Silver and <b>Gold Prices</b>: The <b>Gold Price</b> Closed Higher at $1,257.60 |

| Silver and <b>Gold Prices</b>: The <b>Gold Price</b> Closed Higher at $1,257.60 Posted: 06 Feb 2014 04:46 PM PST Gold Price Close Today : 1257.60 Change : 0.30 or 0.02% Silver Price Close Today : 19.908 Gold Silver Ratio Today : 63.171 Silver Gold Ratio Today : 0.01583 Platinum Price Close Today : 1374.40 Palladium Price Close Today : 709.45 S&P 500 : 1,773.43 Dow In GOLD$ : $256.89 Dow in GOLD oz : 12.427 Dow in SILVER oz : 785.04 Dow Industrial : 15,628.53 US Dollar Index : 80.970 The GOLD PRICE rose a chiseling 30 cents to $1,257.60 and silver didn't shine much brighter, sneaking up 12.3 cents to 1990.8c. There's a "feel of the thing" even to markets, and a long train of rises that slow down to thirty cents feels like the apogee of a thrown baseball's trajectory. Feels like it's slowing before it falls. Of course, you could ascribe that to the GOLD PRICE resistance at $1,267.50 (today's high) or resistance at that downtrend line, which gold closed nearly plumb on top of today. Don't write this rally off yet. Squint sideways at it, maybe, but don't write it off yet. The elephant sat on the SILVER PRICE today, too, but it's still moving up. Standing above its 50 (1976c) and 20 (1981c) day moving averages, it has a shot at breaking through 2050c. All things added up, stocks and the euro sucked interest away from silver and gold prices today. Still, nothing has changed. Main thing now is the silver holds own above 1897c and gold above $1,210. It may take another try still for gold to breach $1,267.50, but that's not the end of the world. Today markets roused a little excitement. Whether that changes anything or not is another story. Lo, stocks had their best day this year, but then, that's not saying much. Dow fluttered up 188.3 (1.22%) to 15,628.53, and back above its 200 DMA (15,483.08). Since other people watch charts, too, it's reasonable to expect them to buy at the 200 DMA. The S&P500 rose 21.79 (1.24%) to 1,773.43, Behold! Enough to touch its downtrend line. It appears stocks are lining up for an upward correction. 'Twill be fascinating to see how far they can climb. Stocks' strength relative to gold and silver today floated the Dow in Gold and Dow in Silver. Dow in Gold rose 1.16% to 12.42 oz (G$256.74 gold dollars). Dow in Silver barely edged up, 0.89% to 783.78 oz. Mario Draghi, Criminal-in-Charge at the European Central Bank, surprised markets today by announcing there is no deflation in Europe and leaving the interest rate alone. Market was expecting a rate cut or at least a shot of Quantitative Easing, so the opposite probably set off some short covering. Whatever they thought, the euro jumped up 0.44% to $1.3592, without, however, closing above its 20 DMA (1.3604) or 50 DMA (1.3644) or breaking through its top descending channel line. In other words, it bounced from the bottom of the trading channel to the top. That doesn't really change anything. Unless it can close above $1.3650 tomorrow, today will go down in history as, as, well, as nothing. US Dollar Index, Enemy to its Friends, Traitor to Investors, dropped 15 basis points (0.19%) to 80.97, below the psychologically sensitive 81 line. That is slap up against its 20 DMA (80.96) and leaves the dollar suspended in the selfsame range it has wallowed in since September. Yen tumbled 0.6% to 97.94, putting the end to its uptrend at least while a short correction endures. SPECIAL OFFER: MORGAN SILVER DOLLARS I bought some pre-1905 Morgan silver dollars on a swap but since I don't usually stock them, so I would like to say good-bye to these quickly, so they are priced to fly. OFFER No. 1. Seventy-five (75) each VG+ pre-1905 Morgan, silver dollars at $26.50 each, for a total of $1,987.50 plus $35 shipping or $2,022.50. These are not bright, shiny uncirculated coins, but all are simply graded strict Very Good or better, no culls, no rim dings, full rims, etc. Each coin contains 0.765 troy ounce of silver, allowing wear for circulation. Great coin for survival. I have only six (6) lots. OFFER No. 2. Ninety (90) each pre-1905 Morgan, CULL silver dollars at $23.00 each, for a total of $2,070.00 plus $35 shipping or $2,105.00. A "CULL" dollar won't meet the grade of Very Good or better. Worn and might have rim dings or rims worn down in spots, but won't quite reach an honest Very Good. Another great survival coin. I have Six (6) lots only. Special Conditions: First come, first served, and no re-orders at these prices. I will write orders based on the time I receive your e-mail. Sorry, we will not take orders for less than the minimum shown above. All sales on a strict "no-nag" basis. We will ship as soon as your check clears, but we allow Two weeks (14 days) for your check to clear. Calls looking for your order two days after we receive your check will be politely and patiently rebuffed. It increases your chances of getting your order filled if you offer me a second choice, e.g., "I want to order One of Lot 2, but if not available will take One of Lot 2." ORDERING INSTRUCTIONS: 1. You may order by e-mail only to offers@the-moneychanger.com. No phone orders, please. Please do NOT order by replying to THIS email, because it will delay your email. Your email must include your complete name, address, and phone number. We cannot ship to you without your address. Sorry, we cannot ship outside the United States or to Tennessee. Repeat, you must include your complete name, address, and phone number. Our clairvoyant quit without warning last week, then I tripped, dropped, and smashed my crystal ball, and our fortune-teller is on strike, so I can no longer read your mind. 2. When you buy from us, we cannot later change or cancel the trade. We are giving you our word that we will sell at that price, and you are giving us your word that you will buy at that price, regardless what later happens in the market, up or down. If you break your word to us, we will never again do business with you. 3. Orders are on a first-come, first-served basis until supply is exhausted. 4. "First come, first-served" means that we will enter the orders in the order that we receive them by e-mail. 5. If your order is filled, we will e-mail you a confirmation. If you do not receive a confirmation, your order was not filled. 6. You will need to send payment by personal check or bank wire (either one is fine) within 48 hours. It just needs to be in the mail, not in our hands, in 48 hours. 7. "No Nag Basis" means that we allow fourteen (14) days for personal checks to clear before we ship. 8. Mention goldprice.org in your email. Want your order faster? Send a bank wire, but that's not required. Once we ship, the post office takes four to fourteen days to get the registered mail package to you. All in all, you'll see your order in about one month if you send a check. Argentum et aurum comparenda sunt -- -- Gold and silver must be bought. - Franklin Sanders, The Moneychanger © 2014, The Moneychanger. May not be republished in any form, including electronically, without our express permission. To avoid confusion, please remember that the comments above have a very short time horizon. Always invest with the primary trend. Gold's primary trend is up, targeting at least $3,130.00; silver's primary is up targeting 16:1 gold/silver ratio or $195.66; stocks' primary trend is down, targeting Dow under 2,900 and worth only one ounce of gold or 18 ounces of silver. or 18 ounces of silver. US $ and US$-denominated assets, primary trend down; real estate bubble has burst, primary trend down. WARNING AND DISCLAIMER. Be advised and warned: Do NOT use these commentaries to trade futures contracts. I don't intend them for that or write them with that short term trading outlook. I write them for long-term investors in physical metals. Take them as entertainment, but not as a timing service for futures. NOR do I recommend investing in gold or silver Exchange Trade Funds (ETFs). Those are NOT physical metal and I fear one day one or another may go up in smoke. Unless you can breathe smoke, stay away. Call me paranoid, but the surviving rabbit is wary of traps. NOR do I recommend trading futures options or other leveraged paper gold and silver products. These are not for the inexperienced. NOR do I recommend buying gold and silver on margin or with debt. What DO I recommend? Physical gold and silver coins and bars in your own hands. One final warning: NEVER insert a 747 Jumbo Jet up your nose. |

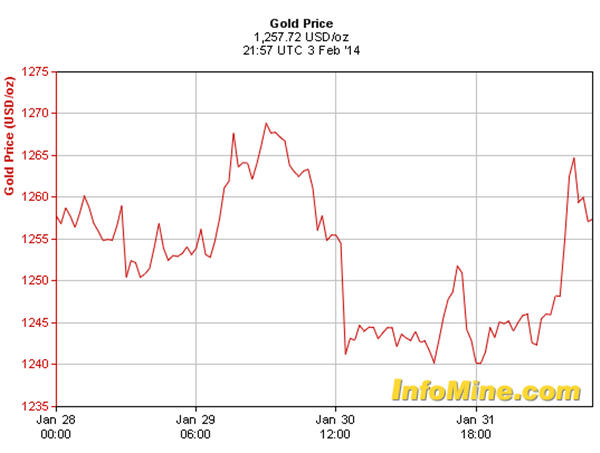

| <b>Gold price</b> gains after US manufacturing data released - MINING.com Posted: 03 Feb 2014 02:15 PM PST The gold price had another good Monday after gaining more than $20 for a spot price of $1,264 by noon. The morning boost simmered to $1,257 by closing. Last Monday the precious metal's spot price had a similar rally, though it reached nearly $1,270 that day. Futures trading also rose sharply: Gold for April delivery - the most active contract - gained $18 to $1,257 on the NYMEX, nearly making up for last week's drop. Gold bugs have the US economy to thank for the gains after the Institute for Supply Management (ISM) reported a Purchasing Managers Index (PMI) of 51.3% – down 5.3% from December's seasonally adjusted reading of 56.5%. This level is still above the magic 50% mark which distinguishes economic expansion from contraction. The PMI – which is based on a survey of manufacturing supply managers – is considered an important indicator of the health of the US economy. The ISM's report also noted that the manufacturing sector expanded for the eighth consecutive month in January. George Gero, a vice president and metals strategist with RBC Capital Markets told the Wall Street Journal that some of the buying was from automatic buy orders triggered by gold's rise above $1.250 per ounce. |

| You are subscribed to email updates from gold price - Google Blog Search To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 20 West Kinzie, Chicago IL USA 60610 | |

0 Comment for "Silver and Gold Prices: The Gold Price Closed Higher at $1,257.60"