Asset Health: How to potentially save millions in operations costs each year |

- Asset Health: How to potentially save millions in operations costs each year

- Satellite photo shows impact of Mount Polley breach

- Diamond exploration in Canada: Opportunity knocking or a fool’s errand?

- Protesters slam Imperial Metals over Mount Polley

- GALLERY: Dump trucks in trouble

- This $2 million red diamond is the hero in Rio’s annual tender

| Asset Health: How to potentially save millions in operations costs each year Posted: 12 Aug 2014 04:43 PM PDT To compete in today's mining market, organizations must cut costs in while increasing efficiencies in all areas of the business. In this webinar, learn how you can leverage available data to provide predictive, condition-based decision making that can potentially save millions of dollars each year by bringing together equipment, software and communications to enable super-charge asset health management strategies. In this one hour event, expert asset health management panelists will discuss the process and tools to address critical issues such as aging assets and explore how to leverage these assets to achieve optimum performance. Speaker Bio These solutions span many business areas including supply chain management, manufacturing execution systems, asset management, enterprise manufacturing visualization, data insight and collaboration. Nives has a BS and MS in Chemical Engineering from the University of Waterloo and McMaster University respectively, and has greater than 24 years of industry experience in applying IT solutions in the Process and Resources Industries, working for companies including ESSO Petroleum, Aspen Technology Inc., Honeywell and Microsoft. Contest See terms and conditions for contest details. ContestWebinar registrants are automatically entered in a contest to win enrollment in EduMine. The winner will get two months' access to all of EduMine's online courses. With more than 6,000 active enrollees EduMine is the largest educator in mining in the world. EduMine offers more than 150 online courses ranging from Acid Rock Drainage Prediction to Understanding Financial Statements of Mining Companies Using New Accounting Standards.

RecordingThis WebEx service includes a feature that allows audio and any documents and other materials exchanged or viewed during the session to be recorded for resale. By joining this session, you automatically consent to such recordings. If you do not consent to the recording, do not join the session. Registration / ReservationOnline registration ends 1 hour prior to the webcast; however phone registration can be accepted up to 30 minutes before the webcast begins. Please call +1 604 683 2037 ext. 229 for last-minute reservations. We reserved 100 seats for special guests. If unused, some of them might be offered for last-minute registrations. PermissionsBy participating in the webinar you agree that information provided in the webcast registration form can be shared with participating companies. You may be contacted or receive important news releases in the future. How Webcasts WorkOur webcast saves on fees, travel and time! You will be able to ask questions and have live discussions during the webcast just as if you were there in person. At the time of the webcast, you connect to the internet, call in to a toll/toll-free number to hear and talk through the telephone or simply listen and speak over your headset/PC speakers using Voice over IP (VoIP). You will see the presentation as well as the presenter on your computer screen. System RequirementsTo attend this webcast, you will need a computer with a high-speed internet connection (DSL or cable). You will also need a phone line or integrated microphone in your PC or a headset. For your comfort, it is recommended that you use a speaker phone or headset to connect to the webcast. Our system will support both PC and Apple computers using the latest versions of Internet Explorer, Chrome, Firefox or Safari browsers. Accessing the WebcastOne day prior to the webcast, you will be emailed a link for the webcast. About 15 minutes before the scheduled starting time, simply go to the website provided in the email. You should be able to simply click on the link in the email; however, some email programs may require that you copy the address and paste it into your browser's address bar. You will be asked to enter your name, email address, the password that was sent to you in the email. Once you have logged in, a screen will pop up with the Voice over IP option or a toll/toll-free telephone number to call. Of course, our team is available to help if you have any questions about accessing the webcast: +1 604 683 2037 ext. 229. CancellationsMINING.com reserves the right to cancel an advertised investment webcast at short notice. We will endeavour to provide participants with as much notice as possible, but will not accept liability for costs incurred by participants or their organizations as a result of the webcast being cancelled or postponed. MINING.com reserves the right to postpone or make such alterations to the content of a webcast as may be necessary. |

| Satellite photo shows impact of Mount Polley breach Posted: 12 Aug 2014 02:45 PM PDT The environmental impact due to the Mount Polley Mine tailing breach is highlighted in red by the geomatics firm Effigis. The tailings pond dam at the Mount Polley Mine site was breached on BC Day, Aug. 4. An estimated 10 million cubic metres of water and 4.5 million cubic metres of fine sand was released. Hazeltine Creek flows out of Polley Lake and the flow of contaminated water continued into Quesnel Lake. Environment BC says that during the initial breach of the tailings dam the bulk of the original flow created an unstable plug at the base of Polley Lake. The balance of the tailings and water went down Hazeltine Creek and deposited at the confluence of the creek and river. Hazeltine Creek was originally about 1.2 metres wide and is now up to 150 metres wide. The image was taken by a Landsat-8 satellite on August 5, 2014, a day after the accident.  Image by Effigis. Hat tip, Vancouver Miner |

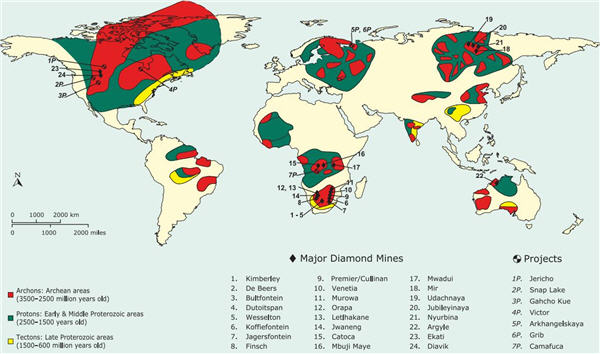

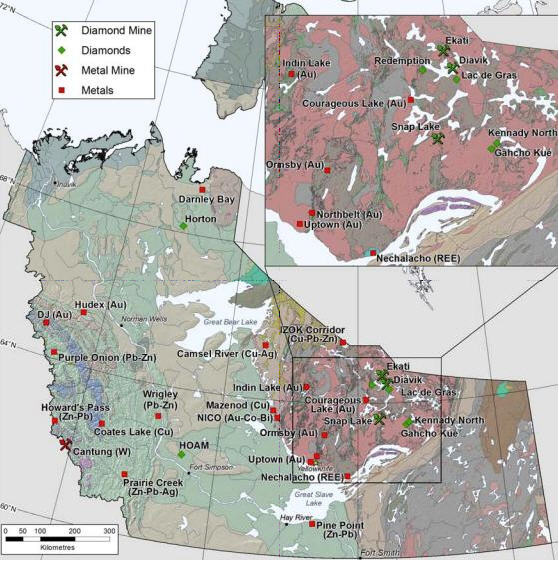

| Diamond exploration in Canada: Opportunity knocking or a fool’s errand? Posted: 12 Aug 2014 01:24 PM PDT Diamonds, crystallised carbon, are the hardest naturally occurring material. The optimal environment for the formation of diamonds requires consistent heat and pressure, which is found beneath stable thick parts of the earth's crust known as cratons. Most primary (non-alluvial or coastal) diamond discoveries are hosted within rock formations older than 2.0 billion years. Diamonds form at depths greater than 160 km below surface and are brought to the surface through violent volcanic activity that has occurred at various intervals through geologic time. During ascent through the lithosphere (upper mantle and crust), the potentially diamond infused magmas accumulate minerals known as KIMs (kimberlite indicator minerals). Kimberlite, an ultrabasic igneous rock made up of at least 35% olivine, form as their volatile rich magmas cool upon their emplacement into the surface and near-surface environment, commonly in the shape of a pipe or champagne flute, and sometimes in the shape of a champagne coupe (as in Saskatchewan). Kimberlites occurring in the Canadian tundra have been affected by the erosion dynamics of continental glaciers during the period of Pleistocene glaciation, which only receded over the last twenty thousand years. These erosion dynamics have in effect smeared these KIMs hundreds of kilometers from their source kimberlite intrusions, distributing evidence of that source as a 'mineral train' of fragments that follows the movement of the ice away from the intrusion. Exploration geologists attempt to delineate and follow the KIMs back to the kimberlite by pattern sampling of soil and till (glacial deposits), and recovering the KIMs by laboratory processing of the samples. Since not all kimberlites are diamond bearing, geologists refine their searches by analysing the KIM grains for their chemistry, which they then assess using industry standard mineral chemistry plots so as to rank those KIM trains to increase their chances of discovering kimberlites that may host diamonds. Kimberlites tend to occur in "clusters" of intrusions of similar geologic age, with multiple proximate clusters referred to as a kimberlite field. A good primer on kimberlites may be found on the Natural Resources Canada website. There are many reports that focus in depth on the chemistry of indicator minerals. However, the simple fact is that the odds of discovering an economic diamond deposit are low, even when kimberlites are being found. Globally, approximately 20% of kimberlites are diamondiferous (i.e. containing some diamonds, including microscopic diamonds that the industry refers to as micro diamonds), with roughly 1% of all kimberlites discovered hosting an economic diamond deposit. The odds in Canada, though still poor, are materially above the world norm. As of 2002, over 50% of kimberlites discovered in Canada were diamondiferous; while Lac de Gras had recorded a prodigious 5% of all kimberlites discovered to host an economic diamond deposit. Clearly, diamond exploration is not for the faint of heart and presents significant risk for even the most seasoned geologist. As a non-geologist, I believe there are five important concepts for evaluating diamond exploration and development companies: The quoted size of the global rough diamond market in any given year will vary slightly depending on the estimate. For example, in 2012 the Kimberly process recorded a market value of U$12.6 billion, while Bain & Company Inc. estimated revenues at U$14.8 billion. There exist significant barriers to entry in diamond mining. In fact, only four large players control approximately 80% of global rough diamond production. It is difficult to access detailed market data as ALROSA, De Beers, Rio Tinto, and Dominion Diamond treat this information as proprietary. Despite this, there is a compelling narrative for diamond explorers as ore production from several historically significant mines has stopped (Mir) or is falling (Argyle). Additionally, Bain & Company reports profit margins for rough diamond production has remained healthy at between 16-20%. The firm also expects demand to achieve a robust compound annual growth rate (CAGR) of 5.1% through 2012 to 2023.[1] This combination of factors should help diamond exploration investment in Canada rebound from C$78.9 million in 2012, which was a contraction of 14% from 2011. Historical Context – Canada is the latest frontier Prior to 1870, diamonds were found exclusively in alluvial deposits, primarily from India. However, in 1867 diamonds were discovered in kimberlite pipes located near the town of Kimberley, South Africa; and by 1887 De Beers exercised monopoly control over the global industry that remained unrivaled for nearly 100 years. Mining from pipes has led to the exponential increase in the annual global market supply of diamonds from less than 1 million carats in 1870 to a peak of 176.7 million carats in 2005. Advancements in geological understanding combined with new mining technology (machines) opened the industrial market for diamonds. However, due to advancements in synthetic diamond manufacturing, mined production of boart (industrial diamonds) could be considered as a by-product that is inconsequential to the economics of diamond mining. Throughout 1870 to 1960, Africa was responsible for nearly 100% of global production, and many experts believed economic diamond deposits did not exist in Canada. Russia's Mir Mine in Siberia, which started production in 1957, likely helped changed this perception; as well as, Australia's Argyle Mine. Commercial production at Argyle began in 1986 and at its peak in 1994, Argyle accounted for nearly 40% of global annual production as measured by weight. In contrast, Canada is a relative newcomer on the global stage for rough diamonds. Academic propositions for diamond deposits in Canada began around the turn of the 20th Century; yet exploration did not begin in in earnest until 1960, and it would take the better part of 20 years to refine exploration techniques using an understanding of glaciation and chemistry. Canada, likely represented a steep learning curve for even the heavyweight foreign diamond miners. Successful diamond exploration in northern Canada was materially challenged by several factors, including:

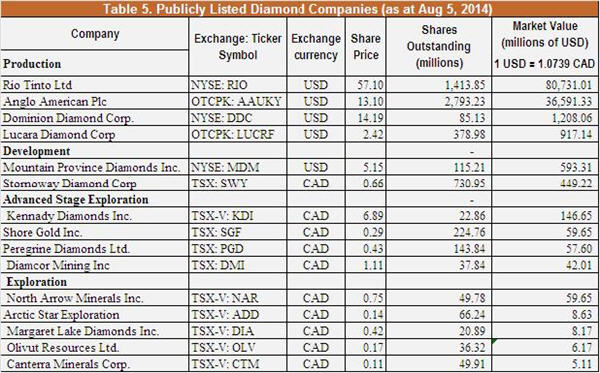

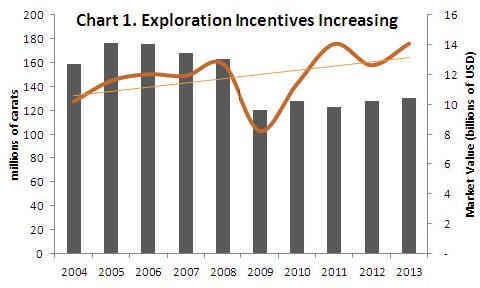

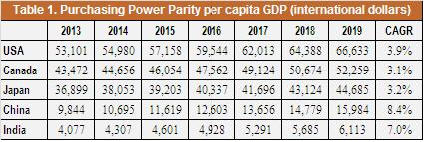

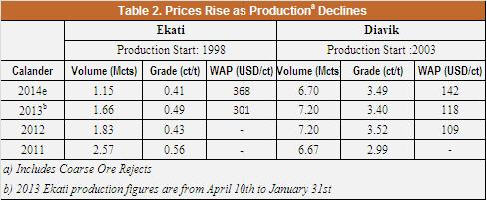

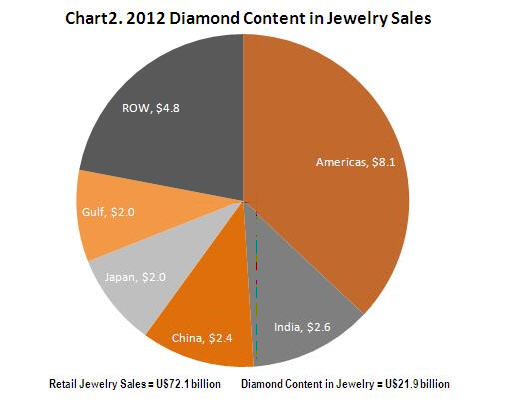

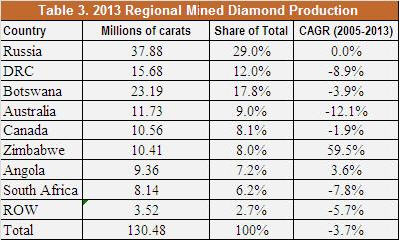

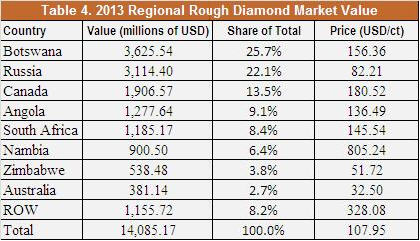

These challenges would take some time to overcome and adapt to. However, for Lac de Gras, home to the world class Ekati and Diavik mines, diamond bearing pipes were discovered in 1991. Production from Canada's first diamond mine – the Ekati – commenced in 1998, with the Panda pipe being the fourth most valuable in the world. Material mine production from Russia, Australia, and eventually Canada, and a bout of persistent high inflation in Israel during the 1970's all contributed to the eventual demise of the De Beers cartel. Russia is now the global leader of mined diamond production by total carat weight produced. The Global Financial Crisis – value perseveres as output falters Global annual mine production has materially fallen from approximately 177 million carats in 2005 to only 130 million carats in 2013 (Chart 1). The global annual decline was partly offset by a significant increase in production from Zimbabwe. However, Zimbabwe production fell in 2013 to 10.4 million from 12.1 million carats a year earlier, and expectations for 2014 project an additional decrease in supply.[1]Interestingly, the value of the global diamond market, measured in USD, has remained on an upward, though volatile, trend throughout 2004 and 2013 with an average and median annual value of U$11.9 and U$12.0 billion, respectively. The outlier in the population set was 2009, which saw the market for rough diamonds collapsed to U$8.3 billion in the aftermath of the Global Financial Crisis; though the recovery was swift and sustained reaching U$14.1 billion in 2013. Gem quality diamonds represent only 20-25% of total annual mined output by weight, yet account for the majority of the value. Price Growth – the song remains the same De Beers marketing is responsible for arguably one of the greatest market creations in the history of capitalism, summed up in one simple slogan – "A Diamond Is Forever". The US has consistently been the largest consumer (Chart 2), though Canada in 2000 lead the US on a per capita basis.[1] In North America, approximately 70-80% of women own at least one piece of diamond jewellery. Nicky Oppenheimer, former De Beers' deputy chairman, once famously stated, "A gemstone is the ultimate luxury product. It has no material use."[2] As there is no more intrinsic value for gem-sized diamonds over their industrial counterparts, the exponential price increase would seem somewhat peculiar. Therefore, the price of gem quality diamonds depends not on the diamonds themselves but on the value bestowed by buyers, or perhaps 'captured' by the jewellery industry. In this light, gem quality diamond prices hinge on three material variables: 1. Discretionary income growth – global growth remains positive, albeit more modest than the recent past, indicating a positive long-run trend for discretionary incomes. As of 2012, the Americas represent 37% of global retail demand, while China – the most important market for near-term future demand growth – was 11%. The Americas proportion of world demand should continue to shrink as long as China continues to grow the ranks of their upper-middle class (Table 1) 2. Supply – falling ore production from several major diamond mines should mean continued global supply constraint and higher prices, all else equal (Table 2). Since 1870, records indicate there have been roughly 30 large, successful operating mines globally. As previously indicated, the economics of diamond mining depends on much more than the mere occurrence of diamond. 3. Cultural – continued adoption and integration of "western" values, such as diamond engagement rings in emerging markets with large populations should continue to propel industry growth (Chart 2). A good example is the success of De Beers Diamond Jewellers, an ongoing joint venture between De Beers and LVMH Moet Hennessy Louis Vutton. LVMH reported their largest market for watches and jewelry in 2013 was Asia (excluding Japan), which represented 27% of total revenue. It is this author's expectation that price volatility will reflect global economic trends going forward. Until 2000, De Beers used its Central Selling Organisation (CSO) – essentially a clearing house for global trade – to control diamond prices. De Beers no longer directly acts in this capacity and in the absence of a buyer of last resort the weighted average prices of rough diamonds should be expected to remain volatile as global uncertainty remains. Diamond Exploration – why Canada? The proportion of gem quality diamonds tend to be quite pronounced in alluvial deposits, whereas the primary source kimberlite pipes tend to have a wider range of qualities, including a significant share of micro, and industrial diamonds. However, with the majority of industrial diamonds being synthetic, new diamond deposits need to contain sufficient quantities of gem and near gem quality diamonds to be considered economic; specifically, a significant tonnage with relative high diamond concentration. This is where Canada has found a niche position. Ekati, Diavik, and Snap Lake are all located in the Northwest Territories (NWT); and Victor in Northern Ontario. Clearly, Lac de Gras in the NWT is the standout among Canadian production centers. Diamond bearing kimberlites in this district are of relatively small tonnage by world standards, yet present as high grade deposits. The combination of improved understanding of the regional glacial geology and distributions of KIM mineral trains and their chemistry, are creating a positive environment for junior exploration to discover potentially high grade pipes with adequate tonnage. Infrastructure continues to be developed while existing processing capacity will require ore in the future. The potential to find high grade deposits may provide discoveries that prove easier to define and are more cost effective to evaluate. There are no universally available statistics related to the odds of successfully intersecting kimberlite per drill attempt; however, several Canadian diamond experts have suggested to me that the odds for an experienced, well-funded team operating in a familiar environment could be approaching 50%. Importantly, Canada, including the NWT, is widely considered more attractive from both a geopolitical and investment risk perspective, when compared with many other large diamond producing countries. As a foreign investor, how safe is capital investment in Angola? Democratic Republic of Congo? Russia? Canada is one of the few large diamond producers with exploration potential, rule of law, infrastructure, technical expertise, and efficient capital markets. Owing to the challenging nature of diamond prospecting, the exploration team is the most valuable asset an exploration enterprise possesses. The team needs to have a good understanding of the geology and chemistry of the prospective region, patience and access to capital. One of the obvious, yet overlooked issues from investors is the need for continued land acquisition while following indicator trains. Sometimes the prospective land will only be available in the future, if at all. Gahcho Kué – demonstrating continued Canadian diamond potential Evaluation of Gahcho Kué diamond bearing kimberlites began in 1995 and is currently advancing through the regulatory process. Gahcho Kué, is a joint venture between De Beers Canada Inc. and Mountain Province Diamonds Inc., and is located at Kennady Lake, in the southeast of the Slave Craton, approximately 150 km southeast of the Ekati and Diavik mines and 80 km east of Snap Lake in the NWT. The Gahcho Kué project consists of four diamond bearing kimberlites, with an aggregate resource estimate 33.8 million tonnes of ore containing 56.5 million carats yielding a grade of 1.67 carats per tonne indicated, and an additional 11.3 million tonnes of ore containing 18.5 million carats inferred. Concluding Remarks Due to clustering potential, exploration in areas with proximity to existing diamondiferous kimberlite should benefit. There are still highly prospective targets in the NWT as claims in the Slave Craton with proximity to Diavik and Ekati were highly sought after during the diamond exploration boom of the 1990's. However, during the exploration ebb since 2000 many claims in the region have been relinquished by exploration companies that were unable to raise fresh capital. With interest returning the above average grade experienced in the Slave geological province is a strategic advantage for junior exploration enterprises with limited budgets. Zimtu believes interest is returning to diamonds. Canada, with increasing rough diamond prices, improved glacial understanding, and advancements in exploration techniques should attract investment for diamond exploration. Though not all-inclusive, we have attached a list of US and Canadian publicly traded diamond companies (Table 5).  |

| Protesters slam Imperial Metals over Mount Polley Posted: 12 Aug 2014 12:30 PM PDT  Protesters hold a banner outside Imperial Metals's head office. Photo: Jeffrey Richmond A crowd gathered outside the Vancouver head office of Imperial Metals (TSX:III) on Monday afternoon to protest against the mining company in connection with the Mount Polley tailings pond disaster. Led by the Secwepemc Women's Warrior Society, protestors chanted, sang and made speeches denouncing the Vancouver-based miner. "The water is essentially our lifeblood," said Dawn Morrison, chair and founder of a working group on indigenous food sovereignty with the B.C. Food Systems Network. "And the salmon are the backbone of our communities and our life and our land and food system. So it's really critical that we protect the water," she said. The catastrophic failure August 4 of the tailings pond wall at the Mount Polley copper and gold mine near Likely released 10 billion litres of water and 4.5 million cubic metres of metals-laden fine sand, contaminating several lakes, rivers and creeks in the Cariboo region. Morrison claimed Imperial Metals is not telling the truth about its ability to treat the contaminated water. "We know that the energy and the spirit of that water is sacred and it will never be the same after they contaminate it, no matter how much they treat it," she said. David Clow, an environmental activist on a 1,400 kilometre wheelchair journey to raise awareness of the potential dangers of the Northern Gateway Pipeline, appeared to agree. "The effects are permanent," he said. We're going to be dealing with this forever, long after (the people responsible are) gone. Long after their companies are gone, we're going to have to be dealing with their mess." Clow dismissed the idea that fining the company $1 million would send other miners an effective message. "If the punitive effects don't exceed their profits, then what incentive do they have to stop these actions?" he said. "If you remove all the speculation and you boil it down to what's left, we have two once pristine lakes that are now Imperial Metals tailings ponds," he said. "That's what's left." |

| GALLERY: Dump trucks in trouble Posted: 12 Aug 2014 12:27 PM PDT Popular posts from Mining Mayhem showing dump trucks that are in distress. |

| This $2 million red diamond is the hero in Rio’s annual tender Posted: 12 Aug 2014 12:26 PM PDT  The 1.21-carat radiant cut "Argyle Cardinal" diamond expected to fetch over US$2 million. (Image provided) A suitably named hero diamond, the "Argyle Cardinal," is the main piece of Rio Tinto's annual tender of Argyle's rare coloured diamonds being held in Sydney, Australia, between Tuesday and Friday. The 1.21-carat radiant cut rock, expected to fetch over US$2 million, is one of the only 13 Fancy red diamonds included in the annual display in the last 30 years. It was named after a small red northern American bird. What makes the "Argyle Cardinal" even more special is the fact that there are only 30 known red diamonds in the world. "These are all one-of-a-kind gems that will take their place in the history of great collectible diamonds," Argyle Pink Diamonds manager Josephine Johnson said in a statement. Last year a precious rock like this one set a record at auction at Christies' in New York of $1.6 million per carat. Increasingly rare Diamonds are becoming an increasingly rare item as fewer mines remain in operation and new discoveries dwindle.  There are only 30 known red diamonds in the world. (Image by Brian A Jackson | Shutterstock.com) Polished diamond prices increased 4.5% in the first half of 2014, according to a study published Tuesday by EY, and further upside is expected for the second half of the year, driven mainly by rising demand, recent transactions and availability of financing. Since the 1870's, when the first kimberlite was found, another 6,800 kimberlites have been discovered worldwide. Of those, only about 1,000 contained diamonds, and of those only 60 actually contained diamonds on an economic level. Rio Tinto controls the market for pink diamonds from the Argyle mine in Australia. Around 65% of the world's diamond supplies come from the Cullinan mine in South Africa. Tender viewings will be held in Sydney, New York, Hong Kong and Perth with bids closing on October 8, 2014. |

| You are subscribed to email updates from MINING.com To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 20 West Kinzie, Chicago IL USA 60610 | |

0 Comment for "Asset Health: How to potentially save millions in operations costs each year"