BHP Billiton could put as much as $1bn into Trinidad and Tobago deep water exploration |

- BHP Billiton could put as much as $1bn into Trinidad and Tobago deep water exploration

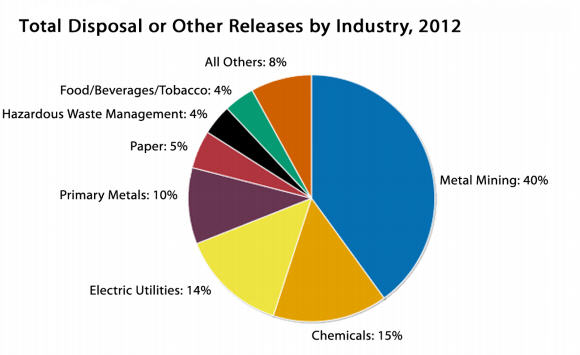

- Metals mining sector accounts for 40% of toxic chemical releases in the US – EPA says

- Eight workers rescued, nine still missing after fire at Harmony’s Doornkop mine

- EU prepares scheme to stem use of conflict minerals — report

- JP Morgan about to close sale of $3.3bn commodities business with Mercuria

- Goldcorp doesn’t give up on Osisko, extends bid offer

| BHP Billiton could put as much as $1bn into Trinidad and Tobago deep water exploration Posted: 05 Feb 2014 03:07 PM PST BHP Billiton – one of the world's largest resources companies – has plans to invest up to $1 billion in oil exploration in Trinidad and Tobago, according to the Trinidad Express. Speaking at an energy conference on Monday, BHP's Trinidad manager Vincent Pereira said the company was "very optimistic" about business on the island nation and that it "remains an important part of BHP Billiton's global petroleum portfolio." The country's deep water oil reserves are largely untested and BHP will start 3D seismic surveys later this year. The funds will go toward a new "deep water exploration phase." About half a billion will go toward the first phase and the rest to optional steps thereafter, according to Trinidad Express. BHP's Caribbean ambitions will represent the "world's biggest pre-drill, or seismic, exploration program," The Australian reported last week, though budget estimates at the time were reported to be about $200 million. Trinidad and Tobago is the largest oil and natural gas producer in the Caribbean. In 2012 it was also the world's sixth largest liquefied natural gas (LNG) exporter and it is the largest LNG exporter to the US, according to the US Energy Information Administration. Pereira said its still unclear whether the designated deep water blocks are more prospective for oil or gas. "Whether oil or gas is discovered, we will be looking for sufficient quantities to make any discovery commercially feasible," he said, as reported by Trinidad Express. The company hadn't put much emphasis on deep water plays in Trinidad and Tobago until recently when the country's fiscal terms became more "consistent with [the company's ability to make money," president of BHP's petroleum and potash unit Tim Cutt said last December. "The terms are now satisfactory," he said, as reported by Bloomberg. Image featured on homepage: A stamp printed in Trinidad and Tobago circa 1969 | Photo by Lefteris Papaulakis |

| Metals mining sector accounts for 40% of toxic chemical releases in the US – EPA says Posted: 05 Feb 2014 12:12 PM PST Releases of toxic chemicals in the US decreased by 12% in 2012, according to the US Environmental Protection Agency's (EPA) most recent Toxic Releases Inventory (TRI) report. The metals mining sector accounts for 40% of the releases of TRI chemicals. Here's why. TRI is an annual report compiled by the EPA in order to make people aware of what toxic chemicals are being used and released by industries. It's based on self-reported data from 2012 submitted by thousands of US facilities covering over 650 chemical substances. The recorded decrease in the disposal of toxic chemicals is mainly due to a reduction in on-site land disposal by the mining industry, the EPA wrote. The metals mining industry accounts for 40% of total disposal or other release of TRI chemicals. "Most of the metal mining releases are to on-site land disposal; this sector reported nearly two-thirds (65%) of the on-site land disposal for all industries," the report reads. After a steady drop in releases between 2003 and 2009, levels suddenly increased; metal mines were responsible for 97% of the increase in total releases between 2009 and 2011. Latest figures show that this trend is reversing and releases are close to 2009 levels. This is not because production increased – which it didn't. In the mining sector "even a small change in the chemical composition of the deposit being mined can lead to big changes in the amount of toxic chemicals reported nationally," the agency wrote. "In recent years mines have cited changes in production and changes in the composition of waste rock as the primary reasons for the reported variability in land disposal of TRI chemicals."  Figure from EPA's 2012 TRI report The TRI report also collects information on the quantities of toxic chemicals managed through recycling, energy recovery, and treatment, giving a more complete pictures of what happens to chemicals. In 2012, total production-related waste managed by TRI facilities declined by 14%. But only 15% of facilities reported practices that reduced the total quantity of chemical waste generated. In the metal mining sector, 6 out of 88 reporting facilities initiated practices to reduce their toxic chemical use in 2012. "Toxic chemical quantities reported by this sector are not especially amenable to source reduction, since they primarily reflect the natural composition of the waste rock," the EPA wrote. In terms of which company manages the most production-related waste, Teck American – a subsidiary of Canadian mining giant Teck Resources – takes the number one spot, followed by Koch Industries and the Dow Chemical Company. |

| Eight workers rescued, nine still missing after fire at Harmony’s Doornkop mine Posted: 05 Feb 2014 10:27 AM PST South African emergency workers continue their efforts Wednesday evening to rescue nine miners still missing deep underground in the burning Harmony Gold's (NYSE:HMY) Doornkop mine, west of Johannesburg. Nine of the 17 workers initially trapped after a fall-of-ground accident at the mine and subsequent fire late Tuesday, have already been rescued, the company said. "All the focus right now is on trying to locate the missing men," Harmony Gold said in the statement, adding that while underground fire has been subdued, conditions underground remain challenging due to smoke and small landslides. BBC's correspondent in Johannesburg, Andrew Harding, says the missing miners are supposed to be carrying their own packs of oxygen, so Harmony Gold hopes they will have made their way to other refuge bays underground and successfully rescued. |

| EU prepares scheme to stem use of conflict minerals — report Posted: 05 Feb 2014 07:53 AM PST  Regulation seeks preventing warlords funding their militias by selling minerals to European companies. Karel De Guch, the European Union's trade chief, is ready to submit a voluntary certification scheme to the block's lawmakers and governments, which aims to prevent warlords funding their militias by selling minerals to European companies. The EU's trade directorate had been expected to publish a regulation that would secure uniform compliance among coalition members – and beyond – by the end of last year. However it was delayed without explanation. The proposed regulation would allegedly only cover gold and the "Three T's" — tin, tungsten, and tantalum— leaving diamonds out, Reuters reports. The EU is already a member of the Kimberley Process, a government, industry and civil society initiative set up in 2002 to control the use of rough diamonds that fund rebel movements and human rights abuses. Analysts believe the Dodd-Frank Act provisions on source-checking materials acquired from the Democratic Republic of Congo (DRC) or nearby, have been a catalyst to international efforts to deal with the conflict minerals problem. Dodd-Frank forced the US Securities and Exchange Commission (SEC) to create rules for addressing whether conflict minerals were benefitting armed groups in the DRC, and introduced a "due diligence" certification plan, imposing companies to source-check materials. The set of rules also caught European firms operating in the DRC in its net, and this in turn nudged the EU to come forward with its own proposal. Image by Julien Harneis, via Flickr |

| JP Morgan about to close sale of $3.3bn commodities business with Mercuria Posted: 05 Feb 2014 06:38 AM PST  The deal is expected to come with a contract supplying crude oil to the biggest US East Coast refinery, Henry Bath & Sons. JPMorgan Chase & Co (NYSE:JPM), the largest US bank, is allegedly engaged in exclusive talks with Swiss trading house Mercuria, led by two former Goldman Sachs (NYSE:GS) executives, to sell its $3.3bn commodities business. The firm, which spent five years and billions of dollars building the banking world's biggest commodity desk, may sell Geneva-based Mercuria all or some of its commodity-related divisions, reports Reuters. These units include base metals, coal, North American power, North American natural gas, European power and gas and Henry Bath, the metal warehousing group. The most valuable of them is global crude oil, which JP Morgan values at $1.7 billion. Pushed by higher capital levels and tougher regulation, the US financial giant last year decided to follow other investment banks, such as Barclays and Deutsche Bank, and ditch its commodities business. While the final deal with Mercuria could take months to see the light, if it goes ahead the transaction would place the Swiss commodity trader into the top tier of trading houses with Glencore Xstrata (LON:GLEN), Vitol and Trafigura. |

| Goldcorp doesn’t give up on Osisko, extends bid offer Posted: 05 Feb 2014 05:37 AM PST  For five years, Vancouver-based Goldcorp has been trying to buy Osisko to gain control of the company's massive gold mine in Quebec called the Canadian Malartic, shown in this photo. (Courtesy of Osisko) Goldcorp (TSX:G) (NYSE:GG) has extended its $2.6 billion unsolicited takeover bid on fellow Canadian miner Osisko (TSX:OSK), from Feb. 19 to March 10, after the Quebec Superior Court set a hearing yesterday to decide if its complaints against the Vancouver-based gold giant have merit. On Tuesday Osisko announced it was suing Goldcorp, alleging the firm misused confidential information to attempt a takeover. Osisko has already advised its shareholders to reject the bid. Goldcorp, which is seeking access to access to Osisko's Malartic mine in Quebec, already has a gold project in the province – Éléonore, set to begin production later this year. If it goes through, the proposed deal will make Goldcorp, which already is world's largest gold miner by market capitalization, the No. 1 gold producer in the province of Quebec. |

| You are subscribed to email updates from MINING.com To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 20 West Kinzie, Chicago IL USA 60610 | |

0 Comment for "BHP Billiton could put as much as $1bn into Trinidad and Tobago deep water exploration"