About $50bn in mining investment expected in Guinea by 2025 |

- About $50bn in mining investment expected in Guinea by 2025

- Ivanhoe transfers 26% of S. Africa’s platinum project to locals

- Iron ore price hits unwelcome 5-year-low

| About $50bn in mining investment expected in Guinea by 2025 Posted: 04 Sep 2014 08:37 AM PDT  The Simandou mountains in Guinea hold some of the richest iron ore deposits in the world and has the potential to transform the fortunes of the impoverished West African nation. Guinea, one of the main producers of bauxite, the raw material used in aluminum production, expects to attract $50 billion of investment into its mining sector in the next ten years, the country's minister of mines said Thursday. The West African country has long seen mining as having potential to deliver much needed income. However some of the nation's resources that are considered among the world's largest, such as the Simandou iron ore deposit, have not been turned into producing mines yet because of both financial and political reasons. Moving forward with the Simandou South iron project could double Guinea's current GDP, Mines minister Kerfalla Yansane was quoted as saying by Reuters. But first production from Rio Tinto's (ASX, LON:RIO) massive $20 billion project is not expected until 2019 at the earliest. The miner has already spent over $3 billion actively building the project. At full production the mine would export up to 95 million tonnes of iron ore per year – that's about a third of the firm's total capacity at the moment. Simandou North up for grabs In April the West African nation took back the northern half of the Simandou deposit after concluding that BSG Resources (BSGR), the mining arm of Israeli tycoon Beny Steinmetz's empire, and Vale's joint-venture partner, obtained the concession through corrupt practices. Guinea's government is expected to release tender documents covering the area within the next two to three months. Rio Tinto has said that the company was unlikely to take part in the bidding process. Glencore (LON:GLEN) has also denied reports that it had expressed an interest to develop the coveted deposit. Potential investors may be deterred, however, by extremely iron ore prices and by a threat from BSGR that it will sue any investor in its former license. Image from archives. |

| Ivanhoe transfers 26% of S. Africa’s platinum project to locals Posted: 04 Sep 2014 07:19 AM PDT Africa-focused Ivanhoe Mines (TSX:IVN) said Thursday it has completed an empowerment deal on its Platreef project in South Africa, which leaves 26% of the venture in hands of local communities. The Canadian miner said it has transferred 20% to 20 local groups, 3% to black entrepreneurs and managerial employees, and another 3% to historically disadvantaged South African staff. The Vancouver-based company is planning a multi-phased development of a large, mechanized, underground mine on its Platreef discovery of platinum, palladium, nickel, copper, gold and rhodium on the Northern Limb of the Bushveld Complex in South Africa. Based on a preliminary economic assessment, the Platreef project could mine eight million tonnes a year yielding 785,000 ounces of platinum, palladium, rhodium and gold per year. According to the company, this would make it Africa's lowest-cost producer of platinum-group metals. |

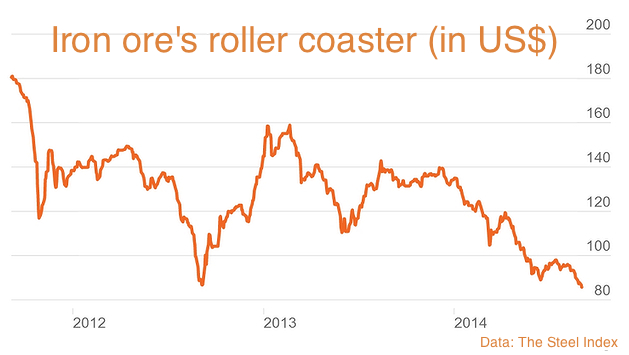

| Iron ore price hits unwelcome 5-year-low Posted: 04 Sep 2014 03:45 AM PDT After flirting with a five-year low for about a month, the iron ore price has finally hit levels seen last in October 2009 over worries about slowing demand in China and a glaring oversupply in the market. The price has fallen by more than 35% this year, having one of it worst run in August. Benchmark Australian ore tumbled from around $95 a tonne at the start of August to $85.70 a tonne on Wednesday, down more than 1% from the $86.70 closing mark in the previous session, the Steel Index figures show. The drop is not only affecting the top producers stocks, but also seriously damaging the economy of commodity dependent regions, such as Western Australia. According to the state's main newspaper, every dollar fall in the average iron ore price costs the State Budget A$49 million in lost revenue:

The big three global producers —Rio Tinto (ASX:RIO), BHP Billiton (ASX:BHP) and Vale (NYSE:VALE), which all depend heavily on iron ore for their profitability, are largely responsible for the price slump. They are spending billions of dollars ramping up output to meet anticipated future demand, and capture market share, while pushing the global market into surplus. High-cost miners to leave market Their actions, experts agree, will force high-cost Chinese miners out of the market, which in turn will stabilize iron ore prices, lifting them back towards $100 a tonne. But it is also causing collateral damage. Mid-cap Australian iron ore miners are already feeling the pressure, as current prices will barely let them break even. According to UBS estimates, published by The Sydney Morning Herald, Australian miners Grange Resources (ASX:GRR) and Gindalbie Metals (ASX:GBG) are facing uneconomic production, with break-even prices of $87 a tonne and $98 a tonne respectively. Atlas Iron (ASX:AGO) and Arrium (ASX:ARI) are next in the firing line with cash costs over $80 a tonne. |

| You are subscribed to email updates from MINING.com To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 20 West Kinzie, Chicago IL USA 60610 | |

0 Comment for "About $50bn in mining investment expected in Guinea by 2025"