Kinross Gold allegedly trying to recover Ecuador mine losses |

- Kinross Gold allegedly trying to recover Ecuador mine losses

- Golconda diamond fails to find buyer at Christie’s auction in Hong Kong

- Mongolia mining reforms seek $1bn in coal, shale investments

- Output at No.1 global copper producer slips slightly in first quarter

- Total E&P Canada shelves $11-billion oil sands mine

- Vale gets green light to restart nickel mine in New Caledonia

| Kinross Gold allegedly trying to recover Ecuador mine losses Posted: 30 May 2014 12:29 PM PDT  Fruta del Norte, discovered in 2006, is one of the world's biggest gold discoveries, containing about 6.7 million ounces of proven and probable gold reserves and 9 million ounces of proven and probable silver reserves. Canada's Kinross Gold Corp. (TSX:K) (NYSE:KGC), the company that took a $720 million write-down when it halted its $1.3bn Fruta del Norte gold-silver project in Ecuador last year, is in negotiations to get back part of the investment, Bloomberg is reporting. The miner said in June last year it was abandoning all efforts to develop the project because of the high taxes demanded by the Ecuadorean government, which refused to renegotiate a plan for a 70% windfall tax on revenue, allow Kinross to sale Fruta or extend the company's licence beyond an August 1 deadline. For Kinross, the project was a calculated risk that simply didn't pay off. For Ecuador, it was a major blow to its ambitious plans of attracting mining companies to develop the industry. Since 2012, the country has signed only one investment contract for a large-scale mining project with the Chinese-owned Ecuacorriente S.A. for the open-pit Mirador copper project, scheduled to start production at the end of 2015. Ongoing talks A member of the country's mining chamber told BNamericas earlier this month (subs required) the project sale was still ongoing, and that the potential buyer "would have to be approved by the government." One of the rumoured bidders is Chile's Codelco, the world's largest copper producer, which is already involved in the Ecuadorian mining sector. But people familiar with the matter told Bloomberg that President Rafael Correa's administration may agree to renew the company's rights to the concession, removing legal hurdles to the prospective sale. Another option, says the report, is for Kinross to just sell data gathered from its prospecting operations. Fruta del Norte, found in 2006, is one of the world's biggest gold discoveries, containing about 6.7 million ounces of proven and probable gold reserves and 9 million ounces of proven and probable silver reserves, according to Kinross' website. |

| Golconda diamond fails to find buyer at Christie’s auction in Hong Kong Posted: 30 May 2014 11:44 AM PDT A pear and cushion-shaped diamond and emerald necklace, having two Golconda diamonds, failed to sell at Christie's Magnificent Jewels auction held this week in Hong Kong, as Chinese buyers demonstrated more selectivity than at previous auctions. The rock, the centrepiece of a diamond and emerald necklace, is known as "The Eye of Golconda," and it was expected to fetch up to $10 million. Instead, it remained unsold. A 9.38 carat pear-shaped fancy intense pink diamond fared better, selling for almost $6 million (or $636,117 per carats), still at the low end of its estimate. The Indian medieval region of Golconda is universally famous for the mines that have produced the world's most famous and coveted gems, including the Hope Diamond, Idol's Eye, the Koh-i-Noor and the Darya-i-Noor. Overall Christie's sold about $390 million worth of art during the five-day spring sale, with jewellery showing disappointing results, as only 81% of the 300 lots on offer sold with a 73% sell-through value. |

| Mongolia mining reforms seek $1bn in coal, shale investments Posted: 30 May 2014 10:49 AM PDT Mongolia wants to expand the area available to mining to a fifth of the country and so boost coal, shale gas and oil exploration, in an attempt to end its dependence on foreign oil by the end of the decade. The mineral rich country, seeking to regain investors' confidence by overturning last year's cancellation of more than 100 mining licenses, is hoping to attract $1bn of investment this year, vice-minister for mining Erdenebulgan Oyun told Bloomberg this week. As recently as 2011, the central Asian nation economy grew at a world-beating record of 17.5%. The figure moderated to 11.7% last year, amid a collapse in foreign investment that has extended into this year. Mongolia is seen as one of the most interesting countries for mining exploration, combining good geology with a strategic location next to China, the world's largest user of commodities. But investors have been losing confidence in the country amid a series of legal disputes and stalled developments. The government last month embarked on a 100-day programme to improve economic performance through dozens of measures to boost investment and cut imports. The path to prosperity for Mongolia, ranked 155th in the world according to GDP per capita, has always been a rocky one. The The International Monetary Fund (IMF) has bailed out the country no fewer than five times and its domestic bank sector seems to have a major fallout on average every 18 months. Image is of Naadam festivities at Oyu Tolgoi in 2012 |

| Output at No.1 global copper producer slips slightly in first quarter Posted: 30 May 2014 09:54 AM PDT Chile's Codelco, the world's top copper producer, said Friday (in Spanish) output dropped slightly in the first quarter and its profit dived as metal prices fell and ore grades deteriorated. The company posted a 0.3%$ drop to 383,000 metric tonnes, and said its pre-tax profit tumbled 38% to $539 million. The miner said efforts to reduce production costs partially helped to offset the sharp drop in revenue, as copper prices averaged $3.194 a pound in the first three months of the year, a value that is 11% lower than in the same period of 2013. Finance and Administration vice-president, Ivan Arriagada, said that despite the slight output fall, Codelco is dealing with prices well above the average registered in the company's history. However, he acknowledged the firm needed to continue efforts to reduce costs and increase productivity. Codelco has seven mining divisions. Radomiro Tomic, Chuquicamata, Gabriela Mistral, Salvador, Andina, El Teniente and the new Ministro Hales mine, which began production in the last quarter of 2013 and it is set to reach its full capacity this years. The state-owned miner also owns the Ventanas copper smelter and refinery, has a 49% stake in El Abra, a joint venture with US-based Freeport-McMoRan Copper & Gold, and —since 2012— owns 20% of Anglo American Sur. Chile expects mining investment to reach $112 billion by 2021, figure that includes the $27bn planned by Codelco. By the same year, the country's total copper production is projected to reach an annual 8.1 million metric tons. The red metal accounts for 60% of Chile's exports and 15% of gross domestic product. |

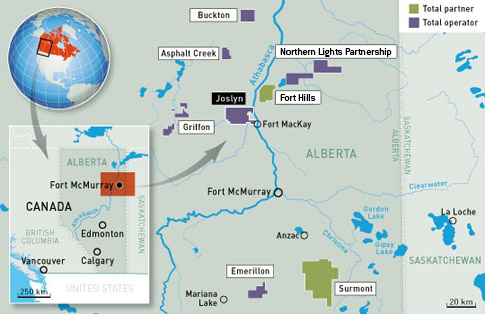

| Total E&P Canada shelves $11-billion oil sands mine Posted: 30 May 2014 06:58 AM PDT  Alberta oil sands | Creative Commons image by Howl Arts Collective French energy powerhouse Total SA, along with its partners in the Joslyn north oil sands project, unanimously decided Thursday to mothball the mine, as escalating costs made the $11-billion endeavour financially untenable. In a conference call, the head of Total's Canada André Goffart said Joslyn was facing the same challenge most of the industry worldwide. "We are still in the cycle within this industry where cost inflation in general is going much faster than price adjustments. We know that there is a rebalancing that needs to be done," he told reporters. There were no indications as to whether the ownership structure of Joslyn, located northwest of Fort McMurray, would change. Currently, Total is operator with a 38.25% stake. Suncor Energy (TSX:SU) holds a 36.75%, Occidental has 15% and Inpex 10%. The oil sands project has been a difficult one since Total acquired it as part of its Cdn $1.7 billion purchase of Deer Creek Energy in 2005. It went through a lengthy regulatory process but ended up being put on the back burner when the company entered a joint venture with Suncor to develop the Fort Hills mine. The price tag of the project, finally approved 2011, was most recently set at $11 billion. It had aimed to start producing 160,000 barrels a day toward the end of the decade. For Alberta-born analyst Nelson Smith the news is important to investors because it symbolizes how much of a problem cost overruns are for oil sands producers. "Oil sands workers are paid two to three times what regular workers are paid for the same job. It's not uncommon to see ambitious workers make more than $200,000 per year after tax. There are stories about people heading up to the oil sands as 22-year-old fresh graduates and coming back five years later as millionaires. "And yet, even after all those efforts, oil sands producers are still having problems attracting staff," he writes for The Motley Fool. Total retains significant oil sands investment, but it is in a tough position. The firm is committed to ship oil on three major undeveloped and uncertain pipeline projects: Keystone XL, Northern Gateway and the Trans Mountain expansion. |

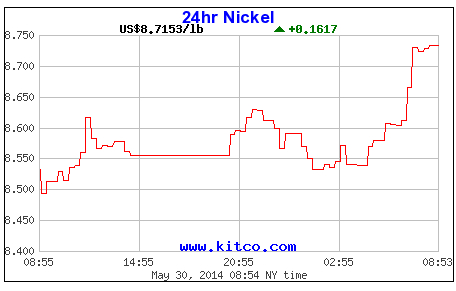

| Vale gets green light to restart nickel mine in New Caledonia Posted: 30 May 2014 04:15 AM PDT  Rioters caused tens of millions of dollars in damage to vehicles, equipment and buildings at the plant on Tuesday. Image by Thierry Perron | Les Nouvelles Caledoniennes. See full slideshow here. Brazil's Vale (NYSE:VALE) has got the green light from New Caledonian authorities to restart nickel mining activities Friday, after being forced to suspend operations at the $6bn plant earlier this month due to a chemical spill. Dozens of rioters caused between $20 and $30 million in damage to vehicles, equipment and buildings at the facility on Tuesday, as anger boiled after some 100,000 litres of acid-tainted effluent leaked from the troubled plant and into a local river, killing about 1,000 fish. A spokeswoman for the Goro province told Reuters Friday authorities were ready to issue an authorization to restart mining activities "by the end of the day or in the next few days." Nickel prices have reacted to Vale's plant closure, which on top of Indonesia's nickel ore export ban have worsened the current the tightness in the market.  Spot quotes are non-LME prices. Source: Kitco.com The metal was trading up 0.16% at $8,7153 per pound on Friday. Overall it is up by more than 35% this year. Nickel mining is a key industry in New Caledonia, which holds as much as a quarter of the world's known reserves. Vale's plant is the second-largest employer in the southern province, with some 3,500 employees and contractors. |

| You are subscribed to email updates from MINING.com To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 20 West Kinzie, Chicago IL USA 60610 | |

0 Comment for "Kinross Gold allegedly trying to recover Ecuador mine losses"