Spot Chart | WTF <b>Chart</b> Of The Day: Spot <b>Gold</b> Spikes Over $20 As Futures Close <b>...</b> | News2Gold |

- WTF <b>Chart</b> Of The Day: Spot <b>Gold</b> Spikes Over $20 As Futures Close <b>...</b>

- <b>Chart</b> of The Week - <b>Gold</b> - INO.com

- <b>CHART</b> ALERT: Quiet <b>gold</b> market primed for break-out price move <b>...</b>

- The Keystone Speculator™: <b>Gold</b> COT (Committment of Traders) <b>Chart</b>

| WTF <b>Chart</b> Of The Day: Spot <b>Gold</b> Spikes Over $20 As Futures Close <b>...</b> Posted: 26 May 2014 10:12 AM PDT Gold futures stopped trading at 1300ET for the Memorial Day holiday... seconds after that Spot Gold prices exploded higher from $1291 to $1312... of course liquidity is extremely light but it seems someone was anxious to get their hands on the real thing... Gold has breached its 200DMA, 100DMA, 50DMA, as well as the crucial $1300 (that Morgan Stanley said would never be seen again). Nothing to see here , move along... Moments later... And there goes silver... Un-rigged markets? Charts: Bloomberg (10 votes) |

| <b>Chart</b> of The Week - <b>Gold</b> - INO.com Posted: 27 May 2014 10:30 AM PDT Each Week Longleaftrading.com will be providing us a chart of the week as analyzed by a member of their team. We hope that you enjoy and learn from this new feature. Further Downside Expected as Gold Finally Chooses Its Direction This week's market focus turns to August Gold futures, where a break out of recent consolidation may have finally determined the near term direction of Gold. The week starts out extremely bearish for Gold as the stock market continues to establish new all-time high levels. Recent economic numbers that have missed the mark have provided additional confidence to stock market investors that FED support will continue in the stock market. Optimism that stocks can continue their higher track has taken away from the safe haven appeal of gold. Over the past month, August Gold futures have consolidated into a very tight range as the market has been deciding on its future direction. As of this morning the direction looks to be a sell off for the foreseeable future. With a break of the recent pennant pattern at $1285, the next downside target will be $1240. A close below $1280 in today's session would confirm a further potential downside move over the coming months. To take advantage of this downside continuation, I would look to purchase August put option strategies in gold that would take advantage of the next potential continuation move to $1240, while allowing roughly 2 months for the strategy to work. These strategies would expire on July 28th. Per strategy used, we would look to keep the maximum exposure in the market to $500 and the maximum profit potential to $2,500. I advise clients on trading futures and futures options markets on a day to day basis. If you have any questions regarding this chart or questions regarding trading futures and futures options, feel free to call me directly at 888-272-6926. Thank you for your interest, ** There is a substantial risk of loss in trading futures and options. Past performance is not indicative of future results. The information and data contained in this article was obtained from sources considered reliable. Their accuracy or completeness is not guaranteed. Information provided in this article is not to be deemed as an offer or solicitation with respect to the sale or purchase of any securities or commodities. Any decision to purchase or sell as a result of the opinions expressed in this article will be the full responsibility of the person authorizing such transaction. |

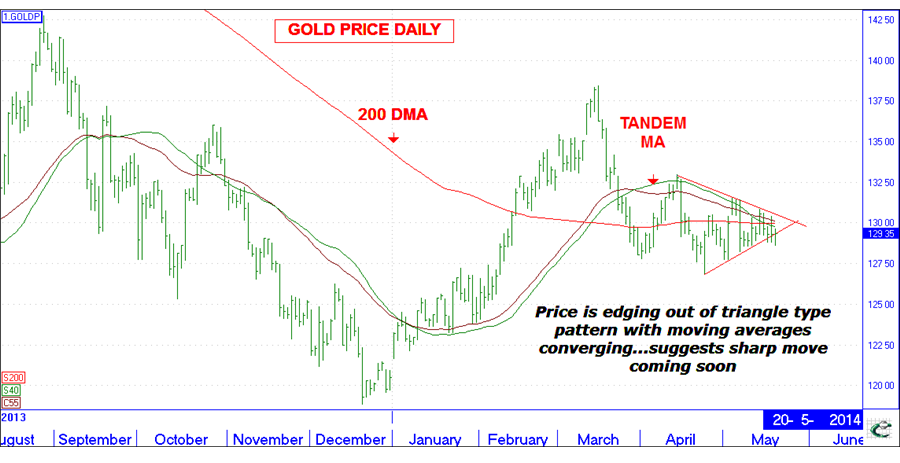

| <b>CHART</b> ALERT: Quiet <b>gold</b> market primed for break-out price move <b>...</b> Posted: 21 May 2014 12:30 PM PDT The gold market has been uncharacteristically calm this year with the metal hovering either side of $1,300 for the better part of two months. In a recent research note Edel Tully and Joni Teves, analysts at investment bank UBS, argued that the quiet on the gold market may be a good thing: "Gold is not on the radar for many, and with broad expectations that prices will be range-bound this year, many investors are opting to stay out of this market," UBS wrote. "That is probably gold's biggest positive right now." The thinking being that too much attention from speculators and any big economic news would automatically be seen as a negative given current gold market sentiment. Gold's charts may be telling a different story however. Tony Henfrey from technical research and investment blog InvesTRAC passed on this price graph to MINING.com showing gold is primed for a big move. "This is an alert. The gold price has formed a triangle type pattern and is dropping out of it, plus the moving averages have converged with price. This type of action invariably precedes a sharp move." |

| The Keystone Speculator™: <b>Gold</b> COT (Committment of Traders) <b>Chart</b> Posted: 28 May 2014 02:14 AM PDT |

| You are subscribed to email updates from gold chart - Google Blog Search To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 20 West Kinzie, Chicago IL USA 60610 | |

0 Comment for "Spot Chart | WTF Chart Of The Day: Spot Gold Spikes Over $20 As Futures Close ... | News2Gold"