CHART OF THE DAY: Attendance at the industry's biggest shindig and the mood of miners |

- CHART OF THE DAY: Attendance at the industry's biggest shindig and the mood of miners

- Copper, iron ore miners take huge hits

- PICTURE OF THE DAY: Dump truck partially covered by rock slide

- Barrick to sell off 13.5 pct of African holding

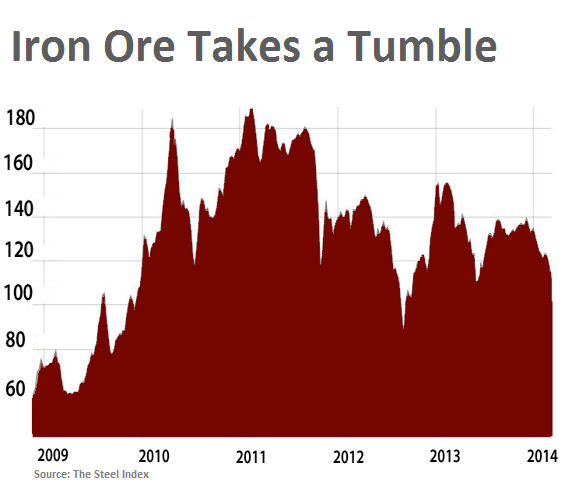

- Iron ore price craters 8%

- Australia’s mining tax expected revenue continues to disappoint

| CHART OF THE DAY: Attendance at the industry's biggest shindig and the mood of miners Posted: 10 Mar 2014 03:15 PM PDT The mining industry's overhang is visible in the number of attendees at the Prospectors & Developers Association of Canada's 2014 Convention held in Toronto last week. The PDAC organizers say 25,000 people attended the show. IKN, which compiled the chart, notes that 2012 was the convention's record year of 30,369. In a new release the PDAC says it's organizers were ". . . thrilled with the turn out." "The mood was very optimistic amongst attendees," says new PDAC President Rodney Thomas. The PDAC says the annual convention is the industry's largest gathering. Image from San Diego Air & Space Museum Archives |

| Copper, iron ore miners take huge hits Posted: 10 Mar 2014 02:22 PM PDT Mining's top companies were all marked down on Monday following dismal economic numbers from top commodities importer China and a sharp fall in two key commodities. Data released over the weekend showed Chinese overall exports slid a stunning 18.1% year-on-year sparking fears that the slowdown in the world's second largest economy is much worse than feared. The price of copper dropped more than 1% in late New York trade, just short of crashing through the psychologically important $3.00 a pound level, following news that Chinese imports of copper fell 30% in February from the month before. The red metal is down more than 9% since the start of the year. The fall in the price of iron ore was more pronounced amid a crisis in the Chinese steel industry. The steelmaking raw material plummeted 8.3% to the lowest since October 2012 after rumours of the collapse of a large mill sent shivers through the sector and plunge in imports of iron ore of more than 25 million tonnes in February. The iron ore price of $104.70 is down just shy of 22% since the start of the year, according to data from the The Steel Index. The other vital ingredient in the steelmaking process coking coal also fell, trading below $120 a tonne, compared to more than $160 a tonne this time last year. China's ferocious demand for iron ore has been a central feature of the global mining industry over the past decade and the driving force behind the spectacular profit growth at mining's big three. In recent earnings announcement number three producer BHP Billiton (LON:BHP), behind Vale (NYSE:VALE) and Rio Tinto (LON:RIO), said every $1 decline in the price of iron ore translates into a $120 million hit to the bottom line. For copper, BHP said net after tax profits decline $25 million for every one US cent drop in the price. The slide in copper and iron ore saw BHP Billiton's ADRs trading in New York lose 2.7%. The $175 billion company with headquarters in Melbourne is down 5.8% in March. Valuations of Rio Tinto and Brazil's Vale, both of which are more exposed to iron ore than BHP, were also slashed with Rio losing 2% and Vale shedding 3.2%. The world's largest iron ore miner is down 16% so far this year. Combined, the globe's biggest listed mining companies are worth some $340 billion. Second tier players most exposed to iron ore really go hammered, with Australia's Fortescue Metals Group (ASX:FMG) shedding 9.4% in Sydney, while Anglo-American unit Kumba Iron Ore's ADRs (NYSE:KIROY) declined more than 6% in New York. After staging a comeback of sorts in 2014 after years of dismal share price performance Anglo-American (LON:AAL) declined 2% in New York where it is now worth $33 billion. Number four diversified miner Swiss-based Glencore Xstrata (LON:GLEN) curbed losses to 2.3% on the LSE. The $71 billion company is the world's largest coal producer, but has minimal exposure to a fall in the iron ore price. Copper and coal giant Canada's Teck Resources gave up 2.5% on the Toronto Stock Exchange. The Vancouver-based miner is one of the worst performers this year; the counter is down 14% in 2014, giving it a market value of $12 billion. Freeport-McMoran Copper & Gold (NYSE:FCX) declined 2.5% in New York on Monday, adding to market value losses in excess of 16% suffered so far this year. The $32 billion company based in Phoenix has been punished this year thanks to punitive new export taxes on concentrates in Indonesia where it operates the massive Grasberg mine. Freeport peer Southern Copper Corp (NYSE:SCCO) fell 3.5% in New York affording it a market value of $24 billion. The Peru and Mexico focused miner is down 2.5% year to date. |

| PICTURE OF THE DAY: Dump truck partially covered by rock slide Posted: 10 Mar 2014 01:19 PM PDT Photo from Mining Mayhem. Date and place not released. |

| Barrick to sell off 13.5 pct of African holding Posted: 10 Mar 2014 11:42 AM PDT Barrick Gold (NYSE:ABX) announced today that it will divest itself of 13.5% of African Barrick Gold (LON:ABG). The company said that the placement will be conducted through an accelerated bookbuild offering process launched beginning immediately. Barrick Gold was down 1% to $19.71 at 2:30 p.m. a share in a generally down day for gold miners. African Barrick Gold (LON:ABG) was up 3.18% to GBX308.10 per share. UBS, J.P. Morgan Securities and RBC Europe are joint bookrunners. The placement will comprise of approximately 41.0 million ABG ordinary shares, representing approximately 10.0% of the issued ordinary share capital of ABG. African Barrick Gold, which was established in 2000 when the Barrick Gold began operations in Tanzania, has resources of about 32 million gold ounces. |

| Posted: 10 Mar 2014 10:26 AM PDT China's steel industry in full panic mode as rumours of large mills collapsing see iron ore price and imports plummet. The benchmark import price of 62% iron ore fines at China's Tianjin port on Monday dropped $9.50 or 8.3% to $104.70 a tonne. It was the worst one-day decline since the 2008-2009 financial crisis and the steelmaking raw material is now trading at its lowest since October 2012. The iron ore price is down just shy of 22% since the start of the year, according to data from the The Steel Index. The sell-off in iron ore – and other industrial metals – intensified after trade data released on Saturday showed Chinese exports slid a stunning 18.1% year-on-year, down from double digit growth in January, sparking fears that the slowdown in the world's second largest economy is worse than feared. Iron ore was hit hardest because of a worsening crisis in China's steel sector which consumes more than two-thirds of the seaborne iron ore trade and forges almost as much steel as the rest of the world combined. The globe's most active steel future – Shanghai rebar – fell 4% on Monday to an all-time low for the contract. At the same time Chinese imports of iron ore fell back sharply from its record-breaking pace, dropping by more than 25 million tonnes to 61.2 million tonnes in February. The drop in imports did not translate into lower inventories at the country's ports which swelled to a new high of 105 million tonnes according to Steelhome, a consultancy. Last week Choari Solar became the first Chinese company in history to default on a corporate bond, sending shivers through China's corporate world. Many observers believed that the country's steel sector would be the first to make financial history, given its chronic lack of profitability and overproduction, and rumours on Friday caused widespread panic in the industry. "The Chinese steel industry is in total disarray today, following rumours surfacing of the first debt defaulting mill (3.6m tonnes per annum) from Shanxi province shutting 5-6 furnaces," Melinda Moore, analyst at Standard Bank told the FT on Friday: "And this panic could potentially reverberate further; firstly into another destock across both physical steels and iron ore . . . but also beyond, into other commodities and other sectors more generally." The stockpiled iron ore is not being put to industrial use, but because of tight credit conditions inside China the ore is being used as collateral to secure loans. About 40% of the iron ore at China's ports are part of finance deals, Mysteel Research estimates while official news outlet Xinhua reports about one-third of China's 200,000 steel trading firms could collapse as the loan crisis deepens. Loans to the industry peaked around 200 billion yuan or nearly $33 billion following China's economic stimulus program in 2008 following the global financial crisis. |

| Australia’s mining tax expected revenue continues to disappoint Posted: 10 Mar 2014 10:18 AM PDT Mining tax revenue in Australia continues to fall short of the government's expectations, with only $232 million raised so far, as opposed to $4 billion originally forecast when the legislation was enacted in 2011. An analysis by The Weekend Australian shows the much-debated Minerals Resource Rent Tax (MRRT) has failed to raise revenue, even though the profits of the three big iron ore miners — BHP Billiton, Rio Tinto and Fortescue— soared by 81% and the price of the commodity rose to more than US$130 a tonne. The paper adds the three miners made a combined US$14.6 billion (A$16.1bn) in half-year profits, but only one of them —BHP— had the obligation to pay under the MRRT in the six months to December 31. While the country's government have not offered an explanation for why the tariff failed to raise revenue, analyst say it is likely because the original tax was modified by BHP, Rio, Glencore Xstrata and the Gillard Government to allow the inclusion of market values for mines. "That allowed mining companies to claim depreciation from a valuation that includes the rent that is supposed to be taxed. Thus, it is neutralized," says the Macro Business blog. In an opinion piece for The Guardian, Luke Mansillo, suggests another interesting reason:

While the Minerals Council of Australia has defended the design of the tax, saying the industry already pays its fair share, the Abbott Government wants to get rid of the tax, and is expected to do so when the new Senate comes into term after July 1. Image by Pixabay |

| You are subscribed to email updates from MINING.com To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 20 West Kinzie, Chicago IL USA 60610 | |

0 Comment for "CHART OF THE DAY: Attendance at the industry's biggest shindig and the mood of miners"