Aleutian volcanoes are waking up |

- Aleutian volcanoes are waking up

- GE acquires Alstom's power and grid business for US$16.9 billion

- Enbridge opponents rally against pipeline in Prince George

- Gold investors: Let this cycle be your guide

- VIDEO: Bulldozer falls off a flat-bed truck

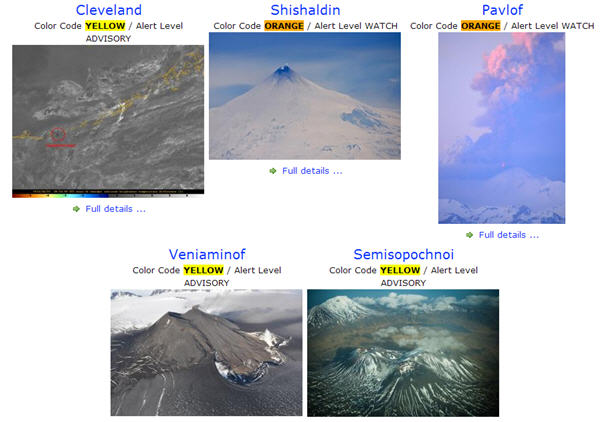

| Aleutian volcanoes are waking up Posted: 22 Jun 2014 05:19 PM PDT Sharply increased seismic activity and volcanic eruptions in the Aleutian Islands and the far western Brooks Range are being investigated by scientists. The Alaska Volcano Observatory says the activity over the past few months is the most seen by the station 26 years. On the Alaska Volcano Observatory three volcanoes are classified with a yellow alert level—signifying signs of elevated unrest above known background levels—and three are at an orange alert level—heightened unrest with increased likelihood of eruption. Orange is the second-highest alert level after red signifying an eruption that is imminent or underway.  Screen shot from the Alaska Volcano Observatory's website. Pavlof Volcano released an ash plum in May that diverted aircraft. The 8,262-foot (2,518-meter) tall volcano erupted sending ash plumes as high as 30,000 feet (9,144 meters). Aircraft were advised to avoid the area since ash could damage airplane engines. With heightened activity from all volcanoes, scientists still don't have enough information to point to any larger trend or activity. "At this point, you know, we have to say it's coincidental," he said in an interview with radio station KTOO News. "It could be that there is a larger process at work, but we're not able to say what that is at this point in time, or if there is such a process. You know, perhaps the answer is we haven't been looking long enough to know." The government agency posted news updates on its Facebook page. Hat tip, Boing Boing |

| GE acquires Alstom's power and grid business for US$16.9 billion Posted: 22 Jun 2014 03:08 PM PDT General Electric (NYSE:GE) will now own Alsom's power grid business, a portfolio of thermal, renewable and grid business units. Announced today the all-cash totaling $16.9 billion transaction values the three business units at 7.9 times earnings before interest, taxes, depreciation and amortization. Alstom board of director unanimously approved GE's offer. The deal is expected to close in 2015. The French government says it will allow the acquisition. Once closed, GE and Alstom would form three joint ventures:

"We will now move to the next phase of the Alstom alliance," said GE Chairman and CEO Jeff Immelt. "We look forward to working with the Alstom team to make a globally competitive power and grid enterprise. We also look forward to working with the French government, employees and shareholders of Alstom. As we have said, this is good for France, GE and Alstom. "For GE, the overall economics of the deal remain intact," Immelt said. "This transaction remains accretive in year one." Image of United States Secretary of Labor Hilda L. Solis touring a Alstom Power manufacturing facility in Richmond, VA in 2012. |

| Enbridge opponents rally against pipeline in Prince George Posted: 22 Jun 2014 10:23 AM PDT Several hundred people gathered outside Prince George MP Dick Harris' office on Thursday to voice their opposition to the proposed Enbridge Northern Gateway Pipeline project. Protesters sang songs, waved signs and vowed to stop the proposed pipeline, "whatever it takes." Carrier Sekani Tribal Council Chief Terry Teegee said opponents of the pipeline need to send a political message to Prime Minister Stephen Harper and the Conservatives. Canada and B.C. should be focusing on developing alternative energy instead of continuing to promote fossil fuels, he said. "We need alternatives. We've come here to say 'no' to the project," he said. "Much like alternatives to energy, we need an alternative to this government. They changed the rules… laying out the big red carpet to big oil." On Tuesday the federal government announced regulatory approval for the proposed 1,177 km twin pipeline from Alberta's oil sands to Kitimat. The pipeline would transport oil from Alberta to a marine terminal in Kitimat, and condensate -a chemical used to treat crude oil for transport -from the terminal to Alberta. Voters should take their opposition to the ballot box in the federal election slated for 2015. "There is 21 Conservative MPs in B.C. We can tell Harper that his agenda doesn't belong in British Columbia," Teegee said. "[Harper is] making unilateral decisions, he's being a dictator. It we want democracy, we need to take it: impose our will on the government, not the other way around. We are the majority." UNBC climate researcher professor Ian Picketts, a member of the Sea to Sands Conservation Alliance, said the proposed pipeline is the opposite of progress. "The thing that depresses me is a project like this isn't just one step backwards, it's a 25-year, locked-in move backwards," Picketts said. "If this is a bad idea now, in 10 years it is going to be a terrible idea." Picketts said despite his research he's optimistic humanity can solve environmental issues like climate change, if solutions are given a chance. "As humans, as stupid as we can be… we are also incredibly smart and innovative," he said. "All we need is a chance to have an economy that doesn't pit the environment verses money. All we need is a chance to think forward." Sea to Sands Conservation Alliance spokesperson Mary MacDonald – and others – said she was pleased to see so many children and young people at the rally. "I think a lot of the reason a lot of us are here today is thinking about future generations," MacDonald said. Nineteen-year-old Gracie Wilson said she's concerned about the future her generation, and her children's generation, will have. "As a young person… I'm terrified by the very real prospect of an oil spill," Wilson said. "I'm saying 'no' to toxic bitumen moving across the territory of 50 First Nations. I'm saying 'no' to B.C. being a doormat for oil companies to wipe their feet on." Peter Ewert of the Stand Up For the North Committee said Enbridge and the Conservatives need to understand they can't simply force projects through without local popular support. "It is no longer the case that the federal government and resource companies can ram their unpopular resource projects through B.C." Ewert said. "First Nations are affirming their right to have a say on what happens in their traditional lands." Municipalities and citizens from across the province are also standing up to voice their opposition, he added. "Friends, our struggle is being watched all across Canada and around the world," Ewert said. "[Our struggle] not to have our rights trampled by corporations that could care less about our beautiful mountains, forests [and] rivers…" A large delegation from the Nadleh Whut'en First Nation near Fort Fraser came to Prince George to show their opposition to the proposed pipeline. Nadleh Whut'en Chief Martin Louie said it's time for First Nations people to take the driver's seat and determine their own future. "Throughout history, First Nations have always been sitting in the backseat somehow – decisions have been made for us," Louie said. "It's time they listen to us -to put our laws back on the land. First Nations are the voices for the land, the animals… the water. We're here to protect the future of our children- our kids your kids." Harper's government is putting the business interests of foreign companies ahead of the interests of Canadian citizens, he added. "What are we going to leave here for our kids? That is what we're going to protect, for B.C., Canada and for the world." PIPELINE POLITICS In an interview on Wednesday, NDP finance critic and Skeena-Bulkley Valley MP Nathan Cullen said he's disappointed, but not surprised, by the Conservative's decision on the pipeline. "This was a predetermined thing. [Harper] stacked the deck with laws and gave himself the power to approve this," Cullen said. "The environmental assessment [process] needs to be fixed in this country. The [National Energy Board joint review panel] overwhelmingly heard from people opposed to the pipeline, but still found a way to approve it." Cullen said many of the 209 conditions recommended by the board's review panel "were written by Enbridge." "And many are just to obey the law. It's pretty sad when we have to have conditions included to obey the laws of Canada," he said. Cullen said the Conservatives have tried to distance themselves politically from the announcement. The day it was made, Cullen said he tried to goad one of the 21 Conservative MPs from B.C. to defend their decision, but not one would rise to speak in the House of Commons. "I still don't think believe this pipeline will every be built… Certainly the lawsuits will begin, and cost the taxpayers millions," he said. "I also think it's going to go to the ballot box in 2015. It may be their political demise." According to an Angus Reid poll conducted after the announcement, 37 per cent of Canadians polled said the federal government made the right choice, 34 per cent said the Conservatives made the wrong choice and 29 per cent were unsure. However, in B.C. 40 per cent of people said the Tories made the wrong call. UNBC political scientist Gary Wilson it remains to be seen if the Enbridge decision will have an effect on the Conservatives' election results in B.C. "Voters tend to have short memories," Wilson said. "The opposition is very vocal. [But] they may not be the people who would vote Conservative anyway. There is a silent plurality who are not speaking up on Enbridge." Much will depend on the quality of candidates and the quality of campaign the opposition parties bring to the election, he added. "It's always hard to run against incumbents, especially incumbents who have been around a long time," Wilson said. "[And] the Conservative base here is pretty strong." |

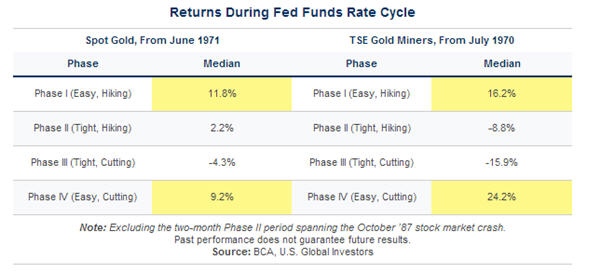

| Gold investors: Let this cycle be your guide Posted: 22 Jun 2014 10:08 AM PDT U.S. Global Investors recently welcomed Doug Peta, an economist from BCA research, to our offices. He presented some interesting research regarding the Fed Funds Rate Cycle, and in turn, what that research could mean for gold. I wanted to share points from his presentation, as well as our own in-house research, to help you understand the positivity we see for the precious metal looking towards 2015. Where are we now? As we know, the Fed enacted QE to stimulate our nation's economy. Right now we're benefitting from our placement in Phase IV of this cycle because it is in this phase that the Fed is able to keep interest rates low, keep reserve requirements low and continue printing money. Similarly, when money is "easy," businesses can find funding for projects and consumers have easier access to credit. Historically, Phase IV (as well as the shift towards Phase I) are the best for equity investors because stocks usually rise during these two positions in the cycle. Why these phases are good for gold, too. When it comes to the performance of gold and gold stocks, history indicates good times are ahead based on where we are in the cycle. Take a look at the tables below showing median returns during the cycle dating back to 1970 and 1971. You'll see that for gold and gold stocks, Phase IV and Phase I both show the highest median returns. The reason for the high returns during these two phases is because of "easy money." Tight money, which is what Phase II and III are based upon, is typically bad for gold investors. When money is tight, we don't have inflation, and investors don't need to turn to gold as a hedge against inflation. Without inflation there is no need to hedge. Another reason we've traditionally seen gold investors benefitting during Phases IV and I of the cycle is that when money is easy, interest rates are low, meaning less opportunity cost for holding the precious metal. To help illustrate, imagine putting your money in a savings account and earning 5 percent on it. Well, the opportunity cost of keeping gold under your mattress would be giving up that 5 percent that you could be earning elsewhere. When your savings account yields next to nothing, some reason, why not just buy some gold? This pattern is worldwide. Right now, gold could use a pick-me-up, and here's why. Over the last several years we've seen slowing money supply growth in many E7 countries. E7 refers to seven countries with emerging economies including China, India, Brazil, Mexico, Russia, Indonesia and Turkey. It's these countries that drive the Love Trade for gold, primarily China and India, which purchase the metal for religious and cultural celebrations. With less money being spent or borrowed, not only did the Love Trade begin to slow, global GDP growth also began to slow as you can see below. The good news is, as we see various countries applying monetary stimulus, including emerging markets, we can expect this to contribute to global GDP growth. In 2014, global GDP is expected to grow by 3.2 percent, according to the World Bank's latest projections. Similarly, the money supply of the United States has been a steady grower and the money supply in the E7 countries is also expected to reverse course; right now it is growing again but at a slower rate. The U.S. data suggests that a new easing cycle is starting in Europe, Japan and emerging markets. A pickup in economic activity in the E7, especially the big gold consumers, is yet another positive sign for the yellow metal. Real interest rates are headed lower for most of the world as well. As money supply grows, countries eventually feel inflationary pressures. This will hold true in the U.S. as we move into 2015 and back into Phase I. All of these changes can lead to a declining confidence in paper money, yet another good sign for gold. An interesting side note. |

| VIDEO: Bulldozer falls off a flat-bed truck Posted: 22 Jun 2014 08:37 AM PDT Changing lanes quickly downtown seemed to have resulted in a bulldozer tipping and falling off a flat-bed truck. Date and place of the video, posted by Mining Mayhem, are not divulged. Incident was recorded on a vehicles dash cam. |

| You are subscribed to email updates from MINING.com To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 20 West Kinzie, Chicago IL USA 60610 | |

0 Comment for "Aleutian volcanoes are waking up"