Suncor can't randomly drug test employees, panel rules |

- Suncor can't randomly drug test employees, panel rules

- Mysterious stock dump sends Montreal metals junior tanking

- Capstone Mining gains on life-of-mine extension

- Taseko fights for New Prosperity, files second judicial review application

- Gold price dips below $1,300

- The US now produces more than 10% of the world's crude, thanks to the shale industry

| Suncor can't randomly drug test employees, panel rules Posted: 26 Mar 2014 03:43 PM PDT Oil sands giant Suncor Energy (TSE:SU) won't be able to randomly test its employees for drug and alcohol use, a court-ordered arbitration panel has ruled. Suncor announced its testing program in 2012, but the workers' union Unifor filed a grievance and applied for an injunction, which blocked random testing until the arbitration panel could issue a decision. Now the panel has determined that Suncor's proposed policy is, in its present form, "an unreasonable exercise of the Employer's management rights." "The 2012 Policy would cause intrusions into the privacy of employees beyond what is reasonably necessary to address the issues which have been raised by the Employer," the ruling reads. Suncor alleged that there was an "out-of-control" drug culture among the workers and in the broader community of Fort McMurray. The panel rejected this claim, saying there was no evidence to establish that such a problem existed. The panel concluded that the policy "is proposed without any time limits for reviewing its effectiveness, is not targeted as narrowly as possible, does not use the least intrusive or most accurate testing measures available and does not contain provisions for communicating with employees around false positive results." The unionn, which represents close to 3,400 Suncor employees had this to say. "Random drug testing of workers that have done nothing wrong is a violation of their basic rights," President of Unifor Local 707A Roland Lefort wrote in a statement. "We will work with Suncor to achieve the highest possible levels of workplace safety with education and prevention, not invasive medical procedures." Suncor has said it will appeal the decision. |

| Mysterious stock dump sends Montreal metals junior tanking Posted: 26 Mar 2014 03:13 PM PDT Stock in Orbite Aluminae Inc (TSE:ORT) crashed 36% in massive volumes on Wednesday without any fresh news that could have prompted the sell-off. By the close the Montreal-based developer was trading down 36% at $0.205 on the Toronto big board, with more than a 10 million shares changing hands – that's at least ten time usual volumes. Orbite now has a market value of $80 million. The Montreal-based company said in a press-release it is "unaware of any undisclosed material changes or corporate developments in its operations" that could have caused the move and have now asked for a formal investigation. Orbite hopes to complete construction of a $105 million high-grade alumina plant by the end of the year. A cost blow-out at the plant that decimated the stock price saw an overhaul of top management and board last year. At the beginning of March the company announced a $10 million equity investment from the Government of Quebec. Orbite was also able to raise $56 million late last year through a $16 million public offering and separate private placement to complete the construction of the plant. The plant in Cap-Chat, Quebec, will use a patented technology that can extract alumina and by-products such as rare earth and rare metal oxides from feedstocks that include aluminous clay, kaolin, nepheline, bauxite, red mud and fly ash. Orbite owns the Grande-Vallée aluminous claystone deposit that will feed another plant on the drawing board. The dramatic fall had stockboards buzzing and punters scratching their heads why the stock started tanking in late afternoon trade after being flat for most of the day. Data from CanadianInsider show a director of the company picked up 70,000 shares on the open market on Thursday, while more than 4 million options were granted to insiders yesterday. Director Claude Lamoureux, who built the Ontario Teachers' Pension Plan into a $100 billion investment fund, bought at the pre-crash price of $0.34. At $0.40 the directors and management options issued on Tuesday are now also deeply under water. |

| Capstone Mining gains on life-of-mine extension Posted: 26 Mar 2014 03:10 PM PDT Vancouver-based Capstone Mining (TSE:CS) says that based on a new pre-feasibility study, its Pinto Valley copper mine in Arizona has an extra 8 years to operate, extending its mine life to 2026. Capstone was trading for $2.87 per share, a gain of more than 5%. Pinto Valley, which has been in operation since 1974 with three shutdown periods, was supposed to stop producing in 2018. Capstone pointed out some highlights of its Pre-Feasibility Study — Mine Life Extension ("PV2 PFS") in a news release Wednesday. Average annual production for the first five years is 128.4 million pounds of copper contained in concentrate and 6.6 million pounds of copper cathode, the company wrote. "The Pinto Valley PFS has validated the purchase price and confirms our position as a leading intermediate copper producer," President and CEO of Capstone Darren Pylot said in a statement. "Completion of the PV2 PFS extends the mine life to 2026 and provides us with the platform to stabilize operations, gain efficiencies and gives us the opportunity to take a longer-term view towards the future of the Pinto Valley Mine in Arizona." Capstone purchased the Pinto Valley mining operation from BHP Billiton for US$650 million in 2013. |

| Taseko fights for New Prosperity, files second judicial review application Posted: 26 Mar 2014 02:28 PM PDT Despite having been rejected by the federal government twice, Taseko Mines (TSX:TKO) isn't giving up on its proposed $1.5 billion New Prosperity copper and gold project in British Columbia. This week Taseko filed a second application for judicial review asking the Federal Court to nullify Environment Minister Leona Aglukkaq's rejection of New Prosperity. In a statement sent out Wendesday, the company claims that the project was not evaluated "in a fair, open and transparent manner," and that government officials held "inappropriate closed door meetings with opponents of the proposed mine without Taseko's knowledge or informing the Company of the content of those meetings." "Taseko maintains it had a legitimate expectation that if any third‐party representations were made to the federal government concerning the project after the Panel Review was complete that Taseko would be afforded an opportunity to make responses to those submissions. The Company was never given that opportunity." CEO Russ Hallbauer said that going to court is the only "reasonable option" the company has. Last October a review panel from Natural Resource Canada (NRCan) concluded that Taseko's proposed mine would pose "several significant adverse environmental effects." The panel's assessment was sent to the federal Minister of the Environment to be used in deciding whether or not to approve the plans. Taseko strongly objected to the panel's findings, claiming that NRCan had made an 'outrageous' error when assessing the project. According to the company, the panel based its report on a tailings storage facility design that did not correspond with what the miner actually proposes to use. Shortly after the assessment was released Taseko filed a judicial review application to try and block the scathing report from being used in the federal review process. The latest application will address the government's actual decision. |

| Posted: 26 Mar 2014 12:56 PM PDT The gold price briefly dipped below the psychologically important $1,300 level on Wednesday, the lowest in more than six weeks. On the Comex division of the New York Mercantile Exchange, gold futures for June delivery last traded near its lows for the day of $1,299.90 an ounce, down $11.50 or nearly 1% from yesterday's close. The yellow metal has taken a hammering during the past eight trading sessions – gold is down from a high above $1,380 reached on Monday last week which was best level since June. On a technical basis gold is also close to dangerous waters with a key indicator – the 200-day moving average – currently sitting at $1,296.60. If the gold price should fall through this level all bets are off concerning further weakness. Gold is still up some $100 since the start of the year, but positive news from top consuming region Asia and bullish positioning from speculators in New York has not been able to turn around recent negative sentiment. Instead, large investors on the futures and options market appears to have used this week to lighten their long positions (bets that the price will go up), while investors in gold-backed ETFs booked some profits from gold's strong showing in 2014. Last week saw the first reduction in four weeks of holdings in exchange traded funds backed by physical gold. The reduction was small, only 0.2 tonnes, but the loss of positive momentum has soured sentiment. An underlying weakness has been expectations that interest rates will continue to rise in the US and boost the dollar. Gold, which unlike other financial assets provides no yield, competes with US bonds for investor money and gold and the dollar usually moves in opposite directions. Picture of gold mannequins from Dali-Theatre Museum in Barcelona by Chirag D Shah. |

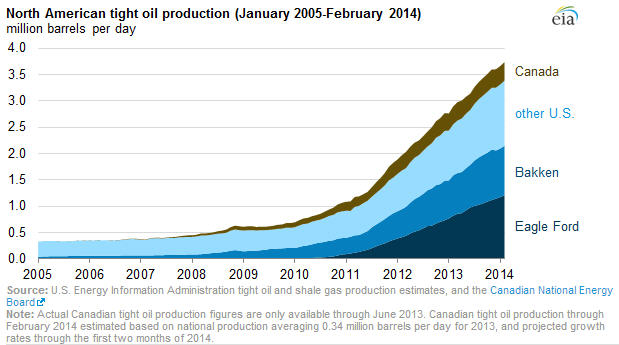

| The US now produces more than 10% of the world's crude, thanks to the shale industry Posted: 26 Mar 2014 12:23 PM PDT Boosted by the shale industry, US crude oil production in the first quarter of 2014 made up more than 10% of the world's total output. US tight oil production averaged 3.22 million barrels per day over the past three months – due largely to two shale formations, Eagle Ford and Bakken – according to data released Wednesday by the US Energy Information Administration (EIA). "This level was enough to push overall crude oil production in the United States to an average of 7.84 MMbbl/d, more than 10% of total world production, up from 9% in the fourth quarter of 2012," the EIA wrote. According to 24/7 Wall Street, "[t]he last time the U.S. produced that much crude was 25 years ago, in 1988." Over the past decade, US tight oil production has skyrocketed, as seen in the chart below. "Tight oil refers to oil found within reservoirs with very low permeability, including but not limited to shale," the EIA explains. "Permeability is the ability for fluid, such as oil and gas, to move through a rock formation." The US and Canada are the only major tight oil producers in the world, though Russia is producing some in the West Siberia Basin. According to the EIA, Australia and the UK have the "potential to be among the next countries with commercially viable tight oil production." |

| You are subscribed to email updates from MINING.com To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 20 West Kinzie, Chicago IL USA 60610 | |

0 Comment for "Suncor can't randomly drug test employees, panel rules"