Gold price | CHARTS: <b>Gold price</b> entering make or break territory | MINING.com |

- CHARTS: <b>Gold price</b> entering make or break territory | MINING.com

- There's no budging these <b>gold price</b> bears | MINING.com

- The <b>Gold Price</b> Lost $6.10 Today Closing at $1316.10

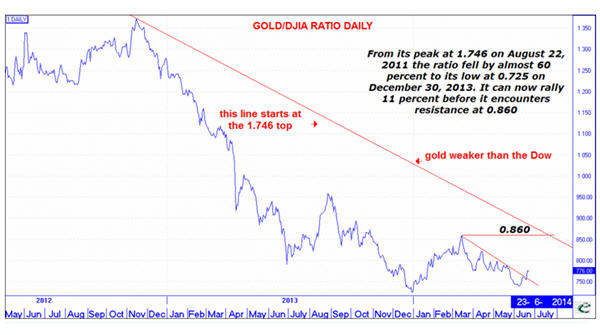

| CHARTS: <b>Gold price</b> entering make or break territory | MINING.com Posted: 25 Jun 2014 03:37 PM PDT The gold price jumped around on Wednesday only to settle in familiar territory. On the Comex division of the New York Mercantile Exchange, gold futures for August delivery in late afternoon trade exchanged hands for $1,319.50 an ounce, down $1.80 from its settlement level in middling volumes. Earlier in the day gold touched a low of $1,305.40, only recovering after a drop in the dollar following a surprisingly large down adjustment in the first quarter US GDP. Last Thursday's nearly $50 an ounce surge in frenzied trading now appears to have been a blip as gold's momentum turns sideways. Ole Hansen, Head of Commodity Strategy at Denmark's Saxo Bank, says for gold to continue to show strength the metal must first clear $1,331: If successful it should be able to make further progress towards trend-line resistance at 1371 USD/oz ahead of the 2014 peak at 1392 USD/oz. However, a move back below 1300 USD/oz would remove the current momentum and most likely result in a renewed period of range-bound trading around 1295 USD/oz. which has been the average price for the past year. Technical research and investment blog InvesTRAC's chart of the gold price versus the blue-chip Dow Jones Index, which on Wednesday was again toying with record territory despite the GDP numbers, indicates that gold is set to outperform stocks: The long term downtrend from the top at 1.746 is still intact…the recent weakness held above the 0.725 low and the ratio has now pushed up through the first downtrend which opens the way for an 11 percent rally to the next visible resistance at 0.860. If the ratio can get through this barrier it would suggest that after an almost 60 percent decline it would have the potential to go substantially higher: FLASHBACK: Towards the end of May, InvesTRAC produced a chart showing that the uncharacteristically quiet gold market was primed for break-out price move. That bust out if its trading range started out as a big gap down with the gold price hitting $1,244 at the start of June. That was before Yellen and ISIS changed the picture again and a 90 tonne 15-minute trade lit a fire under the metal. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| There's no budging these <b>gold price</b> bears | MINING.com Posted: 24 Jun 2014 03:58 PM PDT The gold price consolidated recent gains on Tuesday, buoyed by safe haven buying following a deepening crisis in Iraq and rotation out of riskier assets like equities which pulled back sharply on the day. On the Comex division of the New York Mercantile Exchange, gold futures for August delivery in after hours trade exchanged hands for $1,319.10 an ounce, up slightly from Monday's trading session but off its highs for the day of $1,326. Tuesday's trading was quiet again with only some 115,000 contracts changing hands. This compared to Thursday last week when after months of subdued trade on gold futures markets volumes surged and gold jumped nearly $50. Last weeks rally was ascribed to dovish comments comments by Federal Reserve chair Janet Yellen that US interest rates would be lower for longer and the escalating situation in Iraq. Those two factors are very much still in play but gold's recent price performance has not convinced most market analysts that a rerating is in order. Prices will average $1,250 an ounce in the third quarter a decline of more than 5% from current level, according to the median of 15 estimates by Bloomberg. The analysts were surveyed before and after the US central bank's June 18 outlook, but predictions were not altered: "The surge in gold can't sustain itself," Donald Selkin, who helps manage about $3 billion of assets as chief market strategist at National Securities Corp. in New York, said June 20. "It was a temporary spike because of a confluence of events: Iraq and Yellen. People will be looking at other areas for excitement. Holdings are down, so people are leaving gold in search of something better." A new note by Barclays concurs with these sentiments adding that "any price level above $1,300 per ounce must be viewed as opportunity to sell gold," reports Hard Assets because of expectations of stronger US economic numbers and employment: "Any upside for jobs growth would imply further downside for gold. Moreover, analysts predict a broad-based US dollar rally in the near term, which again would weaken the gold's prospects." Gold is up 10% so far this year after 2013's dismal 28% drop, the worst performance in more than three decades for the metal. Image of bear skin rugs on sale at Ismaylovo market, Moscow, March 2007 by beggs | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| The <b>Gold Price</b> Lost $6.10 Today Closing at $1316.10 Posted: 26 Jun 2014 04:30 PM PDT

Same game plan was played on the SILVER PRICE, with just as little effect and a 2080 low. About 9:30 silver came roaring up out of that hole, then traded gently higher until it crossed 2100c. Closed Comex 8/10 of a cent lower at 2110.3. This is all strong trading, and the silver price will be fine as long as it stays above 2075c - 2050c. The GOLD PRICE is headed higher even if it closes as low as $1,295. Even under attack, silver and gold prices are proving the resilient strength of their rally. Y'all are going to mess around and miss buying, waiting for the perfect price. Stocks broke that support I was talking about yesterday, the top line of a long established rising wedge. Just cracked it like you'd crack an egg shell, but it's cracked all the same. Dow cracked its 20 day moving average, too, but the S&P500 stopped short of that. Dow lost 21.38 (0.13%) to 16,846.13. S&P500 shaved off 2.31 (0.12%) to 1,957. Lower prices a-comin'. Dow in silver fell again for the fifteenth straight day, and is so oversold I'm beginning to expect some sort of corrective rally. DiS lost another 5 oz (0.62%) to 797.64 (S$1,031.29 silver dollars), a scant six silver dollars from its S$1,023.46 (791.58 oz) 200 DMA. Dow in Gold bounced up 0.05%, just a little fly-tick, to 12.79 oz (G$264.39 gold dollars). Downtrend is firm and has plenty of room to drop. Both Dow in metals indicators are pointing to lower stock prices and higher metals prices. US dollar index today did something unusual: closed unchanged at 80.28. It traded as low as 80.19, and as high as 80.44 around 9:30 a.m. when it tried to rally, but fell back feckless. Only encouragement in this is that the dollar index closed above its 20 DMA and slightly above important internal support at 80.25. Euro drew near its 200 DMA ($1.3662) yesterday, but fell back today as if it were Kryptonite. No danger the euro will run away starward any time soon. Yen rose 0.11% to 98.31, continuing its baby steps to its 98.51 200 DMA, which it hit today but closed below. A close over that 200 DMA followed quickly by a close above 99.00 would send the yen rallying. Aurum et argentum comparenda sunt -- -- Gold and silver must be bought. - Franklin Sanders, The Moneychanger © 2014, The Moneychanger. May not be republished in any form, including electronically, without our express permission. To avoid confusion, please remember that the comments above have a very short time horizon. Always invest with the primary trend. Gold's primary trend is up, targeting at least $3,130.00; silver's primary is up targeting 16:1 gold/silver ratio or $195.66; stocks' primary trend is down, targeting Dow under 2,900 and worth only one ounce of gold or 18 ounces of silver. or 18 ounces of silver. US $ and US$-denominated assets, primary trend down; real estate bubble has burst, primary trend down. WARNING AND DISCLAIMER. Be advised and warned: Do NOT use these commentaries to trade futures contracts. I don't intend them for that or write them with that short term trading outlook. I write them for long-term investors in physical metals. Take them as entertainment, but not as a timing service for futures. NOR do I recommend investing in gold or silver Exchange Trade Funds (ETFs). Those are NOT physical metal and I fear one day one or another may go up in smoke. Unless you can breathe smoke, stay away. Call me paranoid, but the surviving rabbit is wary of traps. NOR do I recommend trading futures options or other leveraged paper gold and silver products. These are not for the inexperienced. NOR do I recommend buying gold and silver on margin or with debt. What DO I recommend? Physical gold and silver coins and bars in your own hands. One final warning: NEVER insert a 747 Jumbo Jet up your nose. |

| You are subscribed to email updates from Gold price - Google Blog Search To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 20 West Kinzie, Chicago IL USA 60610 | |

0 Comment for "Gold price | CHARTS: Gold price entering make or break territory | MINING.com"