CHARTS: Giant gap between future lithium supply, demand |

- CHARTS: Giant gap between future lithium supply, demand

- Iron ore price bears come out in force

- How to test for fake gold and silver

- Doubling down on inflation

- This is the $10 million-plus white diamond just found in South Africa

- Waste has just stopped leaking from Mount Polley mine

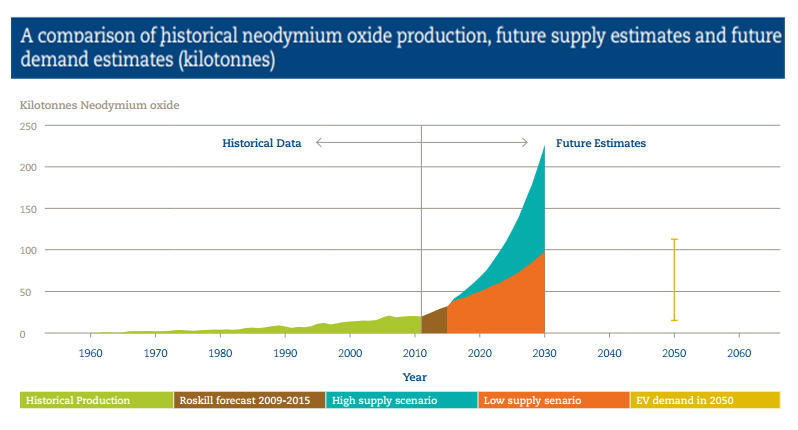

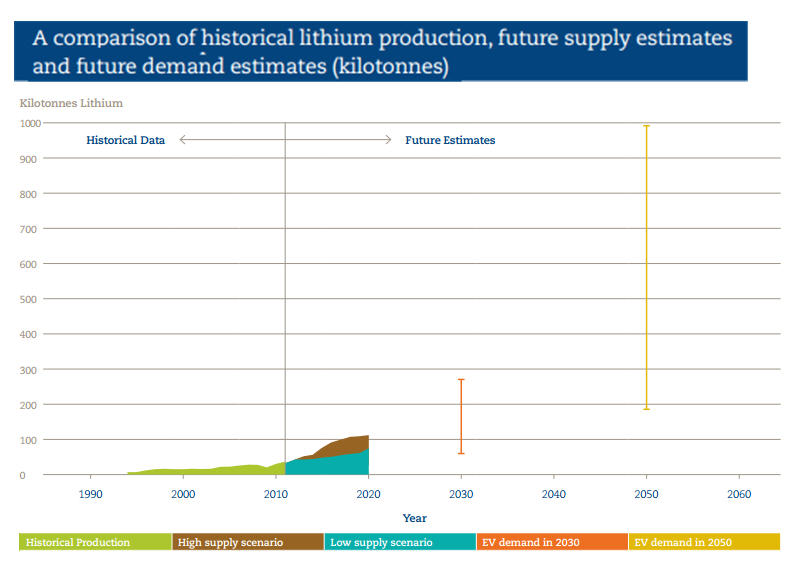

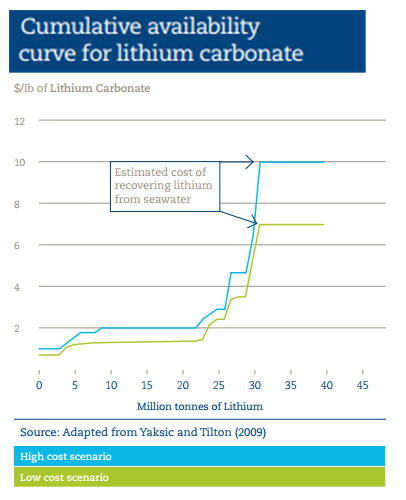

| CHARTS: Giant gap between future lithium supply, demand Posted: 10 Sep 2014 04:58 PM PDT  1960 Nu-Klea Starlite Electric Runabout – Nu-Klea Automobile Corp. of Lansing, Michigan hoped to get this electric car into production. Drive was to be "D.C. Electric Motors". Power was described as "Battery 36 volts", with "built-in charger". Body: All Plastic, with optional fiberglass cloth or Plexiglass top. Image: Alden Jewell New research by the UK Energy Research Centreand the Energy Research Partnership looking at materials availability for green technologies finds critical metals used to manufacture low-carbon energy technologies "is rising rapidly and requires serious attention from industry and policymakers." However says the report "scaremongering about scarcity is misguided" as there is "little evidence to suggest that resource availability or depletion is affecting production growth now and/or in the short term." This chart shows rising production of 10 of these raw materials used in electric vehicle batteries, photovoltaics for solar polar, hydrogen fuel cells and wind turbines among others in response to rising demand:  Source: UKERC The study zoned in on lithium and rare earth element neodymium, critical components of electric vehicles, which are also not easily substituted. The report notes there is currently no efficient substitute for lithium-based EV batteries "given the unparalleled energy density delivered by this chemistry" and no other chemistry provides magnets of the power achievable with neodymium magnets used in permanent magnet motors. The question is whether future production can meet this demand. From this chart it's clear for neodymium the picture is not all that rosy (although the first chart shows REE production is already falling to reflect future demand):  Source: UKERC Lithium on the other hand, even at the lower end of demand forecasts, will need significant investment in production to meet future needs.  Source: UKERC The authors do caution that the wide supply-demand ranges is a reflection of "the wide range of assumptions in the literature and the uncertainty in estimates of critical metals futures." This chart presents a cumulative availability curve for lithium, highlighting the very large quantities of resource available if consumers are willing to pay the This indicates the physical challenges associated with extracting metals from geological sources with ever-decreasing metal concentrations, and the ever-increasing costs associated with recovering these metals, says the report. Click here to download the full report. |

| Iron ore price bears come out in force Posted: 10 Sep 2014 04:39 PM PDT Long held assumptions about the direction and dynamics of the iron ore market have been tested in 2014. After hitting a high of $158.90 in February, the industry was jolted on March 10, when iron ore suffered the worst one-day decline since the 2008-2009 financial crisis, cratering 8.3% in a single session. The recovery from there was swift, but by June 16 the steelmaking raw material was sliding again. On Wednesday benchmark Northern China 62% Fe imports fell again to trade at $82.20 a tonne, a fresh five-year low and down 40% this year. Iron ore is fast becoming a big boys game and a number of miners have already fallen by the wayside including Sweden's Northland Resources, Australia's Cairn Hill and Canada's Labrador Iron Mines. While the majors such as Rio Tinto, Vale, BHP Billiton and (less so) Fortescue can still make money at these prices, for smaller producers there's more pain ahead. The UK paper also quotes from a note by Christian Lelong, analyst at Goldman Sachs, who said major producers are underestimating the extent of potential price declines: "The long period of above trend in profitability enjoyed by the iron ore industry is at an end, destroyed by the billions of dollars major producers have ploughed into new, low-cost capacity. "In our view, 2014 is the inflection point where new production capacity finally catches up with demand growth, and profit margins begin their reversion to the historical mean; in other words, the end of the Iron Age is here." Goldman on Wednesday also cut its price forecasts by $10 to an average $80 a tonne next year, with only slight declines over the next two years. Strong medicine indeed, but Lelong is not the biggest bear out there. Bloomberg quotes Alberto Calderon, former BHP exec and now a board member of Orica, the biggest supplier of chemicals and explosives to the mining industry: "Right now the wall of excess supply is obvious. At some point someone has to take a lead and say we are all just heading towards a cliff. At some point, common sense will have to prevail." Calderon also said the majority of mine closures or output cuts "won't necessarily take place in China as producers anticipate," but a much of it will come from higher-cost miners in Australia: "Until mines close it's a world of $70 prices of iron ore." |

| How to test for fake gold and silver Posted: 10 Sep 2014 11:02 AM PDT |

| Posted: 10 Sep 2014 11:01 AM PDT Friday's release of disappointing August payroll numbers should have been a jarring wake-up call warning Wall Street that the economy has been treading on thin ice. Instead the alarm clock was stuffed under the pillow and Wall Street kept sleeping. The miss was so epic in fact (the 142,000 jobs created was almost 40% below the consensus estimate) that the top analysts on Wall Street did their best to tell us that it was all just a bad dream. Mark Zandi of Moody's reacted on Squawk Box by saying "I don't believe this data." The reliably optimistic Diane Swonk of Mesirow Financial told Reuters the report "sure looks like a fluke, not a trend". But the opinions of those that really matter, the central bankers in charge of the global economy, are likely taking the report much more seriously. Given that this is just the latest in a series of moribund data releases, such as news today that U.S. mortgage applications have fallen to the lowest levels in 14 years, caution is justified. Unfortunately very little good comes from central bank activism. Recent statements from Fed officials across the United States and recent actions from ECB president Mario Draghi reveal their growing resolve to fight too low inflation, which they believe is the biggest threat to recovery. There are many things that are contributing to the global woes. But low prices are not high on the list. Since the markets crashed in 2008, central banks around the world have worked feverishly to push up the prices of financial assets and to keep consumer prices rising steadily. They have done so in the official belief that these outcomes are vital ingredients in the recipe for economic growth. The theory is that steady inflation creates demand by inspiring consumers to spend in advance of predictable price increases. (The flip side is that falling prices "deflation," strangles demand by inspiring consumers to defer spending). The benefits of inflation are supposed to be compounded by rising stock and real estate prices, creating a wealth effect for the owners of those assets which subsequently trickles down to the rest of the economy. In other words, seed the economy with money and inflation and watch it grow. Thus far the banks have been successful in creating the bubbles and keeping inflation positive, but growth has been a no show. The theory says the growth is right around the corner, but like Godot it stubbornly fails to show up. This has been a tough circle for many economists to square. Two explanations have emerged to explain the failure. Either the model is not functioning (and higher inflation and asset bubbles don't lead to growth) or the stimulus efforts thus far, in the form of zero percent interest rates and quantitative easing, have been too timid. So either the bankers must devise a new plan, or double down on the existing plan. You should know where this is going. The banks are about to go "all in" on inflation. Despite their much ballyhooed "independence", central bankers have proven that they operate hand in glove with government. They are also subject to all the same political pressures and bureaucratic paralysis. There is an unwritten law in government that when a program doesn't produce a desired outcome, the conclusion is almost never that the program was flawed, but that it was insufficient. Hence governments continually throw good money after bad. The free market discipline of cutting losses simply does not exist in government. This is where we are with stimulus. Six years of zero percent interest rates and trillions and trillions of new public debt have failed to restore economic health, but our conclusion is that we just haven't given it enough time or effort. My theory is a bit different. Maybe zero percent interest rates and asset bubbles hinder rather than help a real recovery. Maybe they resurrect the zombie of a failed model and prevent something viable and lasting from gaining traction? This is a possibility that no one in power is prepared to consider. But what if they succeed in getting the inflation, but we never get the growth? What if we are headed toward stagflation, a condition that in the late 1970s gripped the U.S. more tightly than Boogie Fever? It may come as a surprise to the new generation of economists, but high inflation and high unemployment can coexist. In fact, the two were combined in the 70s and 80s to produce "the Misery Index." But according to today's economic thinking, the Index should not be possible. Inflation is supposed to cause growth. If unemployment is high they say there is no demand to push up prices. But it's the monetary expansion that pushes prices up, not the healthy job market. The tragedy is that if the policy fails to produce real growth, as I am convinced it will, the price will be paid by those elements of society least able to bear it, the poor and the old. Inflation and stagnation mean lost purchasing power. The rich can mitigate the pain with a rising stock portfolio and more modest vacation destinations. But they won't miss a meal. Those subsisting on meager income will be hit the hardest. Many economists are now trying to make the case that the United States had hit on the right stimulus formula over the past few years and is now reaping the benefit of our bold monetary experimentation. They continue the argument by saying Europe and Japan were too timid to implement adequate stimulus and are now desperately playing catch up. But this theory is false on a variety of fronts. First off, the U.S. is not recovering but decelerating. Annualized GDP in the first half of 2014 has come in at just a shade over one percent, which is lower than all of 2013, which itself was lower than 2012. The unemployment rate is down, but labor participation is at a 36-year low, and wages are stagnant. We have added more than $5 trillion in new public debt, but very little to show for it. We are not the model that other countries should be following but a cautionary tale that should be avoided. It is also spectacularly wrong to assume that the problems in Europe and Japan can be solved by a little more inflation. Higher prices will just be a heavier burden for European and Japanese consumers, not an elixir that revitalizes their economies. The problems in Europe, Japan and the U.S. all have to do with an oppressive environment for savings, investment, and productivity that is created by artificially low interest rates, intractable budget deficits, restrictive business regulation, antagonistic labor laws, and high taxes. Since none of the governments of these countries have the political will to tackle these problems head on, they simply hope that more monetary magic will do the trick. So as the Fed, the ECB, the Bank of Japan, and all the other banks that follow suit, push all their chips into the pot and hope that a little more inflation will save us from the abyss, we can wish them luck. It's going to take a miracle. Best Selling author Peter Schiff is the CEO and Chief Global Strategist of Euro Pacific Capital. His podcasts are available on The Peter Schiff Channel on Youtube Catch Peter's latest thoughts on the U.S. and International markets in the Euro Pacific Capital Summer 2014 Global Investor Newsletter! |

| This is the $10 million-plus white diamond just found in South Africa Posted: 10 Sep 2014 09:42 AM PDT Shares in Petra Diamonds (LON:PDL) continued to soar Wednesday after the miner revealed late Tuesday it had found a 232.08-carat white diamond at its Cullinan mine in South Africa, which four analysts predict could fetch between $10 million to $16 million. The London-listed company, increasingly famous for its exceptional recent discoveries, saw its stock climbing over 10% since the announcement, closing at a high of 195.5 pence Wednesday. The new stone is a D colour Type II diamond of "exceptional size and clarity," and it has become Petra's largest white diamond since the 507-carat Cullinan Heritage found in 2009 at the same mine. That rough white diamond was given a "flawless" clarity grade and fetched $35.3 million, a record price for the company. The Cullinan mine, near Pretoria, is famous for the discovery of the largest diamond ever recovered. That one was made in 1905 when miners unearthed a 3,106 carat diamond, which was later cut to form the Great Star of Africa and the Lesser Star of Africa, set in the Crown Jewels of Britain. Images courtesy of Petra Diamonds. |

| Waste has just stopped leaking from Mount Polley mine Posted: 10 Sep 2014 08:34 AM PDT The Canadian province of British Columbia has issued a formal warning to Imperial Metals (TSX:III) after an inspection to the Mount Polley mine found waste was still leaking from its breached tailing dam facility a month after it burst. Inspectors from the Ministry of Environment, who were at the mine last Friday, found waste was still dripping from the tailings pond that collapsed over a month ago. The leaks have now stopped, but the inspectors are worried that the upcoming rainy season will put the area at risk again. The Ministry hit Imperial Metals with an "advisory letter" warning that it was violating environmental laws. The document, dated Sep. 9, states that while the authority understands that there are challenges around working at the spill site, it also believes "more action" could be taken to ensure greater environmental protection in a "more timely manner." The breach sent the equivalent of 2,000 Olympic swimming pools of mining waste into the creek, tearing a swath as much as 45 metres wide down the previously metre-wide waterway. Images from archives |

| You are subscribed to email updates from MINING.com To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 20 West Kinzie, Chicago IL USA 60610 | |

0 Comment for "CHARTS: Giant gap between future lithium supply, demand"