Copper price extends rally as Beijing catches hedge funds short |

- Copper price extends rally as Beijing catches hedge funds short

- Newmont up on Q1 results while Barrick blasts company's culture

- Centerra digesting law prohibiting activities which affect glaciers

- Gold price retakes $1,300 on Ukraine tensions

- Watch a sandstorm in China turn day into night

- PIC OF THE DAY: 785B hits concrete bridge, splits

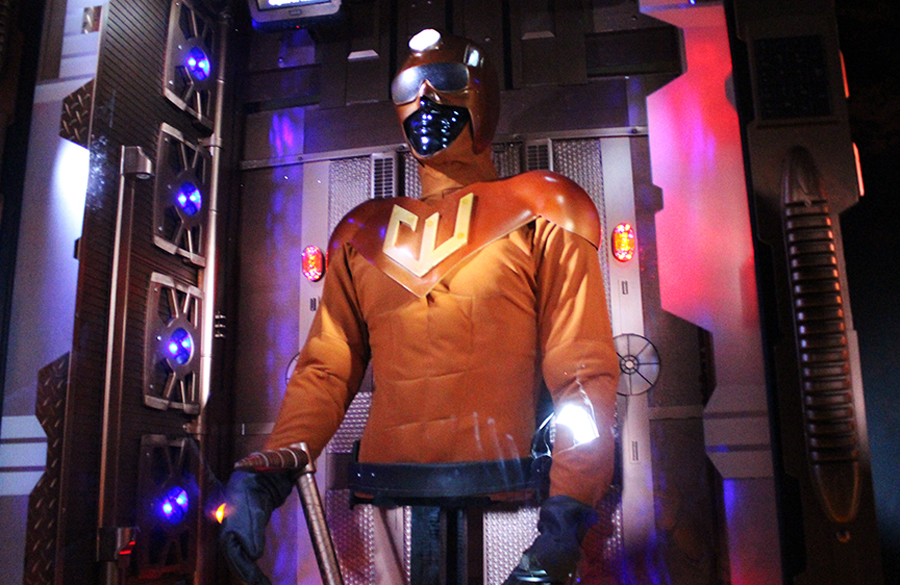

| Copper price extends rally as Beijing catches hedge funds short Posted: 25 Apr 2014 12:55 PM PDT Copper has been out of favour with hedge funds for a long time. The red metal is the ONLY commodity in a list that includes everything from lean hogs and NY Harbor Ultra-Low Sulfur Diesel to cocoa and gold, that so-called managed money investors have placed in a net short position. Hedge funds on the New York Comex have placed bets to the tune of 375 million pounds of copper that the price will go down according to CFTC data. This year those bets have paid off big time with copper falling to a near four-year low of $3.92 a pound mid-March. After a steady recovery, the price of the metal dipped below $3.00 again last week.  Source: FT, 10-year Front Month Future Contract Comex But when a new report surfaced Wednesday indicating that the Chinese State Reserves Bureau has bought up to 350,00 tonnes of copperbetween March and April to move into state warehouses it lit a fire under the price. Orders from Beijing to buy when prices fall below $3.15 and to pick huge loads should copper go below $3.00 immediately put a floor under the price. That sent managed money scrambling for July contracts to cover their positions. After a jump yesterday, Friday saw copper consolidating its gains trading at a seven-week high just above $3.10. The last time the SRB intervened in base metals markets was in June 2013 when the copper price turned around before hitting $3.00 after sliding from a $3.70 high in February of that year. The Chinese government, which naturally doesn't disclose purchases publicly, was also believed to be a big buyer during the height of the 2008 financial crisis when it made the most of prices as low as $1.30. At the time of the 2013 reports, one metals trader told the FT the SRBs purchases "may be interpreted as a bullish sign," adding: "If you had bought copper every time the SRB bought copper you would have made a fortune" Fresh data about hedge funds' short and long positions as at Tuesday this week will be released by the US Commodities Futures Trading Commission after the markets close Friday. It should reveal whether managed money anticipated the Beijing-inspired rally or blew their copper bets. Judging by Thursday and Friday's action they may have left things a little bit late. Image of Captain Copper, a superhero teaching Chilean kids about the metal, courtesy of Codelco |

| Newmont up on Q1 results while Barrick blasts company's culture Posted: 25 Apr 2014 10:16 AM PDT Despite rocks being thrown by Barrick chairman, Newmont gained 2.71% today after filing its Q1 on an increased production outlook and lower cost. Newmont said in its Q1 outlook that its all in sustaining cost will increase by 13 percent, and production in Africa should go up two percent. It also said that Reduced spending on exploration, advanced projects, and sustaining capital also led to $82 million in lower gold AISC this quarter. Yesterday Barrick Gold's chairman Peter Munk told the Financial Post that Newmont is not shareholder friendly and bureaucratic. Barrick Gold and Newmont are trying to make a deal on merging. In a conference call announcing its Q1 resuts Newmont's CEO Gary Goldberg deferred on discussing the rumoured merger stating only that Newmont is "always open to opportunities." Newmont's Q1 was not all good. The company's net income from continuing operations was down, $117 million or 23 cents per basic share, compared with $314 million or 63 cents per share in 2013. The decline was due a fall in the average realized gold and copper prices of approximately 21 percent and 20 percent respectively. Here are the company's highlights:

|

| Centerra digesting law prohibiting activities which affect glaciers Posted: 25 Apr 2014 09:30 AM PDT Centerra Gold says it is still unclear how a law prohibiting activities which affect glaciers in the Kyrgyzstan will affect its operations. The glacier law was passed on Wednesday by the Parliament of the Kyrgyz Republic. It still needs to be signed by the president before it takes effect. The company says it has not received the official version of the law and its provisions are unclear. The law does require payment of compensation for damages to glaciers. Despite the law, Centerra believes it has protection from punitive actions. "Nevertheless, Centerra believes that the stabilization and non-discrimination provisions contained in the agreements governing the Kumtor project and the law of the Kyrgyz Republic which implemented the Kumtor Project Agreements support the view that the Glacier Law would not apply to Kumtor mining operations," said the company in a statement. "In addition, Centerra believes that any disagreement in relation to the application of the Glacier Law to Kumtor would be subject to the dispute resolution (international arbitration) provisions of the Kumtor Project Agreements." Centerra is up 5.66% over the week to $5.66 a share. In February Centerra announced that the company had made peace with the country's parliament after the creation of a joint venture that evenly splits control of the Kumtor gold mine. Full news release below.

|

| Gold price retakes $1,300 on Ukraine tensions Posted: 25 Apr 2014 09:22 AM PDT The price of gold jumped to a two-week high on Friday as safe-haven buyers returned to the market on growing fears of an escalation in the conflict in Ukraine. On the Comex division of the New York Mercantile Exchange, gold futures for June delivery in midday trade exchanged hands for $1,301.30 an ounce, up more than $10 from Thursday's close. Gold is now at its highest since April 14. Earlier in the day the metal touched $1,305.20, bringing its year to date gains to 9%. Gold was supported by a weak dollar and investors seeking the relative safety of gold as a hard asset after news of renewed clashes between Ukrainian security forces and pro-Russian activists. Western leaders accuses Russia of failing to live up to the terms of the Geneva deal cut a week ago, by not doing anything to restrain rebel activity in the east of the country while at the same time amassing its troops at the border. Ukraine officials said rebels who have seized the town of Slavyansk in the east of the country will be removed through military action and that any incursion by Russian forces will be deemed an invasion. Ukraine's prime minister Arseniy Yatsenyuk accused Russia of wanting to start World War 3, while Russian president Vladimir Putin warned of "consequences" should Kiev eject pro-Russian militias by force. |

| Watch a sandstorm in China turn day into night Posted: 24 Apr 2014 08:58 PM PDT The worst sandstorm since 1996 blanketed Gansu Province in Northwest China this week. Visibility was reduced to less than 65ft. "Suddenly it became dark and I can't tell whether it's day or night," said one resident. Hat tip, Zero Hedge |

| PIC OF THE DAY: 785B hits concrete bridge, splits Posted: 24 Apr 2014 08:31 PM PDT Pictures courtesy of Mining Mayhem. Dates and location not revealed. |

| You are subscribed to email updates from MINING.com To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 20 West Kinzie, Chicago IL USA 60610 | |

0 Comment for "Copper price extends rally as Beijing catches hedge funds short"