Gold price | <b>Gold price</b> on insane surge after massive trade | MINING.com |

- <b>Gold price</b> on insane surge after massive trade | MINING.com

- <b>Gold price</b> breakout sparks massive move into mining stocks <b>...</b>

- <b>Gold Price</b> Stabilises Above 1,300 As Energy Shock Risk Remains <b>...</b>

- Millennium Minerals could shine with rising <b>gold price</b> - Proactive <b>...</b>

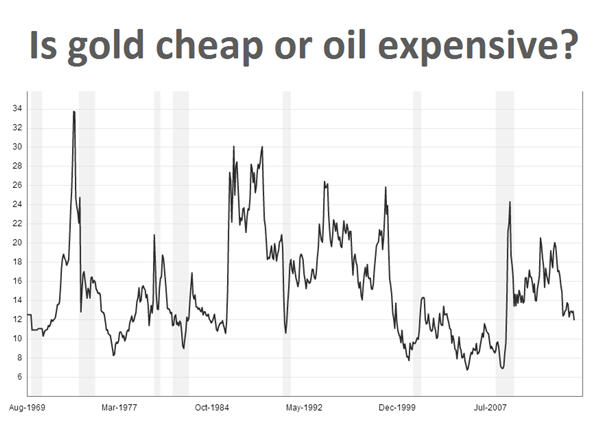

| <b>Gold price</b> on insane surge after massive trade | MINING.com Posted: 19 Jun 2014 10:39 AM PDT The gold price scaled $1,300 an ounce for the first time in more than a month, after comments by US Federal Reserve chair Janet Yellen yesterday and a huge buyer lit a fire under traders. On the Comex division of the New York Mercantile Exchange, gold futures for August delivery – the most active contract – jumped to a day high of $1,322.00 an ounce, up $49.30 or nearly 4% from yesterday's close. After months of subdued trade on gold futures markets volumes surged on Thursday leaping past 210,000 contracts – double recent daily averages – by mid-afternoon. As the chart shows, after a steady climb throughout the morning, during lunchtime volumes suddenly spiked with more than 2.9 million ounces (90 tonnes) changing hands in three big chunks in the space of 15 minutes. Gold built on its gains from there to settle at $1,320.40, the the best one day performance for the metal since September last year. The chart looks almost like the inverse of the trading pattern on April 15 this year when exactly year to the day of 2013's $200 shocker another strange gold price plunge occurred. Gold's positive move started yesterday after Yellen, speaking at the latest meeting of the Fed's interest rate committee, said she was comfortable interest rates could stay low for a considerable period, which sent the dollar tumbling against the euro and pound sterling. Gold and the US dollar usually moves in the opposite directions and gold's perceived status as a hedge against inflation is also burnished when central banks flood markets with money. Monetary expansion, particularly since the financial crisis, has been a massive boon for the gold price. Gold was trading around $830 an ounce when previous chairman Ben Bernanke announced the first program of quantitative easing in November 2008. The QE program together with other stimulus measures saw the balance sheet of the Fed cross the $4 trillion mark in January, up 400% in seven years. The US has not been alone in printing money and together with the Bank of Japan, the European Central Bank and the Bank of England, more than $15 trillion of easy money is now sloshing around in the system. Earlier this month the ECB took the unprecedented step of moving rates into negative territory. Gold was also pushed higher through safe haven buying as the deteriorating situation in Iraq sends oil prices rising. Benchmark West Texas Intermediate traded higher again on Thursday to reach $106.70 a barrel. Looking at the ratio between the gold price and the oil price which usually rise in tandem (rising oil prices pushes up inflation increasing demand for gold as a hedge), gold looks undervalued by comparison. Since 1970 the average ratio – how many barrels of oil can be bought with one ounce of gold – is 15 compared with 12 now, which suggests that gold is cheap compared to oil. The last time the ratio was at 12 was at the height of the global financial crisis in October-November 2008. The price of gold slid close to 28% in 2013 – the worst annual performance since 1980 – in anticipation of an end to the ultra-loose monetary policy, but has enjoyed double digit gains in 2013. |

| <b>Gold price</b> breakout sparks massive move into mining stocks <b>...</b> Posted: 19 Jun 2014 02:37 PM PDT Gold ended the day at its high of $1,320 an ounce on Thursday, fighting back from lows of $1.244 at the beginning of this month. The metal is up 10% in value this year. The silver price jumped nearly 5%, climbing back above $20 an ounce for the first time in two months. Gold's positive momentum sparked heavy buying of gold counters with the Market Vectors Gold Miners ETF (NYSEARCA:GDX), holding stock in the world's top gold miners, soaring 5.4% bringing its gains so far this year to 23.5%. The bellwether for the industry for decades The Philadelphia Gold & Silver Index (INDEXNASDAQ:XAU) gained 5% and is back to levels last seen in March when gold hit a 2014 high of $1,379 an ounce. By the close on Thursday, Barrick Gold Corp (NYSE:ABX, TSE:ABX) was up 3.2% with 4.3 million shares changing hands, more than double usual volumes for the world's number one producer of the metal. It was revealed earlier this week the company has been in talks about about possible partnerships with China's largest gold producer, China National Gold. The state-owned giant with nearly 50 operating gold mines in the country said it's actively looking at acquisition in gold, silver and copper companies around the world as it embarks on an expansion drive. Co-operation with Barrick would not include the the Toronto-based miner's Pascua Lama projecton the border between Chile and Argentina which is the subject of a number of class-action lawsuits. The class actions allege that Barrick Gold shareholders lost billions of dollars as a result of Barrick's "misrepresentations and failures" regarding the stalled project. The < href="http://redirect.viglink.com?key=11fe087258b6fc0532a5ccfc924805c0&u=http%3A%2F%2Fwww.mining.com%2Fbarrick-talking-to-new-chile-mines-minister-to-restart-pascua-lama-60443%2F">technically and politically challenging project high in the Andes launched in 2006 (initial capex costs were pegged at $1.5 billion but has now ballooned to $8.5 billion) suffered a number of defeats in Chilean courts about water use and the impact on glaciers in the area. Barrick which will produce roughly 7 million ounces of gold in 2014 is now worth $22.7 billion on the TSX, compared to its peers up a relatively modest 4% in 2014. Barrick shares struck 21-year lows in July last year after peaking at a $54 billion market value in 2011. Newmont Mining Corp (NYSE:NEM) with a market value of $12.3 billion also gained more than 3% with a whopping 12 million shares changing hands. Talks in April between Newmont and Barrick about a possible merger ended acrimoniously with both sides going public with unflattering comments about incompatible corporate cultures. The world's third largest gold producer behind Newmont, AngloGold Ashanti (NYSE:AU) jumped 4.8% in Thursday trade. The Johannesburg-based company's ADRs listed in New York is up a whopping 46% this year after first-quarter results showed a turnaround in operations with production of 1 million oz at a total cash cost of industry-beating $770/oz. Goldcorp (TSE:G) added $1 billion to its market value, surging 4.7% in heavy volumes of 4.4 million shares. The Vancouver-based company is widening the gap to its peers as the world's most valuable gold stock after a 28.7% gain in market capitalization to $24.1 billion this year. Goldcorp is expected to produce around 3 million ounces of gold this year and was praised by investors for walking away from a hostile takeover of fellow Canadian gold miner Osisko (TSE:OSK). Osisko found white knights in the form of Yamana Gold (TSE:YRI) and Agnico Eagle Mines (TSE:AEM) which will now jointly own 100% of the Montreal firm and take over operation of the company's only operating mine, the Canadian Malartic in Quebec. Yamana which is forecast to produce 1.4 million ounces this year, gained 5.6% on Thursday, while Agnico Eagle Mines (TSX:AEM) traded just under 5% for the better. The bidding for Osisko boosted the stock 83% this year for a market value of $3.8 billion ahead of its delisting on Monday. Malartic will produce nearly 600,000 ounces this year. Toronto-based Yamana is worth $7.1 billion and Agnico $7 billion making the acquirers the globe's seventh and eighth most valuable listed gold miners. Yamana shares are up 3% year to date, while Agnico has soared more than 40%. Toronto's Kinross Gold (TSX:K) increased 5.5% on the day but has only managed 3.2% upside in 2014 over worries about the impact on the company's operating mines in Russia amid the tensions over Ukraine. Kinross is worth a good $1.5 billion less than Yamana, despite being forecast to produce some 1.3 million ounces more than Yamana this year. Canada's Eldorado Gold Corp (TSX:ELD) was the best performer on the day with a 8.5% bounce. Eldorado is close to starting up a mine in Romania and also operates in China, Turkey and Greece with a target of 1.4 million ounces this year. South African miner Gold Fields (NYSE:GFI) continued its turnaround adding 5.2% in New York. The Johannesburg-based firm which is expected to mine 2 million ounces this year is up 20% in 2014 after a dismal performance last year when in a contrarian move its picked up some of Barrick's Australian operations. Randgold Resources ADR's trading on the Nasdaq (LON:RSS, NASDAQ:GOLD) jumped 4.2% and is up 31% this year as its massive new Kibali mine in the Democratic Republic of Congo (DRC) exceeds expectations. Africa-focused Randgold has become something of an investors' favourite with the company valued at some $7.7 billion in London, as it rapidly ramps up production in 2014 to around 1.2 million ounces and boosts it projects in the pipeline. Based on the sector's performance today many investors are choosing to ignore the advice of investment bank Citigroup which last month warned punter not to buy gold stocks no matter how tempting valuations had become. |

| <b>Gold Price</b> Stabilises Above 1,300 As Energy Shock Risk Remains <b>...</b> Posted: 23 Jun 2014 04:48 AM PDT by GoldCore Today's AM fix was USD 1,313.50, EUR 967.02 and GBP 771.51 per ounce. Gold fell $8.40 or 0.64% Friday to $1,311.30 per ounce and silver slipped $0.05 or 0.24% to 20.65 per ounce near 3pm EST. Gold and silver were up 3.33% and 6.58% for the week. Gold price stabilises above 1,300 as energy shock risk remains. The speed with which insurgents threatened Iraqi Oil production has stunned many analysts and underscored the fragile nature of energy exports from politically unstable regions. Oil prices are now trading at a the highest level since September trading in London at $115.66 a barrel. The move by insurgents has also made a mockery of the U.S. administration's policies in Iraq, which seems to be plagued by intransigence, nepotism and corruption. With large swathes of Iraqi people excluded from the political process on the basis of religious and tribal affiliation it is little wonder that a group such as ISIS found the necessary support to field an army and take such enormous territory and is now threatening the capital. It is also telling that the U.S. seemed wholly unprepared for such an event as it would seem that all stakeholders were caught flat footed. The fact that the "response" being considered is a joint effort with Iran (remember the axis of e-eeeevil"), rings of desperation.

Low Interest Rates are good for gold bullion, India mulls cutting tax on gold imports. Recent steps taken by the ECB, with the introduction of negative interest rates, and dovish comments from Yellen have underscored a low rate accommodative monetary policy for the foreseeable future. Professional gold investors may now look at gold as being attractive from a potential risk on trade perspective and be able to finance such purchases with low financing costs. The Hindustan Times reports today that India's battle to reduces its Current Account Deficit has been largely successful and the government is preparing to reduce the tax on imports and remove some of the restrictions that meant that 20% of what was imported must then be exported. India's imports of gold fell, circa 245 tonnes, in 2013 – 2014 from the year previous. If the report proves to be accurate extra demand for gold from India could drive gold prices far higher. 28 Total Views 28 Views Today |

| Millennium Minerals could shine with rising <b>gold price</b> - Proactive <b>...</b> Posted: 20 Jun 2014 06:39 PM PDT () may be set to attract market attention as a gold producer. With a rising gold price these profits are set to continue upwards. Overnight the price of an ounce of gold soared to A$1400 an ounce (US$1320 an ounce). Last reporting period, Millennium achieved a record quarter at Nullagine with production rising 33% on the last quarter to 18,762 ounces. Notably, production was above its previous guidance of 16,000 to 18,000 ounces of gold due to the higher tonnage milled. Sales of 18,925 ounces at an average gold price of A$1,458 per ounce generated revenue of $27.6 million at a sustaining cash cost of A$1,191 per ounce. Mine level EBITDA was $7.16 million while mill throughput was 426,473 tonnes, 19% above 2013 quarterly average. The company's production guidance for the June 2014 quarter is between 16,000 and 18,000 ounces of gold and 76,000 ounces for the 2014 financial year. The company also has a standout hedgebook with Millennium undertaking further hedging of 60,000 ounces to provide extended risk cover. When combined with existing hedging, the new structure will be equivalent to about 70% of forecast production over the term of the Senior Facility and represent 26% of the contained gold in the company's Ore Reserve. The remaining hedge structure, prior to the additional hedging mentioned above, requires 60,236 ounces to be delivered by September 2015 at an average forward price of A$1,613 per ounce. Cash and bullion on hand amounted to $8.9 million at 31st March, while the outstanding balance of the Senior Facility was $29.5 million. Drilling Continues to Expand Resource Recently, Millennium intersected further substantial gold zones at the Au81 deposit, located just 2 kilometres from its Nullagine gold processing facility. Multiple intersections confirmed that the Au81 deposit main zone mineralisation extends over 180 metres of strike, and remains open. Intersections were broad and shallow with high grade cores. Significant gold intercepts included: - 22 metres at 3.64 g/t gold from surface, including 3 metres at 17g/t from 4 metres; And, these assays were amongst numerous other significant intercepts. Drilling was designed to upgrade the maiden 2013 Inferred Resource estimate to the higher confidence Measured and Indicated categories, and based on these results, a restated Mineral Resource will be estimated shortly. It also appeared that there may be multiple, stacked gold lenses, and more drilling is being planned to evaluate these further.

With the improving gold price, increasing production, clever hedging, a small market cap, manageable debt levels, and surging profits - Millennium could be on the cusp of a re-rating. Further gold price increases should have a marked positive effect on Millennium's share price.

Proactive Investors Australia is the market leader in producing news,articles and research reports on ASX "Small and Mid-cap" stocks with distribution in Australia, UK, North America and Hong Kong / China. |

| You are subscribed to email updates from Gold price - Google Blog Search To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 20 West Kinzie, Chicago IL USA 60610 | |

0 Comment for "Gold price | Gold price on insane surge after massive trade | MINING.com"