Silver prices | Are <b>Silver Prices</b> Set Up for Another Heartbreak? - The Market Oracle |

- Are <b>Silver Prices</b> Set Up for Another Heartbreak? - The Market Oracle

- Firmer Tone for Gold and <b>Silver Prices</b> :: The Market Oracle <b>...</b>

- <b>Silver</b> demand reached record high in 2013, <b>prices</b> jump | MINING.com

| Are <b>Silver Prices</b> Set Up for Another Heartbreak? - The Market Oracle Posted: 16 May 2014 07:35 AM PDT Commodities / Gold and Silver 2014 May 16, 2014 - 12:35 PM GMT By: Dr_Jeff_Lewis

How long prices can remain relatively quiet and range-bound (in the face of growing fundamentals, geopolitical tension, and the rising awareness of inflation) is anyone's guess. Restlessness is developing, perhaps correlated with the volatility and commingled with hope over news of the ending the "London Fixing". Due to trading positions and willingness to overtly manipulate the market, combined with upcoming geopolitical tensions, it might be best to expect a move down over the short term. Price Discovery Price discovery is the main culprit. As long as positions held at COMEX remain dominated and concentrated, nothing is real and the darker mechanism out of London means very little. It's not difficult to envision JPM, et al., walking unsuspecting weak-handed longs and seeking natural safety into this market in order to sheer them out of position and buy the HFT-induced dips. Producer prices surprised the market to the upside, while the BLS has just "discovered" food inflation. Professional traders can play this game and come out as winners because they are nimble enough and can turn on a dime. But as weak (paper) hands play into the game, their losses will probably become the big bank's gains. This is the script. In addition to range bound restlessness, traders are looking now toward volatility to gauge the next move. Low Volatility Forbes recently published: "Just last week (silver) prices slipped to $18.685, the lowest level since mid-July on a continuation chart and a four-year low for a July futures contract. Prices rebounded, following the bounce in gold prices. 30-day silver options volatility is around 12% as of Tuesday's close, coming just off a 10-year low made during last week's price drop. The last time silver volatility fell to the mid-teens was last year, just before silver prices broke in April 2013 and then in late 2010, ahead of the 2011 spike to record highs. Comparatively, silver's volatility is usually around 30%. Volatility is always mean-reverting, so when volatility is that low, it's ready for a big move, according the (obscure) source quoted." Volatility is all about where the big banks want the price and perception to be in the short term. Again, (viewed from the perspective of specs who are ultimately at the mercy of the big shorts), they can be harvested - they will be, independent of prices. Having such low volatility is unusual for silver, and one analyst said it's a situation that's unlikely to last. Does this mean anything more than an after-effect of what happens when each and every rally is stifled? When a range-bound channel works well for those seeking a profit, picking up nickels in a steamroller - and those who would rather not see the price move too far too fast? Users are happy - and by proxy. And it works out for monetary policymakers, most who probably don't think or concern themselves with the metals. Bernanke's answer to Ron Paul's question in 2012 said it all. His answer that gold was not money was probably less of an outright lie than an example of how far off the radar we've gone. One must not forget is that the manipulation of gold and silver has been achieved by legal mechanisms. It's the equivalent of allowing a semi truck to drive through a regulatory loophole. Ultimately, by distorting fundamental expression (as well as cultural wealth expression) for so long, the resultant risk builds tremendous fuels for whichever ransom spark eventually ignites the fire. What Fundamentals? Here are few developments on top of the more obvious ones. For example, above ground investment grade silver amounts to less than one fifth the supply of gold, yet the price is inverse - to the tune of 65 to 1. Or that most silver used by industry is delivered just in time and, therefore, demand is totally underestimated. Or that silver is the only commodity that makes inflation adjusted high seem like some bizarre phenomenon. A few others:

With regard to investing alternatives, let us be reminded that there are always a thousand reasons to buy at the top; and a thousand reasons to sell at the bottom. Most have a clear choice between buying into a conventional stock market, making all time high after all time high. Or buying an asset like silver that is off over 60% from its highs and 100's of percentage points from conservative inflation-adjusted highs. Markets (even rigged ones), contrary to what many are saying, do not fall forever. Any thoughts about this? Share it! For more articles like this, and/or for a breath of fresh silver market reality amidst the stench of denial and technically meaningless short term price obsessed madness, check out http://www.silver-coin-investor.com By Dr. Jeff Lewis Dr. Jeffrey Lewis, in addition to running a busy medical practice, is the editor of Silver-Coin-Investor.com Copyright © 2014 Dr. Jeff Lewis- All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors. © 2005-2014 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication. |

| Firmer Tone for Gold and <b>Silver Prices</b> :: The Market Oracle <b>...</b> Posted: 16 May 2014 07:38 AM PDT Commodities / Gold and Silver 2014 May 16, 2014 - 12:38 PM GMT By: Alasdair_Macleod

From there precious metals never looked back. Interestingly, for the first time in a long time, prices advanced in London dealings, indicating they were being driven more by physical demand than trading in US futures. This is hardly a surprise given that GOFO is still negative for up to three months forward and has been in backwardation every day since 3rd April. The sharpness of the bounce in the gold price is shown in the chart below of gold and silver prices for the year so far. Given the short-term bearishness of some of the major banks one can only conclude that there is an underlying firmness in these markets. Yesterday's US Initial Claims numbers came in lower than expected, triggering algorithmic traders to sell gold which fell $10 in minutes. The test will come from London later this morning: will physical buyers keep the market bid, or will there be some profit-taking ahead of the weekend? Computer-driven traders are not getting it all their way. US bond yields have fallen dramatically, which is wholly inconsistent with a recovering economy as Initial Claims would suggest. It is clear that very little of the money printed through QE is getting into the economy, other than by government spending, and instead is still confined to financial markets. The most important news regarding precious metals markets was the announcement of the end of the silver fix from this August. The background to this move is Deutsche Bank's withdrawal from the gold and silver fix, which in silver's case left only HSBC and Bank of Nova Scotia agreeing the daily fix. Given increasing regulatory interest in the fixing processes for both precious metals, coupled with potential litigation for the banks involved, it is clear that for only two banks to continue fixing silver is untenable. The broader question of the future of the gold fix is more important. It appears that no bank is willing to take over Deutsche Bank's seat, raising the question why. It is likely that compliance officers at the major banks have all reached the same conclusion: that the gold fix may be difficult to defend from allegations of market-rigging, and it would be wise to turn down the opportunity. If nothing else, in my opinion, it looks like there is a growing possibility the daily gold fix will end as well. Next week

Alasdair Macleod Head of research, GoldMoney Alasdair.Macleod@GoldMoney.com Alasdair Macleod runs FinanceAndEconomics.org, a website dedicated to sound money and demystifying finance and economics. Alasdair has a background as a stockbroker, banker and economist. He is also a contributor to GoldMoney - The best way to buy gold online. © 2014 Copyright Alasdair Macleod - All Rights Reserved © 2005-2014 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication. |

| <b>Silver</b> demand reached record high in 2013, <b>prices</b> jump | MINING.com Posted: 14 May 2014 10:07 AM PDT

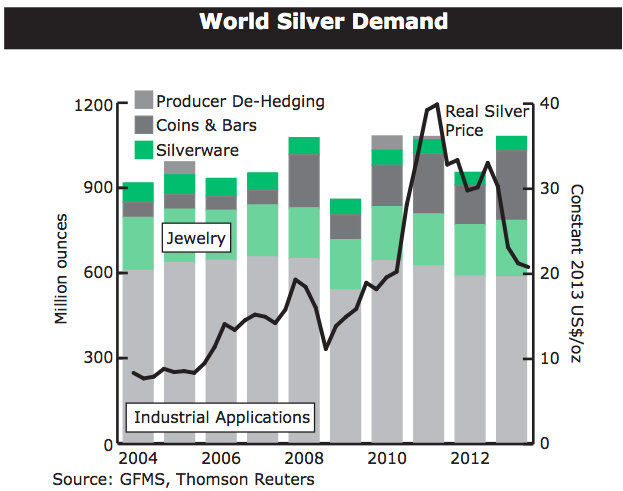

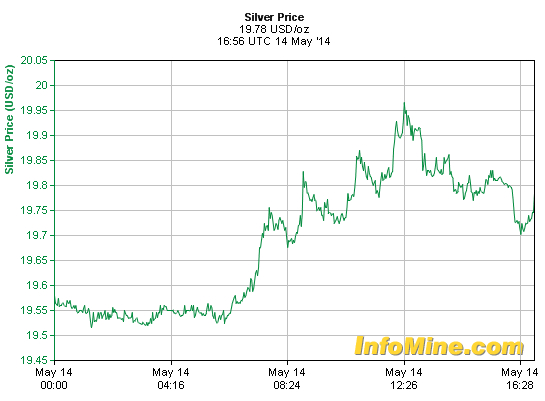

July silver rose 25 cents, or 1.3%, to $19.80 an ounce as traders assessed the Silver Institute's World Silver Survey. According to the report, total physical silver demand rose by 13% in 2013 to an all-time high of 1,081.1 million ounces, fuelled by unparalleled 76% increase in retail investment in silver bars, coins and jewellery. The precious metal price averaged $23.79 per ounce last year, the third-highest nominal average price on record, but still down 24% year-over-year in a particularly volatile environment for all precious metals, the report said. The biggest increase in silver demand came from Asia, particularly from India, where jewellery sales jumped by nearly a third to the highest level since 2001. Besides the lower price, government restrictions on gold imports helped make silver more attractive to Indian consumers. Thomson Reuters GFMS' precious metals analyst Andrew Leyland said he expects the average silver price to dip to $19 per ounce this year and $18.50 per ounce in 2015. A backcloth of rising investor appetite for riskier assets such as stocks, and a potential decline in exchange-traded fund (ETF) holdings, are all likely to weigh on the metal price, Leyland said. While gold has enjoyed a solid 7% price appreciation so far in 2014, the silver market has failed to experience such a bounce, mainly due to fears over Chinese economic cooling has dampened enthusiasm for the industrial and investment metal. |

| You are subscribed to email updates from Silver prices - Google Blog Search To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 20 West Kinzie, Chicago IL USA 60610 | |

0 Comment for "Silver prices | Are Silver Prices Set Up for Another Heartbreak? - The Market Oracle"