ETF investors selling gold like it's 2013 all over again |

- ETF investors selling gold like it's 2013 all over again

- The how and when of Chinese stimulus

- BHP spin-off plans met with skepticism

- Oil sands air emissions linked to serious health problems

- New US potash mine about to clear final licensing hurdle

- Uralkali’s potash goes on sale, India to pay lowest price in 7 years

| ETF investors selling gold like it's 2013 all over again Posted: 01 Apr 2014 04:44 PM PDT The price of gold slid for the fifth straight session on Tuesday continuing a retreat in the metal from its 2014 highs above $1,380 struck mid-March. On the Comex division of the New York Mercantile Exchange, gold futures for June delivery settled at $1,280.00 an ounce, down $3.80 or 0.3% from Monday's close to a 7-week low. Gold was also hurt by fresh outflows from exchange traded funds backed by physical gold. Net redemptions equaled 6.4 tonnes on Monday, the biggest daily reduction since December 23. Last week was the second week in a row of outflows from all gold ETFs taking total bullion allocated to investors by funds down to 1,759.4 tonnes. Gold bullion holdings in global ETFs hit a record 2,632 tonnes or 93 million ounces in December 2012, but last year saw net redemptions of 800 tonnes. Holdings of SPDR Gold Shares (NYSEARCA: GLD) – the world's largest gold ETF holding more than 45% of the total – have also been on a declining path with 10.5 tonnes pulled out of GLD over the past week. At the end of the trading day Tuesday, GLD holdings stood at 810.9 tonnes, down from more than 1,350 tonnes in December 2012. The gold price is still up 7% since the start of the year and the metal's strong showing in 2014 has surprised a number of forecasters. On Tuesday, Deutsche Bank became the latest bullion bank to revise upwards its earlier forecast, albeit still below today's trading range. Kitco reports the bank, Europe's second largest, upped its 2014 average gold price estimate by 10% to $1,261 an ounce with a strong second quarter at $1,300 to be followed by $1,250 and $1,200 in the third and fourth quarters: "We expect gold prices will succumb to positive growth shocks in the US and QE (quantitative easing) tapering since combined these will encourage further advances in US real yields, fresh highs in the S&P 500 and a stronger US dollar," the bank said. The S&P 500 did in fact reach a new record on Tuesday at 1,885.52 points after manufacturing data and car sales in the US pointed to a strong economy which boosted the dollar. The greenback and gold usually move in opposite directions. Image by beckycaplice |

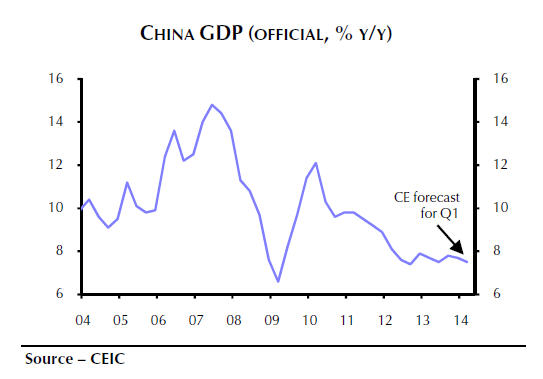

| The how and when of Chinese stimulus Posted: 01 Apr 2014 02:16 PM PDT  Study the spirit of Daqing, persevere in the great principles of acting independently and with the initiative in one's own hand and self-reliance The world's second largest economy is slowing down and dragging all resource-based economies down with it. China's leaders want to move the country from an investment-led economy to one based on consumption. But the rebalancing is proving difficult and signs of a slowdown are not hard to find. Consensus forecast for 2014 growth in China is 7.4%, just below the official target rate set by the government (a number widely believed to be massaged so as to produce the required level). GDP expansion at 7.4% would be the slowest in 24 years. Something that's causing alarm among resource companies reliant on Chinese demand. China watchers are now waiting with bated breath for the government to inject cash to rev up the economy again. Just like the $640 billion (4 trillion yuan) package delivered in 2008-2009 that made China the only major economy to continue growing strongly through the financial crisis. That's not going to happen says Capital Economics. The independent research house parsed Premier Li Keqiang's speech delivered to a meeting of provincial leaders last week. He spoke of "targeted measures", mentioned "last year's successful experience in fighting the economic slowdown" and cautioned on shifting macroeconomic policies" which may be effective in the short term but is not necessarily beneficial for the future":

In any event, when looking at China in absolute terms the slowdown does not seem so alarming anymore. Growth in 2014 would indeed be the slowest since 1990 – in the mid-Nineties Chinese growth rates peaked at an eye-watering 30%. But mainland China is tacking onto its economy some $700 billion this year. That's equal to the size of its entire economy in 1994. And as big as the Swiss economy and the equivalent GDP of two South Africas and four New Zealands. Not too shabby. Image courtesy of Chineseposters.net |

| BHP spin-off plans met with skepticism Posted: 01 Apr 2014 11:03 AM PDT The world's largest miner BHP Billiton (ASX, NYSE: BHP) (LON: BLT) said Tuesday it's considering spinning off its nickel, manganese, and aluminum businesses into a separate unit. With the exception of nickel which has received a boost from Indonesia's ore export ban, these are not exactly the most exciting commodities at the moment and their prices reflect that. Following the exit from the steel industry more than a decade ago, its recent sale of the diamond business for $550 million and offloading uranium assets to Canada's Cameco, the strategy makes sense. But putting a valuation of $19 billion on these out-of-favour raw materials may be a bit overoptimistic. Particularly given the forecast that nickel, manganese, and aluminum will contribute less than $100 million to BHP's pre-tax earnings this year, expected to come in at $25 billion. The Financial Times' Lex column discusses the prospects for BHP's simplification process below: |

| Oil sands air emissions linked to serious health problems Posted: 01 Apr 2014 10:47 AM PDT Just when the Canadian oil sands have passed with flying colours a test that showed no links between the industry and an increased cancer rate in adjacent aboriginal communities, a new study warns odours from these operations do cause health problems. The independent report, published by the Alberta Energy Regulator (AER) Monday, is the first of its kind conducted in the area that has found a conclusive link between the industry's activities and human health. The document outlines how companies near Peace River should handle their emissions, so that they eliminate gas venting, reduce flaring and conserve all produced gas where feasible. "The Panel's main finding in this section is that odours from heavy oil operations in the Peace River area have the potential to cause some of the symptoms experienced by residents; therefore, these odours should be eliminated," the report says. The AER panel, which held public hearings in January, heard evidence from local residents, scientists, engineers and oil companies on the issue of odours and emissions from heavy oil operations in the region. They learned that while some families have left because of the odour, others have complained for years about health problems such as severe headaches, dizziness, sinus congestion, muscle spasms, popping ears, memory loss, numbness, constipation, diarrhea, vomiting, eye twitching and fatigue. The report also recommends setting up an air-quality monitoring program and calls for stepped up enforcement of environmental standards. |

| New US potash mine about to clear final licensing hurdle Posted: 01 Apr 2014 09:39 AM PDT A planned $1 billion potash mine in south-eastern New Mexico may begin construction as soon as summer this year, AP reported. IC Potash Corp.'s Ochoa potash and polyhalite project is expected to reach 48% of its annual production capacity in 2017, with full capacity to be achieved in 2018. The site has an estimated 414 million tons of polyhalite reserves beneath the 40 sections of land the company has leased from the US Bureau of Land Management. And, according to an independent study, it could produce about 714,400 tons of sulphate of potash per year for a minimum of 50 years. Ochoa is located in an industrial region, which has a long history of potash production from mines currently owned by two large producers, Mosaic Company and Intrepid Potash. The area has the largest known concentration of potash reserves in the US and accounts for more than 77% of the product produced in the country. Image by IC Potash |

| Uralkali’s potash goes on sale, India to pay lowest price in 7 years Posted: 01 Apr 2014 09:02 AM PDT Russian potash miner Uralkali (MCX:URKA), the world's largest producer of the fertilizer ingredient, said Tuesday it has signed a one-year sales deal with India's largest importer, which pay $322 for a metric ton of the soil nutrient. The price, the lowest in seven years, is also about 25% below the levels reached last year with the now defunct Belarusian Potash Co., which Uralkali owned jointly at the time with Belaruskali. According to analysts, the contract to sell 800,000 metric tons to Indian Potash Limited between now and March 2015, signals a firming of prices and a possible end to the uncertainty in the potash market. Potash prices had fallen more than 25% from $400 a ton last summer, after Uralkali left the trading partnership with Belarus, effectively ending an informal global pricing cartel that used to control about 43% of global exports. Demand for potash in India has declined in the past few years as the rupee has depreciated and government subsidies have fallen. "We hope that the contract will help stimulate potash application rates in India, and support the country's agriculture at the time of continued population growth and rising food demand. We expect that the conclusion of the Indian contract will boost the global potash market growth," said Oleg Petrov, Uralkali's director for sales and marketing. In January, Uralkali signed a first-half deal with a Chinese agro-chemical consortium to sell 700,000 metric tons at $305 per ton. China is the world's biggest consumer of potash and contracts signed there have been viewed as setting the price for the global market. |

| You are subscribed to email updates from MINING.com To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 20 West Kinzie, Chicago IL USA 60610 | |

0 Comment for "ETF investors selling gold like it's 2013 all over again"