Last time hedge funds were this bearish, the <b>gold price</b> was $700 <b>...</b> |

- Last time hedge funds were this bearish, the <b>gold price</b> was $700 <b>...</b>

- Iamgold suspends dividends due to weak <b>gold price</b> - Proactive <b>...</b>

- Banks switch to net long positions and boost <b>gold prices</b> with QE <b>...</b>

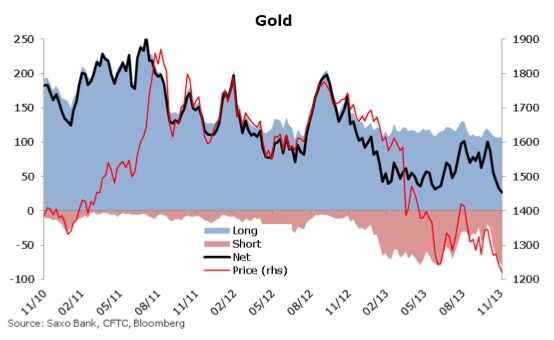

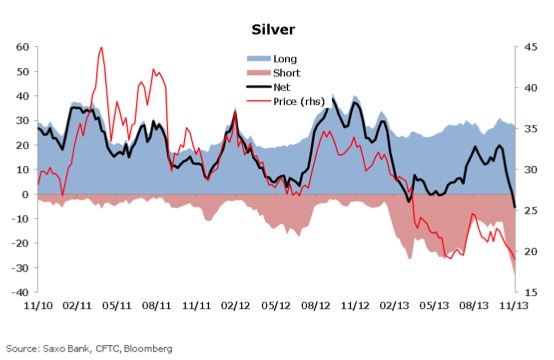

| Last time hedge funds were this bearish, the <b>gold price</b> was $700 <b>...</b> Posted: 10 Dec 2013 12:34 PM PST The gold price jumped more than $30 or more than 2% an ounce to a near 3-week high on Tuesday as contrarian investors read plummeting net long positions held by hedge funds as a sign that big sellers of the metal have now been flushed out of the market. On the Comex division of the New York Mercantile Exchange, gold futures for February delivery traded at $1,262.20 an ounce during early afternoon dealing, up over $30 from the $1,237.40 low struck shortly after the opening, but off the day's high of $1267,50. Silver tracked gold's trading pattern, jumping more than 3% to a day high of $20.32, crossing the $20-level for the first time since 20 November. Retail buying interest in precious metals came after data from US Commodity Futures Trading Commission showed hedge funds are now the least bullish on the yellow metal since 2007 when gold averaged around $700 an ounce. So many large players short of gold could translate into further upside for the metal as commercial traders are forced to cover their positions. Net-long positions – bets that the price will rise – fell by 16% to a mere 26,774 contracts last week data from Danish investment bank Saxo shows. Around 150,000 futures contracts are traded in gold each day. Precious metals have been under pressure as markets believe a recovering US economy – and specifically an improved labour market as evidenced by the strong employment numbers released on Friday – could prompt the US Federal Reserve to slow the pace of its $85 billion in monthly bond purchases as soon as next week at the bank's final meeting for the year. A stronger economy strengthens the hands of Fed members who are eager to start unwinding the near $4 trillion the central bank has taken onto its balance sheet since QE1. The Fed first embarked on its quantitative easing program in December 2008 when gold was trading around $830 an ounce. But many market watchers now believe the impact on the gold market of the eventual QE taper announcement would be minimal. The dreaded taper has been signposted for months and should now be baked into the gold price. What's more, with the big money managers who have been dumping metal at every opportunity out of the market, a big source of selling pressure has been removed. Evidence that large investors are abandoning precious metals also came from the silver market where sentiment turned negative – a net short position – by the largest margin since the data was first collected in 2006. Silver breached $10 an ounce for the first time that year, ending 2006 at $12.80. Image by artemuestra |

| Iamgold suspends dividends due to weak <b>gold price</b> - Proactive <b>...</b> Posted: 12 Dec 2013 06:39 AM PST

Corp (NYSE:IAG) (TSE:IMG) shares were down more than 3% premarket in New York on Thursday after the gold miner said it has suspended future dividend payments until further notice, citing the weak gold price as the chief reason for the decision. "While our outlook for gold over the long term is optimistic, in light of the current gold price we are suspending the dividend to preserve our balance sheet," said president and CEO Steve Letwin in a statement late Wednesday. "We are on target to reduce costs by $100 million this year and will continue to look for further reductions next year. This decision to suspend the dividend allows us to conserve cash and ensure we maintain the flexibility we need to take advantage of opportunities when they arise." Precious metals miners across the industry have engaged in aggressive cost-cutting programs this year to survive the current gold price environment, which has seen the price of the yellow metal tumble about 25% year-to-date. Miners -- ranging from large to small -- have cut operational and administrative costs so as to conserve cash, with many mines becoming uneconomical to run under a price of $1,250 an ounce. These measures have included cutting mining contractors, reducing staff, renegotiating contracts and halting dividends. Gold futures for February delivery on the Comex are currently trading around $1,234 an ounce amid tapering fears, with the set to soon start to scale back its support for the U.S. economy. The $85-billion-a-month Fed program has boosted the price of gold in the past years and sustained its bull run, with gold now set to post its first annual loss since 2000. , which has a portfolio of assets in Canada, South America and Africa, has six operating gold mines, including one of the world's top three niobium mines. The company noted that it continues to maintain $750 million in undrawn, unsecured credit facilities. Shares of were down 2.8% just minutes before the opening bell, at $3.73. So far this year, the stock has tumbled nearly 67%. The S&P/TSX Global Mining Index has shed over 24% year-to-date. |

| Banks switch to net long positions and boost <b>gold prices</b> with QE <b>...</b> Posted: 11 Dec 2013 11:07 PM PST Posted on 12 December 2013 with no comments from readers Bank traders who set the price of gold in the trading pits of the futures exchanges have shifted their positions. That is what explains the recent strength of the gold price despite the imminent start to a winding up of the QE money printing program. The TF Metals Report said: 'The latest Bank Participation Report showed the most bullish extreme (for gold prices) seen yet. The combined position of the 24 US and non-US banks surveyed showed a net long position of 43,369 contracts, up from 10,254 last month and exceeding by 30 per cent the previous extreme seen in the survey from August 6th when the banks revealed a net long position of 37,434.' Short covering Bloomberg commented: 'Markets seem to have already priced in the possibility of a December tapering of QE as prices did not show any weakness after last week's stronger than expected non-farm payrolls data. Rather, gold has risen and hedge funds have rushed to cover their short positions ahead of the Fed meeting next week and due to growing concerns of a short squeeze.' A short squeeze is what happens to traders caught on the wrong side of a rising market. They naturally always try to position themselves on the winning side and leave the less well informed investing public on the other side. Another way to understand this is to think that the market has gotten ahead of itself in writing down the price of gold. Money printing is only going to slowdown, not stop. This is the reaction in the other direction. Buy on the rumor, sell on the news in the case of shorting gold. It's confusing and that's the way the banks like to play it with only their proprietory trading desks having the true picture. Is that a manipulation of the gold price? Well what else would you call it? Price discovery? Posted on 12 December 2013 Categories: Gold & Silver |

| You are subscribed to email updates from gold price - Google Blog Search To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 20 West Kinzie, Chicago IL USA 60610 | |

0 Comment for "Last time hedge funds were this bearish, the gold price was $700 ..."