Gold price lifted out of danger zone |

- Gold price lifted out of danger zone

- Iron ore price drops to 2-year low

- Imperial Metals new copper and gold mine ready to begin production

- Big step closer to bringing back mining to Upper Peninsula

- U.S. miner buys Glencore's massive Donkin coal mine

- Zambia to ease tax rules on copper exports

| Gold price lifted out of danger zone Posted: 26 Aug 2014 03:44 PM PDT On the Comex division of the New York Mercantile Exchange, gold futures for December delivery on Tuesday attempted a comeback of sorts, recovering from a two month low. By the close of regular trade gold was changing hands for $1,285.20 an ounce, up over $6, after earlier hitting a day high of $1,291.90. The gains follow six weak sessions which saw the metal lose 2% in value. Tuesday's move lifted the metal above its 200-day moving average – a bullish technical sign – after bouncing off support at $1,272 and could now attempt a move back above $1,300 an ounce. The gains in the price of gold came amid fresh money flowing into US equities with the S&P 500 setting new records above the 2,000 point level on Tuesday. Minutes of the last US Federal Reserve meeting showing the US central bank opting for a more hawkish tone as the country's job picture continues to improve sparked last week's sell-off on the gold market. Bond yields are negatively correlated with the gold price as the metal is not income producing, but rising interest rates do not necessarily turn gold into a one-way bet. During the last Fed tightening cycle from June 2004 to June 2006 the price of gold actually increased by about 50%. And soaring equity markets and sky-high stock valuations may push investors back into gold. London-based ETF Securities, an institutional research firm, sees money flowing back into hard assets: "Gold and silver have had substantial corrections offering attractive relative value propositions and remain near the cost of production. Fundamental value and relative valuations normally prevail in the long term as many prudent investors have continued to diversify into the precious metals." |

| Iron ore price drops to 2-year low Posted: 26 Aug 2014 12:18 PM PDT Long held assumptions about the direction and dynamics of the iron ore market have been severely tested in 2014. After hitting a high of $158.90 in February, the industry was jolted on March 10, when iron ore suffered the worst one-day decline since the 2008-2009 financial crisis, cratering 8.3% in a single session. The recovery from there was swift, but by June 16 the steelmaking raw material was sliding again, hitting a low of $89 a tonne. Iron ore slowly clawed back some of those losses for a 2% gain in July breaking a six-month losing streak. But August brought renewed selling and on Tuesday, the price of benchmark Northern China 62% Fe imports slid to $88.90, the lowest since September 5, 2012. Iron ore touched $86.70 then, but quickly recovered to end 2012 above $150. The commodity is set to trade below $100 on a quarterly basis for the first time since 2009. The more than 33% slump in the price this year is blamed on a surge in supply and a slowdown in China which consumes more than two-thirds of the 1.2 billion seaborne trade. No-one is predicting a move back to the early days of the iron ore trade when the price, set during secretive annual contract negotiations, never strayed from $10 a tonne for more than 20 years. But it is worth noting that back in 2007 the commodity was still trading at $36 a tonne. And the all time high of $192 in February 2011 now seems like nothing more than an aberration.  Source: The Steel Index |

| Imperial Metals new copper and gold mine ready to begin production Posted: 26 Aug 2014 12:01 PM PDT Canadian Imperial Metals (TSX:III), the company that drew international attention due to a massive spill of mine waste in British Columbia early this month, said it is ready to begin operations at its Red Chris copper and gold mine in the province once a power line is completed in September. Announcing an agreement with the local First Nations' representatives, the Tahltan Central Council (TCC), the miner said Tuesday a third-party will be in charge of reviewing the tailings impoundment at the new mine to make sure it meets world-class standards in terms of design, engineering, operation and construction. That third-party will be chosen by the TCC, the firm added. Red Chris, in northwest B.C., is located near the Iskut River, a major tributary of the Stikine River, which ends in southeast Alaska and it is considered one of the largest salmon habitats in the Tongass National Forest. This has triggered rising anxiety among the mine's neighbours, locally and across the border. "In Southeast Alaska, we will absorb nothing but risk," Brian Lynch of the Petersburg Vessel Owner's Association told JuneauEmpire.com. "A breach like [Mount Polley's] would be a disaster (…) These systems produce a lot of salmon for our billion-dollar-a-year industry." "Sooner or later [the tailings dams] are going to fail," Guy Archibald, mining and clean water coordinator at the Southeast Alaska Conservation Council, was quoted as saying. "It's not a matter of 'if,' but 'when.'" According to Imperial Metals' website, the mine will process almost 30,000 tons of ore per day for 28 years. And after the Mount Polley disaster locals are saying a similar breach would ruin both the environment and the state's economy. Image courtesy of Imperial Metals |

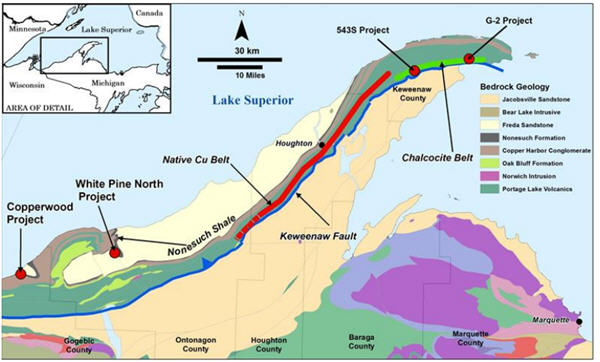

| Big step closer to bringing back mining to Upper Peninsula Posted: 26 Aug 2014 10:52 AM PDT Shares of Highland Copper (CVE: HI) were trading unchanged midday Tuesday on the Toronto Venture Exchange after announcing a maiden resource estimate for its 543S copper deposit in the Keweenaw region of Michigan's Upper Peninsula. The 65%-owned deposit is one of four the Quebec-based company hopes to consolidate to re-establish copper mining in the region where production dates back to the mid-19th century. The area produced in excess of 11 billion pounds of copper until production stopped in 1977. The National Instrument 43-101 compliant estimate is headlined by a 1.52 Mt indicated resource grading 3.27% copper and 5.1 g/t silver, and an additional 0.19 Mt inferred resource grading 3.08% copper and 4.8 g/t silver (based on a 1.9% copper-equivalent cut-off grade) This high-grade volcanic deposit will be combined with Highland's G2 project and the much larger sedimentary White Pine and Copperwood deposits acquired last year from First Quantum Minerals and Orvana Minerals respectively. The White Pine Copper project includes a historic mine and mill complex which produced nearly 1.7 million tonnes of copper and 4.5 million ounces of silver between 1953 and 1996. Highland is now carrying out a preliminary feasibility study for the development of four mines through a central processing facility located at White Pine which boasts an existing 40 megawatt power plant, copper refinery and water processing plant. The pre-feas is expected next year and earliest start-up is envisaged for 2018 for a capital outlay of roughly $700 million. Highland, worth $47 million on the TSX-V, raised $20 million in June to further the project. In May 2014, Highland and AMCI entered into a non-binding letter of intent to form a 50-50 joint venture for the development of the mining complex whereby AMCI could contribute $45 million by the end of year. |

| U.S. miner buys Glencore's massive Donkin coal mine Posted: 26 Aug 2014 10:19 AM PDT The Donkin coal project, in Canada's Cape Breton Island, will have a new owner as its majority holder Glencore (LON:GLEN) sold its 75% stake in the asset, which involves the development of one of the largest undeveloped coal deposits in North America, to U.S.-based Cline Group. Canadian junior Morien Resources (TSX-V:MOX), which owns the 25% remaining in the project, cleared the way for the new operator Monday, as it announced it was waiving its right of first refusal to acquire the controlling interest in the mine. Morien and Glencore have invested $43 million in the fully permitted Donkin project since 2006. The reopening of the project, located less than 30 km from the deep water port of Sydney, has been in the works for eight years, since the Nova Scotia government granted permission to get the site ready for coal production. Devco, a former federal Crown corporation, dug the tunnels in Donkin in the 1980s but the project was abandoned before the mine opened because of a drop in coal prices. Final approval Morien says it will work with Cline and advance discussions with the Nova Scotia government to gain final approval and move forward to commercial production. Donkin, located less than 30 km from the deep water port of Sydney, Nova Scotia, is estimated to have reserves of at least 480 million tonnes of coal, worth more than $1 billion at current prices. According to Dailycommercialnews.com, the project will generate around 8,500 jobs in the first five years of construction and contribute $483 million to the province GDP during the development phase. Coal has been mined in the Sydney coal basin since the early 1860s. Image courtesy of Morien Resources Corp. |

| Zambia to ease tax rules on copper exports Posted: 26 Aug 2014 08:25 AM PDT The government of Zambia, Africa's second largest copper producer, said Tuesday it plans to waive a rule requiring miners to produce import certificates from destination countries. The move could imply a $600 million refund in accumulated value-added tax to copper companies operating in Zambia that have failed to produce such import documents, WSJ.com reports. The African nation, which last year lost its position as Africa's top copper miner to Congo for the first time since 1998, began enforcing the rule last year in order to curb tax avoidance. The companies affected include the local units of First Quantum Minerals (TSX:FM), Barrick Gold (TSX, NYSE:ABX), Glencore (LON:GLEN), Vale (NYSE:VALE),and Vedanta Resources (LON:VED), all of which have copper projects in the country worth billions of dollars. |

| You are subscribed to email updates from MINING.com To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 20 West Kinzie, Chicago IL USA 60610 | |

0 Comment for "Gold price lifted out of danger zone"