Gold preparing to launch as U.S. dollar drops to key support |

- Gold preparing to launch as U.S. dollar drops to key support

- The big palladium rally is finally under way

- Brazil Batista engaged in insider trading: report

- US gold and silver production dips, copper jumps

- Iran said to be exporting more oil than allowed

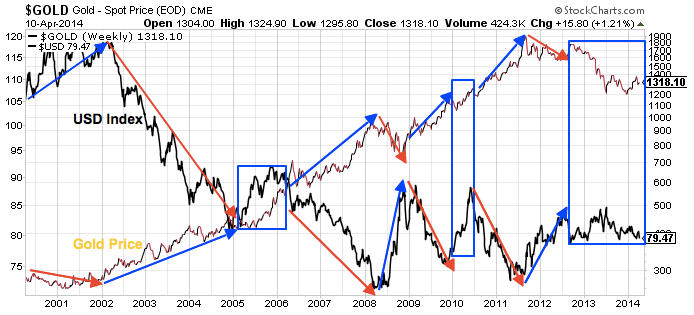

| Gold preparing to launch as U.S. dollar drops to key support Posted: 12 Apr 2014 05:45 AM PDT Gold bugs have been forecasting a dollar collapse for years. They have been correct about the gold price, which has advanced nearly 400% in the past 12 years versus a gain of just 64% for the S&P 500. They were also correct about the dollar during the first phase of the gold bull market (2001-2008), when the USD index fell from 120 to around 72. But the dollar did not continue to plummet after 2008 and indeed has held up remarkably well. The USD index has put in a series of higher lows over the past few years, showing strength against other currencies. But this strength is being tested once again as the index has fallen to critical support around the 80 level. While these tests of support are typically spaced out by several months, this will be the second test of support in the past month. Pressure on the U.S. dollar appears to be increasing and failure of support could ignite a massive decline. Looking back to the start of the gold bull market, we see that gold and the dollar have maintained a fairly consistent inverse relationship. When the dollar moved up, gold moved down. When the dollar fell, gold pushed higher. The only major exceptions were 2005 and early 2010, when gold and the dollar moved higher in lockstep. It is interesting to note that over the first 12 years on this chart, there was never been a prolonged period where gold and the dollar dropped together. This has changed over the past year. When we zoom in on the chart, we can see a new anomaly in boxes 1, 2 and 3, whereby the gold price has been dropping alongside the dollar, rather than rallying. If we add together gold's losses in these three boxes, we get a decline of nearly $300, despite a weakening of the U.S. dollar. Something is clearly out of whack as gold has failed to push higher against the backdrop of a lower dollar for the first time in over a decade. Lastly, in box 4 we can see gold rising alongside the U.S. dollar for the first time since 2010. When combining these time periods, gold and the USD have actually had a positive correlation for a good part of the past 18 months. I believe the anomaly is due to increased manipulation and use of HFT algos in the precious metals market. I don't suspect that the positive correlation will persist, especially with the increasing spotlight on gold price manipulation. Additionally, fundamental conditions are becoming increasingly favorable for a major drop in the value of the U.S. dollar. There is a growing movement to dump U.S. dollars in global trade in favor of local currencies or even gold. Russia and China appear to be spearheading these efforts, with new bilateral trade deals that bypass the U.S. dollar and additional agreements with BRICS nations to use Rubbles or local currencies. Russia has also set up agreements to purchase oil from Iran with Rubbles, Yuan or even gold. Central banks are increasingly replacing dollar reserves with Yuan reserves and the increased spotlight on the manipulation in the gold market could hamper the ability of the United States to continue propping up the dollar. These developments are all very bearish for the U.S dollar, whose days as world reserve currency appear to be numbered. Given the debt levels of the U.S. government, unprecedented money printing to bail out the banks and keep the economy afloat over the past 5 years and growing distrust and distaste for the U.S. following the NSA revelations, one has to wonder if the whole house of cards could come crumbling down sometime soon. Gold has been the major benefactor, up roughly 10% year to date. The technical chart has turned bullish, with gold breaking through long-term resistance in February. It put in a rough double bottom, followed by outlines of a cup and handle pattern, both bullish indicators. The RSI is pointing higher with room to run and I expect gold will be above $1,500 within the next few months. Gold bugs may have been too early in their call for the dollar's demise, but the prediction may prove true yet. With the stock market looking to be in the midst of a major crash, precious metals would seem the obvious buy at the moment. Gold is one of the only asset classes that does not appear overheated and wildly overvalued at current levels. Whether the dollar collapses suddenly or dies a slow death, you will want to have gold and silver in your portfolio to protect your wealth. By Jason Hamlin Gold Stock Bull is not an investment advisory service, nor a registered investment advisor or broker-dealer and does not purport to tell or suggest which securities customers should buy or sell for themselves. All ideas, opinions, and/or forecasts, expressed or implied herein, are for informational purposes only and should not be construed as a recommendation to invest, trade, and/or speculate in the markets. Any investments, trades, and/or speculations made in light of the ideas, opinions, and/or forecasts, expressed or implied herein, are committed at your own risk, financial or otherwise. The information on this site has been prepared without regard to any particular investor's investment objectives, financial situation, and needs. Accordingly, investors should not act on any information on this site without obtaining specific advice from their financial advisor. Past performance is no guarantee of future results. View full terms and conditions. |

| The big palladium rally is finally under way Posted: 11 Apr 2014 11:46 AM PDT Market watchers have been calling for a spike in the price of palladium and platinum for weeks. That's now finally beginning to happen. Palladium futures trading on the Nymex in New York broke through the $800 an ounce level on Friday touching a day high of $812 an ounce, the highest since August 2011 and up 5% since Monday. In early afternoon trade the precious metal had eased back to $804.50 an ounce, up nearly 12% since the start of the year. Platinum continued to underperform its sister metal however and July delivery contracts were static on Friday at $1,4590 an ounce. Platinum is up 6% in 2014, but down $85 compared to this time last year. Chief among the factors pushing prices higher are the strike at South Africa's PGM mines and the stand-off between the West and Russia over Vladimir Putin's adventurism in Ukraine. South Africa and Russia combined account for some 70% of world platinum output. Platinum production is even more concentrated with close to 80% of global supply of palladium coming from these two countries with Canada a distant third. Palladium is mainly used to clean emissions in automobiles and as a substitute for pricier platinum in auto catalysts. Apart from the dicey supply situation, demand is robust with number one PGM consumer, the European auto industry in full recovery mode after falling for six straight years and car production soaring in the rest of the world. Global auto assembly lines are forecast to push out a record 72 million cars this year – versus an average of 50 million between 2000–2010. Another factor boosting the the palladium price was the launch of two physical palladium-backed exchange traded funds in Johannesburg, South Africa, late March. Holdings in the new palladium funds on Johannesburg Securities Exchange enjoyed inflows of roughly 270,000 ounces or 7.6 tonnes during only the first two weeks. Taken together with the impact of the Anglo American Platinum (LON:AAL), Imapala Platinum (OTCMKTS:IMPUY) and Lonmin (LON:LMI) strikes some 750,000 ounces have been taken off the market over 11 weeks since the labour action began. That compares to annual global mine production of 6.4 million ounces and scrap supply of 2.4 million. London-based precious metals broker Sharps Pixley CEO, Ross Norman, argues in a note on Friday based on lease rates palladium could be ready for a significant rally: "Palladium [...] is just starting to respond. The two and six month rates have doubled from 0.25% to 0.5% but in general terms remain 'affordable'. With old Russian palladium stocks said to have been largely exhausted about a year ago, the market demand has hitherto been satisfied from current production until now. "The oddity about this however is that palladium is responding and not platinum given that South African production is predominantly platinum (which is strike-bound) whereas palladium is predominantly from Russia (which is not…). It remains to be seen whether this is an extension of the Russians withholding gas to Europe story or whether this is a genuine supply issue – either way, palladium may just be primed for a roller-coaster ride." To further support prices, South Africa's state pension fund manager – echoing sentiments expressed by the country's mines minister – suggested last week an Opec-style organization should be set up between producing countries to control supply. The idea has been met with skepticism due primarily to the negative impact on jobs if and when mines are idled to curb supply. BDlive quotes Cadiz Corporate Solutions mining analyst Peter Major as saying this ship has sailed for PGMs: "Great idea, but it should have been done a long time ago, as De Beers did with the Russians on diamond sales. Today, there are some downsides such as, for example, you might get caught. Such an arrangement would break every rule in the World Trade Organisation book." |

| Brazil Batista engaged in insider trading: report Posted: 11 Apr 2014 11:36 AM PDT Brazil's securities regulator, known as CVM, has no doubts the country's former richest man Eike Batista used insider information and manipulated the selling of shares at his Oleo e Gas Participacoes (OGP) firm, formerly known as OGX. According to documents published Friday by local newspaper Valor Economico (in Portuguese, subs. required) Batista and other executives at the oil firm waited 10 months to disclose its shareholders that four oil fields were not commercially viable. Last year a Brazilian newspaper claimed OGX knew since 2012 that its oil reserves were much lower than initially estimated. But the company replied to this accusation saying it had always kept the market informed about its projects "as soon as the analyses were completed, to avoid divulging incomplete information." As late as 2012, Batista still touted estimates of more than 10 billion barrels of oil equivalent in pre-salt resources in Brazil's Atlantic Ocean offshore coastal São Paulo, but many of OGX's wells came up dry and failed to fulfill those estimates. Shareholders furious Aurélio Valporto, who has lead actions against Batista on behalf of the company's minority investors, told MINING.com earlier this year evidence against the country's most famous entrepreneur was solid. He added that regulators seemed to have ignored the "several irregularities" committed by the company's leaders, such as the fact that Batista sold 56 million of his OGX shares a few days before the company announced it was suspending development of its only three producing oil wells. Under Brazil's regulations, management must release any information that could influence a firm's share price, as well as disclose their personal ownership stakes in the company, which Eike didn't do. He has also accused the oil company of publishing multiple regulatory statements about the same hydrocarbon discoveries in an effort to boost the company's share price. OGX, once the flagship of Batista's five public "X" companies – the X representing the tycoon's presumed ability to act as a business multiplier – finally sank in October last year, becoming Latin America's largest corporate default in history. Eike, as he prefers to be called, founded OGX only five years ago with $1.3 billion. He can face penalties that go from fines to criminal charges. |

| US gold and silver production dips, copper jumps Posted: 11 Apr 2014 09:33 AM PDT The latest quarterly report by the US Geological Survey shows a continued downtick in American production of silver and gold, but a jump in copper production. US mines produced 60.8 tonnes (2.1 million ounces) of gold in the final quarter of 2013, down from 61.5 tonnes produced over the same period in 2012, but up sharply on the 54.6 tonnes produced in the first quarter of this year. On an annual basis recoverable gold mined in the US decline by 4 tonnes to 231 tonnes, placing the country third on the list of top producer behind Australia and just ahead of Russia. Mines in the US produced 251 tonnes (8.8 million ounces) of silver in Q4 2013, down 10.7% year on year. For 2013 as a whole, output was 1,040 tonnes, down from 1,060 tonnes in 2012, said the Geological Survey. While the fourth quarter showed a decline, overall production in the US of copper grew 5% to 1.23 million tonnes in 2013 compared to the year before. The increase came despite the massive landslide at Utah's Bingham Canyon mine early in the year that closed the mine for a prolonged time. Mine production of 14 mineral commodities was worth more than $1 billion each in the U.S. in 2013. These were, in decreasing order of value, crushed stone, gold, copper, cement, construction sand and gravel, iron ore (shipped), molybdenum concentrates, phosphate rock, industrial sand and gravel, lime, soda ash, salt, zinc, and clays (all types). In 2013, 12 states each produced more than $2 billion worth of nonfuel mineral commodities. These states were, in descending order of value—Nevada, Arizona, Minnesota, Florida, Texas, Alaska, Utah, California, Wyoming, Missouri, Michigan, and Colorado. The mineral production of these states accounted for 64% of the U.S. total output value. |

| Iran said to be exporting more oil than allowed Posted: 11 Apr 2014 09:21 AM PDT Iran may have exported oil at higher levels than allowed under western sanctions in March for the fifth month in a row, according to data released Friday by the International Energy Agency (IEA). The developed world's energy watchdog claims the nation exported 1.65m barrels of crude per day in February, the highest level since June 2012, and probably close to that level again last month. "Preliminary data for March show imports from Iran [to OECD and non-OECD countries] declined to 1.05m b/d but that figure will probably be revised upwards closer to February levels on receipt of more complete data," the report said. Among the countries that bought oil from Iran last month, the IEA names Albania, Syria and long-term clients such as China, India, South Korea, Japan and Turkey. The IEA data is based on statistics provided to the organization by member and non-member states as well as shipping data. |

| You are subscribed to email updates from MINING.com To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 20 West Kinzie, Chicago IL USA 60610 | |

1 Comment for "Gold preparing to launch as U.S. dollar drops to key support"

Prox Trade 25% daily for 50 days

The Prox Trade was founded with the goal of providing our investors with the most reliable investment offer available. For each of our clients we strive to help create financial stability and security to provide financial independence.

ROI 25% - 400% daily for 50 days

Investment Program

http://www.proxtrade.net

100% Risk Free

http://www.payinghyiponline.com/proxtrade.html