Spot Chart | <b>Gold</b> Shines Most in September on Seasonal Buys- Bloomberg <b>...</b> | News2Gold |

- <b>Gold</b> Shines Most in September on Seasonal Buys- Bloomberg <b>...</b>

- This <b>chart</b> shows how pricey <b>gold</b> mining stocks really are | MINING <b>...</b>

- <b>Gold</b> Shines Most in September on Seasonal Buys: Bloomberg <b>...</b>

- <b>Gold</b> Scents: <b>CHART</b> OF THE DAY

- <b>CHART</b>: Interest rates vs <b>gold</b> price shows plenty upside | MINING.com

- Ranking the Surprises on Derek Mason's First <b>...</b> - Anchor of <b>Gold</b>

| <b>Gold</b> Shines Most in September on Seasonal Buys- Bloomberg <b>...</b> Posted: 28 Aug 2014 01:10 AM PDT Gold Shines Most in September on Seasonal Buys The BLOOMBERG CHART OF THE DAY shows bullion averaged gains of 3% each September over the past 20 years, beating next best month November, when prices rose an average 1.8% according to Bloomberg based on a market update by GoldCore. We covered gold's seasonality and gold's best performing months here.

"Indian jewelers and dealers will be stocking up in the coming weeks, so it should affect prices," said Mark O'Byrne, a director at brokerage GoldCore Ltd. in Dublin.

This morning gold in Singapore ticked higher to $1,285/oz and gold in London has been bid higher to $1,293/oz. The gold/silver ratio is currently 66.10, near its one year high showing silver remaining very good value versus gold. Receive our award winning research here

|

| This <b>chart</b> shows how pricey <b>gold</b> mining stocks really are | MINING <b>...</b> Posted: 25 Aug 2014 03:46 PM PDT The gold price drifted lower on Monday, despite a surprise drop in the sales of new homes in the US and geopolitical tensions increasing its allure as a safe haven. On the Comex division of the New York Mercantile Exchange, gold futures for December delivery settled at $1,278.90 an ounce, down slightly following a 2% decline last week. Technical research and investment blog InvesTRAC passed on this price graph to MINING.com showing how the Philadelphia Gold & Silver Index (INDEXNASDAQ:XAU) of top precious metal stocks has run ahead of the gold price: Gold shares are not cheap. In fact relative to the price of the metal, gold shares are historically expensive. This view is based on the ratio of the XAU index relative to the gold price. Have a look at the weekly chart of this ratio below…it shows data from from January 2008. The downtrend is drawn in from the peak at 0.2389 made in October 2007(not shown) and now the ratio is at 0.07798 which is just a third of where it was back then. This has caused some analysts to suggest that the shares are therefore cheap. But the ratio has run into the downtrend and recent previous highs which should give one pause. But the RSI is what convinces me that the shares are expensive in the medium term…each time weekly RSI has been above 60 it has resulted in a drop in the ratio as the XAU index dropped faster than the metal price. In addition the InvesTRAC medium term model's OB/OS indicator is standing at maximum overbought 100 and the medium term forecast is for the ratio to decline until February/March 2015. Let's see what happens. |

| <b>Gold</b> Shines Most in September on Seasonal Buys: Bloomberg <b>...</b> Posted: 27 Aug 2014 04:47 AM PDT by GoldCore Gold Shines Most in September on Seasonal Buys: Bloomberg Chart of Day

Gold investors hurting from prices within 1% of a two-month low can find solace from the historical record and research and showing gold performs best in September. The BLOOMBERG CHART OF THE DAY shows bullion averaged gains of 3% each September over the past 20 years, beating next best month November, when prices rose an average 1.8% according to Bloomberg based on a market update by GoldCore. We covered gold's seasonality and gold's best performing monthshere. Buying increases with India's festival period, which runs from late August to October and is followed by the wedding season. At these times, bullion is bought for part of the bridal trousseau or in jewelry and bar form as gifts from relatives. Chinese purchases may also increase toward year-end, before the country's Lunar New Year celebration in February. China replaced India as the largest gold buyer in 2013. "Indian jewelers and dealers will be stocking up in the coming weeks, so it should affect prices," said Mark O'Byrne, a director at brokerage GoldCore Ltd. in Dublin. "A lot of traders are aware of this trend towards seasonal strength, so that may contribute to higher prices. They tend to buy and that creates momentum." See Gold Shines Most in September on Seasonal Buys: Bloomberg Chart of Dayhere MARKET UPDATE Gold climbed $6.20 or 0.49% to $1,282.40 yesterday and silver rose $0.03 or 0.15% to $19.40 per ounce yesterday. Gold in Singapore was virtually unchanged overnight but has ticked up marginally in London trading.

Silver for immediate delivery rose 0.4% to $19.53 an ounce. Spot platinum rose 0.8% to $1,422 an ounce. Palladium was unchanged at $891 an ounce – remaining near record 13 year nominal highs. Gold is now trading above its 200 moving average of $1284, and the gold price remains relatively strong despite a stronger dollar, rallying equity market indexes, and a relative easing of geopolitical tensions. The gold/silver ratio is currently 66.10, near its one year high showing silver remaining very good value versus gold. Receive our award winning research here 40 Total Views 5 Views Today |

| <b>Gold</b> Scents: <b>CHART</b> OF THE DAY Posted: 28 Aug 2014 06:47 AM PDT |

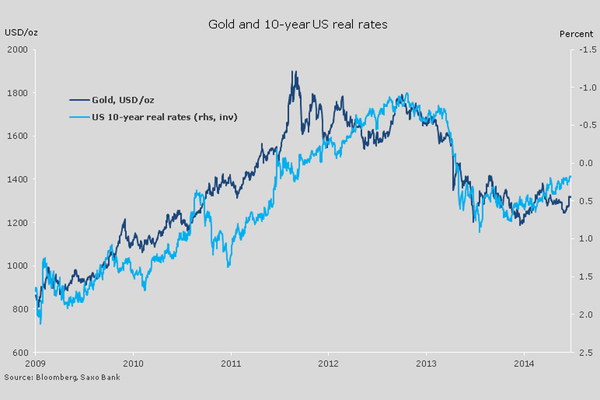

| <b>CHART</b>: Interest rates vs <b>gold</b> price shows plenty upside | MINING.com Posted: 13 Aug 2014 04:07 AM PDT Gold was trading sideways on Wednesday around the $1,310 level, holding onto gains of nearly 9% this year. This year the price of gold has found some support from safe haven buying thanks to the political crises in Eastern Europe and the Middle-East, but the number one negative factor working against the metal has been expectations of higher market interest rates and rising bond yields in the US. As the chart shows the relationship between real long-term interest rates in the US (as proxied by 10-year US inflation-linked bonds) and the gold price is strongly negative. Rising real interest rates raises the opportunity costs of holding gold because the metal provides no yield, and entices investors to rotate into riskier assets like stocks as evidenced by outflows from physical gold-backed ETFs which have continued this year. Higher rates also boost the value of the dollar which usually move in the opposite direction of the gold price. But despite consensus forecast by economists of higher rates the expected upward march of bond yields seems to have thoroughly reversed, even as the world's largest economy continues to recover and the Federal Reserve throttles back monetary stimulus. On Wednesday benchmark treasuries were testing support at 2.46% from above 3% last year, while adjusted for inflation yield in the US sunk to a meagre 0.22% versus 0.75% at the start of the year. According to this chart, 0.22% yield on Treasury Inflation Protected Securities or TIPS (which is actually up from a 14-month low hit last week) seems more consistent with a gold price of around $1,400 an ounce versus today's levels.  Source: Saxo Bank |

| Ranking the Surprises on Derek Mason's First <b>...</b> - Anchor of <b>Gold</b> Posted: 26 Aug 2014 11:02 AM PDT  Marvin Gentry-USA TODAY Sports Derek Mason unveiled his first depth chart as head coach of the Vanderbilt Commodores on Tuesday. As expected, there were several surprises - so we broke them down and then ranked them for you. On Tuesday morning, Derek Mason released his first official depth chart as the head coach of the Vanderbilt Commodores. It featured several familiar faces in starting roles, but also some hungry newcomers who will take the field for the first game of the Mason era in place of some veteran talent. If the listing holds true, players who had been assumptive starters headed into the summer will now have to fight to earn back their spots on the field, starting with Thursday's opener against Temple. A depth chart can't tell us everything. It's a basic breakdown of the starters and backups, but it's not the official code through which Mason will run this team. Players who are listed as first teamers will be usurped by the players behind them. Athletes who start throughout the season may play fewer snaps than their backups. The chart can be used as a legitimate guide for Commodore fans, or it might be used as motivation to fuel some extra fire at practice. With that understanding that everything is dynamic and nothing is set in stone, let's take a look at some of the bigger surprises on Mason's first depth chart for the 2014 season. These surprises were just one man's reaction, so your mileage may vary. All issues can be taken up in the comments below. 1. Stephen Weatherly starts at outside linebacker over Caleb Azubike. Weatherly came on strong at the end of last season as a legitimate pass rusher at defensive end, notching 4.5 tackles for loss in the team's final three games. Even so, he was expected to play a rotational role in 2014 thanks to the presence of Azubike and Kyle Woestmann in front of him. His presence at starter means that Azubike - who was pegged for breakout seasons the past two years after a strong freshman showing - may be behind the curve when it comes to realizing his All-SEC potential this fall. Team officials referenced Azubike's absence from practice due to a death in the family as the reason why he slid back on the depth chart. Will he be prepared, both physically and mentally, for this week's game? Will he be able to jump back in to full speed play and be a beast in the second level despite playing at a new position? His eye-opening first year with the Commodores suggests that he'll be able to adjust on the fly. However, let's not discount Weatherly's ability to play the game as a reason why he's starting on Thursday. He's quickly developing into a reliable and effective presence along the edges, and he'll make life difficult for plenty of quarterbacks this fall. Vanderbilt should be able to force several rushed passes and sacks from their OLBs. 2. Nigel Bowden starts at inside linebacker over Jake Sealand. Sealand had his share of growing pains as a redshirt freshman last fall, but he found a way to adjust to the speed of the game and improved to become a solid backup linebacker by the end of 2013. That experience appeared to give him an edge for a starting spot this summer, but he lost ground to redshirt freshman Bowden. Bowden, a four-star recruit, has prototypical size and strength at ILB. At a stocky 245 pounds he can push back blockers and stop runners at the point of attack, which gave him the early edge on his upperclassman counterpart. As for Sealand, he'll have to outplay true freshman Hawkins Mann in order to see significant playing time on Thursday - the two are listed as equals behind Bowden on the team's first depth chart. 3. Trey Wilkins starts at WR2 over a host of players. Wilkins, a senior, has certainly earned this designation due to his efforts on and off the field. The question now is whether or not he can keep it. He has the #2 spot amongst wideouts, but it's clear that there are no locks in Karl Dorrell's system this fall. Wilkins is listed as an "-or-" starter next to Latevius Rayford, and he could also see his spot taken by C.J. Duncan, who was placed right next to Jordan Cunningham on the depth chart. His two career receptions make him one of the team's most experienced receivers (sadly, this is not sarcasm), but he'll have to produce immediately to be a starter for the Commodores in 2014. 4. Ralph Webb starts at tailback (over Brian Kimbrow and an injured Jerron Seymour). Webb was a revelation at the spring game, and murmurs that he could earn the first carry of the 2014 season began to bubble up soon after this summer's practices began. As a result, it's not entirely surprising that the redshirt freshman was tagged for a starting role against Temple. He'll fill in for Seymour (knee injury) and relegated the shifty Kimbrow to chance-of-pace duties. While Kimbrow may be the more athletic and explosive back, Webb's all around game and ability to pick up blitzing defenders earned him an opening night start in his first season of active duty for the 'Dores. This competition could heat up in the coming weeks. Mason suggested that Seymour "could go today" if needed at Tuesday's press conference, but the team will sit him this week to push him towards 100% for next week's game against Ole Miss. 5. Hayden Lekacz earns a chance to split time as the team's kicker. Lekacz, a kicker out of Illinois, earned the "-or-" distinction as starting placekicker after a solid summer. He'll push Tommy Openshaw for the chance to replace the immortal Carey Spear in the lineup. That's pretty impressive for a player who isn't even listed on the team's official roster online. |

| You are subscribed to email updates from gold chart - Google Blog Search To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 20 West Kinzie, Chicago IL USA 60610 | |

0 Comment for "Spot Chart | Gold Shines Most in September on Seasonal Buys- Bloomberg ... | News2Gold"