leg up—but the next leg up could take some time to materialize. There are individual stocks that should have good performance through the back half of 2014 and over the next 12 to 18 months. From a broader perspective, a lot of the cost improvements have already materialized and I think there is little producers can do to significantly improve margins or cash flow. To accomplish those things we need to see a few things happen: more fundamental support from the gold price and an increase in physical demand in India and the rest of Asia. Better yields will catalyze the generalist investor back to investing in gold stocks. TGR: Thank you, Jeff, for your insight. https://www.theaureport.com/pub/na/jeff-killeen-cash-and-catalysts-rule-the-day Jeff Killeen has been with the CIBC Mining Research team since early 2011. He covers and provides technical assessment of junior and intermediate exploration and mining companies worldwide. Prior to joining CIBC, Killeen worked as an exploration and mine geologist in several major mining camps, including the Sudbury basin and the Kirkland Lake region. Killeen earned his Bachelor of Science degree from Carleton University. Want to read more Gold Report interviews like this? Sign up for our free e-newsletter, and you'll learn when new articles have been published. To see recent interviews with industry analysts and commentators, visit our Streetwise Interviews page. DISCLOSURE: Streetwise – The Gold Report is Copyright © 2014 by Streetwise Reports LLC. All rights are reserved. Streetwise Reports LLC hereby grants an unrestricted license to use or disseminate this copyrighted material (i) only in whole (and always including this disclaimer), but (ii) never in part. Streetwise Reports LLC does not guarantee the accuracy or thoroughness of the information reported. Streetwise Reports LLC receives a fee from companies that are listed on the home page in the In This Issue section. Their sponsor pages may be considered advertising for the purposes of 18 U.S.C. 1734. Participating companies provide the logos used in The Gold Report. These logos are trademarks and are the property of the individual companies. 101 Second St., Suite 110 Tel.: (707) 981-8999 |

| You are subscribed to email updates from MINING.com To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 20 West Kinzie, Chicago IL USA 60610 | |

0 Comment for "Currency mayhem"