Canada's most expensive cupcake is topped with gold, diamond sprinkles |

- Canada's most expensive cupcake is topped with gold, diamond sprinkles

- Alaska lawmakers ask Kerry to intercede on B.C. mines: BIV

- Leonardo DiCaprio in Canada’s Fort McMurray to learn about the oil sands

- Abandoned Canadian mining town up for sale

- Busy times ahead: global mining deals on their way up

- Gold mine collapse in Central African Republic kills 37

| Canada's most expensive cupcake is topped with gold, diamond sprinkles Posted: 23 Aug 2014 02:00 AM PDT Canada's Toronto residents and visitors can now have their cupcake and eat it too, as far as they are willing to fork out the far from negligible sum of $900 per unit. Created by Le Dolci bakery, the extravagant cupcake is not the world's most expensive — that title is hold by Dubai-made "Golden Phoenix" ($1,200) —, but it certainly include top-notch ingredients, such as sea salt from Carmargue in France, Tahitian vanilla beans and Valhrona Cocoa powder. Most importantly, the baked treat is topped with diamond sprinkles, a 24-karat gold leaf, an edible gold-painted branch and confectionary bubbles made with a "molecular gastronomy" technique. According to NBC News, Le Dolci has received a flurry of inquiries and interest about the made-to-order cupcake, which has helped sales of the bakery's everyday $2.75 cupcakes. But so far, there have been no other orders for the $900 version. Images courtesy of Le Dolci. |

| Alaska lawmakers ask Kerry to intercede on B.C. mines: BIV Posted: 22 Aug 2014 02:17 PM PDT The Mount Polley tailings pond spill has prompted a group of Alaskan politicians to ask U.S. Secretary of State John Kerry to intervene in connection with B.C. mine projects, according to Business in Vancouver. The group, which includes senators, legislators and Congressman Don Young, has signed a letter requesting that Kerry act to address worries about the environmental impact of new mines in the northwest corner of the Canadian province. The newspaper reports:

The main concern involves the proposed KSM copper mine located 30 kilometres from Alaska, the paper says, noting that the Mount Polley dam failure happened ahead of what promises to be one of history's biggest sockeye salmon returns. To read the full report, click here. Image: fotostory / Shutterstock.com |

| Leonardo DiCaprio in Canada’s Fort McMurray to learn about the oil sands Posted: 22 Aug 2014 11:09 AM PDT Oscar-nominated Leonardo DiCaprio, a leading figure in Hollywood's environmental movement, is in Canada's oil sands heart these days doing research for an upcoming documentary on the subject. The visit comes on the heels of the release of a short film on carbon pollution narrated and co-produced by the actor. The video, called "Carbon," is part of a series of short films on climate change, with additional episodes released ahead of September's U.N. Climate Summit in New York City. The short-flick does not attack the oil sands industry per se, although it does feature aerial footage shot in the region. It mainly calls for an end to carbon pollution by considering options such as carbon trading or carbon taxes. Locals have enthusiastically used social media to invite DiCaprio to see that Fort McMurray isn't only about the oil sands. DiCaprio, 39, isn't the first celebrity to recently visit the town in northern Alberta. Singer Neil Young sparked controversy in January after saying the oil sands sites around the city resembled the bombed-out ruins of Hiroshima. The movie star currently serves on the board of the World Wildlife Fund and Natural Resources Defense Council, among other organizations. He is spending quite a bit of time in West Canada these days, as he has a key role in the upcoming "Revenant," which currently being shot in Vancouver and Calgary. Watch "Carbon" here: Image from WikiMedia Commons. |

| Abandoned Canadian mining town up for sale Posted: 22 Aug 2014 10:09 AM PDT A whole town in British Columbia, Canada's most western province, has been put up for sale and for less than $1 million. Yes, you read that right. Just two hours north from the popular resort town of Whistler and four from Vancouver, the ghost town of Bradian, a former suburb of the gold mining town of Bralorne, has been listed for Cdn $995,000. The 20-hectares town has over 22 houses still standing in reasonable condition and all basic infrastructure and it is already zoned rural residential, according to realtor John Lovelace. The seller is a family who bought it in 1997 and used Bradian as a place to take holidays and work on the buildings. And while the location is considered one of the most beautiful, scenic areas in British Columbia, the town is a fixer-upper on a major scale. In fact Lovelace told The Province he has received dozens of inquiries, but most back off when they realize how much work is required to upgrade the town. Photos courtesy John Lovelace Real Estate Team. |

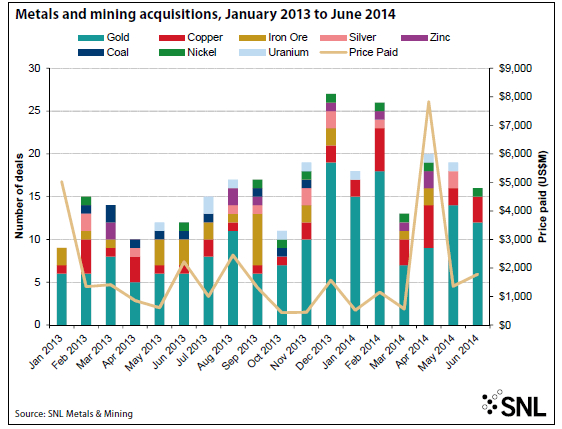

| Busy times ahead: global mining deals on their way up Posted: 22 Aug 2014 07:30 AM PDT Global mining deals picked up in the first half of 2014 and are likely to continue that way for the rest of the year, a SNL Metals & Mining study released Friday shows. Both the averages of price paid and value of acquired commodities per deal, however, were lower than in the same period last year, the report reveals. About 117 transactions totalling US$13.21 billion were announced from January to June, a 56% increase on the 75 deals worth around US$11.47 billion completed in the same period last year. However, the total price paid in the first half of 2014 was only 15% higher than a year earlier, and the value of all commodities acquired was 21% lower. The average price paid per transaction was US$113 million, compared with US$153 million in the first half of 2013, while the average value acquired per deal sank to US$4.55 billion from US$8.99 billion year over year. There were four deals with prices of at least US$1 billion in the half year, compared with three in the 2013 half, and 12 deals with values between US$100 million and US$999 million, compared with 14 in the prior year half. SNL Metals & Mining's upbeat forecast echoes the latest predictions by major research groups including PwC, E&Y and Business Monitor, which had called for a significant increase in mining deals this year. The firm's analysts warn, however, that the much-anticipated influx of capital from new mining-focused private funds is taking longer than expected. Main target: gold assets When it comes to the type of commodities acquired so far this year, the biggest change detected by SNL was in early-stage gold deals. There were 32 early-stage gold deals between January and June compared with only two project purchases without resources or reserves in the first half of 2013. In total, SNL's report says, there were 75 gold deals in the first half, up from 37 a year ago. This suggests that companies have been shedding their noncore gold projects at a high rate, and that companies with sufficient capital are snapping them up — buyers are taking advantage of low project valuations to enhance their long-term pipelines or to acquire properties near their existing mines and projects. The report also notes that while copper purchases rebounded, the number of iron ore deals went down, and there were no coal-related transactions at all. You can read the full report here. |

| Gold mine collapse in Central African Republic kills 37 Posted: 22 Aug 2014 04:15 AM PDT At least 37 people have died after a gold mine located 60 km north of the Central African Republic town of Bambari collapsed, burying about 30 workers. The mine is owned by Canadian Axmin (CVE:AXM), but was taken over by rebels over a year ago, who now control the area. According to local media, the accident was due heavy rains that made the pit in which the miners were working collapse. A government's spokesman said that 10 injured miners have been rescued so far, but there are an unknown number of bodies still buried after the accident. Georges Yacinth-Oubaouba, a senior official in the Ministry of Mines, told Reuters there are no officials on the ground to regulate those illegal miners. "They dig without any rules," he was quoted as saying. Violence broke out in Central African Republic in December 2012. Seleka rebels, loosely organized groups that drew primarily Muslim fighters from other countries, ousted the president and installed their own leader in a March 2013 coup. The Seleka were officially disbanded, but its members continued to commit such crimes as pillaging, looting, rape, and murder. In September 2013, after 10 months of terrorism at the hands of the Seleka, anti-balaka self-defence groups began to form. The anti-balaka picked up momentum in November, and the conflict in the nation took on a sectarian character, as some anti-balaka, many of whom are Christian, began attacking Muslims out of revenge for the Seleka's acts. |

| You are subscribed to email updates from MINING.com To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 20 West Kinzie, Chicago IL USA 60610 | |

0 Comment for "Canada's most expensive cupcake is topped with gold, diamond sprinkles"