Gold price slides again despite largest ETF inflows since 2012 |

- Gold price slides again despite largest ETF inflows since 2012

- Iron ore price hits fresh lows as Beijing warns of supply flood

- The 33 Chilean miners rescued alive back in the spotlight

- Rio Tinto to axe hundreds of jobs at Oyu Tolgoi mine

- Australia not adventurous enough in commitment to ‘essential hunting ground’ of Latin America

- Barrick putting Pascua Lama back on track

| Gold price slides again despite largest ETF inflows since 2012 Posted: 28 May 2014 04:32 PM PDT The gold price extended Tuesday's losses on Wednesday falling to a near 4-year low as negative sentiment sweeps the market. On the Comex division of the New York Mercantile Exchange, gold futures for August delivery last traded at $1,259.35 an ounce, near the lows of the day and down some $7 from yesterday's close. Gold remains 5% to the upside for 2014 but is down $120 an ounce from highs reached mid-March as the rally on the back of safe haven demand and bargain hunting loses steam. Gold's annus horribilis in 2013 when the value of the metal dropped 28%, the worst performance in more than three decades, was characterized by the movement of massive amounts of gold from West to East. Last year the world's physical gold trusts or gold-backed ETFs experienced net redemptions of more than 800 tonnes collectively. Most of that sold gold ended up in China and India and other growing gold consuming nations in Asia led by Vietnam and Indonesia. But in the first quarter that demand tanked. Mainland China's demand for gold fell 18% in the first quarter of the year as investors bought fewer bars and coins, offsetting record demand for jewellery. India's bars and coins buying also showed a huge drop-off of 54% to 98 tonnes and with jewellery consumption also sliding overall gold demand on the subcontinent slid 26%. Hopes for the en masse return of the gold ETF investors peaked in March, but the holdings of industry benchmark SPDR Gold Shares (NYSEARCA: GLD) has once again slipped into negative territory for 2014. There may be some spark returning to the market however, yesterday GLD holdings – which represent about 40% of physical gold-backed ETF holdings – shot up the most since October 2012. Investors bought a net 8.4 tonnes on Tuesday bringing holdings back to 785.3 tonnes or 25.2 million ounces compared to 794.6 tonnes at the start of the year. The last time ETF investors were this bullish was on October 4, 2012 when GLD recorded 9 tonnes of inflows. At the time gold was trading just under $1,800 an ounce. GLD was a one way bet in 2013: the fund recorded only 17 days of inflows all of last year and almost 540 tonnes left the fund. Perhaps the latest buying spurt is a signal of a turnaround in sentiment, especially in the face of continuing negativity on futures markets. — In a video interview at the Wall Street Journal, Barron's Brendan Conway argues the forces crimping gold's rally is not going to go away, namely the disappearance of the ETF investors and developments in China and India. Photo by Bartlomiej Magierowski |

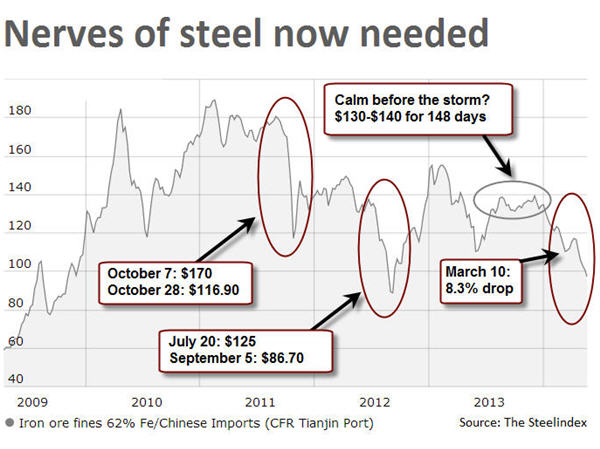

| Iron ore price hits fresh lows as Beijing warns of supply flood Posted: 28 May 2014 02:00 PM PDT Shares in producers fall after China's powerful central planning agency says country's "high steel demand period has passed" and inventories will stay high. Benchmark iron ore fell more than 1% on Wednesday to fresh lows last seen September 2012. According to data from the The Steel Index, the import price of 62% iron ore fines at China's Tianjin port was pegged at $96.80 per tonne on Monday, down $1.30 on the day. Iron ore is down 25% year to date and first declined to double digits nine days ago. Attempts at a comeback since then have fallen short. Apart from that quick gap down in 2012 when the steelmaking raw material spent two weeks below $100 a tonne ore hasn't traded in double digits at all since 2009 during the financial crisis. China is responsible for two-thirds of the 1.2 billion tonne seaborne trade and on Wednesday the country's powerful central economic planning agency said lower price are here to stay "blaming languishing ore prices on a flood of supply". "The period of China's high steel demand has passed, and iron ore demand is now rising at a slow pace of 3%-4% annually," the National Development and Reform Commission said in a statement: "In the next two to three months, iron-ore output will increase, port inventories will remain high, and under slow demand for steel products, it will be difficult for iron ore prices to rise." China forges as much steel as the rest of the world combined and the globe's most active steel future – Shanghai rebar – also continued to weaken hitting CNY3,111 ($497) per tonne near record lows for the contract. Stockpiles of imported iron ore at Chinese ports reached an all-time high of 113.3 million tonnes on May 23 according to industry consultancy Steelhome, up more than 50% from this time last year. Platts reports there are "simply too much material in the dockside market, forcing buying interest away from seaborne cargoes:" "The problem is we are still dealing with losses that we made over iron ore cargoes we bought earlier, and this problem is made worse because whenever iron ore prices move up, they always far outpace steel improvements," a [Jiangsu] steelmaker said. A slowdown in the world's second largest economy – particularly the property sector that accounts for almost half of all steel demand – has unnerved producers in Australia, Brazil and Africa even as they ramp up supply of the raw material to unheard of levels. BHP said its on track to up production at its newest mine Jimblebar to 55 million towards its longer term target of 270 million tonnes per annum. Rio Tinto is most aggressive – it is ahead of schedule to reach 290 million tonnes per annum and is targeting 360 million tonnes per annum in the longer run. Vale has been struggling to keep up with the Pilbara producers but the company is nevertheless sticking to its medium term expansion plans to lift its output above 400 million tonnes from the current 300 million tonnes-plus by 2018 as giant projects like S11D in the Carajas complex come on stream. Anglo American's Minas Rio project in Brazil could add another 26 million tonne before the end of this year at the same time its Kumba unit in South Africa return to nameplate capacity of 40 million tonnes-plus. Gina Rinehart's recently okayed Roy Hill project could dump an additional 55 million tonnes on the market by the end of next year. While Canada has a number of ore projects in the offing, further out Africa is destined to become the price trendsetter. Rio's deal with Guinea on developing the Simandou deposit announced this week creates the prospect of a greenfield 95 million tonnes per annum mine within a decade. Rio's $20 billion project with Chinese and World Bank backing constitutes less than half the Simandou mountain range leases while smaller producers in West Africa are close to bringing to market ore from equally rich fields surrounding the Nimba mountains. Share prices for the Big 3 – number one producer Brazil's Vale (NYSE:VALE) and Australian giants Rio Tinto (LON:RIO), BHP Billiton (LON:BHP) – all declined on Tuesday, while North American operator Cliffs Naturual Resources (NYSE:CLF) tanked 4.6% after doubts were raised about its ability to honour debt covenants. ADRs of Vale lost 1.5% in New York before turning higher. The Rio de Janeiro-based company is down 15% in 2014 despite a huge boost from its nickel operations – it's the world's number two producer – thanks to a soaring price for the metal used in steel alloys. Number two Rio Tinto, which thanks to aggressive expansion in its home base of the Pilbara in Northwest Australia have been rapidly closing the output gap with Vale, dropped 2.8% in New York bringing its losses year to date to 6%. Among the diversified giants, Rio is most exposed to iron ore which last year accounted for nearly all its profits. The world's number one miner with a market value of $180 billion BHP, which is also adding to its iron ore business this year even as it slashes budgets and sell off assets in other divisions, gave up 1.4% in New York. In a recent earnings announcement BHP said every $1 decline in the price of iron ore translates into a $120 million hit to the bottom line and the Melbourne-based firm portfolio of assets are not that heavily skewed to iron ore as its peers. Number four producer behind BHP, Sydney-listed Fortescue Metals Group (ASX:FMG), managed to escape some of the sell-off in New York, but is down 21% this year given that all its ore is shipped to China. From zero production seven years ago is targeting output of annualized 155 million tonnes in 2014. Still, with marginal costs of as low as $40 a tonne the Anglo-Australian giants should be able to weather the storm. Vale is targeting a sub-$20 cost of production on a free-on-board basis. How smaller producers and project developers adapt to the new normal in iron ore remains to be seen. |

| The 33 Chilean miners rescued alive back in the spotlight Posted: 28 May 2014 12:09 PM PDT  "For a Chilean, nothing is impossible," claims the undisputed star of the mine rescue, Mario Sepulveda (centre/front) The 33 Chilean miners trapped for 70 days underground in 2010 are back in the news. This time, the group has shot a TV spot to support the national soccer team in the upcoming World Cup in Brazil, starting June 12. Led by the undisputed star of the mine rescue, Mario Sepulveda, the spot calls players to put their hearts in the field. "For a Chilean, nothing is impossible," Sepulveda exclaims heartily. He is referring to the fact that Chile will play teams traditionally considered the strongest, and most likely to win the Cup — the so-called "Group of Death." "Spain is challenging, the Netherlands is also tough. We are not afraid of the Group of Death. We do not mind death … we have defeated it before," he cries. You can watch the spot (in Spanish) below. Unfortunately, no English subtitles are available at the moment. |

| Rio Tinto to axe hundreds of jobs at Oyu Tolgoi mine Posted: 28 May 2014 10:38 AM PDT Mining giant Rio Tinto (ASX, LON, NYSE: RIO) will lay off up to 300 workers at its $6.6 billion Oyu Tolgoi copper and gold mine in Mongolia, amid continuing efforts to reduce costs. "Workforce reductions are part of the life cycle of a mining business," Oyu Tolgoi LLC Chief Executive Officer Craig Kinnell said in an internal memo sent to staff Wednesday, which was obtained by Bloomberg News. "Given where we are in the life cycle of our project, and the urgent need to reduce our costs, it is critical to the success of the business to address this now," it added, without mentioning how many jobs would be axed. The move, unlikely to make negotiations between Rio and Mongolian authorities over Oyu Tolgoi's expansion any easier, follows the loss of about 2,000 jobs last year, when Rio postponed work on a $5bn expansion of the mine because of discrepancies with local authorities. The government, which owns 34% of Oyu Tolgoi, has been at loggerheads with operator Turquoise Hill Resources (TSX:TRQ), which is controlled by Rio and is the owner the remainder of the mine, for over a year. The parties don't seem to find common ground when it comes to decide how to share revenue from Oyu Tolgoi, solve access to water issue or how to address a $2bn cost blowout on the first stage of the mine. Both sides provided fresh faces for the mine's board in September to break the impasse and resumed talks in December. By the end of March, they had to ask for an extension to project financing, after negotiations failed again.  At full tilt Oyu Tolgoi will account for 30% of the economy of Mongolia, a nation of just over 3 million people. Since then the parties have said they expect issues to be resolved by September, the deadline that prospective lenders have put on their project financing commitments. The central Asian nation has become more conciliatory in the last few weeks, announcing it plans to overturn last year's cancellation of more than 100 mining licenses. For 2014, Oyu Tolgoi is targeting production of 150,000 to 175,000 tonnes of copper in concentrates and 700,000 to 750,000 ounces of gold in concentrates. But after phase 2 the mine in the southern Gobi desert close to the Chinese border could produce more than 1.2 billion pounds of copper, 650,000 ounces of gold and 3 million ounces of silver each year. Oyu Tolgoi will account for 30% of the economy of the nation of just over 3 million people. |

| Australia not adventurous enough in commitment to ‘essential hunting ground’ of Latin America Posted: 28 May 2014 09:29 AM PDT Australian Latin America Business Council Chairman, Jose Blanco, has challenged local mining companies as well as suppliers to be more strategic, adventurous and committed in exploiting the mineral opportunities in Latin America —a region whose geology a market expert believes makes it "an essential hunting ground' compatible with Australia's mining strengths. Addressing attendees to Sydney's Paydirt 2014 Latin America Downunder Conference, Blanco said that what the region had to offer was of such a scale and so compatible with Australia's mining capabilities that local miners, explorers, investors and industry players needed to "significantly ramp up" their involvement. "The resources business is increasingly global and Australian companies in that space cannot afford to limit their activities to the convenience and safety of their home markets," Blanco said. "Australian players should look beyond stereotyped assessments of the region (…) That no longer suffices. What they do need to do is undertake in-depth market intelligence and strategic planning that connects Australian business to the region's capital markets and business elite, making the most of industry trends and cross-border investment flows." Blanco called on Australia's resources players looking to Latin America, to look beyond the traditional Chile-Peru-Brazil axis. "They need to embrace other markets such as México, Colombia and others," he said. "They need to understand and exploit regional synergies, including production and distribution hubs, taxation structures and evolving capital markets. "Australian companies also need to cease treating Latin America as a secondary market – one which is on the radar but not a critical part of their overall business strategy. "The sheer scope of the opportunities on offer easily justifies a wholehearted commitment and the investment of real time and money to make Latin America a core operating environment, a core priority, for them. "The only question is whether Australian business has the foresight and courage to accept the challenge and do the hard work to anchor a mining business within the Latin American offering." Blanco said one only had to look at Latin America's overall credentials when examining why it should figure more prominently on the Australian radar. The region produces 45% of the world's copper, 50% of its silver, 26% of its molybdenum, and equally high percentages of zinc, gold and iron ore. It is also home to five of the countries that consistently rank in the Top 10 global destinations for mining investment. "It is a region that captures 27% of the global exploration budget – and remains a region that is considerably under-explored – even though it has maintained its share of the global budget at close to 25% for more than a decade," he added. |

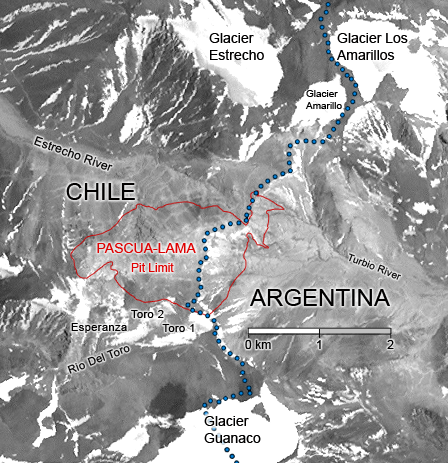

| Barrick putting Pascua Lama back on track Posted: 28 May 2014 07:45 AM PDT  Barrick Gold stopped work at the project on the Chilean-Argentine border in October, after investing $5 billion in it. Canada's Barrick Gold (TSX, NYSE: ABX) has reached an initial agreement with local communities from the north of Chile, which have opposed its stalled $8.5 billion Pascua-Lama gold and silver project in South America, the lawyer for the communities told La Tercera (in Spanish). The deal between the world's largest gold miner and Chile's Diaguita community is, to say the least, unique, considering that the indigenous group represented by attorneys Alex Quevedo and Lorenzo Soto was the one that managed to halt the project in April last year. They also were the ones who originally requested the miner's environmental permit for Pascua Lama to be revoked. The Toronto-based company, which is the subject of a number of class-action lawsuits over the project, stopped work at the project on the Chilean-Argentine border in October, after investing $5 billion in it, saying it will restart it when "conditions improve." Sources close to the ongoing negotiations told MINING.com the agreement reached today could be seen as a first step for the company to obtain the coveted "social license" for Pascua Lama. The memorandum of understanding establishes that negotiations will last six months during which Barrick will provide project details to the community for corroboration with experts. The process, to be funded by the Canadian company, will follow international standards, the sources added. The not binding agreement does not force communities to relinquish their right to pursue further legal actions. Pascua Lama is expected to produce around 850,000 ounces of gold and 35 million ounces of silver in its first five years. Production, scheduled to begin this year, has now been delayed until mid-2016. Barrick's sahres were down 2.2% this morn ing in Toronto hitting $16.92 at 11:43 am ET. |

| You are subscribed to email updates from MINING.com To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 20 West Kinzie, Chicago IL USA 60610 | |

0 Comment for "Gold price slides again despite largest ETF inflows since 2012"