Woodside chairman to head up major CAT distributor WesTrac |

- Woodside chairman to head up major CAT distributor WesTrac

- Greenpeace-commissioned report slams plans to develop world's largest coal deposit

- Were tectonics responsible for the 'Great Dying' 250 million years ago?

- Australians 'short changed' by mining boom, main trade union says

- African ecstasy drug bust yields 2.2 pounds of uranium

- Coeur Mining buys royalty company

| Woodside chairman to head up major CAT distributor WesTrac Posted: 26 Nov 2013 01:28 AM PST Australian investment firm Seven Group Holdings Limited has appointed current Woodside Energy chairman Jarvas Croome as the next chief executive for its subsidiary, WesTrac. Croome will take up the position with WesTrac, one of the world's largest Caterpillar distributors, in April 2014. "Having worked with him before, I know he has a terrific grasp of technical and production aspects of the sectors in which we operate and that couples with outstanding commercial and management capabilities," managing director of Seven Group Don Veolte said. WesTrac recently announced that it would begin sacking 400 employees at its Perth operations. |

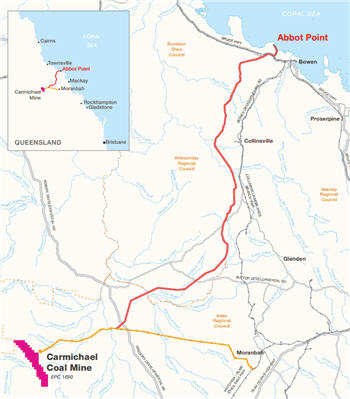

| Greenpeace-commissioned report slams plans to develop world's largest coal deposit Posted: 25 Nov 2013 05:30 PM PST  Carmichael coal mine | Image from IEEFA report Last year, Indian conglomerate Adani Group announced its plans to develop the world's largest coal deposit. Located in Australia, the $10 billion Carmichael mine in the Galilee Basin holds 10 billion tonnes of the black rock. But these lofty plans were dealt a blow on Monday as an investigation commissioned by Greenpeace found the project to be "uncommercial for investors," calling it a "weak partner for this expensive coal, rail and mine project." "The project's economics don't stack up," authors from the Institute for Energy Economics and Financial Analysis wrote. According to the study, both short and long-term coal prices don't support the mine's cost structure. Authors Tim Buckley and Tom Sanzillo also found that the Adani Group is "financially and operationally constrained and faces a series of logistical barriers in Australia." Labelling the project "low quality, high cost," Buckely and Sanzillo estimate an erengy-adjusted cash cost of production of $84 per tonne, inclusive of royalties. They also slam the company's ambitions to supply thermal coal to India, one of the world's largest coal consumers. "India's power market is fatally flawed," the report reads. "It cannot absorb the high price of coal from the Carmichael project." But the bashing doesn't end with the Australian mine. The report goes on to criticize Adani Power itself, calling the company "financially weak and operationally underperforming." Adani Power's share price is down 46% year to date and 74% over the past three years. The company also doesn't have much experience in the coal mining sector, having had its first experience with a mine in Indonesia in 2010. "Adani Enterprises is now proposing to build the biggest coal mine complex in Australian history," Buckley and Sanzillo write. The Indian conglomerate responded with a statement, saying it had "complete confidence" in its project, and that the "motivation at the heart of these reports is short-sighted" and "vested in interests that ignore the long-term fundamentals that underpin Adani's projects." |

| Were tectonics responsible for the 'Great Dying' 250 million years ago? Posted: 25 Nov 2013 04:58 PM PST The most severe extinction of life on Earth, the 'Great Dying', may have been connected to geological processes that resulted in the formation of the Supercontinent, Pangea, according to a new study published in Science China Earth Sciences. Roughly 252 million years ago, 70% of land species and 90% of ocean species were wiped off the planet and the study by professors at the China University of Geosciences argue that this destruction of biodiversity may have been a result of higher mountains and deeper oceans triggered by the formation of Pangea. "Oxygen levels were low in the oceans, making it difficult for many animals to survive. Carbon dioxide and methane levels were unusually high, contributing to major warming of the planet," Johnny Bontemps writing about the study for Phys.org. "Acid rain fell, and made sea water so acidic that all coral reefs disappeared. The inland turned into an dry desert, hot and arid, and devastated by major wild fires." "The climate also varied between periods of sudden warming and cooling, making it impossible for many species to adjust." During the formation of Pangea, the shifting of tectonic plates may have sent cool material all the way to the Earth's core, triggering the Illawarra magnetic reversal and 'super-plume' explosions on the surface: "The accumulation of cool material near Earth's core then could have led to the formation of a large mantle plume (by a process called thermo-convection), other researchers had suggested. That "super-plume" would eventually reach the Earth's surface in two separate bursts—first with an eruption in China 260 million years ago, and then with the other in Russia 251 million years ago." |

| Australians 'short changed' by mining boom, main trade union says Posted: 25 Nov 2013 03:55 PM PST

But a new report commissioned by the Australia's Construction, Forestry, Mining and Energy Union (CFMEU) says that companies' mining profits have "far outstripped growth in resources taxes and royalties." According to the study by SGS Economics and Planning, the boom has has not delivered on the promised long-term economic benefits. Some key findings show that:

The CFMEU argues that more money should be flowing from the mining sector to education and other public services. "We need a federal government willing to stand up to self-interested mining companies and manage this resources boom in a fair and sustainable way," CFMEU Energy Division General Secretary Andrew Vickers said in a news release. The report cites Norway as a good example of how resource wealth can be equitably distributed. Fuelled by oil revenues, the Nordic country's sovereign wealth fund is the largest in the world. The fund invests strategically in domestic companies, predominantly through the Oslo Stock Exchange.

Study authors conclude by arguing that Australia adopt certain "appropriate elements of the Norwegian model." Australia's Mineral Resources Council doesn't agree with the report. The group's public affairs director spoke to Australia's ABC News on Monday, saying that 98% of everything mining companies have earned out of Australia "has been invested back in Australia to keep operations going." He also released a series of Tweets, highlighting the industry's successes at spreading the wealth. |

| African ecstasy drug bust yields 2.2 pounds of uranium Posted: 25 Nov 2013 03:30 PM PST South African officials have seized 2.2 pounds of uranium along with 90 ecstasy tablets from two young men attempting to sell the items in Durban. The uranium was confirmed as such by the South African Nuclear Energy Corporation (NECSA), which claims the substance is unlikely a product of Africa. "Yes it is uranium and the tests suggest that it must have come from a country that is dealing with some uranium enrichment at the moment, very very unlikely (in) Africa," said NECSA spokesman Elliot Mulane. The uranium is 0.38 percent made up of the U-235 isotope, "well below the average 0.7% U-235 found in natural uranium and the 90% level needed to be considered weapons grade," AFP reports. An international investigation into the trafficking is now underway and will target major uranium enrichment countries such as China, Iran, Japan, North Korea and the US. |

| Coeur Mining buys royalty company Posted: 25 Nov 2013 02:57 PM PST Coeur Mining (NYSE:CDE) says it will buy Global Royalty Corp., a Vancouver-based precious metals royalty company with interests in operating mines in Mexico and Ecuador. Coeur, the largest US-based primary silver producer, outbid Blackhawk resources to acquire Global Royalty for $23.8 million – $300,000 in cash and the remainder in common shares. The mining company has also created a subsidiary, Coeur Capital, to hold existing and future royalty and streaming interests. "A royalty/streaming company offers a complementary business model to Coeur Mining's traditional operating model, and this addition will make Coeur Mining a more attractive company for investors," Joe Scolaro, Coeur's account executive at Sterling Kilgore wrote in an email. "Royalty/streaming equities have outperformed mining companies and metals prices and are awarded higher trading multiples. The two models are complementary, especially when pursuing external growth opportunities." Such agreements could help ease some of the financing issues that both large and small companies are currently experiencing. "Small companies that are undercapitalized and lacking cash flow, and large companies requiring very large transactions in order to 'move the needle,'" Sterling Kilgore wrote. "Coeur Capital is well positioned in the middle of these two ends; it's target transaction size is between $3-$30 million." Global Royalty's agreement with McEwen Mining on its El Gallo mine in Mexico gives a 3.5% net smelter royalty (NSR). It's agreement with Dynasty Metals & Mining gives 1.5% NSR on the miner's Zaruma gold project in Ecuador. Coeur was up 1.21% on Monday, trading at $10.84 per share. |

| You are subscribed to email updates from MINING.com To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 20 West Kinzie, Chicago IL USA 60610 | |

0 Comment for "Woodside chairman to head up major CAT distributor WesTrac"