A clear bathroom floor and a view 15 floors down |

- A clear bathroom floor and a view 15 floors down

- Gold in a fix

- IMAGE GALLERY: Stuck in the mud

- Vancouver needs the resource sector to pay for expensive commitments: NDP Premier Dan Miller

- Vancouver investment conference kicks off

- INFOGRAPHIC: Why the Russia-China LNG won't crimp BC imports

| A clear bathroom floor and a view 15 floors down Posted: 01 Jun 2014 11:34 PM PDT When architects Hernandez Silva Arquitectos were commissioned to build a contemporary penthouse on top of an old building, the architects decided to incorporate a second elevator shaft that was never used by installing a clear floor over top and using the space for the bathroom. The contemporary home is situated on top of a '70s Mexican colonial building in Guadalajara, Jalisco, México. The elevator shaft is 15 floors down. See the picture gallery at Home Design. |

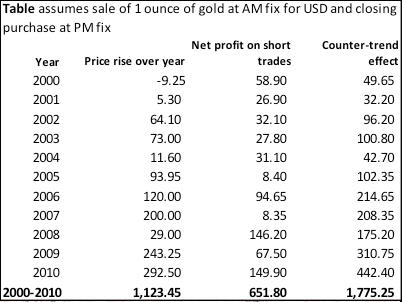

| Posted: 01 Jun 2014 05:06 PM PDT Last week the UK's Financial Conduct Authority fined Barclays for rigging the gold price at a gold fix for the disadvantage of a customer and the benefit of the bank's book. This news could not come at a worse time for the London Bullion Market and the London Gold Market Fixing Limited, the company directly responsible for the twice-daily fix. It may well lead to the end of the gold fix, the silver fix already being axed in August. The fix is a process by which the four fixing members match their orders at an agreed price. The London bullion market is over-the-counter without the formal price records of a regulated market. The fix is therefore a needed reference price, and its status and the liquidity that follows have been central to London being the world's major bullion dealing centre. There are two problems with the fix. The first is it potentially distorts the market by delaying pre-fix business and bringing post-fix business forward. The second is that customers have to trust the fixing banks, who are also dealing for themselves into the fix. And this is what tripped up Barclays. Outside the fix it should be reasonably clear to clients whether a bank is operating as principal or agent. During the fix roles can become opaque, and unscrupulous dealers can find ways to game the system. Claims that the Barclays case was an isolated instance may be true, but indications that the FCA is treating this as a one-off and not investigating other banks may be ultimately damaging to the market's reputation. Then there are the separate circumstances of Deutsche Bank's resignation of its fixing seats on both gold and silver. Last December Deutsche Bank was instructed by the German banking regulator, BaFin, to hand over documents in connection with its enquiry into gold and silver price fixing. Four weeks later the bank announced it was resigning its seats on the gold and silver fixes. While it is premature to positively link the resignations with BaFin's enquiry, the coincidence raises the possibility that banks which have settled with regulators over accusations of fixing LIBOR may have a case to answer in precious metals as well. Interestingly, there are no buyers for Deutsche's seats, suggesting legal and compliance officers at other bullion banks also have doubts about the fixing process. To give this topic further context it should be noted that London has seen some unusual price movements in the past. The table below shows the profits generated by shorting one ounce of gold on the morning fix and buying it back at the afternoon fix every day for the eleven years 2000-2010, covering most of the largest bull market in the LBMA's history. This phenomenon was first drawn to public attention a few years ago by an American analyst, Adrian Douglas. In every year this short trade would have been profitable, despite a rise in the gold price from $282.05 to $1405.50 in December 2010, a rise of 400%. This extraordinary price behaviour was confined to London trading hours. So hard statistics tell us gold has been behaving unusually in London hours for a considerable time. The LBMA is not a regulated market, but derivatives and share prices based on precious metals are, so regulators have a duty to be interested. The FCA should broaden its investigations accordingly, but whether it does or not it is hard to see how the twice-daily gold fix can survive. |

| IMAGE GALLERY: Stuck in the mud Posted: 01 Jun 2014 01:24 PM PDT A round up of some big equipment bogged down at the mine site from Mining Mayhem. Dates and locations not divulged. |

| Vancouver needs the resource sector to pay for expensive commitments: NDP Premier Dan Miller Posted: 01 Jun 2014 12:48 PM PDT Miller, who has worked in the resource sector since leaving office, published a column in The Province championing the economic benefit mining and oil and gas:

Dan Miller was the NDP's interim leader after the resignation of Glen Clark. He was originally elected as MLA for Prince Rupert in 1986. Miller has worked in the resource sector since leaving office. Former NDP premier Mike Harcourt quit the BC NDP two months ago stating that it has failed to find accommodation between rural and urban areas. Image of miniature gold mining from Suspecto |

| Vancouver investment conference kicks off Posted: 01 Jun 2014 12:08 PM PDT The Vancouver Resource Investment Conference 2014 kicks off today. The two-day show is being held at the Vancouver Convention Centre West. Over 300 exhibitors are listed. This years event is expanding beyond the resource sector. Alongside mineral exploration businesses, there will be companies focused on technology, renewable energy, media and technology. Speakers range from resource analysts like Brent Cook, Eric Coffin and Marin Katusa to cannabis spokesperson Jodie Emery. Cost to enter is $20. |

| INFOGRAPHIC: Why the Russia-China LNG won't crimp BC imports Posted: 01 Jun 2014 09:34 AM PDT Resource Works explains why the Russia-China liquid natural gas contract will not impede demand from British Columbia. Announced in early May, Russia will sell China $400 billion of natural gas. Keith Head, a professor at the Sauder School of Business who specializes in international trade and economic geography, says there is still lots of room for Canadian LNG:

The Tyee, however, called the deal a "train wreck". |

| You are subscribed to email updates from MINING.com To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 20 West Kinzie, Chicago IL USA 60610 | |

0 Comment for "A clear bathroom floor and a view 15 floors down"