Report: People's Bank of China holdings likely 2.5X higher than thought |

- Report: People's Bank of China holdings likely 2.5X higher than thought

- Afghanistan's rare earth element bonanza

- EPA stands by claim that Pebble mine would harm Bristol Bay wildlife, economy

- VIDEO: Ron Paul reacts to RonPaulCoin

- Newcrest boosts gold and copper production

- Osisko brands Goldcorp’s $2.6bn takeover bid as ‘very low’ and 'opportunistic'

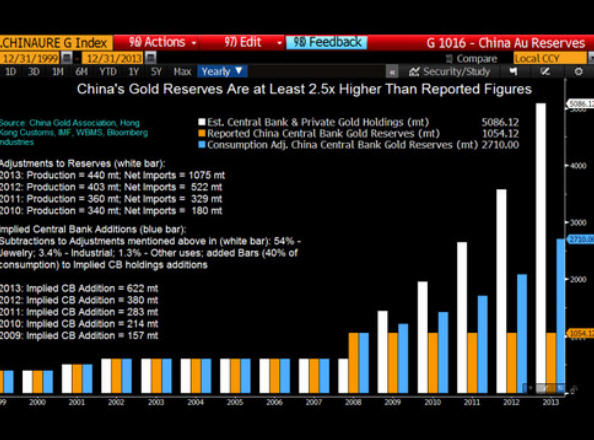

| Report: People's Bank of China holdings likely 2.5X higher than thought Posted: 15 Jan 2014 03:41 PM PST Central banks bought close to 535 tonnes of gold in 2012, the most since 1964. Amid a 28% fall in the gold price last year, gold purchases by central banks slowed to 218 tonnes as at the end of the third quarter. The world's central banks changed from being net sellers of the metal in 2009 after two decades of decreasing holdings. Gold movements by central banks are closely watched by the market. None more so than the People's Bank of China. China's gold reserves are officially put at 1,054 tonnes – a number officials haven't updated since April 2009. Rumours about massive purchases – up to 6,000 tonnes according to some estimates or a more modest 300 tonnes over the first six months of 2013 – continue to circulate as the country seeks to diversify its massive foreign exchange reserves which are mostly held in US dollars. Gold makes up little more than 1% of the country's $3.8 trillion in reserves compared to more than 70% for the United States which holds 8,166 tonnes of gold in vaults. A new report by Bloomberg Industries estimates that actual reserves figures for gold held by the People's Bank of China is likely two-and-half times more than the official figures: "After adjusting for net imports from Hong Kong and domestic output, the figure is closer to 5,086 metric tons [central bank holdings plus private gold holdings]. When taking away gold uses for jewelry, industrial and other categories and adding implied bar demand to central bank holdings, the figure is likely closer to 2,710 mt. "China would need 10 years for its gold holdings to catch up to the U.S., based on adjusted Chinese consumption for jewelry, industrial and other uses and using implied bar demand as the primary driver of incremental central bank additions. Based on run rates during 2013, China may have added 622 metric tons of bars to its central bank holdings, after adding 380 mt in 2012." China is the world's leading producer of gold producing an estimated 440 tonnes in 2013, up some 100 tonnes since 2010. Chinese consumer purchases of gold this year are forecast to jump 29% to reach 1,000 tonnes, overtaking India to become the world's largest user, according to the World Gold Council. |

| Afghanistan's rare earth element bonanza Posted: 15 Jan 2014 02:40 PM PST By Alan Dowd – Fraser Institute After more than a decade of war and nation building, members of the International Security Assistance Force (ISAF) in Afghanistan are heading for the exits. Although what ISAF will leave behind is better than what was there in 2001, Afghanistan remains a battered land. However, the resources Afghanistan's land holds — copper, cobalt, iron, barite, sulfur, lead, silver, zinc, niobium, and 1.4 million metric tons of rare-earth elements (REEs) — may be a silver lining. U.S. agencies estimate Afghanistan's mineral deposits to be worth upwards of $1 trillion. In fact, a classified Pentagon memo called Afghanistan the "Saudi Arabia of lithium." (Although lithium is technically not a rare earth element, it serves some of the same purposes.) Of course, the fact that Afghanistan is rich in minerals is not necessarily new information. The Soviets identified mineral deposits in Afghanistan during their decade-long occupation. What is new is the volume and precision of mineral-related information. Afghanistan has been mapped using what is known as "broad-scale hyper-spectral data" — highly precise technologies deployed by aircraft that, in effect, allow U.S. military and geological experts to peer beneath Afghanistan's skin and paint a picture of its vast mineral wealth. According to Jim Bullion, who heads a Pentagon task force on postwar development, these maps reveal that Afghanistan could "become a world leader in the minerals sector." There's another set of factors at work today that were not present during the Soviet period: REEs are in high demand, the dependability of the REE supply chain is in question, and Afghanistan's mineral wealth may be able to help knit the country back together after decades of war. But simply having a rich mineral endowment doesn't mean that Afghanistan is poised to tap it quickly. Challenges abound. Supply Chain Worries The importance of REEs to the global economy cannot be overstated. They are essential to the manufacture of a host of modern technologies, including cell phones, televisions, hybrid engines, computer components, lasers, batteries, fiber optics, and superconductors. Congressional findings have called rare earth elements "critical to national security," and understandably so. REEs are key to the production of tank navigation systems, missile guidance systems, fighter jet engines, missile defense components, satellites, and military grade communications gear. The supply of REEs and similar minerals is critical to today's technology-dependent economy, which is highly dependent on a reliable supply chain. Regrettably, the main supplier of REEs, China, has proven itself undependable. The Chinese produce 97 percent of the world's REEs, but have begun to manipulate the global REE market by dramatically slowing, and in some cases halting, export of these materials. After a maritime dispute with Japan, China stopped supplying REEs to Japanese customers, reduced overall global exports by 72 percent in the second half of 2010,cut export quotas for the first half of 2011 by 35 percent, and slashed REE mining permits by 41 percent in 2012, claiming its actions were a function of efforts to fight pollution. Although Beijing has resumed delivery of REEs, China's actions have prompted the United States, Japan, and Europe to explore alternative sources. The good news is that market forces are already at work diversifying the REE supply chain. Australia has new REE mines coming online, and mines in Brazil, Canada, Vietnam, and the United States could start producing REEs by 2015. Thanks to REE finds, Mongolia's GDP is also primed to triple in the next 10 years. Leverage Afghanistan can be part of the long term solution to the REE supply problem. However, building a rare earth mining system from scratch in one of the world's most broken countries will not happen overnight. Corruption remains a challenge, stability and security exist only in pockets, and the ingredients that encourage foreign investment — the rule of law, human capital, and infrastructure — are in short supply. For instance, political dysfunction is plaguing efforts to build rail lines considered crucial to transporting Afghanistan's mineral wealth. Yet what Afghanistan lacks in infrastructure, it makes up for in rare earth riches, which explains why some governments are willing to look past the many impediments to development. Of course, those impediments are significant, and removing them will require a commitment within Afghanistan to embrace economic freedom, the foundations of which — personal choice, voluntary exchange, freedom to enter and compete in markets, and property rights — have yet to fully take root. Aiming to build up what the Department of Energy calls "sizable stockpiles" of REEs, Beijing is eager to develop Afghanistan's mineral wealth. China has won exploration rights for copper, coal, oil, and lithium deposits across Afghanistan, and there are reports that Beijing won the rights to develop a copper mine by bribing Afghan mining officials. Make no mistake: China can play an important and constructive role in Afghanistan. Development in Afghanistan can be aided by foreign investment, and Beijing has the resources to make crucial investments in Afghanistan's future. But given China's stranglehold on the REE market — and the West's commitment in blood and treasure to Afghanistan's future — allowing China to stroll in and harvest Afghanistan's rare earth riches seems both unwise and unfair. Before they withdraw, ISAF nations should use their considerable leverage not to secure sweetheart deals for Western investors and developers, but to ensure a level playing field for any firm willing to take a risk on developing Afghanistan's mineral wealth. Curse or Blessing? Some observers warn that if Afghanistan's mining sector does take off, the country could succumb to the so-called "resource curse" — the notion that natural-resource wealth can actually hinder economic growth by diverting investment away from other sectors and encouraging high levels of government spending. There are two ways to answer the resource-curse naysayers: First, on a very practical level, the world should be so lucky if the resource curse becomes the main concern for Afghanistan—a country that has endured and caused so much heartache. Second, the resource curse may be a bit overblown. A Fraser Institutereport found that early studies on the resource curse "overlooked the role of economic institutions and the possible interaction between natural resources and the quality of institutions. Nations with economic institutions of higher quality are more capable of managing their resource revenue." To be sure, those institutions remain nascent in Afghanistan. This underscores the importance of policy prescriptions geared toward economic freedom. Stephen Haber and Victor Menaldo, political scientists specializing in the research of mineral booms, note that "roughly twice as many countries have been blessed by resource booms as cursed by them." Citing poor infrastructure, a largely illiterate population, and a weak central government hampered by warlordism, they report that "until its late 19th century oil and mineral boom, Mexico was not a whole lot different from Afghanistan." Oil and mineral discoveries did not cure all of Mexico's ills, of course. To this day, Mexico struggles with corruption, ranking 105th out of 176 countries surveyed on a global corruption index. However, natural-resource wealth did help stabilize Mexico's political system and legitimize the state. Similarly, there are too many challenges in Afghanistan to think of REEs as a panacea. Political corruption runs high in Kabul; Afghanistan's geographic remoteness will always be an issue; and Afghanistan's neighbors to the east and west are mischievous, to put it politely. But if something akin to the Mexican model can take root in Afghanistan, then the world can help solve Afghanistan's instability problem — and Afghanistan can help solve the world's rare earth supply problem. |

| EPA stands by claim that Pebble mine would harm Bristol Bay wildlife, economy Posted: 15 Jan 2014 02:09 PM PST  Bristol Bay salmon | Photo from EPA report The US Environmental Protection Agency (EPA) has released its final assessment on how mining would impact the Bristol Bay area of Alaska, where miner Northern Dynasty (TSX:NDM) is keen on digging. The report details the potential impacts on salmon and other ecological resources from the proposed open-pit mine; the site is believed to hold about 55 billion pounds of copper and 67 million ounces of gold. If built, it will be one of the world's largest gold and copper mines. The agency found that "large-scale mining in the Bristol Bay watershed poses risks to salmon and Alaska Native cultures." This conclusion doesn't come as much of a surprise: The EPA said essentially the same thing in its 2012 peer review report. "Over three years, EPA compiled the best, most current science on the Bristol Bay watershed to understand how large-scale mining could impact salmon and water in this unique area of unparalleled natural resources," Dennis McLerran, Regional Administrator for EPA Region 10 said in a news release on Wednesday. "Our report concludes that large-scale mining poses risks to salmon and the tribal communities that have depended on them for thousands of years. The assessment is a technical resource for governments, tribes and the public as we consider how to address the challenges of large-scale mining and ecological protection in the Bristol Bay watershed." 'Pre-emptive veto'?  Brown bear in the Kvichak River watershed | Photo from EPA report Proponents of the Pebble Project have long argued that the EPA's review is 'pre-emptive,' considering that the agency has not yet received a mine proposal. The EPA says that it initiated the assessment in response to nine federally recognized tribes and other stakeholders who expressed concerned for salmon populations. In 2010, several native tribes in the region called on the EPA to use its power under the Clean Water Act to prevent Pebble mine. Meanwhile, other tribes asked the agency to hold off until the mine permitting process begins. The EPA says its assessment will help inform the public and governments when considering mining activities in the area. Others argue that Northern Dynasty has simply taken too long to submit plans. The company says it expects to be in a position to initiate federal and state permitting under the National Environmental Policy Act as early as the first quarter of 2014," but that it will need a new partner before making a decision on timing. Pebble mine proponents and republican legislators have also criticized the EPA for how much money it put toward reviewing the yet-to-be-proposed mine. As of July 2013, the agency had spent $2.4 million on its assessment. Impacts Without an official proposal to base its assessment on, the EPA has relied on a preliminary plan that Northern Dynasty submitted to the Securities and Exchange Commission. The EPA says it also consulted mining experts. According to the report, mining in Bristol Bay would wipe out anywhere between 24 to 94 miles of salmon-supporting streams and 1,300 to 5,350 acres of wetlands, ponds and lakes. The EPA also considered the possibility of long-term water collection and treatment failures. "Depending on the size of the mine, EPA estimates adverse direct and indirect effects on fish in 48 to 62 miles of streams under a wastewater treatment failure scenario." In terms of economic impacts, the agency found that the Bristol Bay ecosystem generated close to half a billion dollars in economic activity in 2009 and provided employment for about 14,000 full and part-time workers. Waning support But the EPA isn't the Pebble Project's only problem. Though known as the 'Pebble Partnership,' the project no longer has any characteristics of a 'partnership.' The project is wholly owned by Northern Dynasty after Anglo American walked away from its half last September. Rio Tinto said last month that it's considering dropping its 19% stake in Northern Dynasty. About $700 million has already gone into the project, though the bulk of this came from former partner Anglo American. Rebuttal Soon after the EPA's report came out, Northern Dynasty issued its own announcement, calling the assessment's methodology and findings "flawed." "Publication of the final watershed assessment is really the final chapter in a very sad story," Northern Dynasty CEO Ron Thiessen said in a statement. "We believe EPA set out to do a flawed analysis of the Pebble Project, and they certainly succeeded with both their first and second drafts of the BBWA [Bristol Bay Watershed Assessment]. We have every expectation that the final report released today is more of the same." Theissen assures that the report does not include any recommendation or regulatory actions that would prevent the company from moving forward with its plans. "We have every expectation that the Environmental Impact Statement (EIS) process required by NEPA, to be administered by the US Army Corps of Engineers, will ultimately provide a much more rigorous, fair and transparent review of the science surrounding this important project," the CEO added. Northern Dynasty estimates that the mine would support 15,000 jobs and contribute more than $2.5 billion annually to the country's GDP. The company's share price declined by less than one percentage point on Wednesday, trading at $1.51 per share. Over the past 12 months, Northern Dynasty has dropped more than 60% on the Toronto exchange. |

| VIDEO: Ron Paul reacts to RonPaulCoin Posted: 15 Jan 2014 01:02 PM PST

It's unclear who exactly created the RonPaulCoin – the founder just lists his name as 'Colin' – but we do know that it's not Ron Paul himself. As the cryptocurrency's website explains, the politician had nothing to do with its creation and has no affiliation with it. Rather, the coin is a form of tribute to "the leading champion of financial freedom and economic transparency for the past 30+ years," the website writes. On their website, the creators of the coin write that "perhaps one day, he [Ron Paul] will hear of the fact that he has his own coin, and help to promote the cause of decentralized currency further." Well, that day has come. In an interview with CNBC on Wednesday, the former Texas congressman talked about the RonPaulCoin. "It's fascinating to me," he said. When asked if he supported it, Paul said "yes … I have been for a long time advocating competing currencies because I'm not too high on our own currency." "This is a private alternative to the abuse of government," the politician explained, while conceding that he does not understand the technology behind digital currencies. "As long as there's no fraud involved, I'm all in favour of competition." However, the former congressman also noted that he is not buying any cryptocurrencies. See the full interview with CNBC here |

| Newcrest boosts gold and copper production Posted: 15 Jan 2014 12:15 PM PST Newcrest Mining (ASX:NCM), the Australian Stock Exchange's largest gold producer, says it has boosted gold and copper production during the latest quarter, putting 2014 output on track to reach the top end of the guidance range – 2.3 million ounces. During the three months leading to December 2013, the company produced more than 600,000 ounces of gold and 22,600 tonnes of copper. During the preceding quarter, gold production was 586,000 ounces of gold and 19,600 tonnes of copper. The production boost comes from the Telfer, Gosowong and Bonikro mines. Total output is still slightly lower than June 2013 numbers. Newcrest said it would release further results and details on January 23. The miner's share price was up 3% on Wednesday, trading at $8.53 apiece. Newcrest has fallen sharply over the past 12 months, losing more than 60% of its value since January 2013. |

| Osisko brands Goldcorp’s $2.6bn takeover bid as ‘very low’ and 'opportunistic' Posted: 15 Jan 2014 10:54 AM PST Osisko Mining Corp. (TSX:OSK) responded Wednesday to Goldcorp's (TSX:G) (NYSE:GG) $2.6-billion hostile bid by saying the offer is "very low" and "opportunistic," and that the door is open for new proposals. In a brief but firm statement, the Montreal-based miner said it hired BMO Capital Markets and Maxit Capital LP as financial advisors, and that its board has set up a committee of five independent members to review alternatives for the company. Goldcorp is after Osisko's only operating mine and main asset in the province of Quebec. The Canadian Malartic mine is expected to produce more 500,000 to 600,000 ounces of gold per year over its 16-year mine life, according to its current owner. In its takeover offer circular, the Vancouver-based gold giant revealed this is not the first time it attempts to get control of Malartic. In fact, it has been discussing a possible deal for Osisko since 2008, but the firm "has continually refused to either negotiate or engage in meaningful dialogue," Goldcorp said. Osisko shares have traded well above the $5.95 implied value of the Goldcorp offer since the stock-and-cash proposal was first announced Monday. Analysts have suggested that Goldcorp will have to raise its offer if it wants to close the deal. Goldcorp already has a gold project in Quebec – Éléonore, set to begin production later this year. But if its takeover offer over Osisko goes through, Goldcorp, which already is world's largest gold miner by market capitalization, would become the No. 1 gold producer in Quebec. Image from Flickr Commons |

| You are subscribed to email updates from MINING.com To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 20 West Kinzie, Chicago IL USA 60610 | |

0 Comment for "Report: People's Bank of China holdings likely 2.5X higher than thought"