BHP at full throttle |

- BHP at full throttle

- Copper price rally comes to abrupt end

- Turquoise Hill buys time for Oyu Tolgoi expansion

- Year to the day of $200 shocker, another strange gold price plunge

- Brazil’s Vale gets $2.8bn for iron ore expansions

- Two workers trapped after collapse at Australian coal mine

| Posted: 15 Apr 2014 04:36 PM PDT BHP Billiton's operational update for the nine months ended March 2014 showed record production achieved for four commodities and at 10 operations. Unlike rival Rio Tinto, which released production data yesterday, BHP said the weather had a "relatively limited impact" on its iron ore operations. The continued ramp-up of its new Jimblebar mined underpinned record production at Western Australia Iron Ore of 163 million tonnes (100% basis). The number one diversified miner also raised full-year production guidance by a further 5 million tonnes to 217 million tonnes. Queensland Coal achieved record annualised production of 69 million tonnes (100% basis) in the March 2014 quarter. A sustainable improvement in productivity and the successful ramp-up of Daunia has underpinned an increase in total metallurgical coal production guidance to 43.5 million tonnes for the 2014 financial year, the Melbourne-based company announced. Petroleum liquids production increased by 16% to 77 million barrels of oil equivalent for the nine months ended March 2014, boosted by a 71% increase at Onshore US. As a result of the successful divestment of Liverpool Bay and well remediation activities in the Hawkville that are now complete, total petroleum production for the 2014 financial year is expected to be approximately 245 million barrels of oil equivalent. The overall reduction in full-year guidance has been mitigated by an increased contribution from higher-margin crude and condensate. Full-year copper production guidance remains unchanged at 1.7 million tonnes, with a strong June 2014 quarter anticipated, BHP said. |

| Copper price rally comes to abrupt end Posted: 15 Apr 2014 03:55 PM PDT In late afternoon New York trade on Tuesday May copper changed hands at $2.995 a pound as weakening demand from China and a flood of new supply worry the market. Earlier in the day the red metal fell as low as $2.965, down more than 2% from Monday's close. Tuesday's decline marks something of a reversal in sentiment after weeks of steady gains as the copper price dug itself out of a near four-year low struck mid-March. Copper is down nearly 12% from opening levels for the year as the market adjusts to slower growth in China which consumes more than 40% of the world's copper. China's copper imports have not slowed down, rising a whopping 31% to 420,000 tonnes in March over last last year and bringing the first quarter total to a record-breaking 1.3 million tonnes. But those numbers may be misleading and do not reflect a sharp fall-off in end demand. That's because much of that copper has been tied up in finance deals as collateral for trade credit and is not being put to industrial use. Those deals are now being unwound supplying even more copper to the market. On top of that as activity in China slows it drags down the copper price thanks to the widespread use of the metal in construction, transport and manufacturing. There is a markedly close correlation to the country's purchasing manager's index (PMI), a measure of industrial activity in the economy, and the copper price. A drop off in the PMI usually precedes a decline the copper price as the chart shows.  Source: Capital Economics, Markit China's copper imports are highly price sensitive and traders could have simply made the most of the fall to $2.92 a pound a month ago to stock up. The copper market has also been disappointed at the lack of major policy stimulus in China. A number of small steps taken by Beijing including bringing forward already announced infrastructure projects has encouraged hopes in the market of bolder action. But last week Premier Li Keqiang poured cold water on the notion saying: "China will not resort to short-term stimulus policies just because of temporary economic fluctuations … we will pay more attention to sound development in the medium and long run." The supply side is also driving down price expectations. The closely-watched Thomson Reuters GFMS Copper Survey forecasts a period of copper market surpluses and predicts the average price to test $2.75 a pound ($6,000/tonne) in the second half. Global mine production rose by 8% to 17.8 million tonnes last year, its fastest pace in over a decade thanks to marked expansion top producer Chile and the Democratic Republic of Congo. Output is to top 22.2 million tonnes this year from just over 21 million tonnes in 2013 led by Codelco's new 160,000 tonnes-plus Ministro Hales mine, Glencore's Las Bambas project in Peru it sold to China's Minmetals this week, the first full year of production at Rio Tinto's Oyu Tolgoi mine in Mongolia and expansion at BHP Billiton's already giant Escondida mine. |

| Turquoise Hill buys time for Oyu Tolgoi expansion Posted: 15 Apr 2014 12:43 PM PDT Shares in Turquoise Hill Resources (TSE:TRQ) dropped 4% on Tuesday after the company gave an update on production and financing for an underground expansion project at its massive Oyu Tolgoi mine in Mongolia. By early afternoon Turquoise Hill stock had recouped some losses to change hands at $3.80, down 2.8%. The counter has lost a third of its value over the past year and is now worth $7.6 billion on the Toronto Stock Exchange. The Vancouver-based company said potential lenders have extended a deadline to arrange financing for the $6 billion-plus project until the end of September after initial commitments expired at the end of last month. Talks with the Mongolian government on the expansion of the $6.6 billion mine and the reworking of the initial Oyu Tolgoi deal signed in 2009 is also ongoing says Turquoise Hill. CEO Kay Priestly in a statement said: "All parties remain committed to the underground development of Oyu Tolgoi and to resolving the outstanding shareholder issues. Constructive discussions between all parties have resulted in significant progress being made in resolving the issues, and those discussions are continuing." Turquoise Hill owns a 66% interest in Oyu Tolgoi in the Gobi Desert with the government of the Asian nation holding the rest. The underground project is where 80% of the value of the deposit is situated. Controlling company Rio Tinto (LON:RIO) put out disappointing first quarter production numbers on Monday, with Oyu Tolgoi heavily impacted by post commissioning issues which caused the shutdown of one production line for approximately seven weeks. Copper concentrate output fell 20% from the final quarter last year to 103,000 tonnes and average grades also slipped resulting in output of 25,300 tonnes of copper. Gold in concentrate declined to 66,000 ounces from 74,000 while silver dropped 21% to 163,000. For 2014, Oyu Tolgoi has lowered its targeted production for its full year of production to 135,000 to 160,000 tonnes of copper in concentrates and 600,000 to 700,000 ounces of gold in concentrates. |

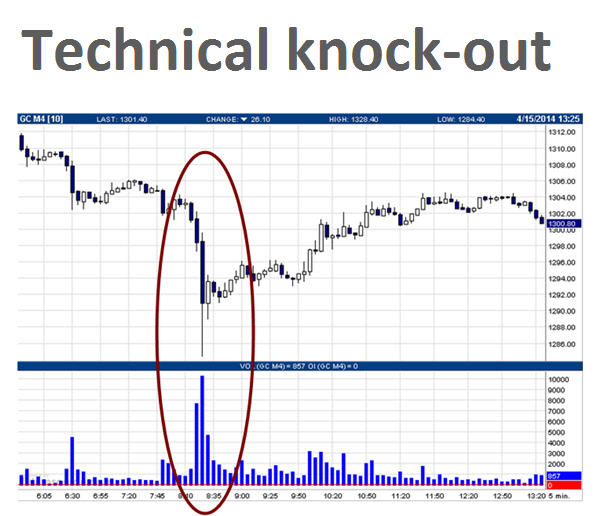

| Year to the day of $200 shocker, another strange gold price plunge Posted: 15 Apr 2014 11:04 AM PDT The price of gold has been rising steadily thanks to safe-haven buying in response to geopolitical crisis and continued support from loose US monetary policy to reach a more than three-week high on Monday. On Tuesday the Ukrainian crisis threatens to spin out of control with both sides sending troops into the restive east. And new numbers in the US show a higher than expected rise in inflation, another positive for gold and its status as a hedge against inflation. But the gold price does not react as expected. Not at all. Shortly after the New York market opened, the price of gold suffers a quick gap down dropping $43 an ounce to $1,284. As the chart shows, during the drop around 8:25 volumes spike with some 2.28 million ounces (64 tonnes) dumped onto the market in three big chunks. Market watchers scramble to find reasons for the drop:

The flash crash on 15 April 2013 – one year ago to the day – when gold dropped $130 in a single session and more than $200 over just two days, also happened without warning. The crash took the price of the yellow metal from a high of $1,566 on the Friday to a low of $1,330 on Monday, a 15% smack down. A convincing argument has been put forward that the drop was the result of the "shock and awe" tactics of a short seller to break the backs of the gold bulls. April 2013's plunge sent shockwaves through the gold market and caused a a turnaround in sentiment from which the metal has never recovered. By lunchtime today gold had creeped back above $1,300, still down $25 or 2% on the day. Perhaps this time gold will be able to absorb the shocks. Or, more likely, prepare for more assaults. Image by Javier Cabrio. |

| Brazil’s Vale gets $2.8bn for iron ore expansions Posted: 15 Apr 2014 09:29 AM PDT

The loan, said the bank according to local newspaper Valor Economico (in Portuguese), will help the Rio de Janeiro-based giant miner improve its railway network and build a new mining and processing unit in Para state, with annual capacity of 90 million metric tons. Last summer Vale received a licence from the Environmental Protection Agency of Brazil to build a $19.5 billion railway expansion its Serra Sul mine, in Carajas. The project is expected to start production in 2016 and reach full capacity of 90-million tonnes a year of iron-ore in 2018, or nearly a third of Vale's existing annual output. Serra Sul will also be the world's first truck-less mine, using conveyor belts to automate production processes. Over 115 million tons of iron ore were produced in Carajas last year. It holds 7.2 billion metric tons of iron ore in proven and probable reserves. |

| Two workers trapped after collapse at Australian coal mine Posted: 15 Apr 2014 08:32 AM PDT Two miners remain trapped following a suspected roof collapse at Austar underground coal mine in Australia's Hunter Valley. According NSW Police a rescue operation was launched at about 9:15pm Tuesday, but the condition of the two men is unknown, Australia Network news reported. Six ambulances, police and the NSW Fire and Rescue, as well as a helicopter, were at the scene. The mine, run by Yancoal Australia, an Australian-Chinese partnership, employs over 400 staff. It operates to a depth of up to 530m with the coal-seams 1300m long and 220m wide. |

| You are subscribed to email updates from MINING.com To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 20 West Kinzie, Chicago IL USA 60610 | |

0 Comment for "BHP at full throttle"