Barclays is the next big bank pulling out of commodities: report |

- Barclays is the next big bank pulling out of commodities: report

- US first rare earth mine in decades may be in Wyoming

- Gold mining comes back to Nova Scotia

- Scientists find 'easy' way to extract rare earths from seafloor

- China coal mine death toll rises to 21

- Peru set to regain world’s second largest copper producer place this year

| Barclays is the next big bank pulling out of commodities: report Posted: 20 Apr 2014 12:35 PM PDT British multinational banking and financial services Barclays is said to be the next big bank planning to sell large parts of its metals, agricultural and energy business in a move that, FT.com reports (subs. required), will be announced on Tuesday. The decision echoes moves by other major players, such as JPMorgan Chase and Morgan Stanley, which have been recently walking away from their commodities business. Since the US Federal Reserve determined in 2003 that certain commodity activities were "complementary" to financial activities and therefore permissible to Wall Street bankers, many jumped at the chance, but that tide has now turned. Morgan Stanley, Goldman Sachs, JPMorgan, Deutsche Bank, UBS and Royal Bank of Scotland are either shrinking their commodities units or plainly moving away from everything to do with them, including mining, processing, transportation, warehousing and trading. JPMorgan (NYSE:JPM) got $3.5bn last month after selling its physical commodities unit to Geneva-based trading house Mercuria, while Morgan Stanley has cut back on commodities operations and staff. Barclays, which is one of the top five banks in commodities, got to control roughly 70% of the commodities trading market last year. But in response to pressure to cut costs and improve returns, the UK bank announced Friday a shakeup of its investment bank management team, including a new head of markets and new co-heads of banking. The British lender also told staff last week it was looking to simplify its operations and that it could axe thousands of jobs, mainly at its investment arm, while conducting a strategic review, which will report next month. Revenues for the investment banks from the sector surged to $15 billion at the peak of the cycle, but has now fallen back dramatically in line with a retreat in metal and mineral prices. Braclays is set to present a strategic update on May 8. Images from WikiMedia Commons |

| US first rare earth mine in decades may be in Wyoming Posted: 20 Apr 2014 11:50 AM PDT  Bear Lodge project flyover, courtesy of Rare Element Resources. The state of Wyoming could soon hold the first rare earths mine to open in the US in over 60 years, as the country's Forest Service recently announced it is preparing to study the environmental impact of a proposed project in the Black Hills National Forest. Colorado-based Rare Element Resources (TSX:RES), (NYSE MKT:REE) discovered the deposit in 2004, but it only submitted plans to mine primarily neodymium, praseodymium and europium two years ago. Locals, however, are already questioning issues related to water quality, dust control and radioactive minerals in the area, as they revealed during two public meetings held last week, Rapid City Journal reports. At the moment about 90% of the world's rare earths —used in a variety of industries including green technology, defence systems and consumer electronics— come from China, which also imposes export quotas. Only two rare-earth mines currently exist in other countries. One of them is Lynas Corp's (ASX:LYC) Mount Weld mine in Australia, and the other one in Mountain Pass, California, owned by Molycorp (NYSE:MCP). Threaten to China?China did not always enjoy a virtual monopoly on REE production. The majority of the 17 rare earth elements were sourced from placer deposits in India and Brazil in the late 1940s. During the 1950s, South Africa mined the majority of the world's REEs from large veins of rare earth-bearing monazite. From the 1960s to 1980s, rare earths were supplied mainly from the US. If it goes ahead, Bear Lodge open pit mine would cover about 6.9 square km of the Black Hills National Forest, in northeast Wyoming. Roughly 2.6 square km of the project will be on private land surrounded by forest. The mine has a useful life estimated in 43 years and includes the construction of a hydrometallurgical plant in Upton. The Forest Service is accepting written comments from the public on the plan until April 30. A draft environmental impact statement will be presented for public comment in the spring of 2015, with a final objection period in the winter that year. If approved, work could begin in the spring of 2016. |

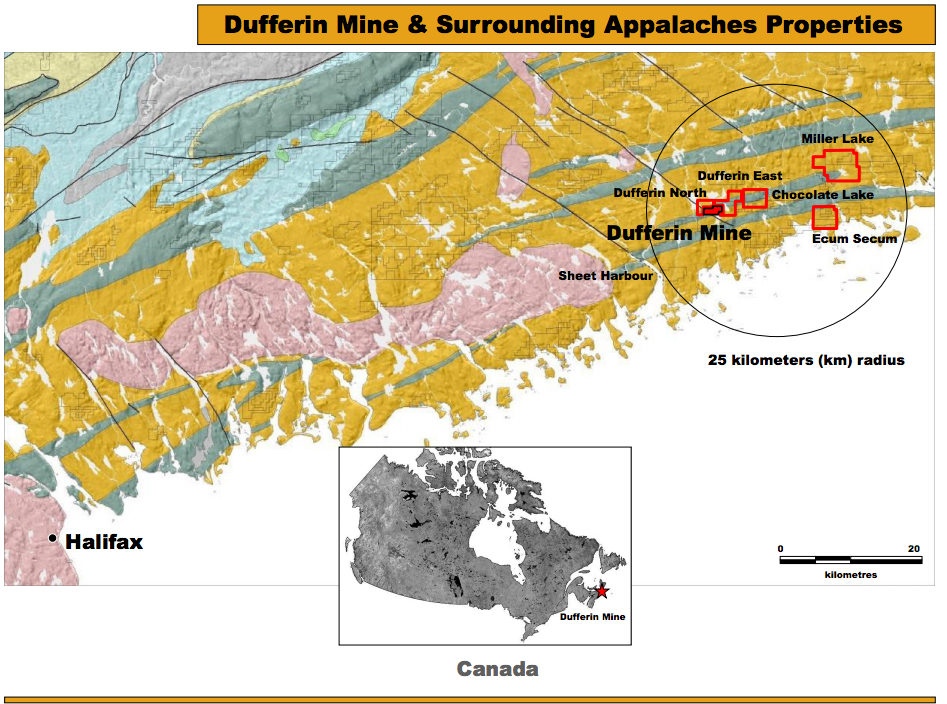

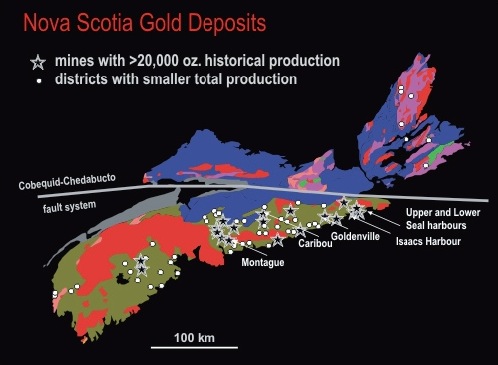

| Gold mining comes back to Nova Scotia Posted: 20 Apr 2014 11:24 AM PDT  Between 1862 and 1976, 1.1 million ounces of gold were mined from 65 gold districts throughout Nova Scotia.Courtesy of Museum of Industry. Demand for mineral resource engineers and skilled miners is increasing in Canada's East Coast, as gold mining stages a huge comeback in the province of Nova Scotia, which holds several projects currently in the works and one major mine already in operations. In a matter of weeks the Dufferin Mine, located on the eastern shore of the province near Sheet Harbour, will produce its first batch of gold. Until then the mine, shut down more than a decade ago and owned since 2009 by Ressources Appalaches (TSX-V:APP) will stockpile the raw material needed to run the mill. Dufferin ran for eight months in 2001 under a different operator, but shut down when the price of gold dropped to around $300 an ounce. Now, the new owner is ready to become a gold mining icon, and it says is on track to ramp up production to 300 tonnes of gold per day. Nova Scotia's not so hidden treasure While Nova Scotia has experienced three relatively short-lived gold rushes over the past 150 years, the persistent issue has been mining gold profitably. Gold deposits in the area are referred to by geologists as "nuggety" pockets of high gold concentrations located sporadically in quartz veins. The difficulty this has long posed is access — how to chase narrow veins of rock with random pockets of gold at a reasonable cost. Analysts believe the province is now in a position that will allow it to reap rewards from the extraction of this precious metal through business tax, income tax, royalties and employee spending. Only last week, mining giant Goldcorp (TSX:G), (NYSE:GG) donated $300,000 to Halifax, NS-based Dalhousie University to establish Professorship in Mining Engineering, so the province can train the amount of experts it will need. "The global mining industry faces an acute shortage of about 55,000 engineers by about 2020, and we're serious about developing talent for our industry," Peter Dey, a member of the board of directors at Goldcorp said in the statement. Other than the Dufferin mine, which is expected to hire about 75 people as production ramps up, there are at least two other major gold endeavours and 2.7 million ounces of proven gold reserves in the province waiting to be mined. One of them is being developed by local firm Moose River Resources and partner Atlantic Gold NL of Australia, which anticipate their $700-million open-pit gold project in Moose River Gold Mines will begin production late next year or in 2016. Ayarco Gold Corp. is also developing a former gold-producing property in Kemptville, Yarmouth County. |

| Scientists find 'easy' way to extract rare earths from seafloor Posted: 20 Apr 2014 10:10 AM PDT  Since 2001 the United Nations' International Seabed Authority has issued 30 exploration permits for the Pacific, Mid-Atlantic and Indian Oceans. While economists and geologists worry the world's supply of rare earth metals will soon be outpaced by demand, a team of German geochemists has found a way to easily extract them from the vast deposits lying under the sea. In a study, published last week in the journal Applied Geochemistry, the scientists suggest rare earth metals could be mined from the solid nodes of iron and manganese found strewn across much of the deep ocean floor. These nodules, called ferromanganese deposits, build slowly over time as dissolved iron and manganese in seawater attaches to seafloor sediments. Using the solvent desferrioxamine-B — a key ingredient of the method they have developed—these elements could be easily extracted. The diluter binds more strongly to some metals than others and when applied to ferromanganese nodes, effectively and efficiently extracts rare earth metals, leaving other metals behind in the nodules. The experts claim they were able to extract up to 80% of four rare earth metals from ferromanganese nodules by refining their ore-leaching method. The finding, experts believe, may push miners to try securing a licence to explore the seabed for these materials, needed for portable electronics and hybrid vehicles batteries. Since 2001 the United Nations' International Seabed Authority has issued 30 exploration permits for the Pacific, Mid-Atlantic and Indian Oceans. But the body says there has been a rush of late, with at least another seven ready to be issued. Last year, the UN published an update to its plan for developing a regulatory framework for deep sea mining, saying private firms would be allowed to apply for mineral, oil and gas extraction licenses as soon as 2016. While rare earths metals aren't as rare as their name lets on, they are hard to come by because they are widely dispersed amidst the Earth's crust and seldom found in large deposits the way other minerals are. Image by Stefano Garau. |

| China coal mine death toll rises to 21 Posted: 20 Apr 2014 05:25 AM PDT

The accident occurred on April 7 at the Xiahaizi coal mine, located near Qujing City, when an explosion caused the mine to flood, trapping 22 miners underground. China leads the world in coal mining fatalities, as mine operators often skirt safety regulations. Last year alone 1,049 people were killed or went missing in mining-related accidents in the nation, the world's largest consumer of coal, official figures show. In comparison, 52 people were killed over the last decade in US coal mining disasters, according to the US National Institute of Occupational Safety and Health. It is estimated that more than 3,000 workers die in Chinese mines every year, mostly at coal operations. One of the worst mining accidents registered in the country happened a year ago, when a landslide that displaced as much as 2 million cubic meters of earth and rubble killed 83 people in a mining area of the Tibet region. Image: Screenshot from Beijing Review via YouTube. |

| Peru set to regain world’s second largest copper producer place this year Posted: 20 Apr 2014 04:21 AM PDT Southern Copper's (NYSE:SCCO) nearly finished US$900 million expansion of Toquepala mine and the imminent approval of its halted US$1bn Tia Maria project, are the two main cards Peru has up its sleeve to reclaim its place as the world's second largest copper producer this year. According to the country's Minister of Energy and Mines (MEM), the start up of both mines is the last push Peru needs to take over China as the world's No. 2 producer of the red metal, a title the South American nation lost in 2012.  Toquepala Mine, aerial. Image courtesy of the International Space Station. Currently China's output stands at about 1,600 tonnes per year, well below the nearly 5,800 annual tonnes produced by Chile, the world's leader, based on data provided by CRU Consulting and quoted by Andina news agency (in Spanish). Tia Maria has been suspended since 2011, as it faces opposition from nearby communities concerned about the use of water. But the company held a public hearing for the project late last year, after which it said it was submitting a revised environmental impact study, which it expected to be approved by June 2014. According to Southern, that would allow the US-based company to start production at Tia Maria in about two years. Peru's government is also counting on Chinalco's (HKG: 3668) US$3.5bn Toromocho copper mine, which began production in December, as well as the recently acquired Las Bambas massive copper mine to up the country's output of the red metal from 1.3 million tonnes last year to 2.8 million tonnes before 2016. South America's sixth-largest economy expanded 5.6% last year, the slowest pace since 2009, as slowing Chinese demand triggered a slump in copper shipments that account for a quarter of Peru's exports. Copper prices have fallen 11% this year, adding to a 7.2% drop in 2013. Gold, Peru's second-largest export, has risen 9.8% so far this year. |

| You are subscribed to email updates from MINING.com To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 20 West Kinzie, Chicago IL USA 60610 | |

0 Comment for "Barclays is the next big bank pulling out of commodities: report"