Oil sands crude jumps nearly $20 a barrel in a month |

- Oil sands crude jumps nearly $20 a barrel in a month

- BC Chamber of Commerce rallies support for Taseko's New Prosperity

- Simandou hearing delay hints at Vale-BSGR settlement

- Last time hedge funds were this bearish, the gold price was $700

- BHP Billiton cuts spending by 25%

- Alberta, oil sands lead the Canadian economy once again

| Oil sands crude jumps nearly $20 a barrel in a month Posted: 10 Dec 2013 03:44 PM PST The price for bitumen-derived oil improved to less than $30 a barrel below the US benchmark on Tuesday, bringing the value of oil sands producers' crude to just under $70 a barrel. The discount of Western Canada Select to US benchmark West Texas Intermediate (WTI) narrowed to $29.08 clawing back much of the ground lost in early November according to CME data. Last month WCS – a blend of heavy oil sands crude and conventional oil – dropped to multi-year lows with the contract weakening to $41.79 below WTI, the biggest gap in nearly five years. The relative strength in oil sands crude comes on top off a jump in US oil to 6-week highs of $98.66 on Tuesday after a much larger fall in the country's oil supply of 7.5 million barrels for the week ended December 6 against expectations of a less than 3 million barrel decline. WTI's discount to global benchmark North Sea Brent has been improving steadily at just under $11 a barrel, halving the $23 gap recorded in December 2012. Brent settled at $109.48 in Europe on Tuesday which translates to an effective price for bitumen-derived oil from Alberta's oil sands of $69.52 a barrel. A month ago oils sands producers were getting $50.60 a barrel although some of these gains are offset by a depreciation in the Canadian dollar, which have fallen to a three-year low against the US currency at 94c. The value of Syncrude, a light oil made from mined oil sands after undergoing an expensive upgrading process, has also reversed fortunes closing the gap WTI to a $6.75 discount this week, a two-month high. |

| BC Chamber of Commerce rallies support for Taseko's New Prosperity Posted: 10 Dec 2013 03:41 PM PST As the Canadian federal government mulls over whether to approve Taseko Mine's New Prosperity mine in British Columbia, the BC Chamber of Commerce and friends are doing their part to encourage a positive outcome for Taseko. Speaking at a Chamber-sponsored event on Tuesday, Mayor of Williams Lake Kerry Cook urged the government to approve the $1.5 billion open-pit copper and gold mine near Williams Lake. The region is heavily dependent on the mining and forestry industries. But with the pine beetle epidemic ravaging the forestry sector, Williams Lake and its neighbours need to diversify their economies, Cook explained. Responsible mining is "one of the most viable ways to sustain our communities," Cook said, calling on the Federal government to consider "all information" when making a decision. Taseko has been waging a very public battle against the Canadian Environmental Assessment Agency (CEAA) – an independent body which studied the New Prosperity plans and concluded that the project would pose "several significant adverse environmental effects." The mining company claims that the CEAA was looking at the wrong tailings facility design during its review, an alleged error which Taseko called 'outrageous.' The Federal government is now assessing the project, with the panel's allegedly-flawed review as guidance. Last week the miner commenced a federal judicial review, asking the court to set aside certain findings of the panel. First Nation support came from Ervin Charleyboy, a former chief of the Alexis Creek First Nation. Charleyboy said he's been ostracised by many in his community for supporting the project, and claims that young people who want to see New Prosperity developed are afraid of saying so publicly. Also present at Tuesday's meeting was the BC Minister of Energy and Mines Bill Bennett who lamented the declining forestry industry and boasted the environmental record of Canadian mining companies. "The government of BC wants to see the project proceed," Bennett said, before concluding that "this is just the beginning, not the end." Over the next few days Bennett will meet with members of the Federal government to explain the merits of the project. He believes the outcome will be favourable. |

| Simandou hearing delay hints at Vale-BSGR settlement Posted: 10 Dec 2013 01:52 PM PST The Simandou mountains in Guinea holds some of the richest iron ore deposits in the world and has the potential to transform the fortunes of the impoverished West African nation. World number two miner Rio Tinto is developing the southern part of the vast mountain deposit with first production from the massive $20 billion project not expected until late 2018 at the earliest. The northern part of the Simandou concession is held by BSG Resources, a company in the stable of billionaire diamond magnate Beny Steinmetz, and Brazilian giant Vale (NYSE:VALE). All work on the section awarded to BSGR by a former Guinea dictator in 2008 and 50%- sold to Vale in 2010 has been halted as the government of Guinea under democratically elected president Alpha Condé revisits all mining contracts entered into under previous regimes. Reuters reports Tuesday the committee reviewing the agreements has delayed hearings scheduled for today where VGB – the Vale-BSGR partnership in Guinea – was to respond to corruption allegations: A source at VGB saw agreement on the new hearing date as a positive sign for the group. "This step by the Guinean government proves that our rights are not being challenged. Now it's up to senior management to negotiate," said the source, who asked not to be named. Last month Condé visited Brazil where he met with Vale's director of corporate affairs Rafael Benker. Condé was in the country on invitation of the Lula Institute, an NGO founded by former president Luiz Inacio Lula da Silva. Lula is said to have close ties to B&A Mineração, an infrastructure and mining investment company set up by Roger Agnelli, former boss of Vale and a large Brazilian bank. Late last year BHP Billiton (ASX, NYSE:BHP) sold its 40% stake in its massive Nimba project in the same district as Simandou to B&A. |

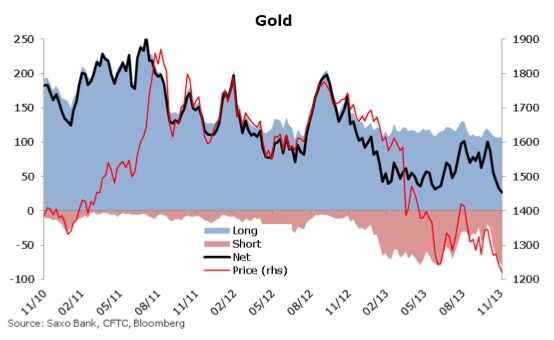

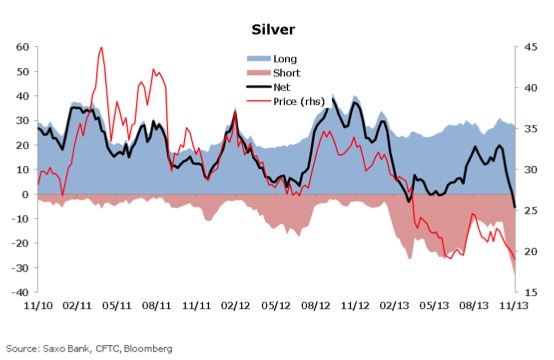

| Last time hedge funds were this bearish, the gold price was $700 Posted: 10 Dec 2013 12:34 PM PST The gold price jumped more than $30 or more than 2% an ounce to a near 3-week high on Tuesday as contrarian investors read plummeting net long positions held by hedge funds as a sign that big sellers of the metal have now been flushed out of the market. On the Comex division of the New York Mercantile Exchange, gold futures for February delivery traded at $1,262.20 an ounce during early afternoon dealing, up over $30 from the $1,237.40 low struck shortly after the opening, but off the day's high of $1267,50. Silver tracked gold's trading pattern, jumping more than 3% to a day high of $20.32, crossing the $20-level for the first time since 20 November. Retail buying interest in precious metals came after data from US Commodity Futures Trading Commission showed hedge funds are now the least bullish on the yellow metal since 2007 when gold averaged around $700 an ounce. So many large players short of gold could translate into further upside for the metal as commercial traders are forced to cover their positions. Net-long positions – bets that the price will rise – fell by 16% to a mere 26,774 contracts last week data from Danish investment bank Saxo shows. Around 150,000 futures contracts are traded in gold each day. Precious metals have been under pressure as markets believe a recovering US economy – and specifically an improved labour market as evidenced by the strong employment numbers released on Friday – could prompt the US Federal Reserve to slow the pace of its $85 billion in monthly bond purchases as soon as next week at the bank's final meeting for the year. A stronger economy strengthens the hands of Fed members who are eager to start unwinding the near $4 trillion the central bank has taken onto its balance sheet since QE1. The Fed first embarked on its quantitative easing program in December 2008 when gold was trading around $830 an ounce. But many market watchers now believe the impact on the gold market of the eventual QE taper announcement would be minimal. The dreaded taper has been signposted for months and should now be baked into the gold price. What's more, with the big money managers who have been dumping metal at every opportunity out of the market, a big source of selling pressure has been removed. Evidence that large investors are abandoning precious metals also came from the silver market where sentiment turned negative – a net short position – by the largest margin since the data was first collected in 2006. Silver breached $10 an ounce for the first time that year, ending 2006 at $12.80. Image by artemuestra |

| BHP Billiton cuts spending by 25% Posted: 10 Dec 2013 11:33 AM PST BHP Billiton (ASX, NYSE: BHP) (LON: BLT), the world's largest miner, plans to cut spending by 25%, down to $15 billion, and focus on its core businesses while commodity prices continue to be weak. As part of chief Andrew Mackenzie's presentation at the company's petroleum investor briefing in Houston, US, BHP said the goal represents a deep cut in the almost $22 billion it spent on projects last financial year. These endeavours included a new operation to mine the vast iron ore deposits in Australia's Pilbara region and the exploration of deep-sea oil and natural gas fields in the US. Gulf of Mexico. Mackenzie highlighted BHP has remained profitable thanks to a severe cost-cutting program implemented earlier in the year and added the mining giant was on track to meet production guidance and deliver 16% growth in the next two years. "By generating more volume from our existing equipment and lowering unit costs, we will continue to build on the $2.7 billion reduction in controllable cash costs delivered in the 2013 financial year," Mackenzie said in a statement. The executive, who took over in May, also noted the company will base future decisions on its "four key pillars": coal, iron ore, petroleum and copper. This doesn't necessarily mean the company is abandoning its other units. In fact, BHP separately announced Tuesday that it will invest $4bn a year to step up output from its US shale reserves,and expects the business to generate $3bn of cash annually by 2020. BHP is just one of the top miners that have recently decided to slash their capital expenditure budget. Last month rival Rio Tinto (ASX, LON, NYSE:RIO) announced it was planning to will spend $3 billion less than previously said, aiming to halve capital expenditure this year. |

| Alberta, oil sands lead the Canadian economy once again Posted: 10 Dec 2013 10:47 AM PST Canada's oil-rich Alberta has come out of the global recession virtually unscathed, and the winning streak isn't over. Fuelled by the oil sands industry, Alberta will again be Canada's fastest growing economy in 2014. Over the past few years, Canada has seen a two-tiered economy in which resource-rich provinces consistently outperformed the rest of the country. For three consecutive years, Alberta has been the largest contributor to economic expansion in Canada, with the energy sector fuelling virtually all the growth. In 2013 Alberta's GDP is projected to rise by 3.2% and slightly more over the following year. According to the latest Provincial Outlook report from the Conference Board of Canada, Alberta's economy has "remained resilient" despite $1.7 billion in damages from flooding this past summer. The Board cautions that pipeline constraints remain a risk, as more bitumen will need to make its way to markets. Over the near term, however, existing capacity should do. Meanwhile, Newfoundland and Labrador has experienced its own oil boom, with GDP expected to expand by 6% due to a rebound in oil production after shut-downs in 2012. Although this growth will be tempered over the next year, the Conference Board predicts a bright future for Canada's easternmost province, with new iron ore mines and multi-billion-dollar energy projects. Saskatchewan, which saw 4% GDP growth this year, won't see a repeat of that success next year. The Conference Board says growth will cool, partly due to turbulence in the potash market. Weak potash prices and production will curb GDP gains, bringing them more in line with the national average. The breakup of the Belarus and Russian potash cartel which sent prices tumbling could affect the Saskatchewan economy by as much as 0.5%, Jacqueline Palladini, senior economist at the Conference Board of Canada, told MINING.com. Although the mining industry will contribute less to the economy in the near-term, a strong construction sector will keep the economy moving. The Board also notes that in the medium and long-terms, prospects for the mining industry are "excellent." But the rest of Canada is finally catching up. The Board forecasts "better days ahead" for most provinces. Although Alberta will hold on to its position as Canada's fastest growing economy this year, the prospect of a stronger US economy will help boost exports and improve the outlook for the rest of Canada as well. In fact, as of 2015, British Columbia is expected to top the charts with 3.1% GDP growth. "Real GDP had been stuck in low gear, but given the positive outlook for key foreign markets, the province should see a turnaround," the Board writes. Mining and natural gas activities should also boost the economies of Manitoba, New Brunswick and Nova Scotia. Metal mining in Manitoba is set expected to jump by 19.7% in 2015 as projects such as the Reed copper mine ramp up production. |

| You are subscribed to email updates from MINING.com To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 20 West Kinzie, Chicago IL USA 60610 | |

0 Comment for "Oil sands crude jumps nearly $20 a barrel in a month"