Shares of Europe's top potash producer soars after reopening mine |

- Shares of Europe's top potash producer soars after reopening mine

- Indian families could recycle 400t gold as premiums reach $130 per ounce

- Bargain hunters pick up gold on Black Friday

- Mexican drug lords get firm grip on country’s mines

- Chile's Codelco's Jan-Sept profit down 61%, output also low

- Iran resumes gold trade with Turkey

| Shares of Europe's top potash producer soars after reopening mine Posted: 29 Nov 2013 01:46 PM PST Shares in K+S AG (OTCMKTS:KPLUY), Europe's biggest producer of potash, shot up on Friday after the German miner said it will recommence production at its Unterbreizbach mine on 2 December. Production was suspended at the mine at the start of October after a fatal gas explosion. The ADRs of K+S trading in New York were last up more than 8% after shares of the $5 billion company rose 5.8% to 20.50 euro on the German bourse. K+S has been one of the worst performers on the DAX index this year after top producer Russia's Uralkali at the end of July sent stock prices in the sector tumbling when it decided to up production and exit a supply control agreement with partner Belaruskali. The breakup of the selling organization that controlled more than a third of global exports has seen the potash price retreat from $400 a tonne to closer to $300 a tonne. Earlier in November ratings agency Moody's cut K+S's debt to junk status after the company announced it is raising some $1.4 billion to fund around a third of its $4.1 billion Legacy project in Canada. The Legacy mine, currently under construction, is expected to start production by the end of 2016, ramping up to two million tonnes per year in 2017 and reaching full capacity of 2.86 million tonnes by 2023. |

| Indian families could recycle 400t gold as premiums reach $130 per ounce Posted: 29 Nov 2013 11:51 AM PST Over the past year and a half P. Chidambaram, India's finance minister, has been fighting his country's insatiable appetite for gold. Gold import duties have risen tenfold – from 1% at the start of 2012 to 10% today – and excise duties stand at 9% while new rules such as strictly cash only for imports and transaction taxes among other punitive measures have stymied India's gold industry. The sub-continent celebrated Dhanteras and Diwali this month, two festivals closely associated with bullion buying and the country's wedding season, another major driver of gold sales, which is in full swing. But the government import restrictions have led to a scarcity of physical gold inside the country which coupled with the weak rupee are putting a huge damper on sales of gold this year. While Indian traders are paying premiums of a whopping $130 an ounce to London prices, families are finding other ways to get their hands onto new gold. Zee News reports with gold scarce, wedding buyers have been forced to recycle jewellery: "In this wedding season, since there is no gold available in the market, people have started coming with recycled gold. They have started exchanging the old gold for new and pay the labour charges," said Kumar Jain, who owns a retail gold shop in the Zaveri Bazaar. Jain expects about 400 tonnes of recycled gold to enter the market this fiscal year to March 2014, compared with normal rates of about 130 tonnes, according to Thomson Reuters GFMS data. According to some estimates Indian households are hoarding 18,000 – 20,000 metric tonnes of gold worth some $900 billion at today's prices, representing almost 50% of the country's GDP. Indian households own 11% of the global total and it is estimated that 7% – 8% of India's 329 million households held their savings in gold in 2009 – 2010. |

| Bargain hunters pick up gold on Black Friday Posted: 29 Nov 2013 10:51 AM PST Bullion bargain hunters made the most of thin post-Thanksgiving trading on US futures markets Friday, lifting the gold price above the psychologically important $1,250 an ounce level. At the early lunchtime close on the Comex market gold for delivery in February, the most active contract, was changing hands at $1,251.00. Around two-thirds of the usual the daily average of 150,000 contracts were traded. Friday's jump helped to trim gold's November loss in value to 4.6%, after the metal earlier in the month dropped to levels last seen early July and within sight of the more than 3-year lows struck at the end of June when the metal briefly traded below the crucial $1,200 level. Gold come under increasing pressure in November as large investors continued to shift money out of precious metals and into stocks. US stocks this week set fresh records and year-to-date the S&P 500 index has risen 29%, the Euro Stoxx 50 Index is up almost 22%, and Japan's Nikkei has surged more than 50%. In contrast gold has retreated 25% from its opening levels of $1,677 and is down more than $470 an ounce compared to this time last year. The rotation out of golf investments is most striking when you consider the sharp decline in the holdings of the world's largest gold ETF, SPDR Gold Shares (NYSE: GLD). Bullion held by the fund established November 2004 are now at their lowest level since January 2009. Net redemptions slowed dramatically from the torrid pace of the second quarter, but picked up again in October and November. As of Black Friday GLD has experienced year-to-date outflows of 507 tonnes to 843.2 tonnes, down 37.6% from the start of the year. |

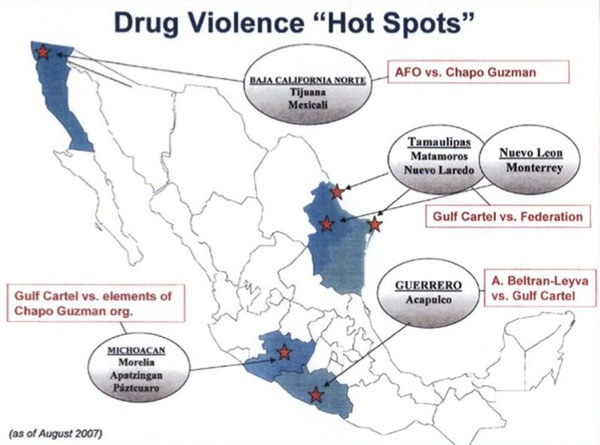

| Mexican drug lords get firm grip on country’s mines Posted: 29 Nov 2013 09:58 AM PST Mexico's notoriously violent drug barons have turned to mining to both expand and diversify their sources of revenue, engaging in the direct ownership and operation of coal and iron-ore mines, especially along the US-Mexican border. The cartels reap immense returns from the sale of coal to state-owned companies, often obtaining profits as high as 30 times their initial investment, while also obtaining an effective channel for money laundering. CTV News reports Mexican authorities have confirmed these Mafia-style organizations have recently been found to also be exporting iron ore to China, and that the Nov. 4 military takeover of Lazaro Cardenas port, the country's second-largest, intended to put a dent in the cartels' export trade. According to Mexican human rights groups, since the infiltration of the Zetas drug cartel in the industry, Mexico's most violent and feared gang, miners are no longer allowed to utilize what limited safety protocols they previously had access to, making the environment all the more hazardous.

In addition to obtaining immense profits from their mining ventures Mexico's drug cartels can also avail themselves of a convenient means of legitimizing and diversifying their earnings. Licit high-income businesses make it easy for the cartels to launder their illegal proceeds. The entry of Mexico's drug cartels into the mining sector has a nearby precedent in Colombia, where local drug barons often took up stakes in gold and coal mines. Images from Wikimedia Commons. |

| Chile's Codelco's Jan-Sept profit down 61%, output also low Posted: 29 Nov 2013 09:07 AM PST Chile's Codelco, the world's No.1 cooper producer, said Friday (Spanish language) its January-September profits before tax and extraordinary items plummeted 61% during the period, compared to the same period last year, due mainly to an unusually high base of appraisal on a vast financial transaction with Anglo American last year. Output declined 0.3% in the period, added the company, blaming lower ore grades, harder rock and more complicated production processes in deeper deposits for the slight fall. The copper giant, however, expects its full-year output to be in a similar range to last year's, when it collapsed to its lowest level in four years. Codelco's most emblematic mines —Chuquicamata, Radomiro Tomic, Salvador and Andina— failed to produce as much as in previous years, but increases at El Teniente Gabriel Mistral helped curb the overall decline. Earlier this month CEO Thomas Keller said Codelco aims to become one of the world's ten largest silver producers as soon as its touted Ministro Hales mine begins production next year. The nearly $3 billion copper-silver mine is expected to add 300 tons of the precious grey material to the existing silver output from the rest of Codelco's operations in the country. The firm owns about 11% of the world's copper reserves. The red metal accounts for 60% of the Chile's exports and 15% of its gross domestic product (GDP). |

| Iran resumes gold trade with Turkey Posted: 29 Nov 2013 06:39 AM PST Turkey, a neighbour and long-term business partner of Iran, will resume trading gold with Tehran as soon as the economic sanctions imposed by world powers ease, following Sunday's deal between the Middle Eastern country and permanent members of the United Nation Security Council, including Germany. Gold trade between the two nations blossomed last year when Iran began using Turkish payments for energy to import gold, bypassing this way U.S. sanctions imposed due its nuclear program. "Because of problems in money transfers in 2012, the gold trade rose. I don't think that we are still in the same situation that would require us to trade in gold in those amounts," said Iran's ambassador to Turkey, Ali Reza Bigdeli, according to Reuters. Analysts agree the restart of gold trading between the two nations will significantly benefit Turkey's glum economy, as it would also boots other goods imports, especially oil. Since Turkey buys Iranian oil with Turkish lira rather than dollars, an increase in oil imports from Tehran would relieve pressure on the Turkish currency, sources told FT.com. Iranian oil, which is cheaper than alternative sources, could also help reduce Turkey's large current account deficit, often identified as its biggest economic weak spot. Turkey currently exports over 20,000 products to Iran, including gold, gold-plated silver, iron, steel, textile yarn, fabrics, land transportation vehicles, electrical machinery and appliances. Iran mostly sells it oil and gas. Images by Asia Society, via Flickr and Wikimedia Commons. |

| You are subscribed to email updates from MINING.com To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 20 West Kinzie, Chicago IL USA 60610 | |

0 Comment for "Shares of Europe's top potash producer soars after reopening mine"