Cameco issues lockout at its McArthur River mine and Key Lake mill operations |

- Cameco issues lockout at its McArthur River mine and Key Lake mill operations

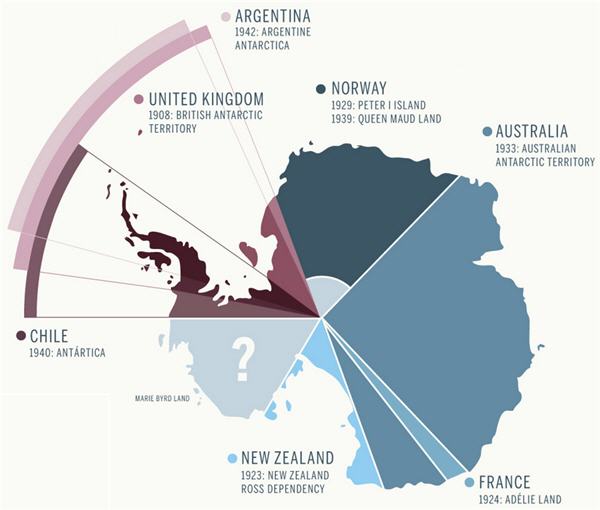

- INFOGRAPHIC: Who owns Antarctica?

- IMAGE GALLERY: Trucks in trouble

- Rick Rule: A briefing on private placements

- Freeport's $2 billion Chile sale hits snag

- Palladium price sets fresh 13-year high

| Cameco issues lockout at its McArthur River mine and Key Lake mill operations Posted: 31 Aug 2014 09:01 AM PDT  McArthur River Uranium Mine aerial view. Image from Wikipedia. In response to strike action commenced by the United Steelworkers on Saturday, Cameco (NYSE:CCJ) issued a lockout notice at its McArthur River mine and Key Lake mill operations. The world's largest uranium miner said the work stoppage involves approximately 535 unionized employees at the two operations. Notice of the strike came on Wednesday. Over the last five days, Cameco has dropped 1.81%. "The union has advised Cameco of its intention to commence strike action, effective 12:01 a.m. on August 30, 2014," said the company in a statement. "In response to the strike notice, Cameco issued a lockout notice effective 12:01 a.m. on August 30, 2014 to assure a safe and orderly shutdown of its facilities. Cameco is continuing to meet with the union during the 72-hour notice period." Contract negotiations began in November 2013. The previous four-year contract expired December 31, 2013. In July, the company and union jointly applied for conciliation under the Canada Labour Code. Cameco says the labour disruption is not expected to affect the company's 2014 uranium delivery commitments to customers. The company says it can draw on a variety of supply sources including primary production, as well as existing purchase commitments and inventories. |

| INFOGRAPHIC: Who owns Antarctica? Posted: 31 Aug 2014 08:39 AM PDT With advancing mining technology and retreating ice, the north and south extremes of the globe are earth's final resource frontiers. Antarctica is a huge land mass, nearly twice the size of Australia. A struggle for resource exploitation has been put off since major nations agreed to a indefinite ban on mining. The restriction will be open for review in 2048. See the full infographic credited to Column Five. |

| IMAGE GALLERY: Trucks in trouble Posted: 31 Aug 2014 08:05 AM PDT Recent images at Mining Mayhem. Locations and dates not divulged. |

| Rick Rule: A briefing on private placements Posted: 29 Aug 2014 03:48 PM PDT Some investors are able to participate in private placements, where a company raises money by offering new shares. For US investors to participate in a private placement, they must be suitably qualified for the offering. Suitability depends on the exemptions under the Securities Act of 1933 through which the company is able to offer new shares. This loosely means that the investor must meet a certain threshold of net worth, income, or investable assets in order to participate. Private placements may be done by private or publicly trading companies. When a public company issues shares in a private placement, the new shares are not freely tradable, but must be held for a specified period of time, and must have their trading restriction lifted by the issuer's legal counsel before they can be sold. Rick Rule believes that if you're able to take part in these transactions, they could be attractive ways to take advantage of a recovery in natural resources: Let's define what a private placement is: a private issuance of new equity, new debt, or new warrants, from the treasury of a public or private issuer. It's not a secondary market transaction of securities that have already been issued, but rather an issue of new treasuries that isn't registered as a public offering. The advantage of private placements to the participant, in a traditional equity private placement, is that you often acquire an amount of stock that would be difficult to buy in the market for a small cap stock. You get to acquire the stock on terms that are set with the issuer, and not set by the vagaries of the bid and ask in the market. You may also be able to acuqire a warrant or a half-warrant along with your shares. A warrant is the right but not the obligation to buy more shares at a fixed price. It's this leverage in the warrant that has made Sprott Global an active participant in private placement markets for 30 years. Increasingly, other forms of private placements have become interesting to the people who run Sprott, myself included. We have found that, particularly in the United States, the costs of running a public company are so extraordinary that for ventures requiring less than $50 million in capital, we are better off funding private companies who avoid many of these costs. So, increasingly, at Sprott, we are investing by way of private equity transactions, or we're doing business in unincorporated joint ventures or partnerships. That's particularly true where our goal is income. We find that the public 'wrapper' — with the ongoing expense of a public listing, including legal, audit, and Sarbanes-Oxley fees — is inefficient and reduces the amount of income that can be distributed by the company to the investor. So one of the things that Sprott customers will be seeing with increased frequency in the next 5 years, particularly with regards to income-generating transactions, will be privately placed debt instruments from public issuers, oil and gas income opportunities, and infrastructure income from opportunities like terminals and pipelines. Theses are not publicly-trading equities, but rather, they are either shares in limited liability companies or in limited partnerships designed to funnel money directly to investors and that are exempt from filing fees, Sarbanes-Oxley, and registration statements. Readers should know that in order to participate in placements generally, they need to have a certain level of assets based upon the type of exemption the offering utilizes. Often, investors need to have $1 million in investable assets; in some cases, the investor must be a Qualified Purchaser, meaning they have $5 million in investable assets. It will be important for investors to understand, when analyzing private placements for their own portfolios, which of these classifications they are in. That's of course a function of their investable capital. If you are an US accredited investor, you can complete and return this form, which will enable you to hear about our upcoming opportunities. If you are an investor from another jurisdiction, please contact us at (760) 444-5298/emailhbonner@sprottglobal.com to learn more. Note private placements involve risks, as the companies that are financed can perform poorly, and can be highly illiquid. P.S.: Not a subscriber? Click here to get Sprott's Thoughts, and you'll also receive a free electronic copy of the Sprott Gold Book. This information is for information purposes only and is not intended to be an offer or solicitation for the sale of any financial product or service or a recommendation or determination by Sprott Global Resource Investments Ltd. that any investment strategy is suitable for a specific investor. Investors should seek financial advice regarding the suitability of any investment strategy based on the objectives of the investor, financial situation, investment horizon, and their particular needs. This information is not intended to provide financial, tax, legal, accounting or other professional advice since such advice always requires consideration of individual circumstances. The products discussed herein are not insured by the FDIC or any other governmental agency, are subject to risks, including a possible loss of the principal amount invested. Generally, natural resources investments are more volatile on a daily basis and have higher headline risk than other sectors as they tend to be more sensitive to economic data, political and regulatory events as well as underlying commodity prices. Natural resource investments are influenced by the price of underlying commodities like oil, gas, metals, coal, etc.; several of which trade on various exchanges and have price fluctuations based on short-term dynamics partly driven by demand/supply and nowadays also by investment flows. Natural resource investments tend to react more sensitively to global events and economic data than other sectors, whether it is a natural disaster like an earthquake, political upheaval in the Middle East or release of employment data in the U.S. Low priced securities can be very risky and may result in the loss of part or all of your investment. Because of significant volatility, large dealer spreads and very limited market liquidity, typically you will not be able to sell a low priced security immediately back to the dealer at the same price it sold the stock to you. In some cases, the stock may fall quickly in value. Investing in foreign markets may entail greater risks than those normally associated with domestic markets, such as political, currency, economic and market risks. You should carefully consider whether trading in low priced and international securities is suitable for you in light of your circumstances and financial resources. Past performance is no guarantee of future returns. Sprott Global, entities that it controls, family, friends, employees, associates, and others may hold positions in the securities it recommends to clients, and may sell the same at any time. |

| Freeport's $2 billion Chile sale hits snag Posted: 29 Aug 2014 02:38 PM PDT Freeport McMoRan's (NYSE:FCX) sale of a large Chilean mine to Canada's Lundin Mining (TSE:LUN) is being held up because of big changes to the South American country's tax regime. The WSJ reports Phoenix-based Freeport has been in negotiations with Lundin to sell its Candelaria copper mine for more than $2 billion, but the sale is being delayed because of uncertainty about planned new capital gains taxes. Broad tax reforms were agreed to by Chile's senate in July, but the legislation still has to be approved by the lower house. Freeport owns 80% of the open pit and underground gold-copper mine, one of four it operates on the continent. Candelaria in northern Chile's Atacama province last year produced 168,000 tonnes of copper. The company's South America operations produced 1.33 billion pounds of copper in 2013 and an expansion is under way at its massive Cerro Verde mine in Peru. Freeport and Lundin have joint ownership of the Tenke Fungurume copper mine in the Democratic Republic of the Congo, but Freeport has been looking to sell that stake too. Freeport, owner of the massive copper-gold Grasberg mine in Indonesia, has been selling off assets at it struggles with debts of nearly $21 billion. |

| Palladium price sets fresh 13-year high Posted: 29 Aug 2014 12:50 PM PDT

Palladium futures trading on New York's Nymex are now at the highest since February 2001 as news of Russian troops entering the east of the country raises concerns that the West will be forced to tighten sanctions against the number one supplier of the precious metal. The US and EU have already imposed restrictions on Russian imports of oil technology and have placed curbs on its defence and banking sectors, but so far supply of platinum and palladium have been mostly unaffected. PGMs are mainly used to clean emissions in automobiles and Europe's car industry is the number one customer of PGMs. Not everyone believes the tensions would affect the fundamentals of the industry. "In a nutshell, Russia needs the money, the EU needs the metal; it all boils down to politics, but the base case is business as usual," GFMS analyst Johann Wiebe told the Reuters Global Gold Forum on Friday. South Africa, where a devastating strike kept mined metal off markets for months, and Russia combined account for close to 80% of global supply of palladium and 70% of platinum output.

South Africa is the top supplier of platinum but with production slowly returning to pre-strike levels and without the Russian risk premium platinum prices have come under pressure. While palladium is up 26% this year, platinum has only managed gains of 3.5% in 2014. After a brief period above $1,500 in early July, platinum has also declined 6%. Expected demand has not materialized either. From expectations of a 6% jump in sales this year, the continent's carmakers only managed to shift around 3% more vehicles in the first half as Europe's largest economies look in danger of sliding back into recession. A slowing economy in China, the world's largest vehicle market where catalyst use skews towards palladium, is also clouding the outlook. Image of statue of Lenin in Illichivsk in the Odessa Oblast by lentina_x |

| You are subscribed to email updates from MINING.com To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 20 West Kinzie, Chicago IL USA 60610 | |

0 Comment for "Cameco issues lockout at its McArthur River mine and Key Lake mill operations"