Silver and <b>Gold Prices</b>: The <b>Gold Price</b> has an Established Uptrend <b>...</b> |

- Silver and <b>Gold Prices</b>: The <b>Gold Price</b> has an Established Uptrend <b>...</b>

- A Closer Look At the <b>Gold Price Chart</b> - Seeking Alpha

- Will <b>Gold</b> and Silver <b>Price</b> Increase from Here? :: The Market Oracle <b>...</b>

- <b>Gold Prices</b> Still Dependent On The U.S. Dollar [SPDR Gold Trust <b>...</b>

- This 50-year <b>chart</b> shows how cheap <b>gold</b> now is relative to stocks <b>...</b>

| Silver and <b>Gold Prices</b>: The <b>Gold Price</b> has an Established Uptrend <b>...</b> Posted: 10 Jan 2014 05:05 PM PST Gold Price Close Today : 1,246.70 Gold Price Close 3-Jan-14 : 1,238.40 Change : 8.30 or 0.7% Silver Price Close Today : 20.201 Gold Silver Ratio Today : 61.715 Silver Gold Ratio : 0.01620 Dow in Gold Dollars : $ 272.55 Dow in Gold Ounces : 13.184 Dow in Silver Ounces : 813.68 Dow Industrial : 16,437.05 S&P 500 : 1,842.37 US Dollar Index : 80.750 Platinum Price Close Today : 1,434.70 Palladium Price Close Today : 745.15 For the third week in a row silver and GOLD PRICES are stronger than stocks, and against a rising dollar too. The silver and gold price came back growling this week, stocks are confused, white metals are up, and the US dollar index fainted again today. After being knocked back from the $1,250 level a few days ago, the gold price darted right back to the line today, rising $17.40(1.4%) to $1,246.70. From that position next week gold can challenge $1,250 and the most significant hurdle, $1,267.50, the December high. Gold closed mere dollars and cents from its 50 DMA at $1,249. So take stock: The GOLD PRICE has an established uptrend, is above its 20 DMA and knocking on its 50 DMA. Momentum indicators are all strong, and related markets (gold equity indices) are firming or showing double bottoms. The Dow in Gold is falling, pointing to gold strength. And the weekly chart has risen three weeks running. All good. Listen, y'all, bull markets always climb a wall of worry -- can it get through the next level? And the next? It's too early to call the December lows a double bottom with June, other than as an operating assumption, but if gold can o'erleap $1,267.50, then $1,361.80, the bottom has been seen. The SILVER PRICE far outshone the gold price today, rising 2.7% (53.8 cents) to 2020.1. Yea, how comforting to see gold above the 2000 cent line! And silver cut into but did not cross over its 50 DMA (2021c), and closed right on it. Silver shows a double bottom in December, which also pairs with the June lows. Internal indicators are all positive. What else do you want? Well, a close above the last high at 2044c, then a quick rise through 2100c resistance, followed by a speedy rise above the October 2309.5c high. Is that plain enough? Unless silver closes below 1940 cents and the gold price below $1,195, I am working on the assumption that they have put a bottom unto the long 2011-2013 correction. Stock indices inauspiciously gainsaid one other today. Day started out with a very bad jobs report that drove stocks down. Oddly, investors discounted that and stocks ended higher. Normally when a market doesn't react to bad news, or moves up rather than falls, it signals great strength. But how does that explain the Dow, the senior, blue chip stock index, FALLING today when all the other indices rose? That disharmony augurs something not quite right underneath. Looking at the chart, the Dow remains in a downtrend begun on 31 December and is closing in on its 20 Dma (16,286) and its uptrend line. It lost 7.71 today (0.05%) to close 16,437.05. S&P500 added 4.24 (0.23%) to 1,842.37. Day's range cut into the uptrend line, but it closed above it. However, it still has painted a downtrend on the chart. 20 DMA stands below at 1,821.85. Might as well tell y'all I expect great sorrow, weeping, and gnashing of teeth for stock investors this year. More I study charts, more I expect that. Meanwhile the US dollar index, apparently in expectation of less "taper" (or is it "tapir") fell, as did the yield on the 10 year treasury note (bond prices rose). Let's see, stocks rose and bonds rose. I reckon I'm too country to cipher that out, but after a break out that's very weak performance. However, a noteworthy difference shows in the Dow in Gold and Dow in Silver. Both broke down through their 20 DMAS (825.85 oz and 13.36 oz), and through their short term uptrend lines. DiG lost 1.78% to 13.17 oz ($$275.25 gold dollars). DiS backed down 3.15% (whew!) to 815.33 oz. These indicators usually show the turn of metals against stocks very reliably, so we want them to lead or concur with silver and gold prices. Y'all enjoy your weekend! Argentum et aurum comparenda sunt -- -- Gold and silver must be bought. - Franklin Sanders, The Moneychanger © 2013, The Moneychanger. May not be republished in any form, including electronically, without our express permission. To avoid confusion, please remember that the comments above have a very short time horizon. Always invest with the primary trend. Gold's primary trend is up, targeting at least $3,130.00; silver's primary is up targeting 16:1 gold/silver ratio or $195.66; stocks' primary trend is down, targeting Dow under 2,900 and worth only one ounce of gold or 18 ounces of silver. or 18 ounces of silver. US $ and US$-denominated assets, primary trend down; real estate bubble has burst, primary trend down. WARNING AND DISCLAIMER. Be advised and warned: Do NOT use these commentaries to trade futures contracts. I don't intend them for that or write them with that short term trading outlook. I write them for long-term investors in physical metals. Take them as entertainment, but not as a timing service for futures. NOR do I recommend investing in gold or silver Exchange Trade Funds (ETFs). Those are NOT physical metal and I fear one day one or another may go up in smoke. Unless you can breathe smoke, stay away. Call me paranoid, but the surviving rabbit is wary of traps. NOR do I recommend trading futures options or other leveraged paper gold and silver products. These are not for the inexperienced. NOR do I recommend buying gold and silver on margin or with debt. What DO I recommend? Physical gold and silver coins and bars in your own hands. One final warning: NEVER insert a 747 Jumbo Jet up your nose. | |

| A Closer Look At the <b>Gold Price Chart</b> - Seeking Alpha Posted: 24 Dec 2007 12:25 AM PST So far, whenever I've addressed the subject of gold, the price of gold would turn down - sometimes way down. After the events of last summer that no longer seems to happen anymore, so there is little reason to think that these few items at this little blog will affect the strong upward move in the gold price that is currently underway today. Then again, you never know. A pennant, a wedge, a flag, a hedge, a triangle ... whatever In case you haven't noticed what has been happening to the POG (price of gold) over the last few months,take a look at the pattern that has been traced out in the upper right hand corner of the chart below. Technical soothsayers have at least one name for this pattern, or maybe even a list of names that describe it, though it's not clear if any of the above names are on that list. What's important about this pattern is that it can't continue unless daily changes to the POG eventually move into the fractions of a cent range, which would appear to be very unlikely. What happens when the current pattern stops? Well, then the POG either goes much higher or much lower and, given last week's markets, the former is more likely. Other possibilities are that the POG goes just a little higher or a little lower, a new pattern emerges, or no new pattern emerges. Another dumb gold article A link to this article was sent to me last weekend and had the original mail or thank you note been located, a hat tip would have been provided here (if it was you who sent it and you are now reading this, please send mail or leave a comment and I'll be happy to give you proper credit). Anyway, it's another reminder that not having any formal investment training has been a veritable godsend for me since being unencumbered by conventional wisdom can really help boost your returns.

Gold has either been money or paper money has been fixed to gold for most of the last 200 years which should help explain why its price hasn't gone up during most of that time (neither did inflation). And if you believe what the government tells you about inflation, then you should certainly buy their "inflation protected" treasuries - good luck with staying ahead of rising prices in the real world. The "no-yield" and "cost to carry" issues are tough ones for most investors to grapple with after a 20-year bull market in stocks, but another year or two of 20+ percent gains in the POG will probably cure that. Netherlands, you're making it too easy The World Gold Council released new reserve statistics earlier in the week. The last time this was reviewed here, the chart below was prepared to show how the streetTRACKS Gold Shares ETF (NYSE:GLD) would be moving up in the rankings if it were eligible for inclusion. Just a few days ago, it was learned that the Netherlands has been selling bullion in recent months and they are now down to just 624.5 tonnes, while the gold ETF has added a little and now stands at just over 617 tonnes. It's almost like you're giving up, Netherlands. France and Switzerland have also been a bit lighter in December than they were in September, by 36 tonnes and 76 tonnes, respectively. Does anyone really believe that 600.0 figure for China - round numbers like that look awfully suspicious. You'd think that they've got to be exchanging at least a few of their U.S. dollars for something a little more tangible. Full Disclosure: Long GLD at time of writing. | |

| Will <b>Gold</b> and Silver <b>Price</b> Increase from Here? :: The Market Oracle <b>...</b> Posted: 10 Jan 2014 07:10 AM PST Commodities / Gold and Silver 2014 Jan 10, 2014 - 04:10 PM GMT By: P_Radomski_CFA

(…) gold's lack of will to really (!) react to positive news, like the dollar's huge intra-day drop, is a bearish piece of information on its own and an indication that gold is likely to move lower in the short run. On the next trading day, after the essay was posted, gold and silver declined and dropped to their fresh monthly lows. With this downward move gold almost touched the June low. This strong support level encouraged buyers to push the buy button and the yellow metal, which last week saw its best week since October, rebounded to around $1,250. At the same time, silver came back above $20. Will the recent week's rally continue? Before we try to answer this question, we'll examine the long-term charts of gold and silver to see if there's anything on the horizon that could these precious metals higher or lower in the near future. We'll start with the long-term chart of gold (charts courtesy by http://stockcharts.com). Even though a lot happened last and this week, from the long-term perspective not much changed on the gold market. We saw a move back to the rising long-term resistance line (currently close to $1,250), but gold only touched it, only to decline once again. At this time the medium-term outlook remains bearish. Any additional rally is not likely to move significantly above this level (from this perspective significantly means not more than $50 above it, which takes significant intra-day volatility into account). Our previous essay on gold we wrote the following: Please note that the exact target for gold is quite difficult to provide. In the cases of silver and mining stocks there are respectively: combinations of strong support levels, and a major support in the form of the 2008 low. In the case of gold, there are 4 support levels that could stop the decline and each of them is coincidentally located $50 below the previous one starting at $1,150: $1,150, $1,100, $1,050, and $1,000. Taking into account the current situation in the yellow metal, the above price targets remain valid. Let's take a look at the chart featuring gold's price from the non-USD perspective. From the non-USD perspective, gold simply moved back to the previously broken support line and verified it as resistance. There was only an intra-week move above it, but the price is already back below the line, and it seems that it will close the week below it as well. Please note that in the final part of 2013 we also saw one intra-week move back above this line and this move was even more significant than what we saw this week. It too didn't invalidate the breakdown. In fact, it was followed by a significant downswing. We can expect the situation to be quite similar shortly, if gold does indeed rally. The move higher could be temporary, and unless we have a weekly close above the rising support line (dashed line, currently close to 46), we will not have any bullish implications whatsoever. Even if we see some strength, the ratio would have to move above 48 (where the upper declining resistance line is currently located) in order for the situation to become bullish. Consequently, some short-term strength is clearly possible, but we don't think that the medium-term downtrend will be invalidated. Having discussed the current situation in gold, let's take a look at the long-term chart of silver. It is often said that history repeats itself (or that it rhymes) and it surely applies when we look at silver's recent performance. At the end of December silver moved temporarily back above the rising support/resistance line, but didn't manage to hold this level. The white metal gave up the gains and dropped below both long-term support/resistance lines, which triggered further deterioration. This week, the white metal made another attempt to move back above the resistance lines, but failed to move above the upper of them and ultimately the breakdown below these lines was not invalidated. The next downside target is the previous 2013 low, slightly above the $18 level. Once we see silver below it, the next (and probably final) stop will likely be close to $16. Overall, the trend remains down. Summing up, looking at the current situation in gold and silver, we see that the medium-term trends remain down and the outlook for both remains bearish. However, on a short-term basis we can expect to see a temporary move higher. In case of gold, it doesn't seem that the yellow metal will move above $1,250, and even if that happened, it would not be likely to move above $1,285 and change the medium-term trend. In the case of silver, given the white metal's back-and-forth performance in the recent weeks, we also can't rule out another move higher before the next big move down materializes. To make sure that you are notified once the new features are implemented, and get immediate access to our free thoughts on the market, including information not available publicly, we urge you to sign up for our free gold newsletter. Sign up today and you'll also get free, 7-day access to the Premium Sections on our website, including valuable tools and charts dedicated to serious Precious Metals Investors and Traders along with our 14 best gold investment practices. It's free and you may unsubscribe at any time. Thank you for reading. On behalf of the whole Sunshine Profits Team, I would also like to thank you for staying with us in 2013 and wish you a Happy and Prosperous 2014! Przemyslaw Radomski, CFA Founder, Editor-in-chief Gold & Silver Investment & Trading Website - SunshineProfits.com * * * * * About Sunshine Profits Sunshine Profits enables anyone to forecast market changes with a level of accuracy that was once only available to closed-door institutions. It provides free trial access to its best investment tools (including lists of best gold stocks and best silver stocks), proprietary gold & silver indicators, buy & sell signals, weekly newsletter, and more. Seeing is believing. Disclaimer All essays, research and information found above represent analyses and opinions of Przemyslaw Radomski, CFA and Sunshine Profits' associates only. As such, it may prove wrong and be a subject to change without notice. Opinions and analyses were based on data available to authors of respective essays at the time of writing. Although the information provided above is based on careful research and sources that are believed to be accurate, Przemyslaw Radomski, CFA and his associates do not guarantee the accuracy or thoroughness of the data or information reported. The opinions published above are neither an offer nor a recommendation to purchase or sell any securities. Mr. Radomski is not a Registered Securities Advisor. By reading Przemyslaw Radomski's, CFA reports you fully agree that he will not be held responsible or liable for any decisions you make regarding any information provided in these reports. Investing, trading and speculation in any financial markets may involve high risk of loss. Przemyslaw Radomski, CFA, Sunshine Profits' employees and affiliates as well as members of their families may have a short or long position in any securities, including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice.

© 2005-2013 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication. | |

| <b>Gold Prices</b> Still Dependent On The U.S. Dollar [SPDR Gold Trust <b>...</b> Posted: 24 Oct 2013 02:52 PM PDT Background We will begin by taking a look at some of the factors that usually drive investors into the arms of 'safe haven' gold and other precious metals. We are all aware that the world is in a chaotic state at the moment, with a number of friction points that could spark and get of hand at any time. The debt ceiling has been raised in the United States, paving the way for more government spending. Bond buying programs remain in place and currency creation by a number of governments continues unabated as each nation attempts to boost exports by debasing their own currency. The production of gold from mining activities is slowing. The demand, especially from China appears to be in overdrive. On a seasonality basis, Fall is usually when gold does very well, but that is not happening this year, at least not just yet. The list of positive factors that support higher gold prices goes on and on, however, as the chart below shows, gold is now trading at around $1300/oz which is long way down from the heady days of $1900/oz, achieved in 2011. The Gold Chart The gold chart shows that over the last 6 months gold has tried to rally and failed. The best it could do was a large jump on the news that tapering had been deferred and that lasted for just two days before all those gains were lost. We would also draw your attention to the formation of a pattern of lower highs and lower lows which suggests weakness and further losses in value. Gold also has an inverse relationship with the USD so it's important that we monitor the dollars progress and performance. The US Dollar Chart The dollar has been sold off recently, as evidenced by the USD Index which depicts the dollar falling from 85 to 79 over the last 4 months. If the dollar can hold at this level then there is a possibility of a rally, which would in turn put a lid on gold's progress. A lot depends on the Fed's assessment of the inflation and the employment figures, the latest of which were released earlier this week. The consensus was for around 180,000 new jobs, so the figure of 148,000 is low, but sufficient for the Fed to assume that they have in place the correct course of action. We doubt that we will see tapering this year and we expect the current level of QE to be maintained. This should have a negative impact on the dollar, although this level of stimulus is becoming the norm and so the Law of Diminishing returns comes into play. Should QE be increased then the dollar would weaken and gold would be the beneficiary. Conclusion The tensions that exist in the world today are a known quantity and are therefore included in the price of gold. The creation of more and more money has become the rule rather than the exception and so gold largely ignores it. China is now the second largest economy in the world so it is reasonable to expect that they should be acquiring more hard assets such as gold. To facilitate China's purchases of gold, someone else must be selling and so the transfer of wealth from the west to east continues. A change in ownership does not necessarily equate to a new bull market in precious metals. The bear trend within the gold bull market is still in place so why not wait until you are sure that this phase has exhausted itself and a new bull phase has commenced. Sure you will miss the beginning of the move but you will have more certainty of generating a decent profit. Should gold manage to form a new near term high; say a close above $1400/oz, then we might get a decent rally, but don't hold your breath, it could be months away. The cost to produce gold is now closing in on the gold price which means that it is doubly important to select good quality gold producers, as they should survive any downturn in prices and live to fight another day, even pay a decent dividend one day, now there's a novel idea. In a nutshell it's a time for patience, a time to do the due diligence that is necessary before embarking on the acquisition trail. Disclaimer: gold-prices.biz or skoptionstrading.com makes no guarantee or warranty on the accuracy or completeness of the data provided. Nothing contained herein is intended or shall be deemed to be investment advice, implied or otherwise. This letter represents our views and replicates trades that we are making but nothing more than that. Always consult your registered adviser to assist you with your investments. We accept no liability for any loss arising from the use of the data contained on this letter. Options contain a high level of risk that may result in the loss of part or all invested capital and therefore are suitable for experienced and professional investors and traders only. Past performance is not a guide nor guarantee of future success. Disclosure: I have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with any company whose stock is mentioned in this article. | |

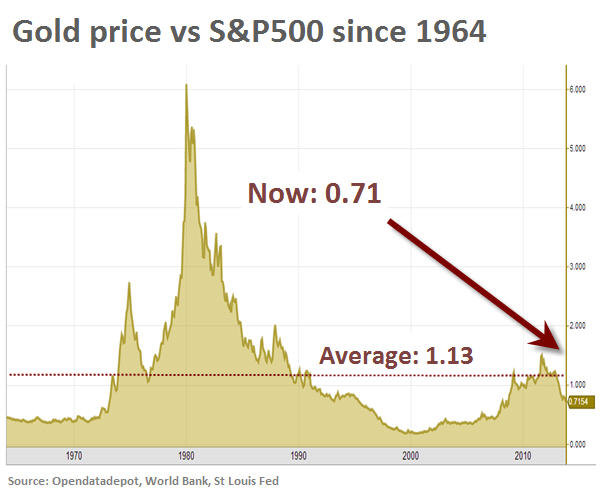

| This 50-year <b>chart</b> shows how cheap <b>gold</b> now is relative to stocks <b>...</b> Posted: 12 Dec 2013 01:37 PM PST After another drop on Tuesday, the gold price is now down 27% for the year and close to $700 an ounce below the metal's peak, struck in September 2011. Gold is heading for its first down year since 2000, ending a spectacular 12-year bull run that took the price from $270 an ounce to where it is today. The gold price's underperformance relative to the S&P 500 index which is up nearly 30% in value since the start of the year cannot be more startling. But on a much longer term trend, the divergence seems to indicate that gold has been heavily oversold in 2013, falling well below its fair value. As the graphs show gold's spike in 1980 to $850 an ounce – in inflation-adjusted terms still the all-time high – saw it lose touch with stock values (and some would say reality) entirely. The downward trend back to the norm took a good decade, but at the start of the bull market in gold it is clear from the chart that gold was deeply undervalued for the better part of the 2000s. The chart also shows that even with gold bugs at their most exuberant – when gold hit a record around $1,900 an ounce in 2011 – those levels did not constitute a wild deviation from the norm. Gold first dropped through its long-term average around Christmas last year. Gold was trading around $1,650 in December 2012. To return to its historically fair price, gold will have to climb by $400 an ounce. Either that or stocks could be in for beating. |

| You are subscribed to email updates from gold price graph - Google Blog Search To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 20 West Kinzie, Chicago IL USA 60610 | |

0 Comment for "Silver and Gold Prices: The Gold Price has an Established Uptrend ..."